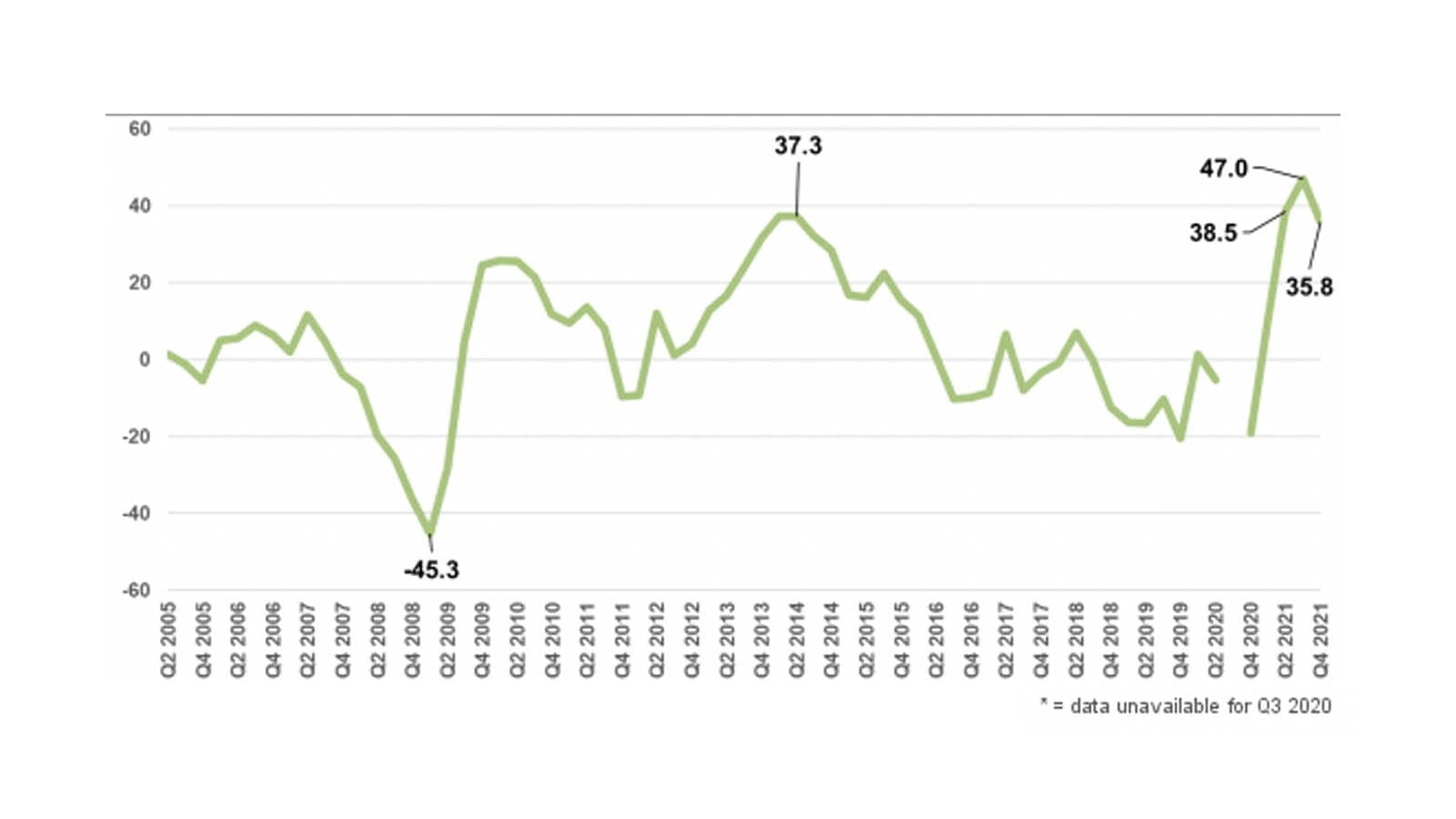

ICAEW’s Business Confidence Monitor (BCM) for Q4, which surveys 1,000 chartered accountants in the UK, found optimism at +35.8 on the quarterly index, slightly lower than the readings recorded in the previous quarter at +47.

Confidence and sales expectations have weakened but remain high

BCM figures have weakened after hitting record-breaking levels in the past two quarters, with lingering challenges from the pandemic dragging down business confidence. However, overall confidence reading remains fairly high as a result of promising sales projections over the next 12 months.

