Best practice

01 Dec 2021

01 Dec 2021

Tax administration and maintenance day: a Budget without a speech

Simplifying the tax system, tackling non-compliance and ensuring the tax system remains fit for the modern world. This framed the consultations, calls for evidence and next steps announced on TAM day. ICAEW’s Tax Faculty highlights the key points.

Read 01 Dec 2021

01 Dec 2021

Meet HMRC’s horizon-gazing futurists

The UK tax authority’s Futures team monitors trends in the economy and society that could have an impact on government revenues and tax administration.

Read 25 NOV 2021

25 NOV 2021

Potential audit implications of salary advance schemes in the NHS

The National Audit Office investigation into supply chain finance found that “free” salary advance schemes for NHS employees started to have a cost after the collapse of Greensill Capital. The report’s authors highlight there may be implications for the audits of NHS bodies.

Read 22 NOV 2021

22 NOV 2021

Levelling up: accessible local public spending data is vital

ICAEW member Ed Humpherson, Director General for Regulation at the Office for Statistics Regulation – which provides independent regulation of all official statistics in the UK – says that economic and finance data must be concrete and comprehensible.

Read 19 NOV 2021

19 NOV 2021

Deficit in line with expectations at £19bn but public debt jumps by £69bn

The monthly public sector deficit was flat at £18.8bn in October but a last-minute rush by banks to access cheap finance caused public sector net debt to jump by £68.7bn to £2,277.6bn.

Read 08 NOV 2021

08 NOV 2021

Public finances post-crisis: rebuilding with balance

The impact of the COVID-19 pandemic, along with the lasting scars of the financial crisis, have sapped the UK’s fiscal strength in a period of major transition. The Resolution Foundation has some recommendations for recovery.

Read 27 OCT 2021

27 OCT 2021

Managing contingent liabilities at government level

Siobhan Duffy, a director at UK Government Investments, tells ICAEW Insights how her team contributes intelligence to policy development.

Read 27 OCT 2021

27 OCT 2021

Prizing the public pound

With increasing pressure on public services and net-zero targets to be met, it’s critical that any public spending delivers value to the taxpayer. The Fabian Society outlines its vision in its recent pamphlet.

Listen 20 OCT 2021

20 OCT 2021

How should government manage its assets better?

Michael Sunderland is the Deputy Director Government Financial Reporting at HM Treasury. He talks to ICAEW Insights about government balance sheet management.

Read 09 OCT 2021

09 OCT 2021

IPSAS vs IFRS

What is the most suitable accounting framework for the public sector?

Read 05 OCT 2021

05 OCT 2021

How do you manage a single issue across all of government?

How to collaborate across departments has long been a conundrum for large organisations. But when that organisation is central government, there is a huge price to pay for failing to be coordinated across departments.

Read 01 OCT 2021

01 OCT 2021

HMRC, Companies House and collaboration across government

Achieving efficiencies across government departments is to be applauded. Mark Chandler, Advisory Accountant at HMRC talks to ICAEW Insights about how collaboration is being achieved with Companies House and other UK Government departments.

Read 27 Sep 2021

27 Sep 2021

HMRC’s priorities: Spending Review, COVID-19, Brexit

ICAEW Insights asks Justin Holliday, Chief Finance Officer at HMRC, about the tax authority’s priorities and strategy, given the turbulence and change of the past 18 months.

Read 13 Aug 2021

13 Aug 2021

Getting the machinery of government to work

Former Downing Street policy chief Dan Corry believes the return of Public Service Agreements could help the government get more out of the hundreds of billions of public money it spends each year.

Read 4 Aug 2021

4 Aug 2021

COVID: financial risk to taxpayers ‘will run for 20 years’

The Public Accounts Committee has published the final report from their COVID-19 Cost Tracker Update inquiry, finding substantial risk levied to taxpayer finances through government response.

ReadClimate and sustainability

27 OCT 2021

27 OCT 2021

Financial sustainability and assurance in the public sector

What are the prospects for our public services given the future challenges they face? Adrian Crompton, Auditor General for Wales, examines the question of financial sustainability in the public sector.

Read 26 OCT 2021

26 OCT 2021

Network Rail on track to reduce the country’s carbon footprint

As the stewards of the nation’s railways, the impact of sustainability and climate is clear to see, writes Peter Leadbetter, Head of Accounting at Network Rail.

Read 25 OCT 2021

25 OCT 2021

Carbon Crunch: Net zero a driver of economic change

Resolution Foundation and the LSE Centre for Economic Performance say speeding up emissions reduction will require changing behaviours in addition to the UK government’s Net Zero Strategy’s focus on technological innovation.

