EU legal thresholds for business-size categories could be shifted for the first time in a decade, pending approval from the European Council and Parliament.

In a short consultation, opened on 13 September, the European Commission is seeking stakeholders’ views on proposed changes that would mean micro, small and medium-sized companies would no longer have to meet many of the financial and sustainability reporting requirements that apply to larger businesses.

Set out in draft secondary legislation in the form of a delegated act, the amendments to the EU’s Accounting Directive would reset business-size categories in line with current, inflationary trends. But perhaps more significantly from a policymaking standpoint, they would also align with the Commission’s objective, outlined in a recent Insights article on the EU’s relief package for SMEs, to reduce company reporting obligations by 25%.

Streamlining obligations

In the draft act’s explanatory text, the Commission points out that while the costs of meeting reporting requirements are offset by the benefits of publishing data, the disclosure process can impose “disproportionate burdens” upon stakeholders – particularly microbusinesses and SMEs.

The accumulation of those requirements over time, the Commission writes, “can result in redundant, duplicating or obsolete obligations, inefficient frequency and timing, or inadequate methods of collection”.

As such, streamlining reporting obligations to reduce administrative burdens for companies is a Commission priority going forward.

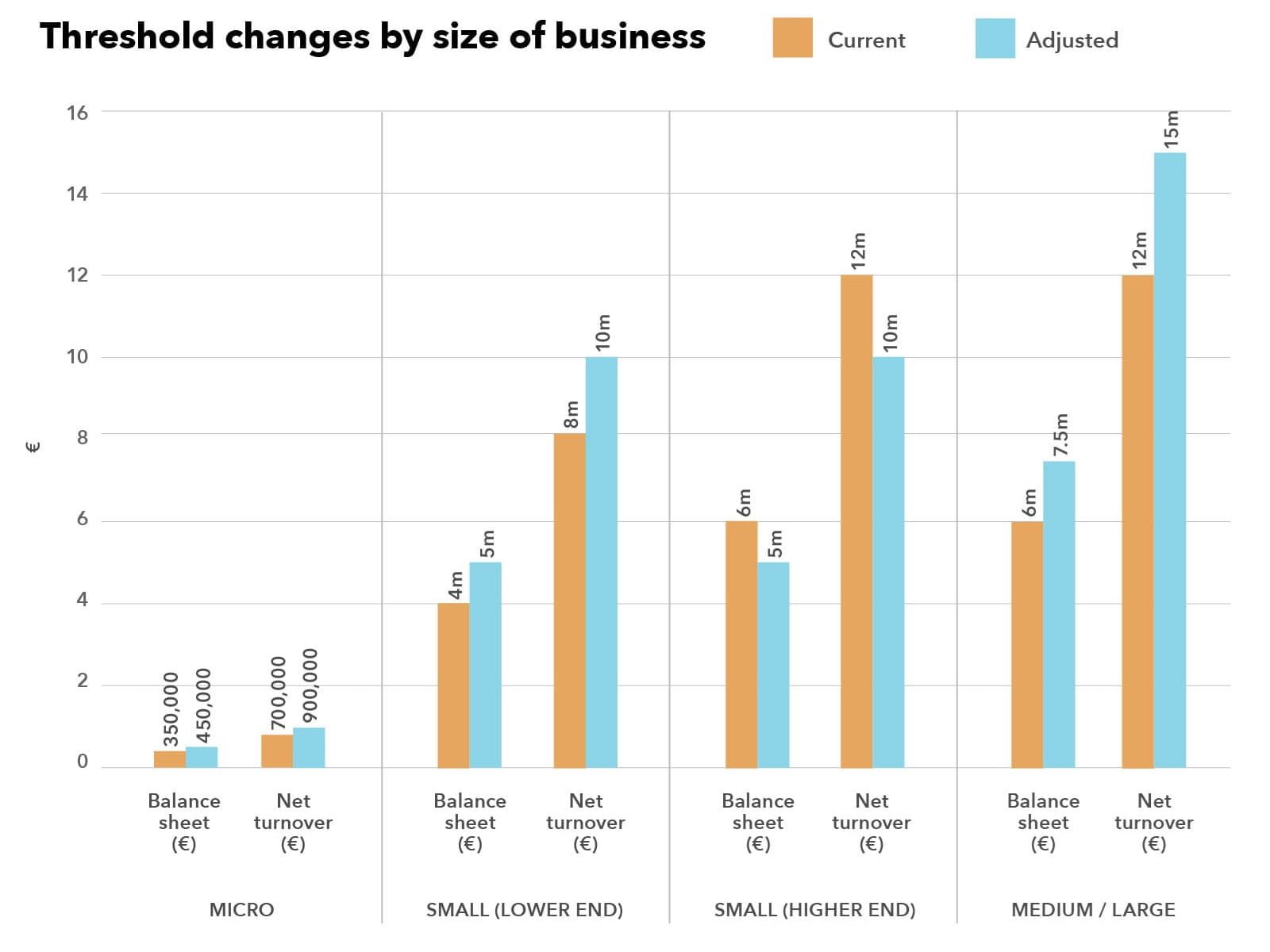

Accounting Directive thresholds for the micro, small, medium and large categories are primarily based on two monetary criteria: balance sheet total and net turnover. Under article 3(13) of the Directive, the Commission is required to review those criteria every five years and, where appropriate, adjust them in line with inflation. That measure is designed to maintain a status quo – avoiding a scenario whereby inflationary trends would make micro and small companies subject to the more demanding requirements that face larger firms.

When the Commission last reviewed the categories as part of a 2021 report, its analysis of data from early 2013 – when the thresholds came into force – to late 2019 concluded that no revisions were necessary. However, in light of the significant inflation that has played out in the EU and elsewhere since 2021, the Commission has decided to revisit the issue, with a view to making adjustments.

Alleviating pressure

The explanatory text notes that from 1 January 2013 to 31 March 2023, cumulative inflation reached 24.3% in the euro area and 27.2% for the EU27. As such, the Commission considers it appropriate for the sizing criteria to be adjusted upwards by 25% to account for those trends – with values in the micro category rounded up to the nearest €25,000.

Here is what those changes would look like in practice:

Harnessing the Bureau van Dijk ORBIS Database – a widely used tool for analysing company information – the Commission ran a model to estimate the percentage of EU limited liability companies (LLCs) that would see an alleviation of their reporting and audit obligations under the proposed new thresholds. That emerged as 6% of the EU’s total 18.9m LLC population – or 1.13m potential beneficiaries.

In the Commission’s assessment, the new size criteria would reduce the scope not just of the Accounting Directive’s standard presentation, audit and publication requirements, but also disclosure obligations established under the Corporate Sustainability Reporting Directive. The impact of that scope reduction would produce initial, one-off cost savings to EU businesses of an estimated €150m and recurrent annual savings of around €700m.

ICAEW broadly supports the changes, according to its Director, Audit and Corporate Reporting, Dr Nigel Sleigh-Johnson. “An increase of at least 25% in the EU accounting thresholds seems long overdue,” he says.

Sleigh-Johnson points out that accounting thresholds loomed large in the recent Department for Business and Trade (DBT) Smarter Regulation: Non-financial Reporting Review, to which ICAEW provided a response.

“We called for a fresh look at the size categories used to determine the type of accounts that businesses must prepare and file with Companies House. We also strongly encouraged DBT to bring all the size criteria and threshold requirements together in one location to allow preparers to identify clearly the category, or categories, into which they fall,” Sleigh-Johnson explains.

Under the Commission’s proposals, the EU’s new sizing thresholds would apply from 1 January 2024. The consultation closes on 6 October.