New data reveals a sombre rebound from the recession line by the UK economy, mostly dragged up by success in the services sector – the main contributor to the pick-up in monthly growth. November’s rebound may have been insufficient to prevent a small technical recession at the end of 2023, with the cost-of-living squeeze and strike action likely to have constrained output in December. However, business confidence is up, with positive signs of both domestic and export activities strengthening.

Official figures showed that the UK economy grew by 0.3% in November, in contrast to the 0.3% decline in October. However, on the three month-on-three-month measure, a better indicator of the underlying trend, UK GDP contracted by 0.2% in the three months to November.

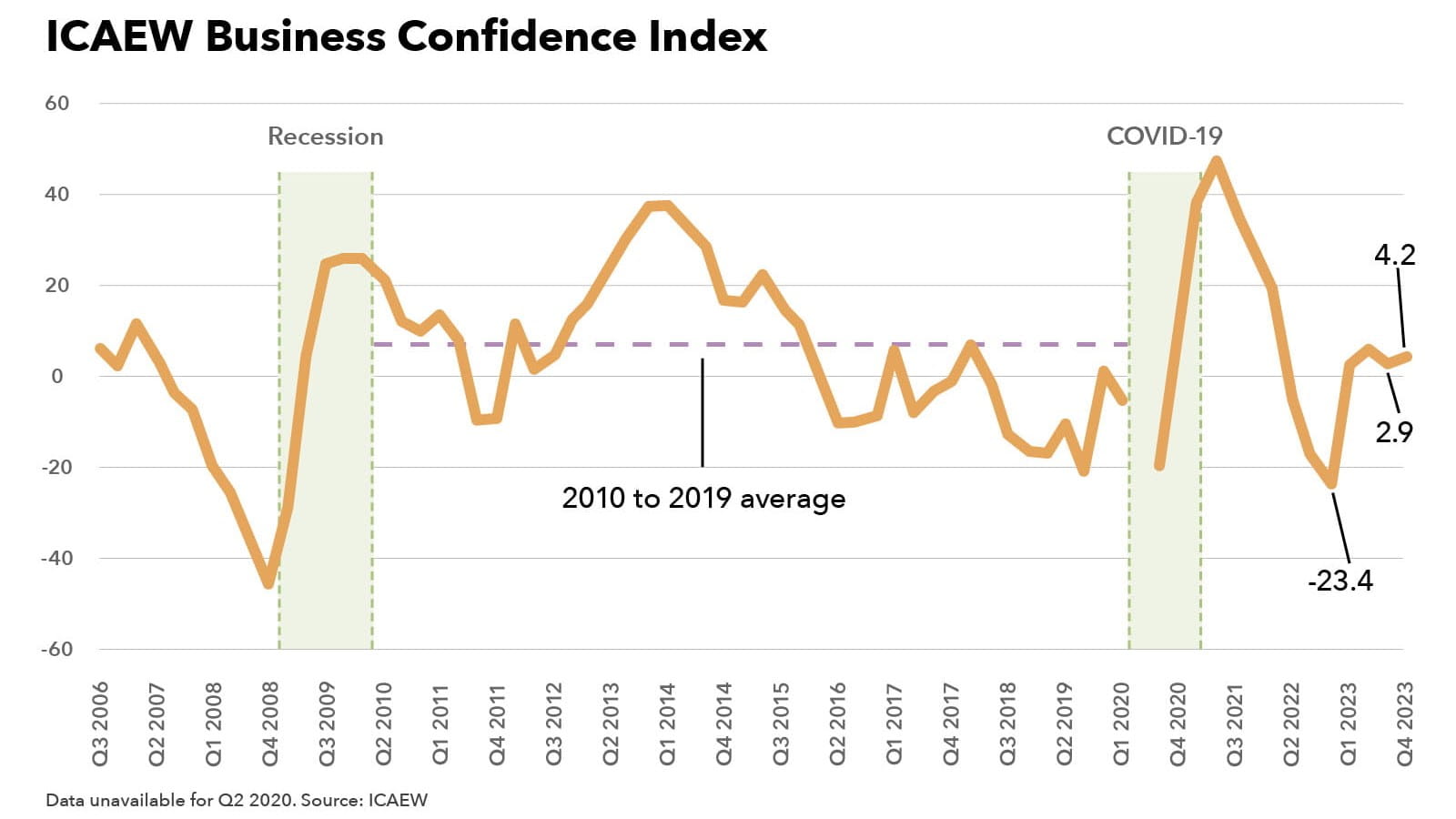

Business confidence treading water

ICAEW’s Business Confidence Monitor (BCM) – one of the largest and most comprehensive quarterly surveys of UK business activity – puts confidence at 4.2 on the index for Q4 2023, up from 2.9 in Q3 (above), but below the pre-pandemic average of 7.2 from 2010-19. Customer demand issues, sales growth and high interest rates are likely to have kept optimism subdued, despite easing inflationary pressures. Meanwhile, around one in four companies said the tax burden was a rising source of difficulty, compared to the historic norm of 16%.

