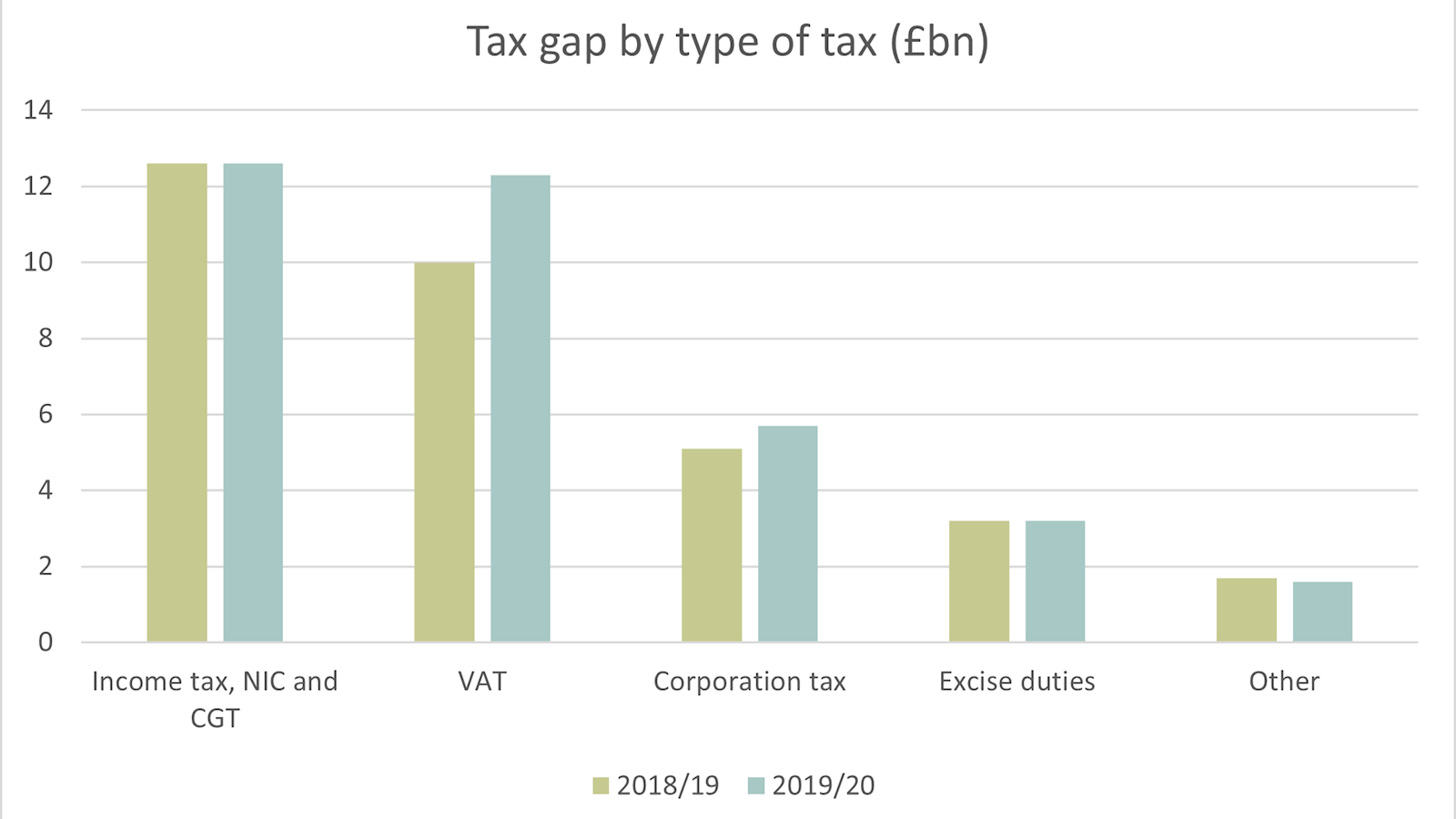

HMRC figures released for the pre-pandemic period of 2019/20 show a £2bn increase in the estimated tax gap, largely attributable to an increase in the VAT gap. ICAEW’s Tax Faculty analyses the key data.

On 16 September, HMRC published its annual data estimating the difference between the total tax expected to be paid and the amount actually paid. The £35bn figure for 2019/20 equates to 5.3% of tax liabilities, a slight increase on the 5% of tax liabilities in 2018/19.

The Tax Faculty highlights that although the estimated tax gap has reduced over time in percentage terms, in real terms it remains stubbornly around the same level. The latest figures show a small increase in percentage terms, largely attributable to an estimated increase in the VAT gap.

The VAT gap is measured predominantly by reference to a top-down method of comparing tax receipts to the estimated tax due based on consumer spending data.

