New data points to an economy fraying at the edges as inflation and higher interest rates hinder businesses and consumers. The forward-looking indicators from ICAEW’s latest Business Confidence Monitor (BCM) indicate a difficult end of the year for the UK economy, with domestic economic activity, employment and investment intentions disappointingly downbeat.

The UK economy grew by just 0.2% in August, only partially recovering from a downwardly revised 0.6% contraction in July when poor weather and strike action hindered activity, according to figures from the Office for National Statistics (ONS).

Services output, which accounts for over three quarters of UK economic output, was the main driver of growth, rising 0.4% on the month. This more than offset declines in production (-0.7%) and construction output (-0.5%).

Construction confidence collapses

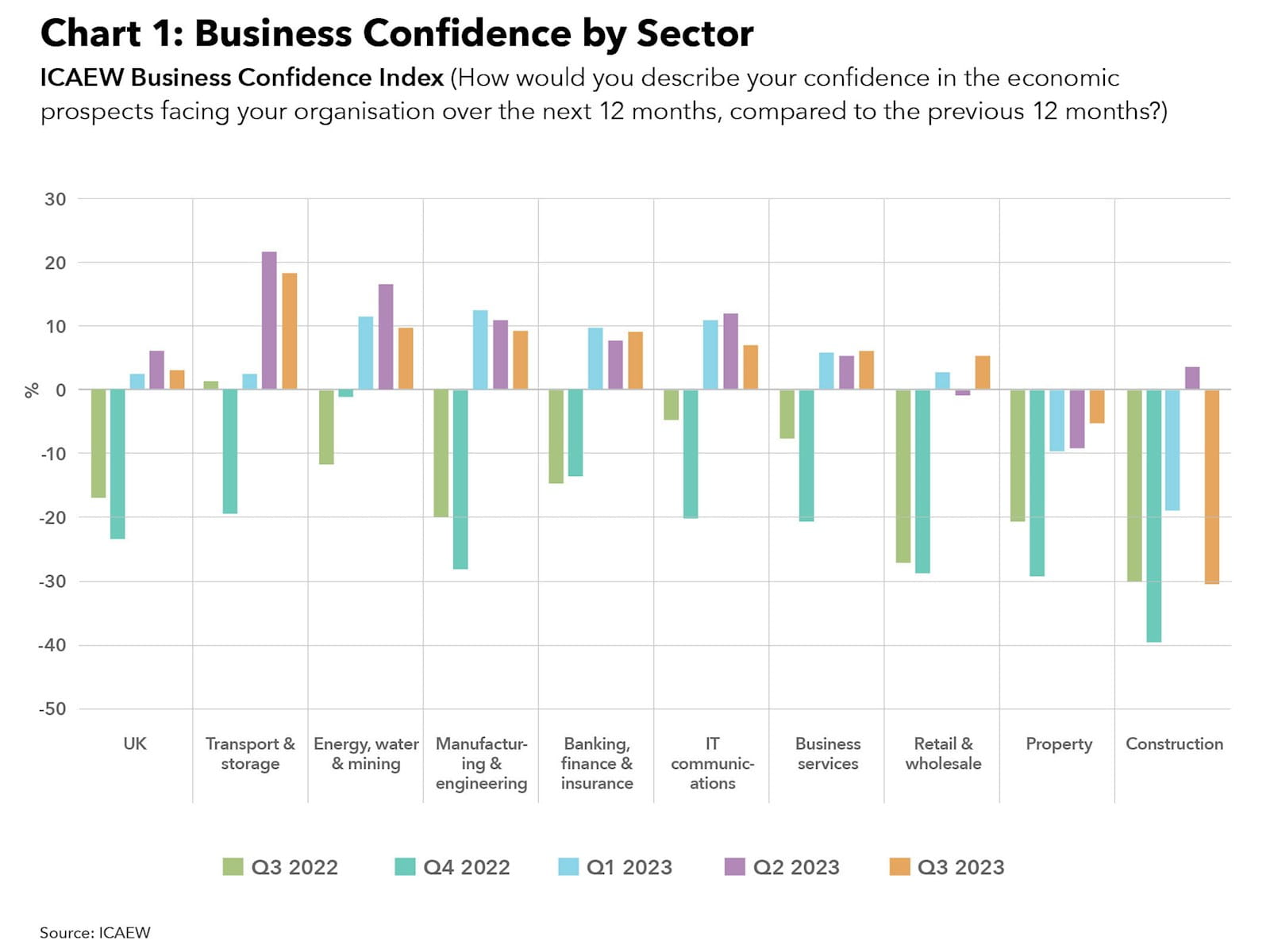

Sentiment tracked by ICAEW’s Business Confidence Monitor (BCM) – a quarterly survey of 1,000 ICAEW-qualified chartered accountants across the UK – put confidence at 2.9 out of 100 on the index for Q3 2023, less than half the Q2 reading of 6.1 (see chart 1). Sentiment can range from -100 to 100.

Confidence was weakest in the construction sector, plummeting to -30.5. This reflected the sector’s exposure to rising interest rates, high input costs and weak customer demand. Heavy rainfall also dampened sentiment by causing delays to planned project work in the sector. By contrast, confidence was highest among transport and storage companies (18.3) due to a strong holiday season boosting demand for leisure travel.

UK inflation holds steady in September

UK CPI inflation stood at 6.7% in September 2023, unchanged from August and the first time since May that inflation hasn’t fallen, largely as a result of rising petrol prices. The largest downward pressure on the headline rate to the monthly change came from food and non-alcoholic beverages, where prices fell on the month for the first time since September 2021.

Many organisations are now facing painful rises next April as business rates increase in line with September’s CPI inflation. While rising global oil and gas prices are an upside risk, the looming squeeze on wages from softening labour conditions and a waning economy should help put inflation on a firm downward trend.

Concerns over bank charges at record high

ICAEW’s latest BCM also reveals that financial challenges are impacting a growing proportion of businesses. The proportion of organisations reporting bank charges as an increasing problem rose to a record high in Q3 2023 (see chart 2) as tighter financial conditions weigh on the economy.

Bank charges are particularly troublesome for companies in the construction and property sectors. One in five companies cite the tax burden, late payments and access to capital as growing issues, and this helps to explain why the latest BCM figures also show that capital investment growth continued to slow and firms restrained their R&D spending in Q3.