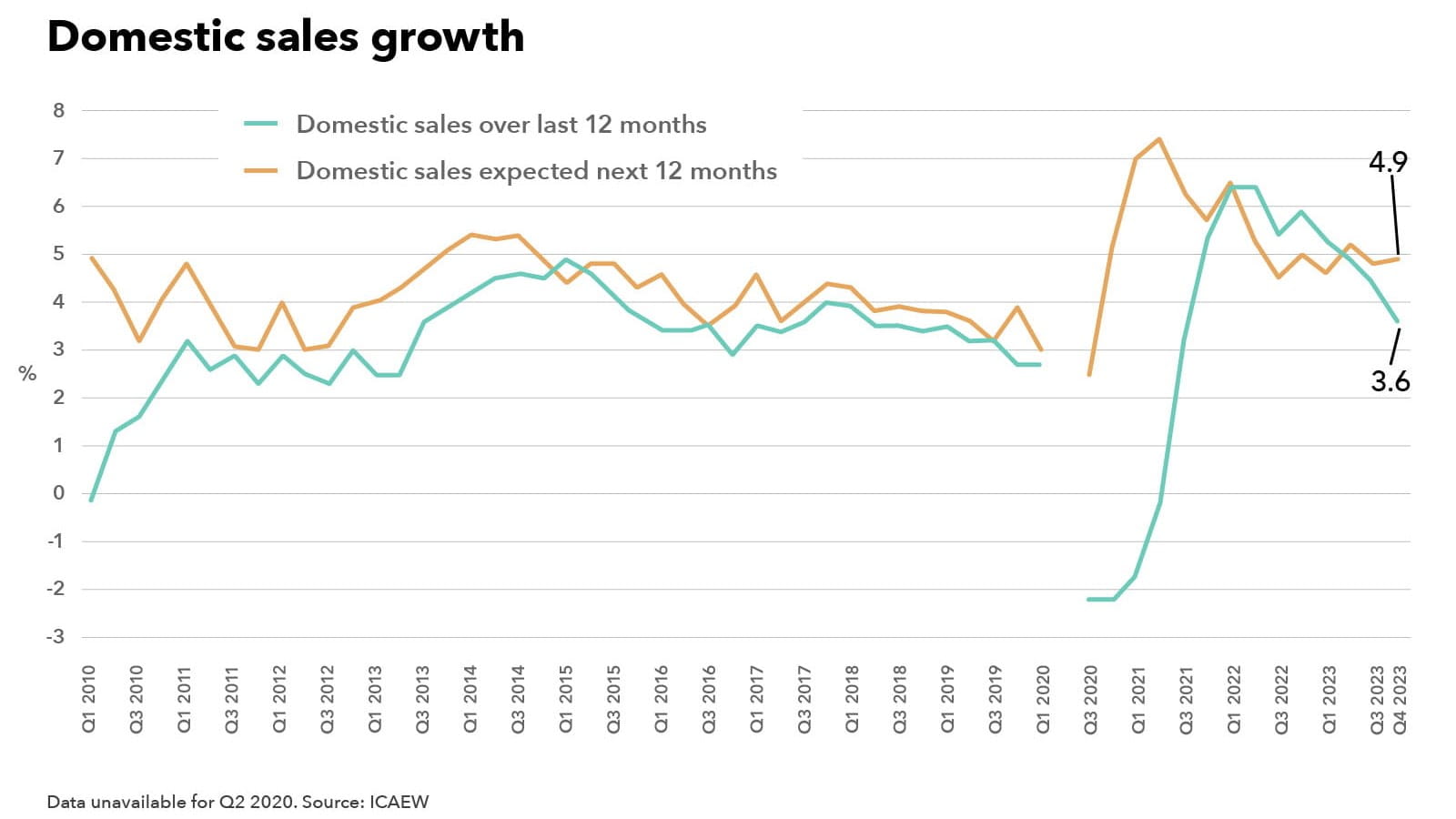

Domestic and export sales growth at two-year low

ICAEW’s latest BCM also reveals that domestic sales growth is continuing to slow, standing at 3.6% year-on-year in Q4 and moving closer to the historical average of 3% (above). Export growth fell more markedly and at 2.1% now stands below the 3% historical norm. Both are also at their lowest point since Q3 2021. However, companies expect faster domestic and export sales growth in the next 12 months. Customer demand remained one of the most significant challenges facing businesses, with 35% citing it as a growing concern, reflecting the continued cost-of-living squeeze and the impact of high interest rates.