Read 05 OCT 2021

05 OCT 2021

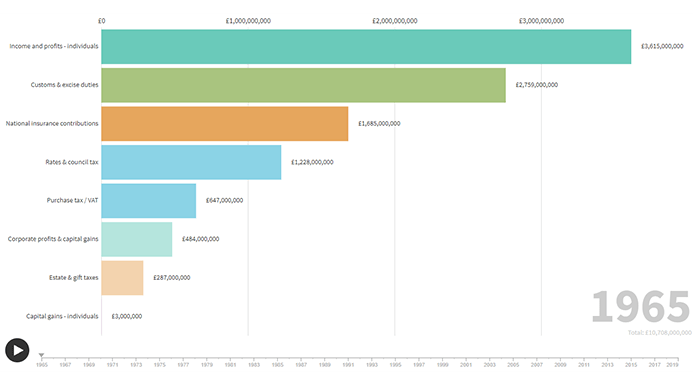

Mazars: tax system could be leveraged for sustainability

Clive Fathers, tax partner at Mazars, uses tax data collected in the ICAEW Tax Race over the last 50 years to foreshadow a more digital and sustainable tax landscape.

Read 05 Oct 2021

05 Oct 2021

The crusade to achieve the SDGs and the role of accounting

Implementing the UN Sustainable Development Goals is no mean feat, but progress must be made. Josette Caruana talks us through the work she is doing with Giovanna Dabbicco on the Global Reporting Initiative, and its relevance for the achievement of SDGs.

Read 04 OCT 2021

04 OCT 2021

KPMG: pandemic an opportunity to level up tax system

Tim Sarson, head of tax policy at KPMG UK, assesses key drivers behind the top-performing tax policies over the last five decades using ICAEW’s Tax Race findings.

Read 01 OCT 2021

01 OCT 2021

Addressing the climate emergency in the UK public sector

The UK has a lot of work to do and a dwindling amount of time in which to do it.

ReadInterviews

27 OCT 2021

27 OCT 2021

Can we plug the gaps in social care funding?

Adult social care spending needs to increase significantly to meet the needs of our ageing population. But how do we pay for it, asks Simon Bottery, senior fellow in Social Care at The King’s Fund.

Read 15 OCT 2021

15 OCT 2021

Solving the growing crisis in children’s social care

The piecemeal nature of procurement in children’s social care services, coupled with local authorities’ financial struggles, is creating a chaotic and ultra-competitive market that is not sustainable.

Read 17 Sep 2021

17 Sep 2021

Finance function skills uplifted across NHS Wales

A Finance Academy that enables every member of staff working in NHS Wales Finance to learn and progress can only be a benefit.

Read 9 Sep 2021

9 Sep 2021

Finance business partnering: in government

The UK Government’s concept of the ‘finance business partner’ is best explained by someone who does the job. We find out what this concept means in practice.

Read 11 Aug 2021

11 Aug 2021

Big Issue founder submits Wellbeing of Future Generations Bill

Lord Bird, founder of the Big Issue magazine and a Crossbench peer, wants to embed long-term thinking into the workings of government.

ReadLocal government and local audit

29 OCT 2021

29 OCT 2021

Spending Review leaves inflationary sting in local authorities

A relatively large increase in central government funding for local authorities is likely to be offset by a below-inflation council tax rise next year. Further cuts may be needed to balance the books in local authorities facing rising costs on top of low reserves.

Read 21 OCT 2021

21 OCT 2021

Local authority audit hits breaking point as 91% miss deadline

New research has found only 9% of local authority 2020-21 audits were completed by the statutory deadline of 30 September 2021, highlighting the crisis in the local audit market.

Read 9 Sep 2021

9 Sep 2021

UK Council stares down deficit and innovates

Waverley Borough Council talks us through its funding challenges, service delivery achievements and the seemingly impenetrable nature of local authority accounts.

ReadCharts and graphics

11 NOV 2021

11 NOV 2021

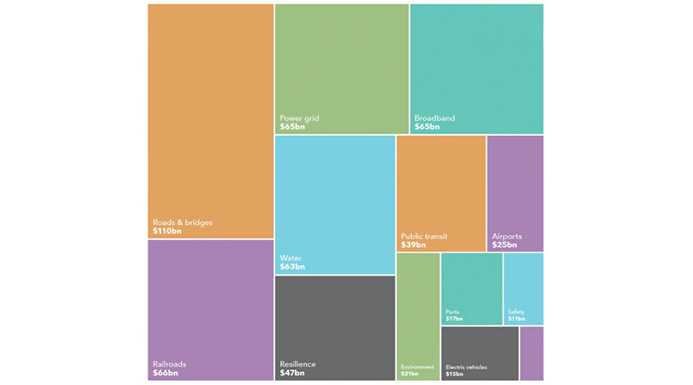

Chart of the week: US Infrastructure & Jobs Act

Our chart this week looks at the $550bn of incremental funding over five years allocated by the US Infrastructure & Jobs Act just passed by Congress.

