When undertaking a transformation project for the first time, it can be difficult to know where to start. As a leader, you may have realised that something about the way you work needs to change. You may also have had the task of transformation thrust upon you by your CEO. It’s easy to feel like a bit of a deer in the headlights, with no clear direction of travel.

Whether you’ve been tasked with improving the finance function to make it more efficient, effective and valued by the organisation, drive the use of AI, or creating processes and procedures for sustainability measurement and reporting, the process is the same.

The problem with transformation projects is that the project lead often has had no experience delivering a project. You might have spent years developing the team and making processes more effective, but that’s not the same as driving a transformation project.

Do you need to go on a course to help develop your project management skills? Maybe, but before you do, let’s help you do as much as you can yourself. As a worst-case scenario, this will leave you better informed when you start the conversation with consultants or business schools.

Repeatable checklists

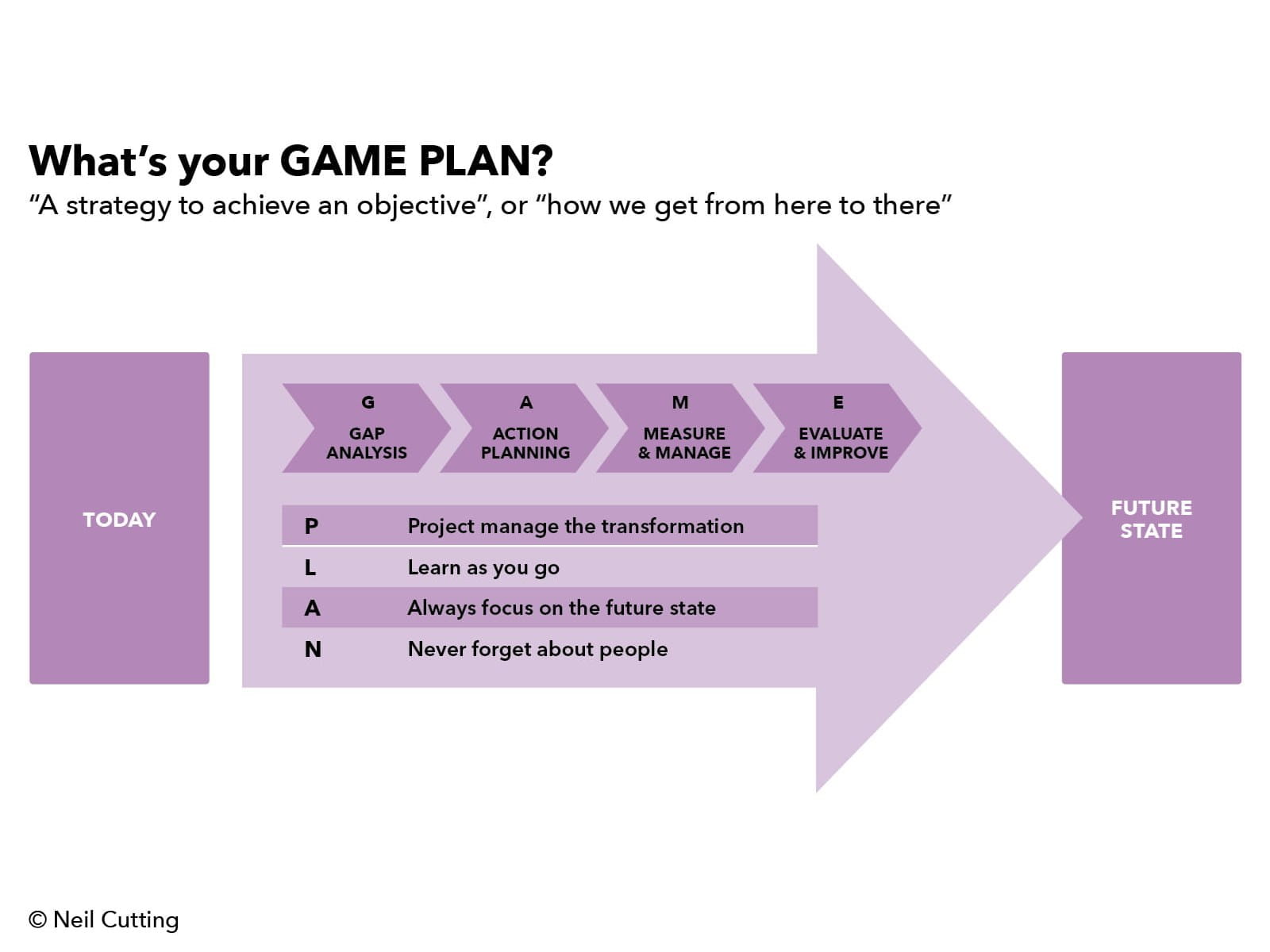

The Game Plan Framework has been designed to help people get started with implementation. I have spent 30 years being a delivery person, so am very focused on repeatable checklists to help get things moving.

