Our chart this week is on the ‘elephant in the room’ that haunts fiscal events such as next week’s Autumn Statement – the rapidly rising number of pensioners that is driving some of the biggest line items in the national budget: pensions, health and social care.

This fiscal event is unlikely to be any different, with the Chancellor expected to focus most of his statement on short-term measures to free up headroom for pre-election tax cuts at a time of stagnant economic growth.

Any substantive discussion on the long-term prospects for the public finances is likely to be absent beyond a continued commitment to seeing the debt to GDP ratio start to fall within the next five years. How he – or more likely his successors – might be able to avoid having to raise taxes significantly in the coming decades to pay for the cost of pensions, health and social care for many more people, living longer, sometimes less healthy lives, is unlikely to be at the core of what is announced.

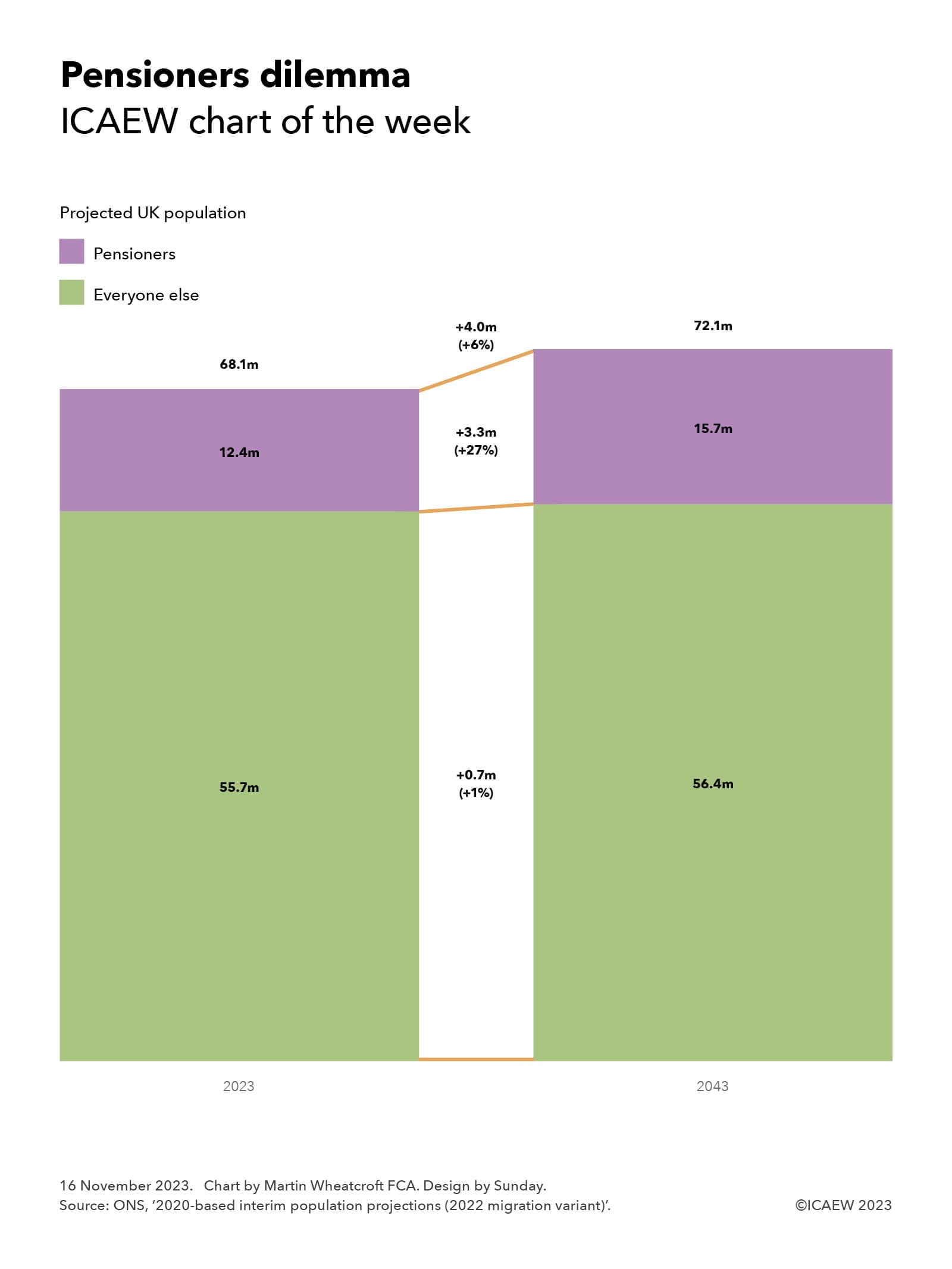

To illustrate the dilemma facing policymakers and the public, our chart shows how pensioners represent 3.3m out of the 4.0m projected increase in the size of the UK population between 2023 and 2043. The total population of the UK is projected to increase by 6% from 68.1m in 2023 to 72.1m in 2043, with the number of pensioners expected to increase by 27% from 12.4m this year to 15.7m in 20 years’ time.

The number of non-pensioners is expected to increase by 0.7m or 1% from 55.7m to 56.4m, with net inward migration of 5.0m over that period offsetting what would otherwise be a significant fall in the numbers below retirement age. (Not shown in the chart is a projected 3% rise in the working age population and a 7% fall in the number of children.)

The projected 27% rise in the number of pensioners is despite a planned increase in the state pension age from age 66 to age 67 in 2027, one of the few long-term steps the government has taken to mitigate the fiscal effects of rising pensioner numbers. However, increasing the retirement age doesn’t directly impact health and social care costs, as well as being partly offset by the cost of supporting increasing numbers of people out of work between traditional retirement age and the age at which they can take their state pension.

Given the significance of the demographic challenge to the public finances, there is very little public debate on what to do, especially as the current policy of cutting the proportion of spending going on public services outside of health appears increasingly unsustainable.

Spending on defence and security (the traditional budget to raid) is already close to the NATO minimum and appears likely to need to increase given the global security situation, while extracting further savings from other public services seems extremely unlikely, especially given the reluctance of successive governments to put in the level of upfront and ongoing capital investment that might make operational savings possible.

The irony is that, unlike the game-theory scenario of the prisoners’ dilemma that makes optimal decision-making difficult for two prisoners who can’t communicate with each other, there is no theoretical restriction on the ability of policymakers to talk to the public about the pensioners dilemma and to have a proper debate about that might mean for taxes and public services in the long term.

Read more: ICAEW Autumn Statement 2023 hub