Retail sector edging closer to recession

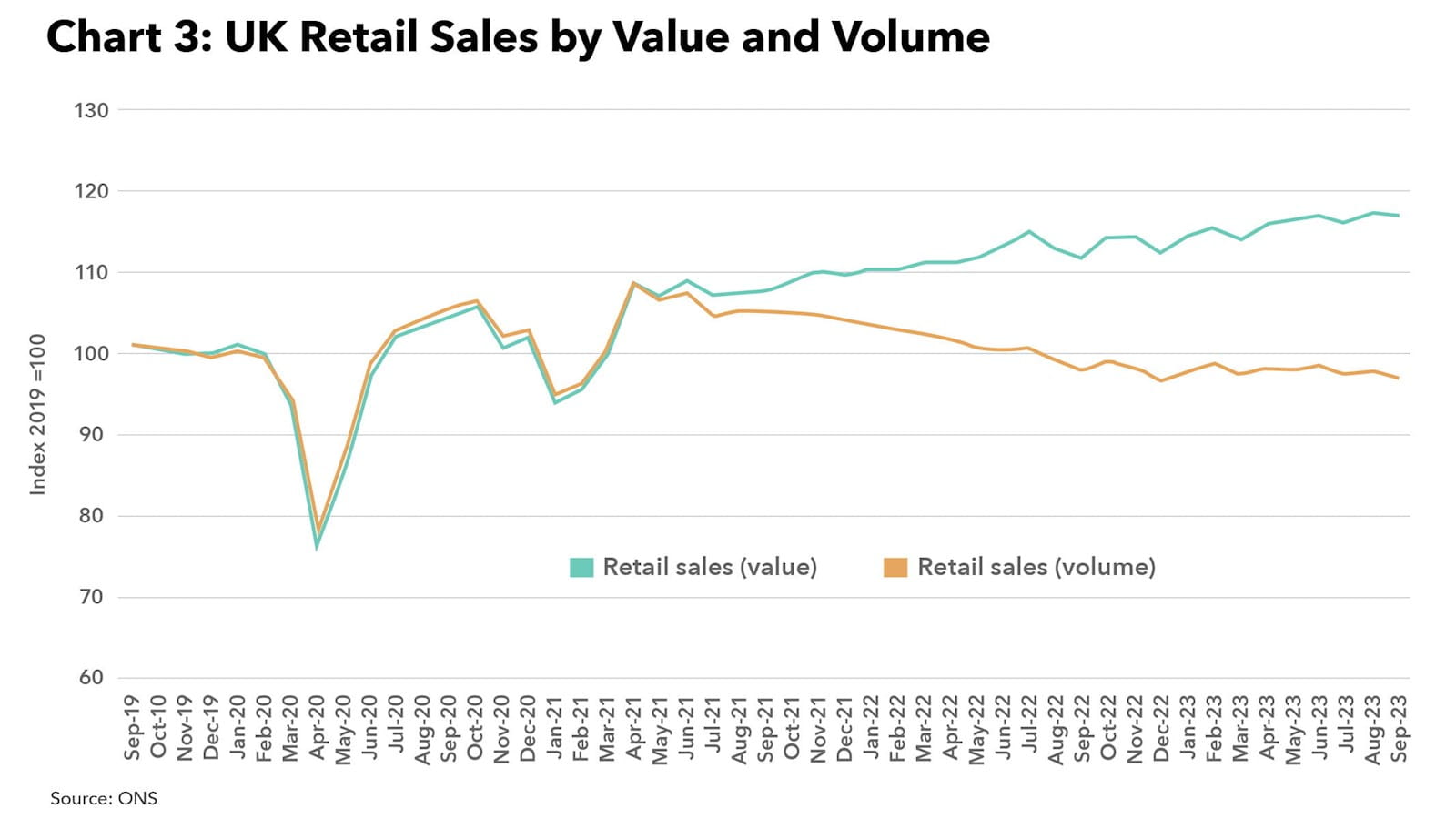

Retail sales in Great Britain decreased by 0.9% in September 2023, according to ONS figures, down from a 0.4% rise in August. Over the third quarter, sales volumes fell 0.8%, the first fall since the three months to the end of February. Clothing sales fell by 1.6% as the joint-hottest September on record suppressed sales. There is continued evidence of the cost-of-living crisis with people paying more for less. When compared with their pre-COVID-19 level in February 2020, the volume of goods bought were 2.5% lower, despite shoppers spending 17.1% more (see Chart 3).

Case for interest rate cuts rise as outlook weakens

The Bank of England kept interest rates on hold at 5.25% for the second successive meeting. The Monetary Policy Committee member voting split in favour of this outcome increased to 6-3, from 5-4 at their last meeting. This is further evidence that rates have probably now peaked. The Bank of England also released its Quarterly Monetary Policy Report which revealed that they are now giving a 50-50 chance of a recession by the middle of next year. With the Bank of England expecting the economy to weaken further, the case for interest rate cuts is only likely to increase.

UK economy – of interest this month:

- All eyes on GDP data to be released on 11 November. Anything less than a 0.4% monthly rise in September would mean that the UK economy contracted in the third quarter.

- Inflation figures for October due out on 15 November should show a sizeable decline; lower energy bills following the cut in Ofgem’s energy price cap, together with a favourable comparison to October 2022 when inflation peaked, are expected to push the headline rate below 6%.

Links to support

For more insights, analysis and resources for organisations facing rising costs of doing business, visit ICAEW’s Cost of doing business hub.

A new Resilience and Renewal campaign launched by ICAEW in September explores some of the most serious systemic challenges facing the UK economy. It brings together government ministers, leading academics, economists and other experts in the field to look at how to build a better, more resilient future economy and the vital role of UK business and chartered accountants.

ICAEW also works with occupational charity caba to promote the mental health of chartered accountants and their families, producing articles, guides, webinars, videos and events which can provide support during these difficult times.

Cost of doing business

Insights, analysis and resources for organisations facing rising costs of doing business amid a multitude of challenges, including energy prices, inflation, supply chain disruption and staff recruitment and retention.