Government financial support in response to the pandemic has created ideal conditions for fraud to flourish around the world. Once again, accountants are on the frontline, finds Christian Doherty

When Chancellor Rishi Sunak announced the first package of support for struggling companies in the UK, it wasn’t just business owners and executives who rejoiced. Fraudsters and opportunists would also have tuned in with interest.

“We see spikes in fraud whenever there’s a crisis or money available from the public or the government,” says David Clarke, chair of the Fraud Advisory Panel and a former Detective Chief Superintendent.

While the speed with which the schemes came into effect was widely applauded, accountants, insolvency practitioners and the enforcement community agree that the conditions created by the pandemic – and the government’s response – have nurtured a perfect storm for widespread fraud of public sector support.

Clarke says although the types of fraud being committed are not uncommon, the potential scale of fraudulent activity is concerning. “This is new in the sense that we’ve never seen the potential for fraud on this scale – it’s totally unprecedented.”

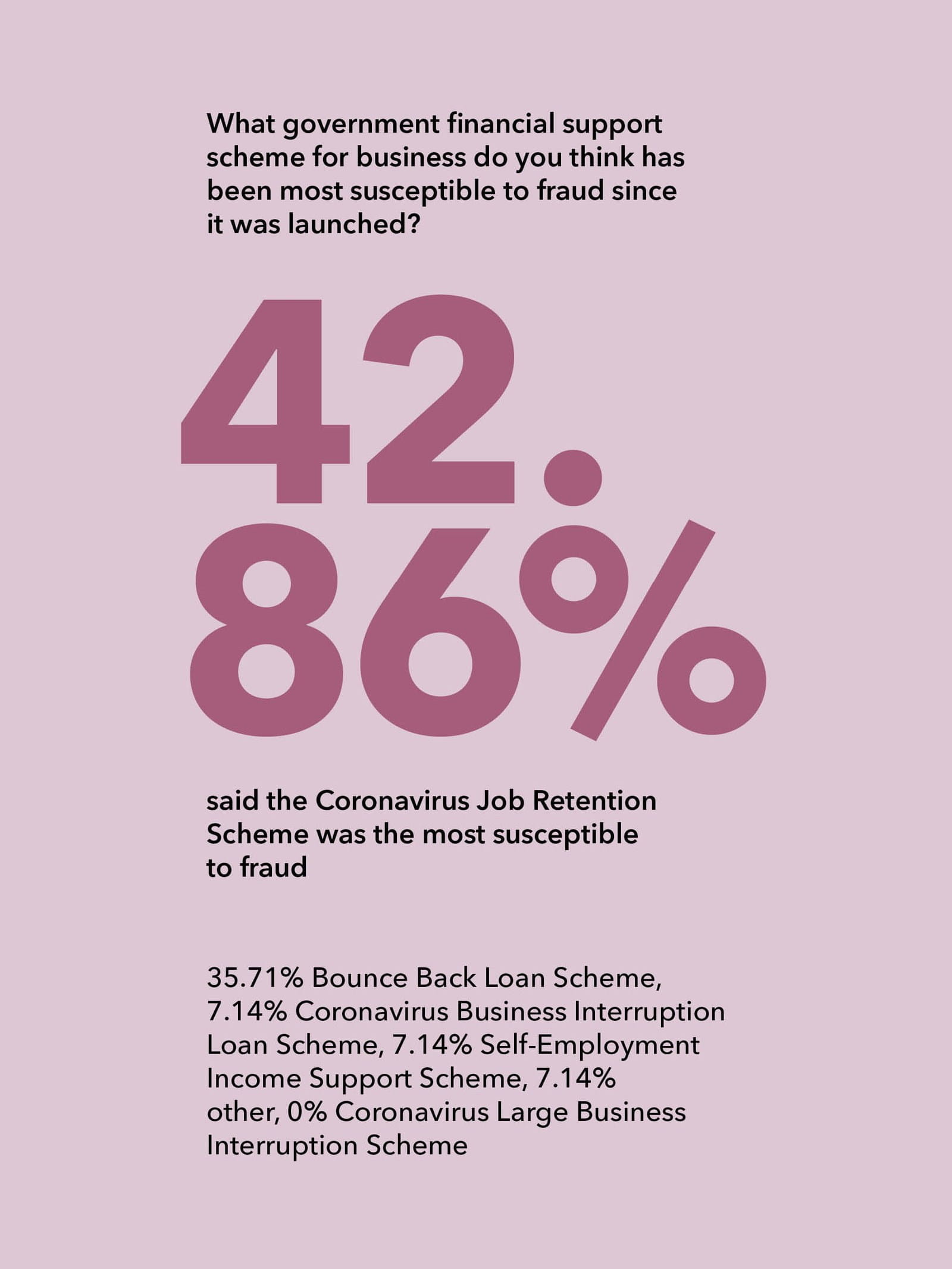

Much like the virus, the exact nature, scale and damage of the impact of fraud surrounding government support packages – such as Coronavirus Business Interruption Loan Scheme (CBILS), Bounce Back Loan Scheme (BBLS), Coronavirus Job Retention Scheme (CJRS) and others – will not be known for some time to come.

