HMRC has acknowledged its error in not allowing overpaid CGT on UK residential property to be offset against income tax. ICAEW’s Tax Faculty explains the solution that has been put in place for 2020/21 self assessment returns.

The fact that HMRC’s systems do not allow overpaid capital gains tax (CGT) reported and paid within 30 days of the sale of a UK residential property to be offset against income tax on self assessment (SA) returns came as a surprise to some early filers of 2020/21 tax returns. The situation was made worse by a complete lack of guidance from HMRC on how taxpayers were supposed to recover the overpaid CGT.

Many taxpayers will find themselves in this position as when filing their CGT UK property return within 30 days of completion, estimates will often need to be used, losses made later in the tax year cannot be anticipated and the applicable rate of tax may also have been uncertain. It is possible to amend CGT UK property returns to correct estimates, but amendments are not permitted for losses made later in the tax year. Once the SA return has been filed the CGT UK property return cannot be amended.

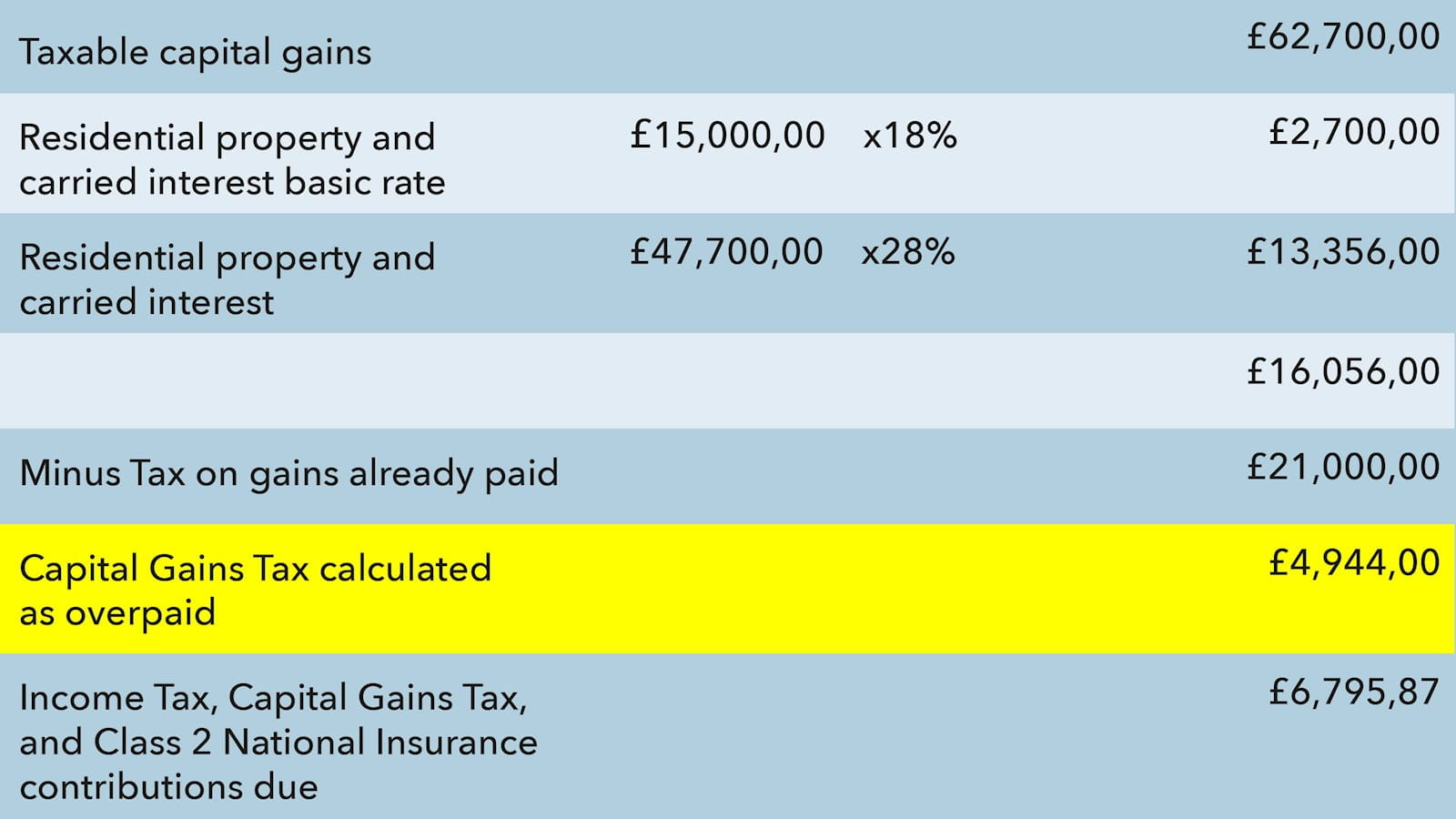

An example of what the SA calculation might look like if CGT has been overpaid is shown below:

The taxpayer or their agent should phone HMRC (on 0300 200 3300 or the agent dedicated line) to ask HMRC to manually offset the CGT paid against the income tax liability.

Where it is possible, taxpayers may prefer to amend the CGT UK property return prior to submitting the self assessment return and request a refund of the overpaid CGT. Others may prefer to deal with the overpayment through the self assessment return. Refunds can be claimed through the service when filing an amendment or an additional return, requesting an offset will require a phone call to HMRC. Amending the CGT return will give access to the funds for a period, instead of an offset against a self assessment liability that is not yet due, but does involve an additional return.

HMRC is exploring options for a more satisfactory solution in the longer term; updating the SA system mid-year is not possible.

The faculty and other professional bodies continue to work with HMRC on the many other problems with the CGT 30-day reporting service. TAXguide 15/20 Capital gains tax 30-day reporting | ICAEW will be updated as further information becomes available.

Download HMRC guidance

HMRC has developed a new question and answer helpsheet and an information document on offering further clarity on UK property disposal capital gains tax.

Download Q&ADownload informationTax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.

-

Update History

- 19 Jul 2021 (12: 00 AM BST)

- Updated to insert new paragraph starting: "Where it is possible, taxpayers may prefer to amend the CGT UK property return prior to submitting the self assessment return and request a refund of the overpaid CGT." and to add link to HMRC's guidance.