If cashflow and late payments are a concern to your practice and your clients, there is good reason, as it has been reported late payments in the UK costs small businesses £22,000 a year on average and leads to 50,000 business closures a year.(1) It has been noted that 46% of small businesses claim the time associated with chasing invoices as having the most noticeable impact on their business, with 31% of businesses spending between 21-30 hours per month chasing customers(2)

Introducing clear guidelines on payment terms at engagement with a client can significantly help you collect your professional fees in a timely manner. In the past, you may have offered bank transfer, or standing order collections and perhaps have even extended this by offering Direct Debit solutions. Whilst the latter can be beneficial, if it is spread over an agreed term, your cashflow is still impacted as the payments are not immediate and in full. Both Next-Day Professional Fee Finance and Invoice Factoring improve on this, by providing further valuable solutions to address cash flow challenges, but they operate in distinct ways. Understanding the differences between them is crucial for businesses to choose the right option based on their specific needs.

What is Next-Day Professional Fee Finance?

Next Day Professional Fee Finance, provided by Keys Finance, is available to accountancy practices across the UK and Ireland. Supported by both ICAEW and Chartered Accountants Ireland, this facility allows accountants to receive 100% of their client fees Next-Day. Providing a boost in cashflow for the practice, a reduction in debtor days and provides clients the flexibility to spread payments over 2 to 12 months, helping to alleviate immediate financial pressures and allowing them to invest capital in other areas of their business.

With Fee Finance, accountancy practices can fund completed work with agreed invoice values, project work, transactional fees, and even aged debt. With minimal processing, there is no additional cost to the practice and provides accountants with the flexibility to use the service as frequently or infrequently as required. With a simple sign-up process, your practice could be offering enhanced payment solutions to your clients within 24 hours.

What is Invoice Factoring?

Invoice factoring is a financing method where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount. Instead of waiting for customers to pay invoices, the business gets an advance on the amount owed, usually 70-90% of the invoice’s value. The factor collects the payment from the customer and remits the balance, minus fees, to the business. The factoring company takes control of the entire collections process and removes control from practice.

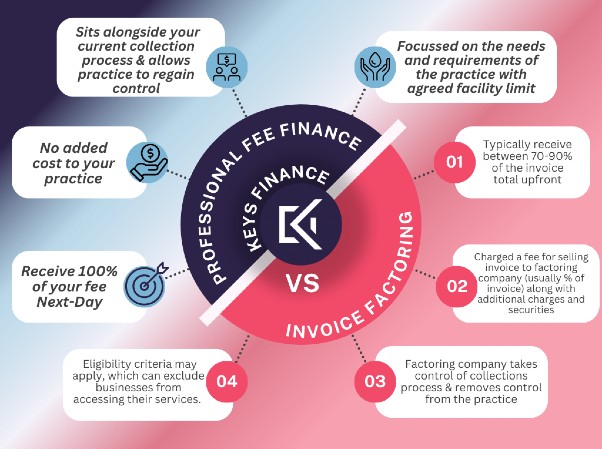

At first glance, these two types of funding may appear similar, but there are clear distinctions between them. The infographic below highlights the key differences between Next-Day Professional Fee Finance and Invoice Factoring

If the thought of Next-Day payment to your practice is an influencing factor, please get in touch with one our experts through our enquiry form.