The balanced budget of 2018-19 is now a distant memory as Australian Treasurer Josh Frydenberg presented a second A$100bn+ Budget in a row.

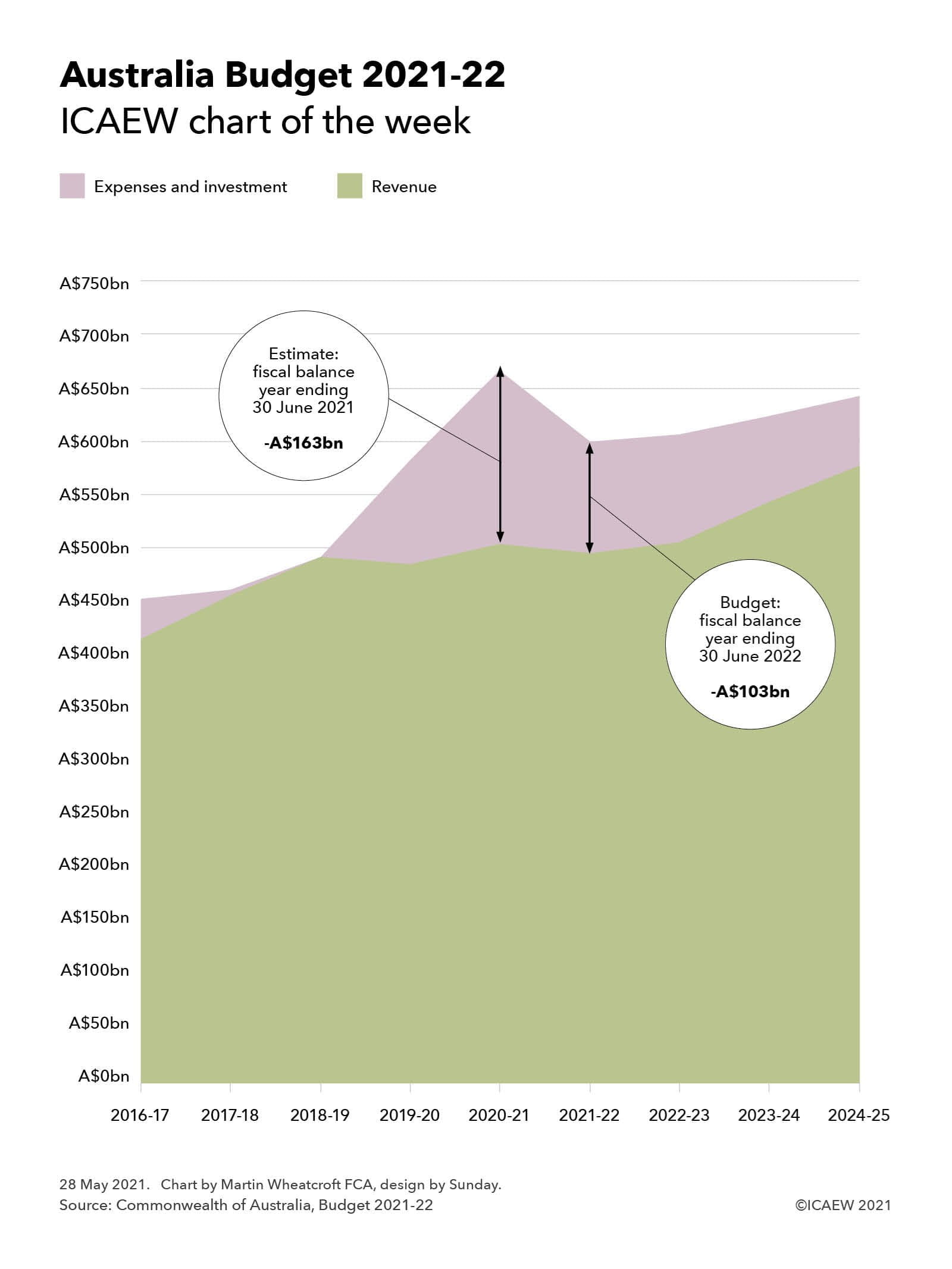

The Commonwealth of Australia set out its financial plans for the year ending 30 June 2022 earlier this month, with a budgeted negative fiscal balance of A$103bn based on revenue of A$496bn less expenses and investment of A$599bn.

The #icaewchartoftheweek illustrates how this follows an estimated negative fiscal balance of A$163bn for the current financial year (A$504bn – A$667bn) and A$96bn in 2019-20 (A$486bn – A$582bn) as COVID-19 related spending of A$311bn swept through the federal government’s finances. A huge contrast from the ‘balanced’ budgets of a just positive A$1bn in 2018-19 (A$493bn - A$492bn) and slightly negative A$6bn in 2017-18 (A$456bn – A$462bn).

Budget balance is not anticipated to return in the near future with forecasts of a similarly sized negative fiscal balance of A$101bn in 2022-23 (A$505bn – A$606bn) followed by A$80bn in 2023-24 (A$544bn – A$624bn) and A$65bn in 2024-25 (A$578bn – A$643bn).

Federal net debt is expected to have increased from A$491bn (25% of GDP) at 30 June 2020 to A$618bn (30% of GDP) at 30 June 2021, before being forecast to rise to A$729bn (34% of GDP) at 30 June 2022 and then to A$981bn (41% of GDP) at 30 June 2025. Net debt as a share of GDP is expected to decline to around 37% in the second half of the decade.

Although dramatic in comparison with previous years – and not the full picture as these numbers exclude the states and local government – the federal budget has weathered the pandemic relatively well compared with many other major economies. This reflects a pandemic response that has kept confirmed cases to around 30,000 or 0.1% of the population and limited the impact of covid-19 on the domestic economy, in contrast with (for example) the 4.5m covid-19 cases (6.6% of the population) reported in the UK that has been accompanied by extensive national lockdowns.

Combined with a relatively strong public balance sheet and a well-funded superannuation (pension) system to support Australian citizens in retirement, Australia looks to be in a much stronger financial position than most other developed countries, even if certain sectors such as tourism will continue to suffer until borders reopen, probably in the first quarter of next year

Join the Public Sector Community

For accountants and finance professionals working in and advising the public sector, this Community is the go-to for the key resources and guidance on the issues affecting practitioners like you. With a range of dynamic services, we provide valuable tools, resources and support tailored specifically to your sector.