Table 1:

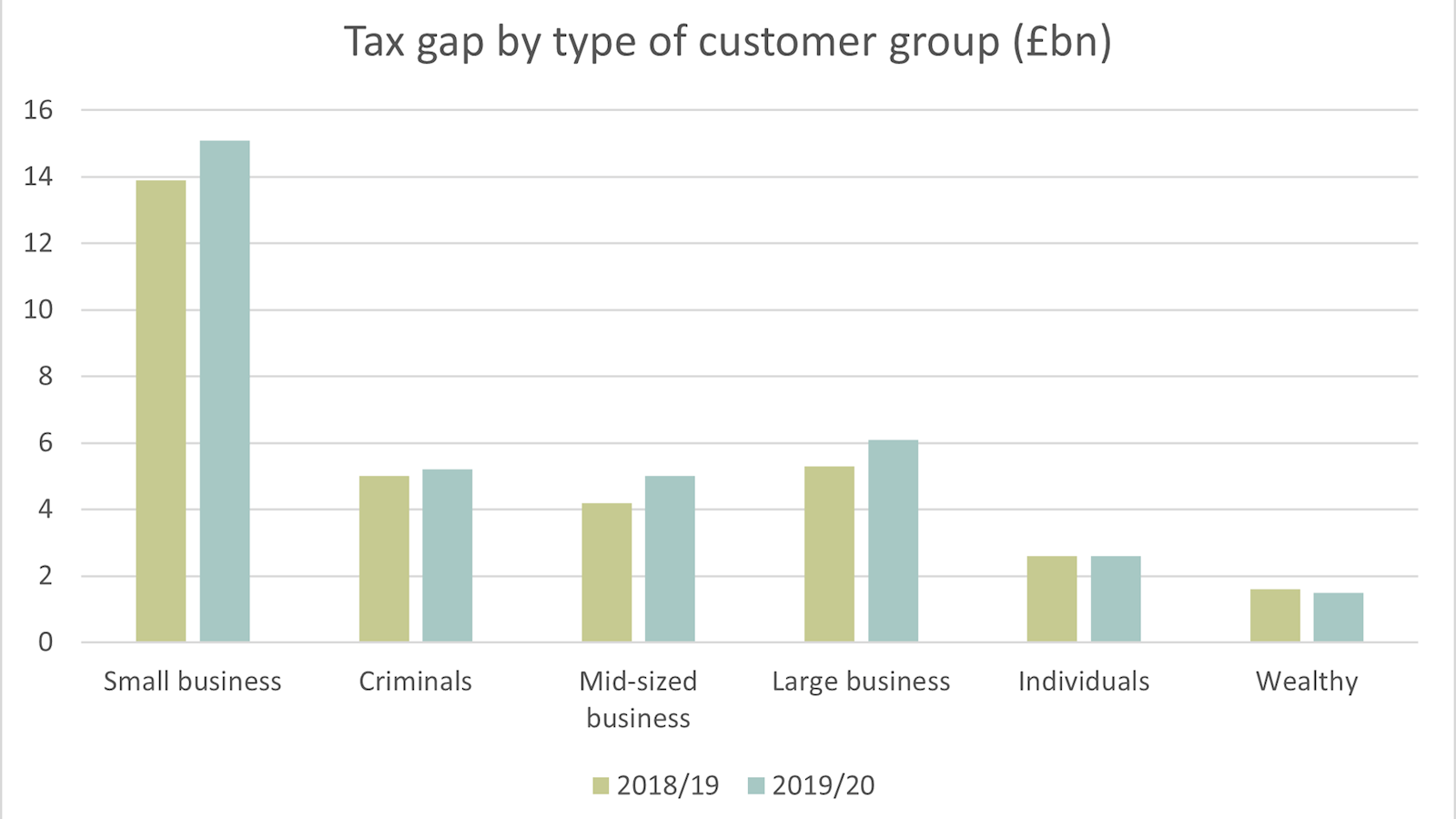

Looking at the tax gap by customer group, small businesses make up the largest group. A striking figure buried within the report is that business taxpayers are estimated to only pay 77.5% of the amount expected under self assessment (underpaying £4.3bn).

However, it is worth noting that HMRC’s methodology for estimating the gap for income tax self assessment is calculated from the bottom up. It is based on enquiries (which ICAEW members report that they rarely see in practice) together with operational results from compliance activity.