One trend highlighted by the survey is an emerging contrast in confidence between particular sectors, leading to what experts have dubbed a ‘K-shaped’ economic recovery.

Confidence drop comes as no surprise

The small fall in optimism reflects the problems businesses have experienced, both at home and abroad, from rising costs, supply chain disruption and difficulties with staff recruitment and retention. Given the much-reported issues reported by companies, Michael Izza, ICAEW’s Chief Executive, was not surprised that business confidence has weakened this quarter.

“Optimism remains very high and businesses will be hoping that the economic recovery continues into 2022,” said Izza. “While strong sales growth is forecast for the year ahead, confidence is not consistent across all sectors of the economy. With more pressures reported by retailers, manufacturers and construction firms, it could be a tough winter in these sectors as cost pressures and supply chain problems persist.”

The K-shaped economic recovery

The sector-specific nature of the recovery has been described as a K-shaped economic recovery. This means some parts of the economy bounce back with ease (the upward-sloping part of the letter K), while other sectors move into the danger zone (the bottom slanting part of the letter). This is further compounded by an increasing asymmetry of performance.

In the BCM this K-shape is portrayed in the gap of about 15 percentage points from the least confident sectors such as construction (+29.1) to the most confident eg IT and communications (+45).

As experiences varied significantly among sectors, sentiment was highest among companies in IT and communications, transport and storage and business services.

These are sectors that have been less affected by supply difficulties and rising costs, and which reported the strongest outlooks for growth of domestic sales and exports in the year ahead. The three sectors above all recorded optimism scores of 40+ on the confidence monitor.

By contrast, sentiment was weakest among retailers (+28.4), manufacturers and construction companies (+29.1), where supply issues and rising input prices have taken their toll.

The lack of availability of prospective recruits with non-management skills also troubled these sectors, particularly in manufacturing and construction.

Confidence high, but challenges ahead

Reacting to the survey Jonathan Whitwam, CFO of multi-label wholesale showroom Rainbowwave, told ICAEW Insights he felt confident looking towards next year working in retail as his sales figures have never been better.

“I'm really confident we're going to boom back into next year. Currently, my sell-through rates are coming through very strong which is really encouraging.”

However, Whitwam said one of the main challenges, also felt by many in the BCM data, is recruitment. He also said that staff turnover was a growing problem, especially finding skilled workers, as the store is close to hitting full turnover within a year.

Dependent on whether current skills shortages persist, salaries are expected to rise by 2.5% next year, which would be the sharpest increase in a decade. Meanwhile, transport issues were particularly acute for manufacturers and retailers.

“Rainbowwave hasn’t had many problems on the transport side of things and I know a lot of people in the sector who have had difficulties,” he said. “We've not had like 10 trucks stopped at Dover or anything like that - things have moved. We've done okay, and it might be because a lot of our brands are smaller, so it goes through.”

Challenges faced by companies

In a separate survey of respondents who said they had vacancies that were ‘hard to fill’, they cited a lack of skills and experience, and competition from other firms as some of the key reasons. Two-fifths of those businesses said that middle-range technical and manual skills were particularly hard to come by.

Also in this survey, a quarter of businesses struggling to fill vacancies cited EU workers leaving the UK as a reason for not being able to fill a particular role. To address these recruitment issues, more than two-thirds of those businesses either increased salaries for new applicants or upped their spending on recruitment.

Employment rose by 1.3% over the last year, the first period of year-on-year growth since the start of the pandemic. There was little evidence that the phasing out of the government’s furlough scheme caused a surge in job losses, ICAEW said, and businesses predict a sharp rise in hiring over the next 12 months.

Domestic sales expectations for the next 12 months remain historically high, the BCM found, but have fallen slightly quarter-on-quarter. However, in Q4 2021 export growth was lower than pre-pandemic levels, with Brexit a possible contributory factor.

ICAEW CEO Michael Izza commented: “As we emerge from the pandemic, it is vital nothing derails the recovery. Companies must already factor in the upcoming National Insurance hike and increasing energy prices, as well as the possibility of a rise in interest rates, and they really need as much stability as possible in the wider business environment.”

Further reading:

- Read the full report: ICAEW’s UK Business Confidence Monitor Q4 2021