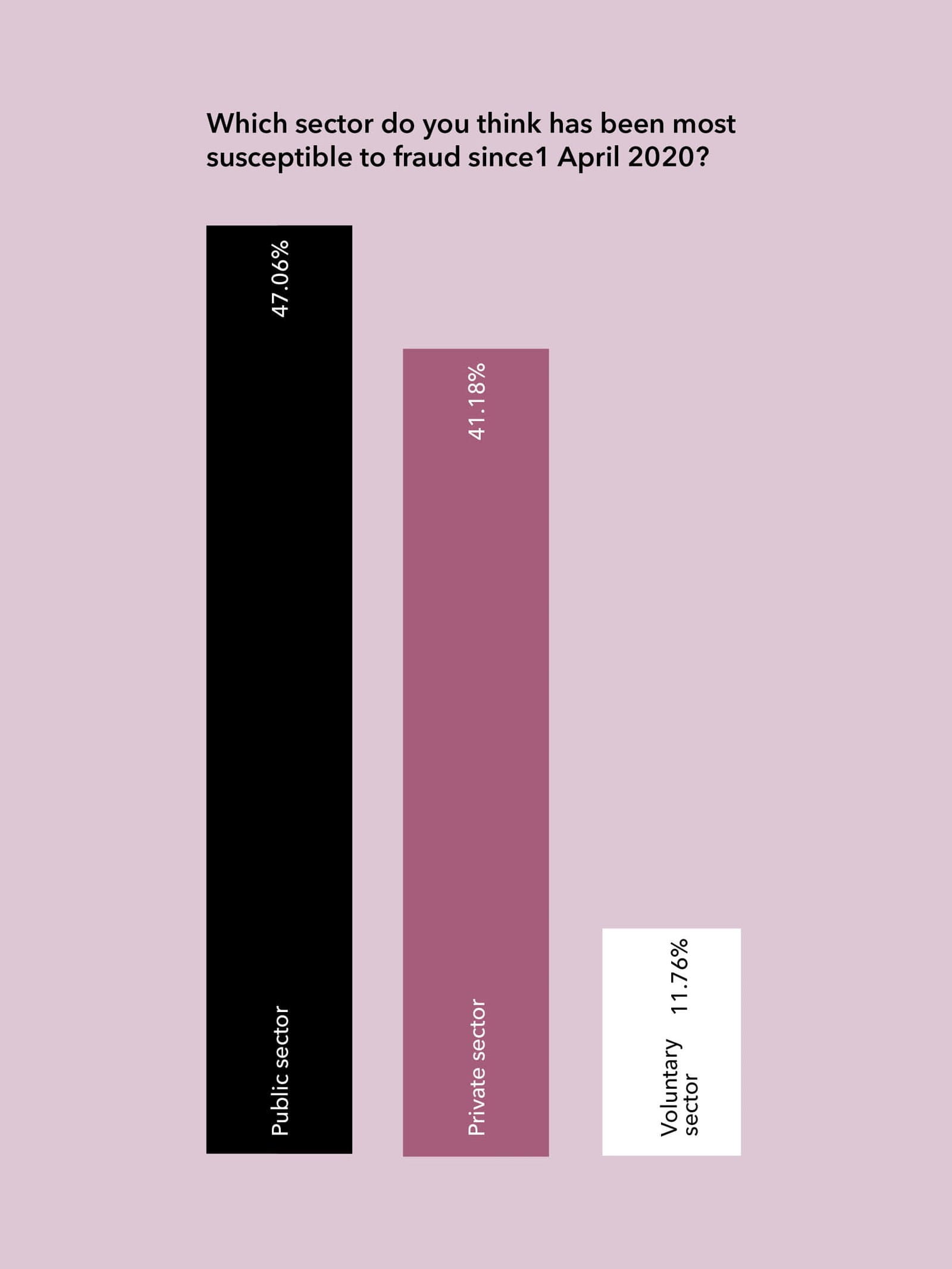

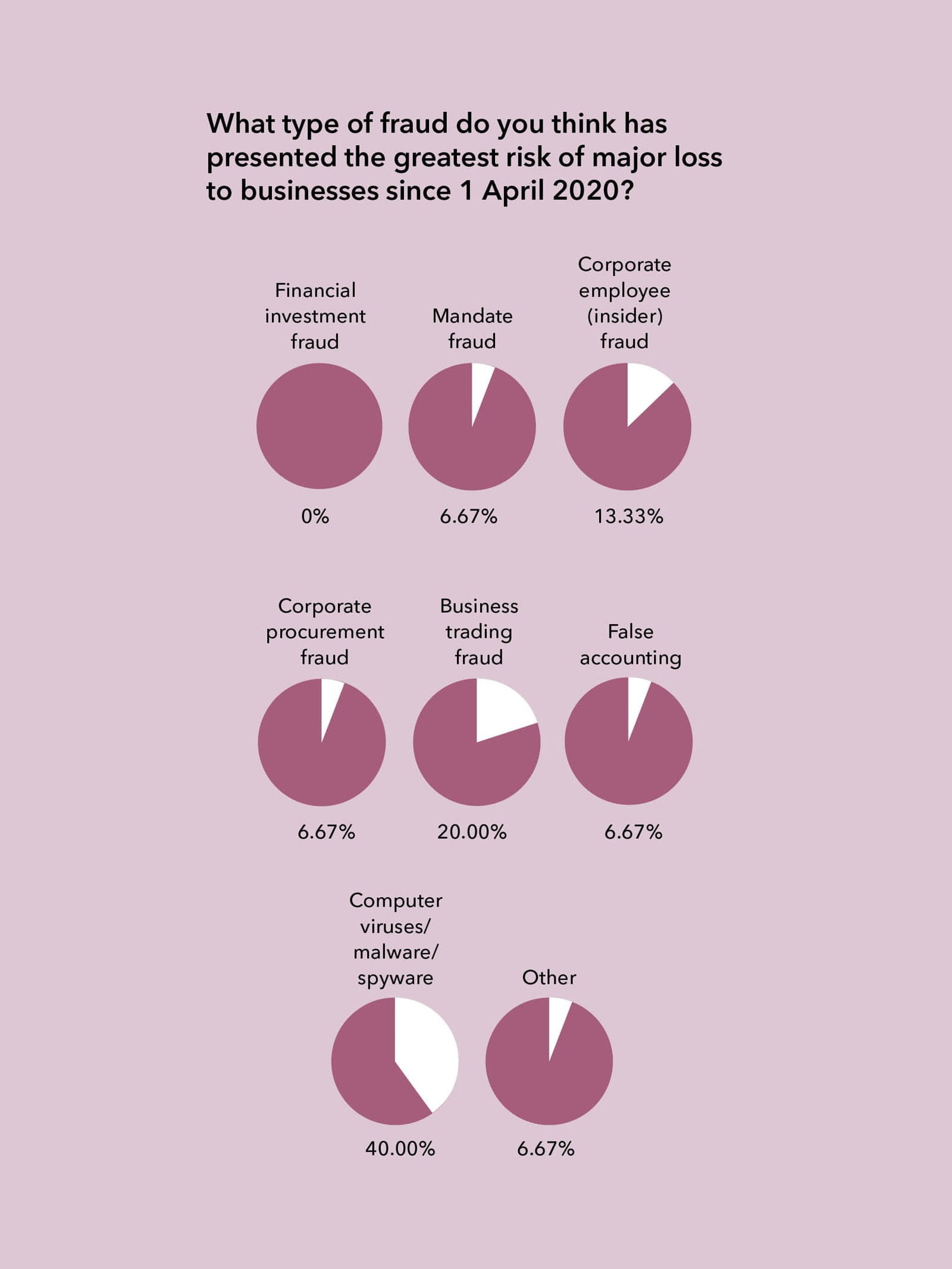

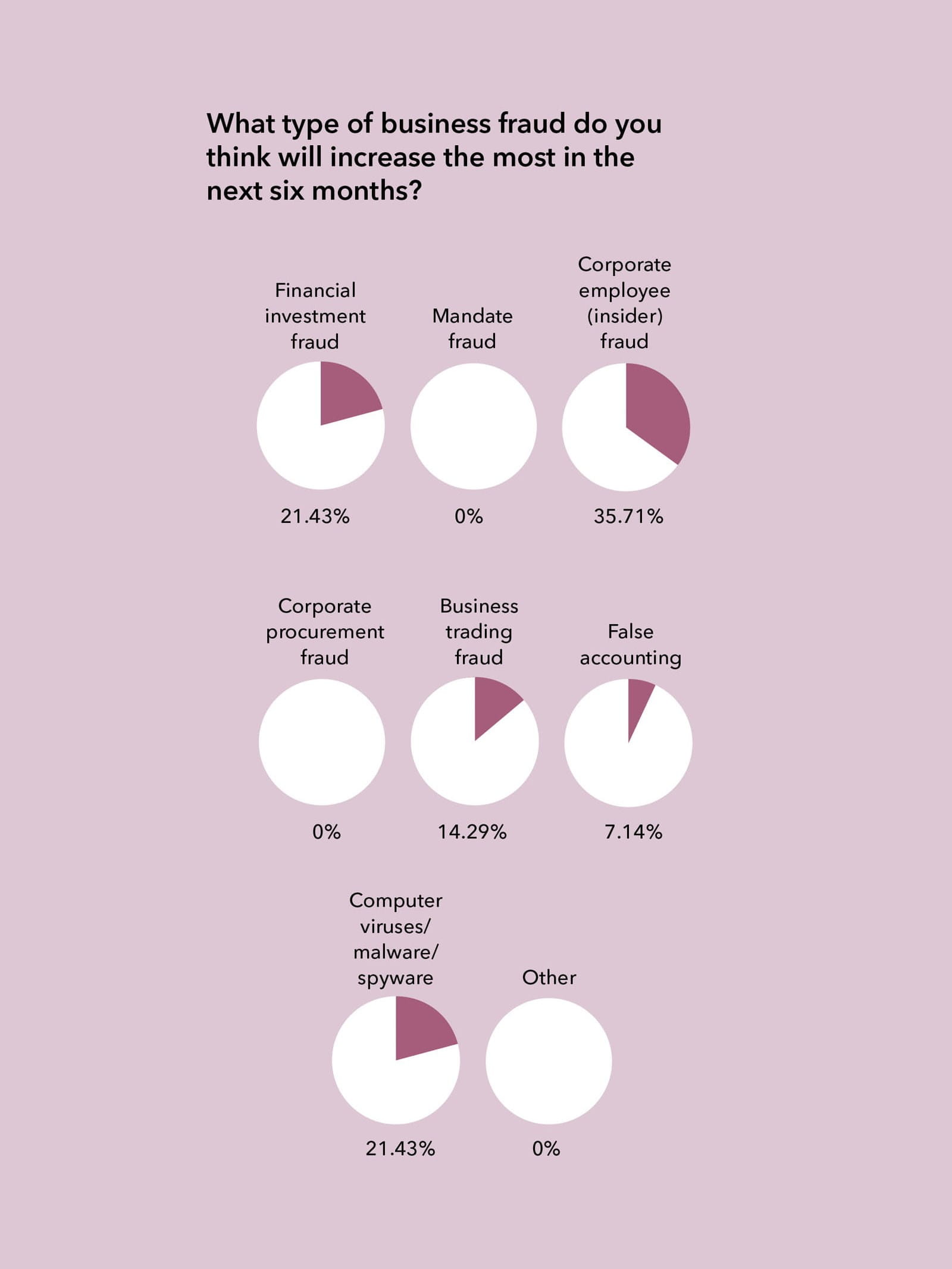

The below data comes from a survey of members of the Fraud Advisory Panel’s COVID-19 Fraud Watch Group, which was carried out in August 2020. The Fraud Watch Group comprises around 80 financial and fraud professionals, including accountants, lawyers, civil servants and law enforcement officers.

Daylight robbery

Current estimates offer some insight though. Research by centre-right thinktank Policy Exchange estimates that fraud and error during the COVID-19 crisis will cost the Government and taxpayers around £4.6bn. But in its July report, Daylight Robbery, the thinktank says the true value of public sector fraud may be as much as £7.9bn “due to the higher than usual levels of fraud that normally accompany disaster management”.

Trends are already emerging; the use of fake companies to access government funding, fraudulent applications for state support and doctoring payrolls to access furlough cash. Fraudsters have also been using open source data to apply for stimulus funding on behalf of legitimate businesses while fake business IDs are being used in payroll frauds. In particular, fears over abuse of the BBLS are growing among those on the front line.

