The last few years have seen the issues that were practised as a cottage industry called sustainability move to centre stage. Climate action is now part of the discussions at G7 and G20 meetings, and finance ministers and businesses were out in force at the Glasgow climate summit.

And climate is part of a wider crisis of massive loss of nature and growing inequalities. There is a widespread understanding that economic and business success is rooted in the success of our societies and our planet. There is a growing appreciation that business stewardship is not so much about what goes on within the corporate boundary: it is about how we look after nature and people.

The necessary transformation of our economies to ones that can allow for prosperity and fairness within what nature can support is a massive challenge. It requires a wholesale rethink of our economic and business models. In order to achieve that, organisations need to understand their dependencies and their impacts on people, society and nature, build those into their decision-making and disclose them to markets, shareholders and other stakeholders, who can then use that information.

We often focus on reporting as the driver of business and market behaviour, and this has been a big year for sustainability reporting. The announcement of the formation of the International Sustainability Standards Board (ISSB) on 3 November is the headline. This will bring together what must seem to many as a bewildering array of non-financial/sustainability reporting initiatives and frameworks.

The even better news is that these initiatives have done a considerable amount of the work already. The ISSB will not be starting from scratch but building on existing frameworks, initiatives and expertise. For the most part, it will be based on the framework of the Taskforce on Climate-related Financial Disclosure (TCFD). The first draft standard is ambitiously expected for consultation in 2022. The goal is to achieve a global baseline for sustainability reporting standards, which can be topped up at a local level with regulation.

The UK has signalled that it will go further. The plan for the UK is set out in the Treasury’s Greening Finance: A Roadmap to Sustainable Investing. The Roadmap states that the ISSB’s standards will be the backbone of its reporting requirements but goes on to say:

“The ISSB’s standards, building on the work of the TCFD, will focus on information which is material to investors. SDR [the Sustainability Disclosure Requirements] will go further, requiring wider information on how firms impact the environment.”

On 3 November, the Chancellor announced at COP26 that most big UK firms and financial institutions, by 2023, will have to set out detailed public plans for how they will move to a low-carbon future - in line with the UK's 2050 net-zero target.

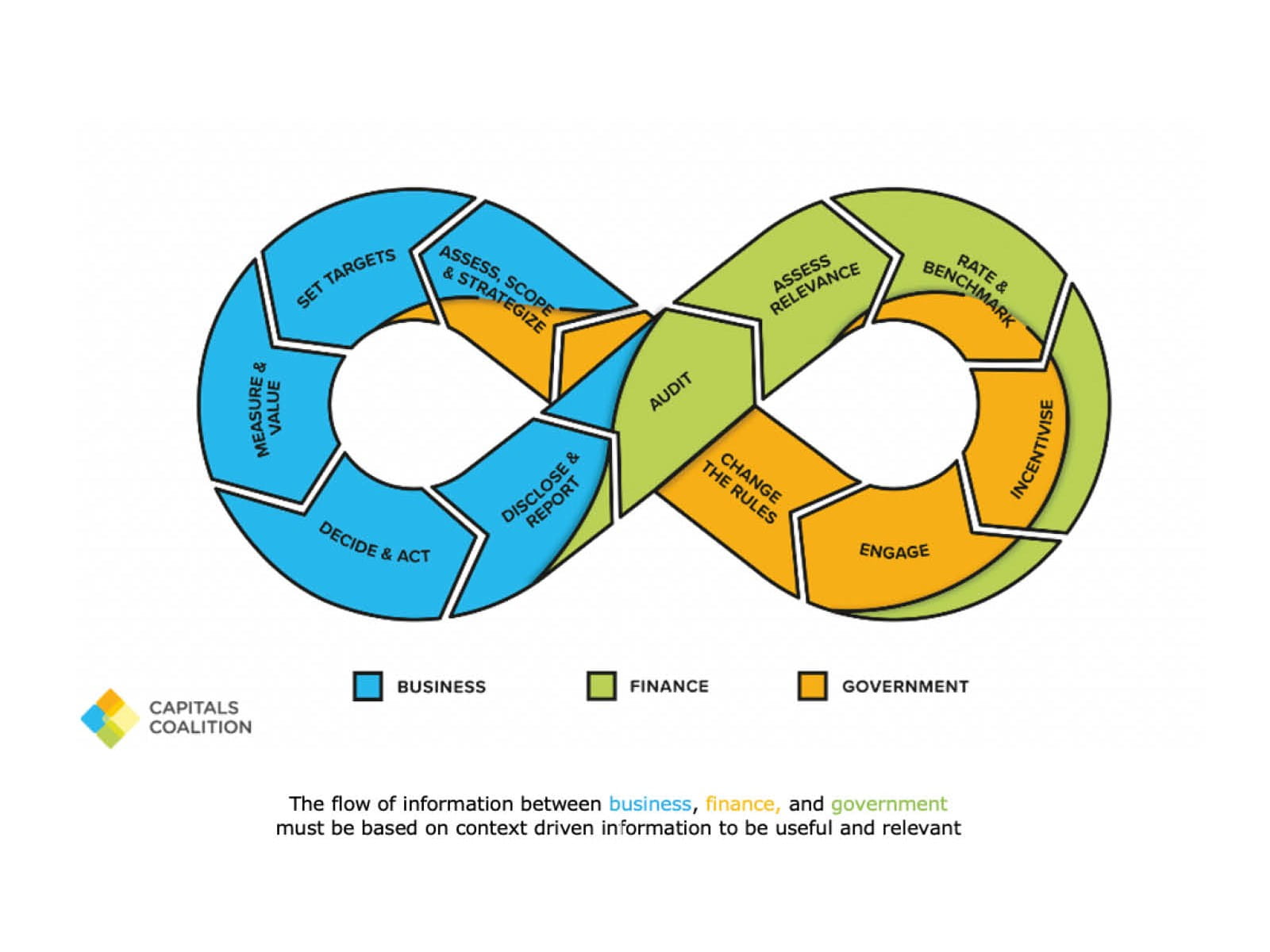

For sure reporting is important - vital even - but it isn’t going to achieve what we want by itself, any more than assurance is. We are talking about a complex market and social system in which reporting and assurance play an important part, telling markets and shareholders what a company has done. There are other drivers of behaviour including supply chain pressures, other stakeholders’ leverage such as consumer pressure, ratings and indices, a company’s own vision and strategy, its access to materials and inputs, taxes, regulations, legislation…the list goes on.

All these require high-quality, decision-useful Information as it flows around the system. Information, the stock-in-trade of the accountancy profession is the lifeblood of the system – it simply cannot function without it. The diagram below, taken from the Capitals Coalition, is a helpful infographic of the flow of information through the system.

Non-financial reporting: where are we headed?

What are the challenges that companies face when it comes to non-financial reports, where can improvements be made, and what does the future hold?