ChatGPT is a chatbot that’s been making headlines. Developed by OpenAI, it is a sophisticated machine learning model designed to answer questions on almost any topic you can think of.

That includes audit and accountancy. Dimitris Kaskantanis, Head of Eurobank’s internal audit data analytics team, asked ChatGPT some questions about audit. Some were straightforward:

What are the key skills to become a successful auditor?

There are several key skills that can help someone become a successful auditor. These may include:

- Attention to detail: auditors must be able to carefully review and analyse financial records and other data to identify any irregularities or issues.

- Communication: auditors must be able to effectively communicate their findings and recommendations to clients and other stakeholders.

- Organisation: auditors must be able to manage their time and workload effectively to complete audits within specified deadlines.

- Integrity: auditors must be able to maintain high ethical standards and be objective and impartial in their work.

- Technical expertise: auditors should have a strong understanding of accounting and auditing principles and practices, as well as any relevant laws and regulations

- Collaboration: auditors often work in teams, so the ability to work well with others is important.

How can data analytics assist auditors?

Data analytics can assist auditors in a number of ways. First and foremost, it can help auditors to more quickly and accurately analyse large amounts of data, which can save time and improve the efficiency of the audit process. Data analytics tools can also help auditors to identify patterns and anomalies in the data that may indicate potential issues or areas of concern. In addition, data analytics can assist auditors in testing the accuracy and completeness of the data they are reviewing, which can help to ensure the integrity of the audit. Overall, data analytics can be a valuable tool for auditors, helping them to more effectively and efficiently conduct their audits.

Others were more specific, directly offering advice on auditing and how to use technology within an audit:

Could you propose tests for a procurement audit?

There are many different tests that could be used as part of a procurement audit. Some examples of tests that could be performed during a procurement audit include:

- Reviewing the procurement policies and procedures to ensure that they are adequate and in compliance with relevant laws and regulations.

- Examining the procurement process to ensure that it is fair, transparent, and competitive, and that it is being carried out in accordance with the organisation's policies and procedures.

- Testing a sample of procurement transactions to ensure that they are properly documented and that the appropriate approvals have been obtained.

- Evaluating the quality and suitability of the goods or services procured, and comparing them to the specifications and requirements outlined in the procurement documents.

- Reviewing the contract management process to ensure that contracts are being properly administered and that the organisation is getting the best value for money.

- Evaluating the organisation's vendor management processes to ensure that vendors are being properly monitored and that any issues or concerns are being addressed in a timely manner.

Overall, the specific tests that are performed as part of a procurement audit will depend on the specific goals and objectives of the audit, as well as the nature and scope of the procurement activities being examined.

Please provide python code for identifying fraud in a customers' transactions dataset.