I have seen the value of this in many ways. At Hewlett Packard, we used a very effective approach called the ‘Process of Management’ which, although outdated now, provided a checklist approach to help teams get going with driving implementation.

Conversely, I have seen experienced finance director colleagues falter and even freeze when asked to drive transformation to improve the effectiveness of the finance team or drive a business turnaround. However, once a substantial amount of engagement time has been spent explaining why this is just like any other improvement project, the individuals will shake off their indecision and crack on swiftly with the task.

The objective of the Game Plan is to help us all ‘unfreeze’ as quickly as possible and move to practical implementation. The gap analysis is the first step and is a great way to inject focus into your transformation project.

How gap analysis works

To initiate the gap analysis phase, we need to answer the following questions:

1) What are we trying to achieve?

Briefly outline your overall goal. It’s important to put this front of mind and keep it there. For example, it could be a business turnaround, finance function transformation, sustainability reporting improvements, or AI capability improvements.

2) What are the three-to-five perspectives that we need to consider to ensure things are progressing?

What I’m referring to here are the organisational perspectives that I covered in my previous series of articles. For example, an organisational transformation should consider leadership and metrics, structure, people, processes, and systems and technology, as it’s a whole organisation change.

A big push for more action on sustainability and the adoption of deeper sustainability reporting will certainly involve leadership and metrics, people, and probably processes. It may involve structure and systems and technology depending on your approach. Think about what your project is likely to affect and go from there.

Once you’ve answered those questions, you’re ready to do your gap analysis. Using the pictured maturity levels framework, plot out a maturity model analysis for the company’s status today (‘as is’) and where it wants to be (‘vision’) and the target for the coming year (‘budget’). The maturity model uses five levels. As you do this, ask yourself the following questions:

- Where do you want to be after your business plan (‘to be’) has been achieved (say three years)?

- Where do you want to be after you have achieved your budget (say 12 months)?

- Where are you starting from (your ‘as is’ or current situation)?

Pick specific dates to achieve your goals by – this is important for robust project management (to be covered in our next article).

Some follow-up questions

Now that this has been plotted on a gap analysis table, ask yourself this: which areas will be your key focus? If it is not obvious to you, you may need to use the strategic decision grid to help with this.

How are you going to seek the appropriate approval for your assessment? This will be covered in more depth in our next article on robust project management.

Since there is never enough money or time to focus on everything, you need to establish what is realistic to achieve in the next 12 months. It will be necessary to make some strategic decisions; this will also be covered in the series.

The gap analysis step-by-step

1) Confirm your goals:

- Business transformation

- ESG and sustainability transformation

- AI transformation

- Resilience transformation

- Other

2) Define the framework:

- Define/confirm perspectives critical for transformation

- Define/confirm maturity levels for transformation

3) Define where you are and where you want to get to:

- Assess “as is”

- Set goals:

a) Budget – 12-month time frame

b) Business plan – three-year time frame

4) Assess the challenges

- In doing this often you need to make strategic decisions about what you want to do and, more importantly, what you don’t want to do. I’d advise that you use the Tony Grundy Strategic Decision grid for this.

In the next article, we’ll be looking at developing a project management plan.

Neil Cutting has held many CFO and transformation leadership roles with complex global organisations. Most recently he was Vice-President of Finance at Jacobs Solutions Incorporated, a $15bn Fortune 250 organisation. He is also a member of ICAEW’s Business Committee, which represents global business members, and is a guest lecturer on strategic performance at the University of Bath.

Related articles

Read related articles by Neil Cutting on finance transformation and the finance team toolkit:

Cost of doing business

Insights, analysis and resources for organisations facing rising costs of doing business amid a multitude of challenges, including energy prices, inflation, supply chain disruption and staff recruitment and retention.