“I’ve seen bounce-back loans approved and delivered on the same day, and that has led to abuse of the scheme,” says Sherad Dewedi, Managing Partner at Bradford-based practice Shenward. “Because there’s very little oversight, neither the government nor the bank will be able to claw it back. And that’s why limited companies exist, to limit liability. BBLS has been really popular, unsurprisingly.”

CBILS, on the other hand, covers bigger loans so the bank’s process is tighter. “Applications up to £250,000 have been checked through projections and forecasts. Beyond that, there have been directors” personal guarantees and the checks have been more stringent,” Dewedi adds.

Fraudsters are also exploiting the CJRS. In July, HMRC announced the arrest of a man from Solihull, West Midlands, in connection to a suspected £495,000 CJRS fraud. Indeed, by 7 May HMRC had already received almost 2,000 calls from employees concerned about employers abusing the scheme, predominantly from the retail and care sectors – which have been some of the hardest hit.

Additionally, supplier fraud is a particular concern. “We’re used to looking at knowing your customer in the anti-money-laundering area, but what about knowing your supplier?” asks Michael Levi, Professor of Criminology at Cardiff University.

Much weaker oversight

As a 50-year veteran of the effort to identify, prevent and prosecute corporate fraud, Levi has seen more than most how extraordinary or unforeseen circumstances can lead to a worrying drop in the levels of scrutiny employed, as normal chains of oversight are weakened. The right checks must be in place, he says, otherwise scrutiny can break down when resources are stretched and procedures ignored.

“When you’re desperate to try to roll out support, very often what you do is go to brokers,” Levi says. “Some of the unscrupulous ones may claim rightly or wrongly that they’ve got good contacts to deliver PPE, for instance. But to deliver PPE – or any other product, hand sanitiser, anything that you can’t get hold of as a company or as a government quickly – sometimes the scrutiny of those companies is nowhere near as good as it should be.”

Much of the fraud is opportunistic, and frighteningly basic. The National Crime Agency (NCA) is especially concerned about the practice of creating so-called dummy or fake companies to claim government support. “If you have a dormant company then it can be brought back to life. You can install “mule” directors and backdate their appointment in order to be eligible to apply for support,” says Clarke.

During lockdown, fraudsters have been busy looking at ways to skirt checks on BBLS. “The issue there is that they’re going to be a juicy target because of the self-certification. Anyone with the ability to put in a mule director can do it, and that’s without looking at the question of the different levels of due diligence being done by lenders,” adds Clarke.

Levi says accountants have to be aware of the opportunistic nature of fraud and be prepared for threats that they may not yet have encountered. “Just as it’s quite possible to buy an off-the-shelf company, in these desperate times, people can be conned into selling their company to a fraudster,” he says. “The fraudster can use the company’s existing credit reputation and walk off with the loot, or people can supply each other with fake references. So those are the kinds of things that accountants or insolvency practitioners are used to seeing but may not be apparent at the time of distribution.”

A Fraud Advisory Panel update on COVID-related fraud highlighted recent concerns about the use of virtual offices and post office boxes that enable people to easily set up and trade with an air of legitimacy – often without any proper anti-money-laundering checks being performed.

Lenders are getting nervous too

It’s not just HMRC and HM Treasury that are worried. Lenders are getting nervous too. Rachel Sexton, Partner and Head of Financial Services Forensic and Integrity Services, EY, says self-certification is likely to produce a spike in bad loans that ultimately default. “Borrowers have to certify that what they are borrowing is a certain percentage of turnover,” she says. “If someone’s really in trouble they may go above that, and again the government may not guarantee it.”

Most of Sexton’s work has so far focused on helping banking, insurance and asset management clients understand default risks. “They are most concerned with people borrowing from more than one bank. We’ve seen examples where a business can go to multiple lenders, and the banks worry that five of them are lending to the same person.”

The banks” defence, she says, will be to point out they have run years” worth of loan applications in a matter of weeks, so they couldn’t possibly check every one to the usual level of scrutiny. Ultimately, they are relying on the truthfulness of borrowers in a time of crisis.

Sexton says it’s too early to say which sectors will be most at risk of fraud. “But those such as hospitality that rely heavily on cash flow will clearly suffer, and consequently we may see more fraud in those areas,” she says. “Any sector – travel for instance, where cash has stopped dead – those without reserves or the ability to keep borrowing will be hit more.”