View 28 OCT 2021

28 OCT 2021

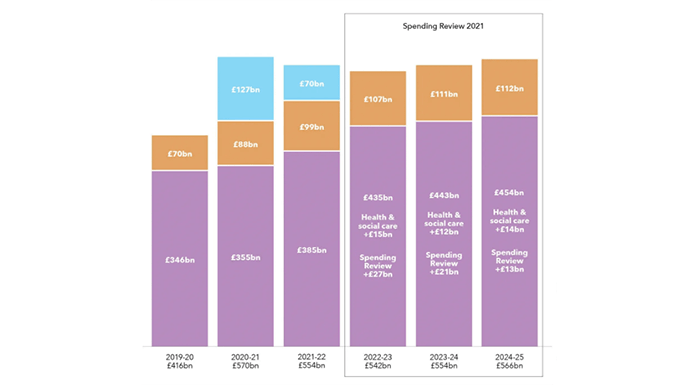

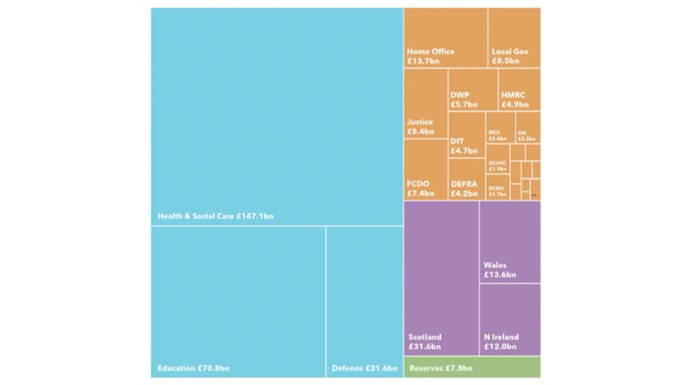

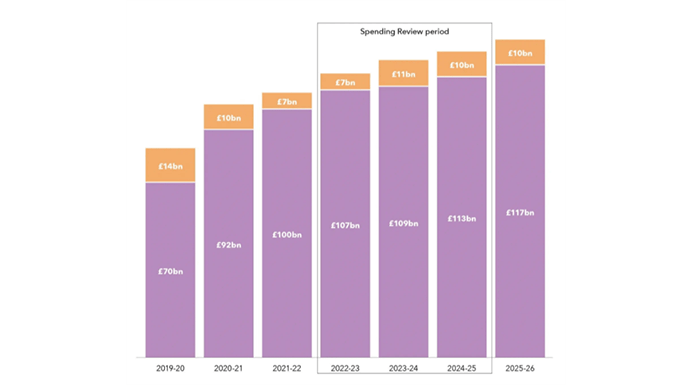

Chart of the week: Spending Review 2021

Chancellor of the Exchequer Rishi Sunak found some extra money to supplement the Spending Review 2021, turning a very tough settlement for government departments into a moderately tough one.

View 21 OCT 2021

21 OCT 2021

Chart of the week: Pre-Spending Review departmental spending

Our chart this week looks at the core departmental resource budgets that are central to next Wednesday’s long-awaited Spending Review.

View 14 OCT 2021

14 OCT 2021

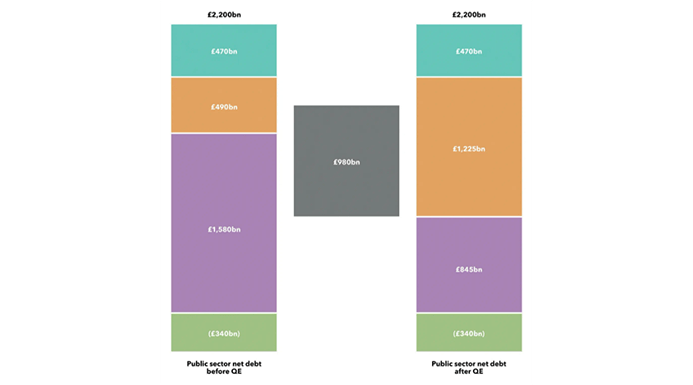

Chart of the week: UK public debt profile

Our chart this week shines a spotlight on the UK’s public debt, focusing on the Government’s debt strategy ahead of the fast approaching Spending Review.