Table 2:

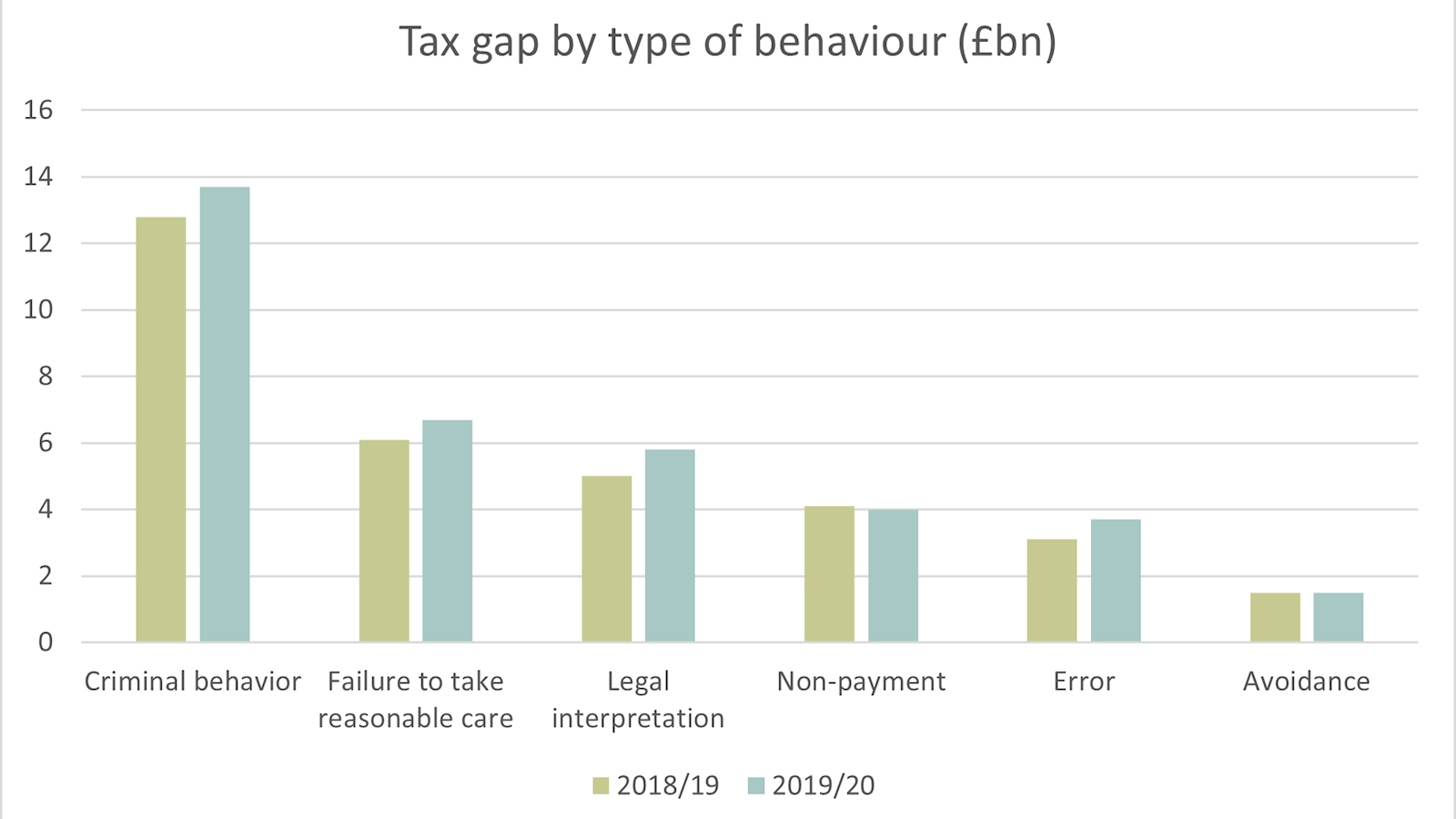

In reporting the figures by type of behaviour, what ICAEW views to be criminal behaviour is subdivided by HMRC into evasion, criminal attacks, and the hidden economy (in table 3 below these have all been combined). Between them they account for almost 40% of the tax gap.

Failure to take reasonable care remains consistently around 19% of the tax gap. ICAEW notes that the estimates do not reveal the estimated population of taxpayers that are represented by professional agents, so it is difficult to assess what role agents play in helping to reduce this figure. In contrast, the tax gap due to avoidance is down to only 4% of the total, which suggests that HMRC’s drive to curb avoidance has achieved results.

Table 3:

Read more:

- Tax gap remains low at 5.3% (gov.uk)

- Measuring tax gaps (gov.uk)

More support on tax

ICAEW's Tax Faculty provides technical guidance and practical support on tax practice and policy. You can sign up to the Tax Faculty's free enewsletter (TAXwire) which provides weekly updates on developments in tax.

Sign up for TAXwireJoin the Tax FacultyTax Faculty

This guidance is created by the Tax Faculty, recognised internationally as a leading authority and source of expertise on taxation. The Faculty is the voice of tax for ICAEW, responsible for all submissions to the tax authorities. Join the Faculty for expert guidance and support enabling you to provide the best advice on tax to your clients or business.