HMRC has taken some small but important steps towards giving agents access to the information and services available to clients. ICAEW’s Tax Faculty outlines recent changes including giving agents access to payments and liability information for VAT and employer PAYE.

HMRC has made significant progress in delivering online agent services in two of the areas most frequently requested by ICAEW members in practice: agent access to client VAT and employer PAYE accounts.

VAT accounts

On 9 October 2021 HMRC released the functionality to allow agents to view clients’ VAT payment history, building on the view VAT returns service which was previously available.

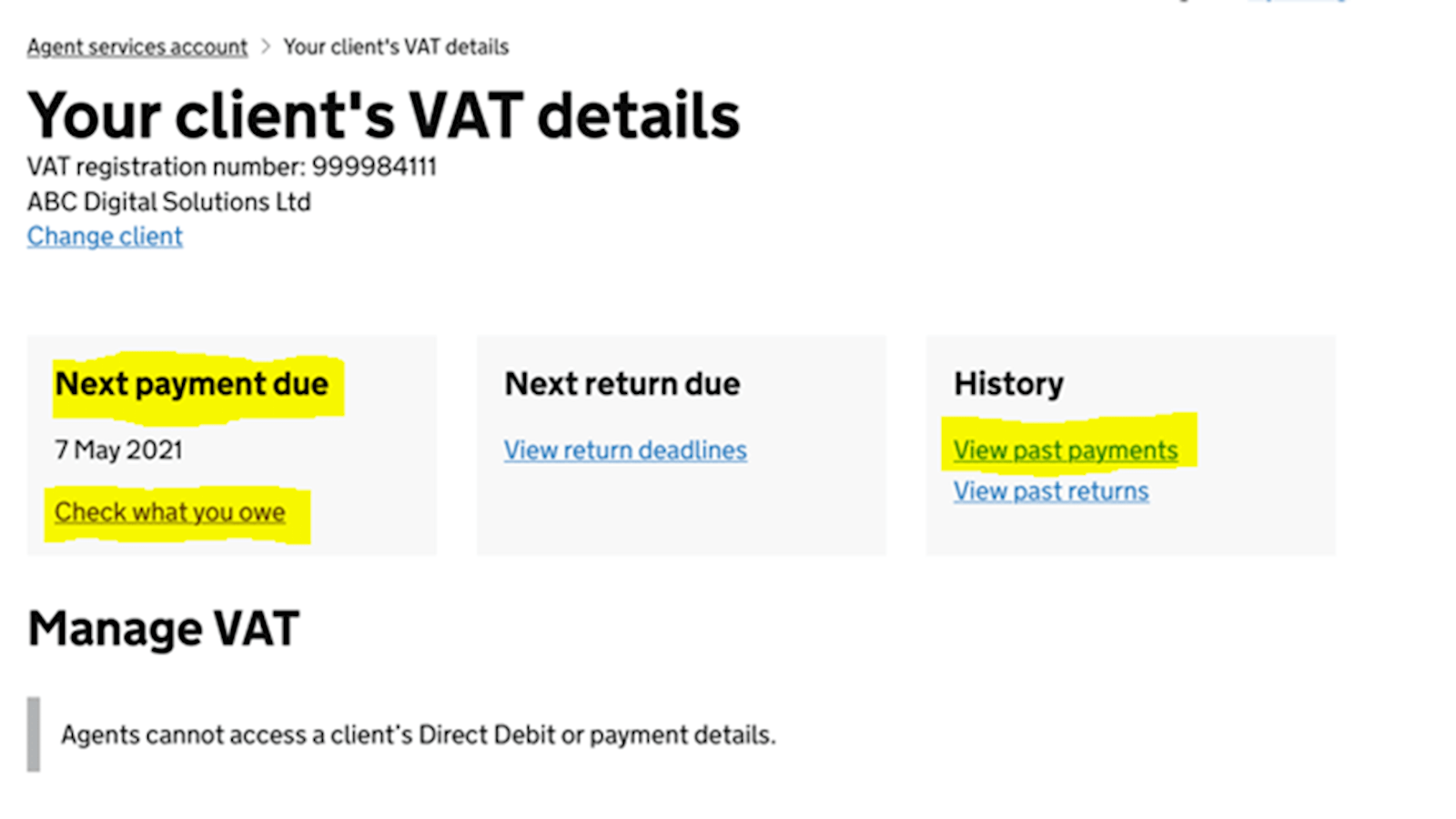

The service is available in the agent services account (rather than the older agent online services portal), follow the option "Your client's VAT details" as shown in the screen shot below.

The service is available for all VAT clients where appropriate agent authority is in place, whether or not they are signed up to MTD VAT, subject to the VAT record having been transferred from the old VAT database to HMRC’s new platform.

Employer PAYE accounts

HMRC is inviting more agents into the service which allows them to view payments and liabilities for their employer PAYE clients.

The service is being gradually rolled out, with invitations currently being issued to agents with up to 5,000 clients (the list of employers being used by HMRC is from October 2018). The invitations are presented when an agent signs into PAYE online for agents and there is a daily cap of 700 invitations.

Further news on extending the service to the largest agents is expected on 25 October and by the end of the month HMRC expects to remove the need to confirm that the agent acts for a client before they can see the liabilities and payments data.

The service has generally been well received, however, some agents have reported the following issues:

- Being unable to access the data for particular clients because the system shows (the agents believe incorrectly) that they have “limited authorisation” (FBI2 only) rather than full authorisation (FBI2 and 64-8 or online authorisation).

- The data that the agent sees is now identical to the information which is displayed to the client in their business tax account, but it is not the same as that visible to HMRC contact centre staff.

Feedback

ICAEW’s Tax Faculty would welcome feedback from members on these services. Please contact caroline.miskin@icaew.com.

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax FacultyTax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.