View 07 OCT 2021

07 OCT 2021

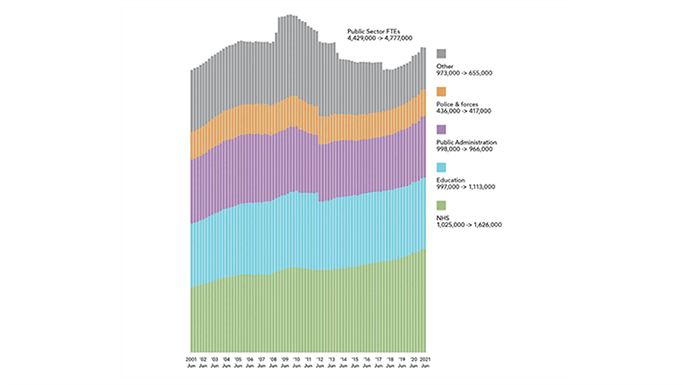

Chart of the week: UK public sector employment

Our chart this week is on public sector employment, the cost of which is one of the largest components of the Spending Review in a few weeks’ time.

View 30 Sep 2021

30 Sep 2021

The ICAEW Tax Race: 54 years in the making

How has the government’s ‘take’ from different UK taxes changed over the last five decades? ICAEW looks at this question with an interactive ‘Tax Race’ graphic.

View 30 Sep 2021

30 Sep 2021

Chart of the week: capital investment before the Spending Review

Given that capital budgets are often the first to be cut when money is tight, will the planned growth in capital investment survive the Spending Review later this month?

View 29 Sep 2021

29 Sep 2021

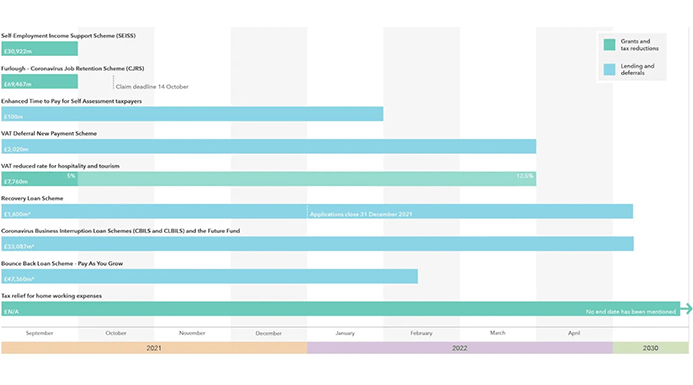

Chart: COVID support schemes are ending, but what continues?

The furlough and self-employed support schemes come to an end today, as does the VAT reduction for hospitality and tourism to 5%, which is increased to 12.5% tomorrow. ICAEW has produced a timeline for the schemes that remain.

ViewInternational

19 OCT 2021

19 OCT 2021

€100bn EU funds has not made farming more climate-friendly

Funding destined for climate action has not contributed to reducing greenhouse gas emissions from farming, says the European Court of Auditors. We speak to Peter Welch, the Director of Sustainable Use of Natural Resources.

Read 05 OCT 2021

05 OCT 2021

A balance sheet approach may be needed by the EU following COVID

The method of reporting deficits and debts by EU Member States may need to change following the disruption of COVID, say Giovanna Dabbicco and Josette Caruana, two researchers who have scrutinised public sector finances and the adequacy of existing reporting mechanisms.

Read 04 OCT 2021

04 OCT 2021

Portugal’s new framework for Intergenerational Fairness

A new framework document aims to encourage more discussion of intergenerational fairness and provide policymakers with the tools to reshape policy design.

Read 29 Sep 2021

29 Sep 2021

International approaches to reduce public sector deficit: Deloitte Cyprus

Pieris Markou, Chief Executive Officer of Deloitte Cyprus, tells ICAEW Insights that tourism and tax will not be enough to fill the hole in public finances left by COVID - the island must continue to bring in foreign investment.

ReadDigital and artificial intelligence

29 Sep 2021

29 Sep 2021

UK government sets out 10-year plan to become AI ‘superpower’

The new National AI Strategy sets out a number of measures to encourage, growth, innovation and adoption of AI technologies across the UK.

Read 23 Feb 2021

23 Feb 2021

Digital infrastructure roll-out: acceleration and reach

23 February 2021: When the National Infrastructure Commission was established in 2015 to advise government on economic infrastructure, digital communications were just part of the mix. Now it is more essential than ever.

ReadPensions

21 Sep 2021

21 Sep 2021

NAO investigation: DWP underpaid more than £1bn in State Pensions

The Department for Work & Pensions estimates that it underpaid 134,000 pensioners more than £1bn in State Pensions - almost £9,000 per pensioner.

Read