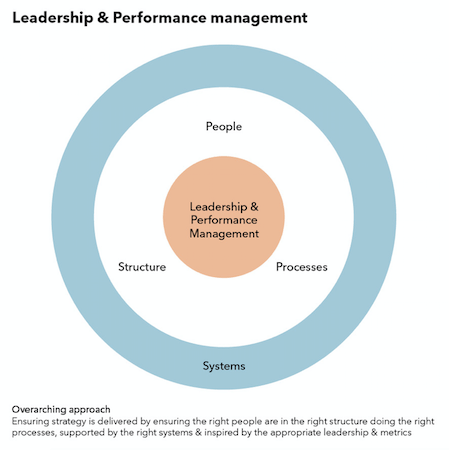

In the introduction to this series, I introduced what I call the five pillars of a successful finance transformation strategy. These are as follows:

- Appropriate leadership and performance management

- The right structure

- The right processes

- The right people

- Supported by the right systems

Over the course of the next five articles, I’ll focus on each pillar individually, with the aim of providing a toolkit to help finance leaders manage a successful transformation strategy - today we start with leadership and performance management.

Cut the fanfare

Finance leaders often have a big fanfare about transformation projects. This, inevitably, requires change right through an organisation’s structure, and often the further down the chain you go the weaker the implementation. Once you get down to the people, systems and tools, if a project hasn’t been adequately scoped, defined, managed and backed, it’s destined not to deliver on its potential.

Realising how an effective finance function is run is critical. Job descriptions need to be tied to process, systems and tools, making the whole system tighter and more efficient.

Here are three simple questions finance leaders should ask before embarking on a transformation project:

a) Is there a clear mandate from leadership?

For a successful finance organisation transformation, you must have a clear vision and direction from the top. Do you have a mandate and support from the executive board? From a leadership perspective this is fundamental.

b) Is it being managed with project discipline?

Is the whole transformation programme being run as a bona fide project, using a project management expert to manage scope and deliver on cost and schedule? If not, why not?

Somebody who helped me with a transformation project once asked: "what is the difference between a chartered accountant and a project manager? A project manager knows they cannot do the work of a chartered accountant".

As you’ve probably figured out, the implication behind this slightly tongue-in-cheek question is that often just because an individual is good with numbers they end up being put in charge of a transformation project without having the required skills and experience to deliver it effectively.

Where I’ve seen transformation projects work well, project teams are supplemented by project management expertise. Finance people are generally good at defining a project and planning the processes, but often not great at bringing in experts from other disciplines. In larger organisations there are generally plenty of people with such experience and expertise to draw on, but smaller ones may wish to bring in external experts who are often worth the effort.

Project discipline also means that every month, if not more frequently, there’s a finance transformation steering group to manage the project, deal with issues and hold people to account. Where I’ve seen such projects work well, the CFO is front and centre running those meetings. Run poorly, these are delegated down the organisation, which gives the impression that senior leadership are not serious about it.

c) Are the benefits of the transformation defined?

Otherwise known as ‘why bother’? Has the CFO (and leadership in general) clearly defined why they are doing this, both to themselves and to the wider organisation?

Is it a cost saving exercise to support cash flow or profits? Is it about freeing up scarce resources by making the organisation more efficient? Or is it about improving the compliance/control environment? It could contain elements of all three, but which ones are most important? Is it about making the finance function the best place to work?

Having clearly defined benefits such as boosting profits, freeing up talent or streamlining compliance make the project a much easier ‘sell’ around the business, and also construct a tangible set of metrics around. This is critical for successful performance management.

So what’s your GAME plan?

So, you have been tasked with delivering organisational transformation for your finance team - where do you start? After struggling with this for years, I developed a simple four-step approach to transform your finance organisation. This is your GAME plan!

So what do I mean by GAME?

- Gap Analysis

- Action plan

- Measure and manage

- Examine and improve

Each of these four steps will now be covered, with supporting downloadable documents which you can use to help you deliver organisational transformation of your finance team.

Gap analysis

- This is the analysis of the five pillars of transformation, which shows where you want to be vs where you are today

- This downloadable document provides a simple template format to help with this.

- Today we are covering the leadership and metrics perspective, but we will cover the other perspectives in the future.

Action plan

- This is a simple SMART action plan which assigns and allocates actions to teams or individuals to ensure the Gap Analysis is achieved for each of the five pillars

- Here's a link to an example diagram which you can adapt for use in your organisation

- The action plan gives an example for this leadership and metrics perspective, we will provide similar examples for each of our other perspectives.

Measure and manage

- This is how you will govern the transformation programme to ensure it is delivered with project discipline. It should include a project governance structure to enable decision-making and action to be taken (where required). Are we achieving our milestones? What are the potential barriers to implementation or project risks the CFO needs to deal with?

- Depending on the size of the organisation, expect to have a steering group with key decision-makers.

Examine and improve

- No project plan or metric system is ever perfect, so we need a way of examining what we have done so that we can continuously improve. This may be a scheduled annual review or may occur as a result of an external event (eg global credit crunch or global pandemic).

- There are many continuous improvement approaches, but the important thing is to do something, I suggest starting with the two simple questions:

- What went well?

- What could have gone better?

In the next article in this series, I’ll look at why it’s important that an organisation has the appropriate structure in place, and hopefully you’ll start to see how this all ties together. The importance of matching a person against a role profile, building these role profiles into an organisational structure, putting the right processes and metrics together to drive improvements in performance and ultimately transform your finance function into a successful and happy one.

Neil Cutting guest lectures on Strategic Performance Management on the University of Bath MBA Programme. This is in the Top 50 Global MBAs in “The Economist” rankings.

His day job is finance transformation executive for US-based company Jacobs. With $13bn in revenue and a talent force of more than 55,000, Jacobs provides a full spectrum of professional services including consulting, technical, scientific and project delivery for the government and private sector.

He is also a member of ICAEW’s Business Committee, which represents global business members.