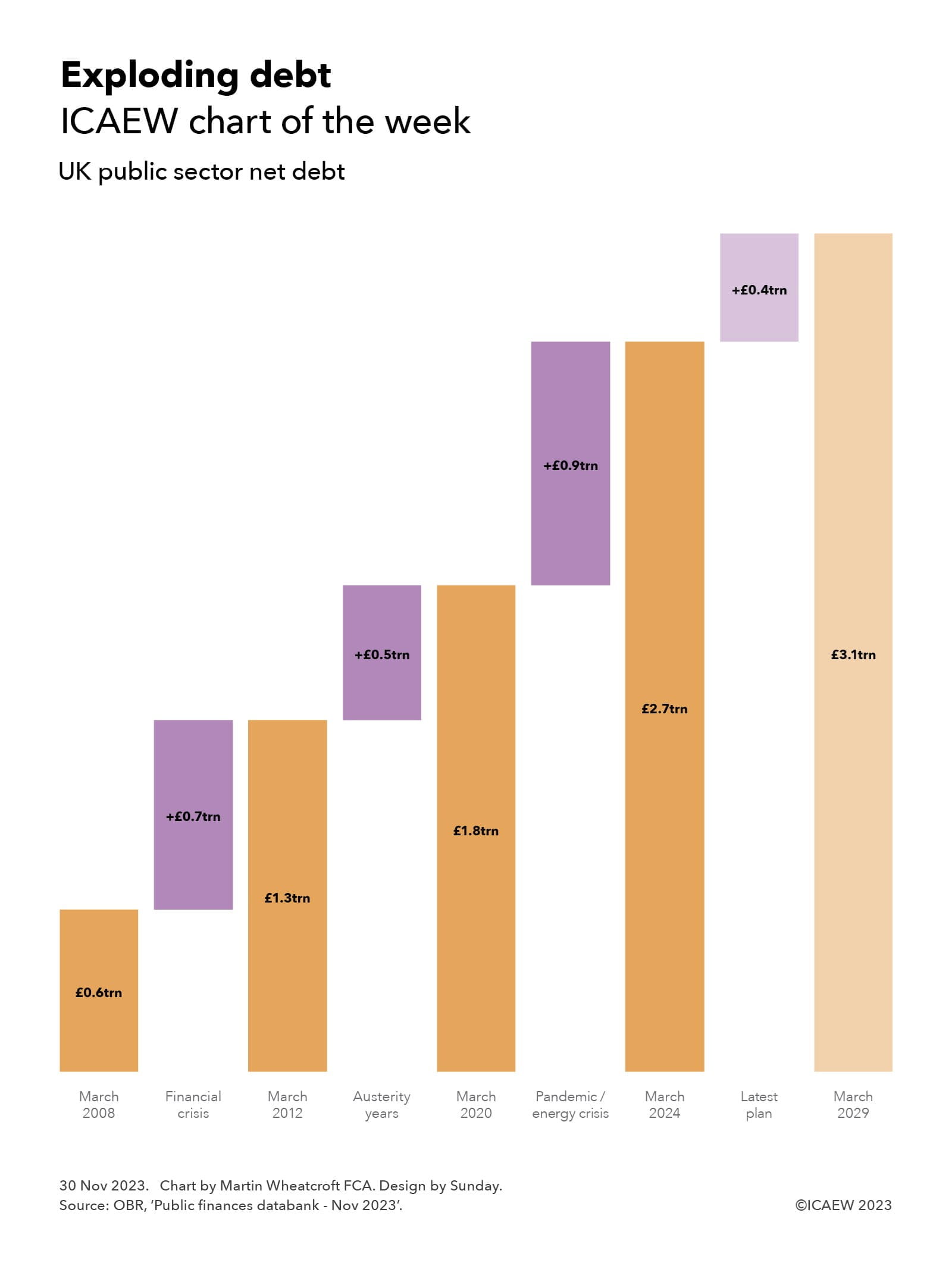

As illustrated by our chart this week, the sums borrowed by the government since the financial crisis of a decade and half ago have been truly astonishing.

In March 2008, the official measure of net debt for the UK public sector was less than £0.6trn. During the financial crisis, government borrowing totalled £0.7trn over a four-year period, causing public sector net debt to more than double to £1.3trn in March 2012.

The eight austerity years saw government cut spending on public services to a significant degree but still borrow a further £0.5trn to see net debt reach £1.8trn in March 2020 – arguably not mending the roof while the sun was shining. This was then followed by an exceptional amount of borrowing during four years of pandemic and energy crisis (including the current financial year) that is expected to see net debt increase by a total of £0.9trn to reach £2.7trn in March 2024.

The Autumn Statement 2023 on Wednesday 22 November saw the Chancellor set out his latest plan for the UK public finances over the next five financial years. This includes a further £0.4trn of borrowing, with public sector net debt projected to amount to £3.1trn in March 2029 – more than quintuple the net amount owed by the UK state 21 years earlier in March 2008.

This assumes that the government can stick to its borrowing plans – many commentators have suggested that planned cuts in spending on public services are unrealistic, meaning more borrowing if taxes are not to rise.

The £2.5trn increase in debt between 2008 and 2029 comprises £2.2trn in borrowing to fund 21 years of deficits (the annual shortfall between receipts and spending) and £0.3trn in other borrowing to fund government lending (such as student loans) and working capital requirements.

As a share of the economy, the increase is less dramatic but still significant – rising from a net debt to GDP ratio of 35.6% in March 2008, to 74.3% in March 2012, to 85.2% in March 2020, to an anticipated 97.9% in March 2024. However, the good news is that net debt / GDP is expected to fall to 94.1% in March 2029 as inflation and economic growth offset the additional borrowing.

The worry for this (or any alternative) government is that while borrowing levels in the OBR’s forecast spreadsheet for the next five years appear manageable and are (just) within the current fiscal rules, the numbers assume that we don’t enter another recession or other economic crisis in that time. Otherwise, we could see debt exploding again.

Read more: ICAEW Autumn Statement 2023 hub