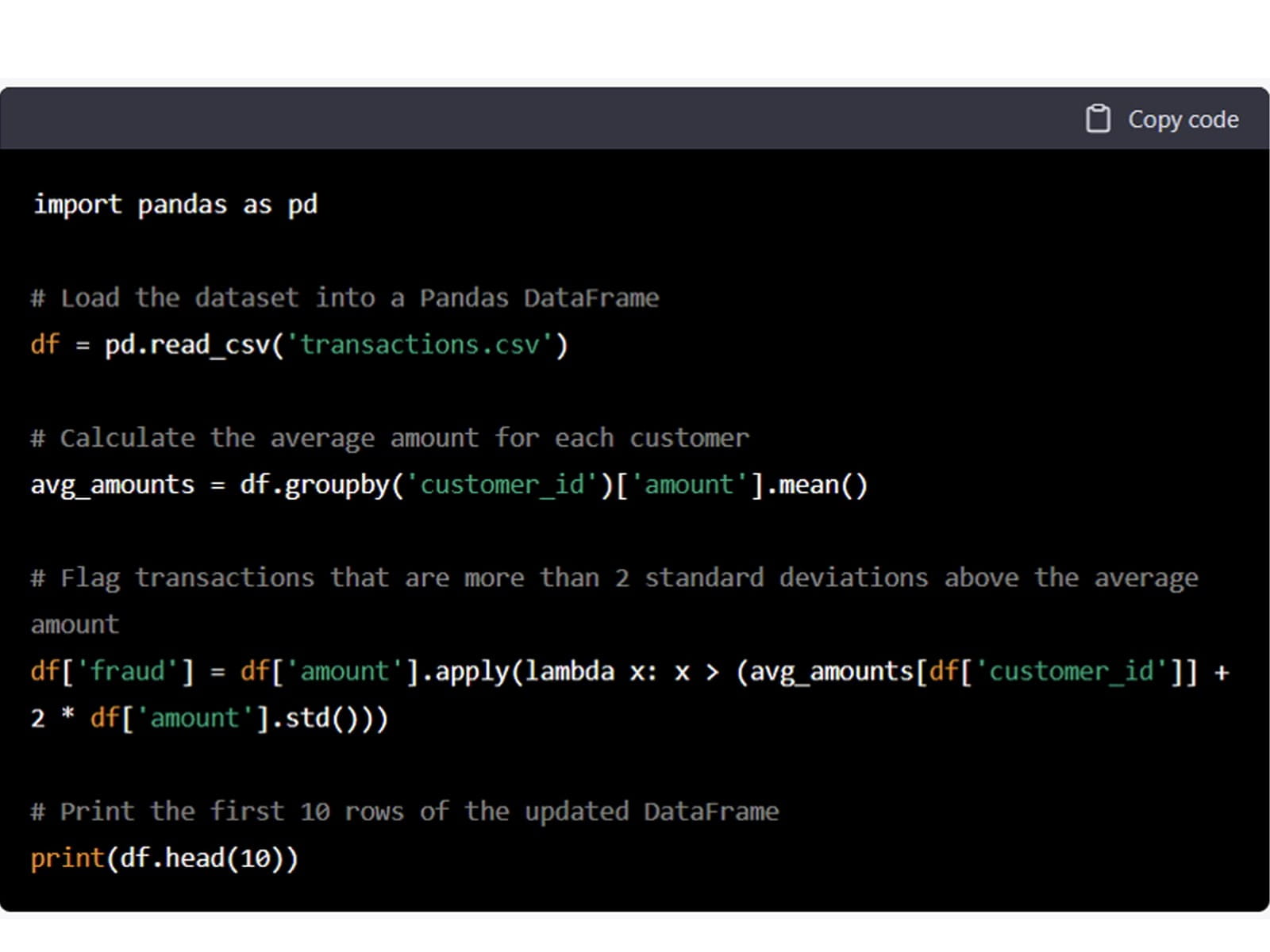

Sure, here's some sample Python code that you can use to identify fraud in a customer's transactions dataset:

This code first loads the transactions dataset into a Pandas DataFrame, then calculates the average amount for each customer. It then flags transactions that are more than two standard deviations above the average amount as potential fraud. Finally, it prints the first 10 rows of the updated DataFrame with the fraud flag included.

Of course, this is just a simple example and there are many other approaches you could use to identify fraud in a transactions dataset. You may want to try different methods and see which one works best for your specific dataset and use case.

This is an exciting development (and fun to play around with), but it does pose some ethical challenges as it delivers responses on topics that require more judgement without a guard or filter. The above code is written to identify fraud in a transactions dataset, for example, but is just one possible solution and if taken at face value could pose a risk, says Ian Pay, Head of Data Analytics and Tech for ICAEW.

“There is a bigger question about whether this could genuinely replace certain jobs as it seems to be pretty adept at providing responses to questions that it might take experts years to develop sufficient knowledge to respond to. However, the responses are far from perfect - while it is just a 'research preview' at this stage, you can see trust issues arising very quickly.”

There is also a risk around misinformation, says Esther Mallowah, Head of Tech Policy for ICAEW. “The chatbot produces responses based on data that it has been trained on, but there is no way of vetting the source of the training data to confirm it is reputable and can be relied on. Search engines like Google also provide information, but you can at least see the sources of the information and decide which ones to use. I think a lot of people will just rely on what ChatGPT says about various topics without querying it.”

Without source checking and a possible lack of understanding/transparency around the training dataset, this could be an issue if people try to use it for something like accounting or tax advice. Its training set only runs to 2021, so any attempt to ask about more current activities, or areas where legal frameworks have changed, may lead to incorrect answers.

“If ChatGPT is refined and improvements are made to citing specific sources of information and to address issues where it strays into judgemental topics, it could be developed into a useful resource for consultation advice on the application of accounting or auditing standards,” says Pay.

“It is easy to envisage a world where, rather than trawling through endless pages of auditing standards, methodology guidance or taxation policy, a simple question to a chatbot like ChatGPT returns the relevant information in a factual way. But we must remember that it will never be able to deliver contextual, personal advice in the way that a trusted accountant can, or design audit procedures that are relevant to the specifics of the business being audited.”