Busy months ahead

It promises to be a busy autumn for those in practice and business. “We want to help clients that end up in trouble,” says James Abbott, Director of Abbott Moore practice in Bedfordshire. As government support ends, Abbott says he’ll be putting his team on notice to be looking out for anything that looks like fraudulent claims for support. “And we’ll be warning our clients about the potential issues around that,” he adds.

Clarke believes that a lot of fraud could be prevented by centralising the data into a powerful database, such as the Cabinet Office’s National Fraud Initiative (NFI), and then making this available to relevant parties.

“If my company’s got no money, I’ve got no money and I’ve got various county court judgements, or my name and address is linked to a previous fraud and I wouldn’t get a bank loan in normal times, and I apply for one of these, I’m flagged. It’s probably the best system in the world for data matching. You can find a multiple blue [disability] badge abuser 200 miles away. The system is very effective. it saves the taxpayer millions every year in public sector fraud; and it’s tried and tested.”

Tried and tested approaches will be in great demand in these unparalleled times. And, as the true figure of fraud emerges, taxpayers will rightly demand government action to combat fraud and punish those who exploit the system in times of crisis.

For more on the UK law and guidance on anti money laundering, visit icaew.com and search for anti-money laundering UK law and guidance.

What of the ethics?

As BBLS and CBILS wind down, HMRC will take a more active role. While accountants have no specific responsibility to address misuse of the support schemes, standards and professional ethics do not permit them to ignore it if it comes to their attention.

The ethics over “use of funds” will be an important area to watch out for, to ensure rules have been applied in a fair and reasonable way. “There will be clear indications where the funds have left the business and that’s an important thing to look out for, especially when you’re looking at BBLS,” says James Abbott, of Abbott Moore. He urges a look not only at the rules but also the spirit of the guidance.

So, if a company receives a bounce-back loan and the director lends themself the money with no clear benefit to the firm, accountants may be expected to ask “where and how have they complied with the requirement to help the business if it’s been used for private matters?”, Abbott says.

Abbott also reports seeing evidence of questionable use of BBLS. “Most people who applied did so to the maximum level. So, yes, while the scheme rules were clearly based on turnover, many businesses don’t know how much they might need.”

Sophie Wales, ICAEW’s Head of Ethics and Economic Crime, says: “It was admirable that support was rolled out at such speed, but it’s inevitable it will lead to more fraud among CJRS, SEISS and the others.” ICAEW expects scrutiny of accountants, and whether they should have spotted fraudulent use of the schemes.

Wales says “in some cases the criticism will be fair, but in most cases it’ll be clear accountants weren’t party to that information at the time’. The question will be for the auditors to uncover what went wrong.

Wales urges accountants working with clients who have benefited from government schemes to tread carefully. “Accountants don’t have an obligation to report fraud; what they do have is an obligation to report suspicions of money laundering. And fraud can be the predicate offence to money laundering.

‘If you know or suspect that a client has fraudulently obtained money through a government support scheme, then that is money laundering and you must report your knowledge or suspicions to the NCA,” Wales says.

As for HMRC’s approach to enforcement, Abbott says: “I suspect there will be a few high-profile prosecutions in place and the amnesty that allows employers 90 days to report if they have wrongly claimed, will have an effect. But come autumn, we will see most of the compliance activity happening then.”

The auditor’s view

Much of the fraud that has gone on since the inception of the scheme is unlikely to be picked up until auditors arrive. For Michelle Cardwell, Technical Manager for Audit, Assurance and Financial Reporting at ICAEW, auditors will play a role in spotting and reporting bad behaviour — and will need to use all the tools at their disposal to do so.

“One tool auditors can use is data analytics software that allows them to spot outliers,” she says. “So now you might be looking through an entire ledger and you can more easily spot unusual things — was the entry made late at night, or at the weekend? That could be indicative of fraud. And then, what about people who don’t typically post journals, or someone who doesn’t normally approve certain things?

“A change in working patterns is a really good breeding ground for fraud. In these situations controls and systems can break down and lead to workarounds, while regular checks and reviews may fall by the wayside. And there may be fewer people around to check details of a new vendor, for instance, making internal controls less robust. Segregation of duty controls can also weaken with people working from home, or when many people are furloughed.

“Over the short term, auditors have to get used to virtual or remote auditing, where you can’t see the ‘whites of their eyes’ so to speak. So if someone is lying or manipulating the truth then it’s very hard to tell from a phone or video call.

“Auditors need sufficient time to gather the appropriate evidence and data to develop a proper opinion — remote audits and heightened fraud risks means that is likely to take more work than normal.”