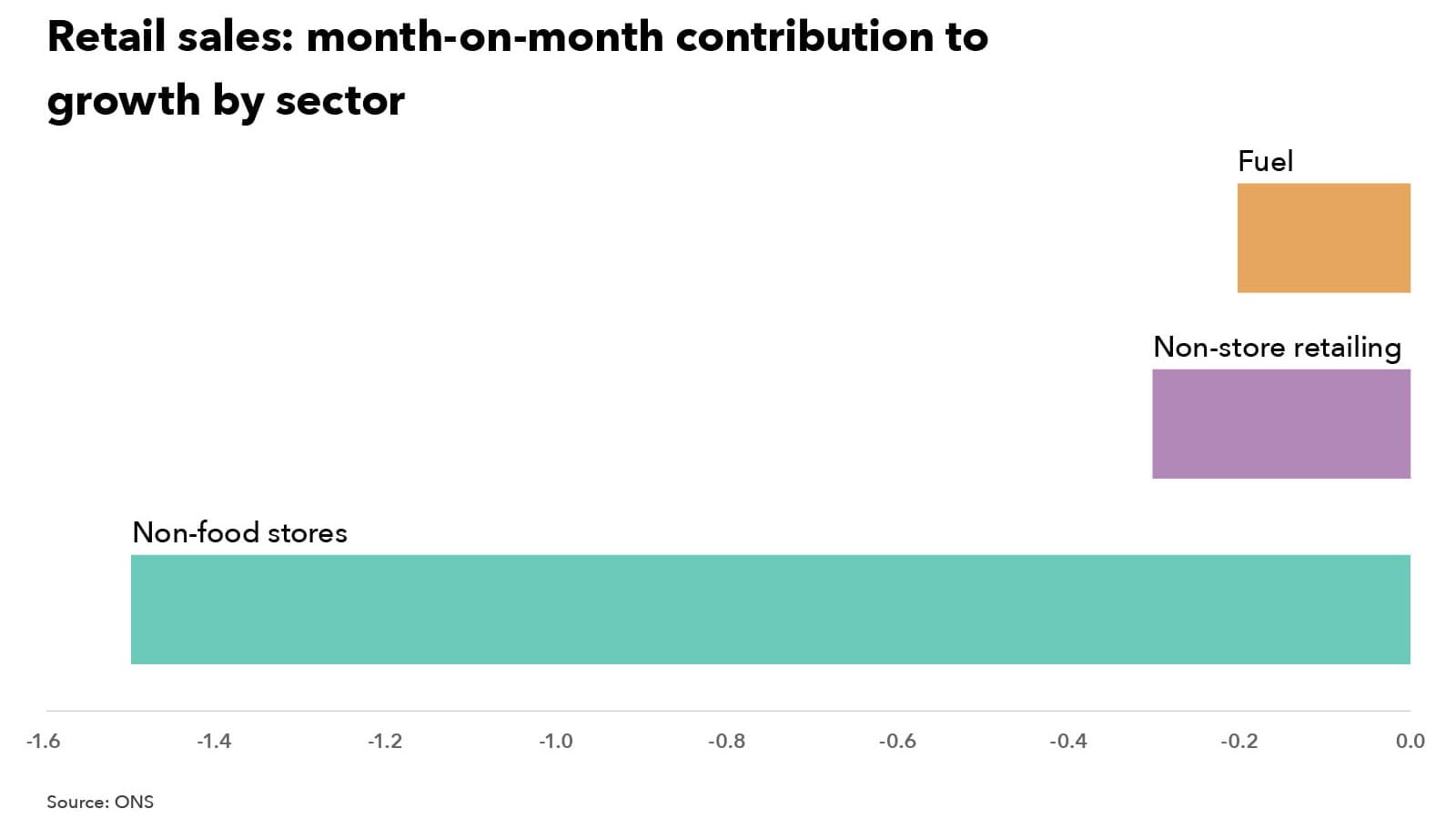

Retail sector endures poor end to 2023

Retail sales in Great Britain fell by 3.2% in December 2023, the biggest fall since the last COVID-19 lockdown in January 2021 and down from a 1.4% rise in November. Over the fourth quarter, sales volumes fell by 0.9%. The biggest fall in sales in December were among non-food shops (e.g, department stores, clothing and household shops), which fell 3.9% month on month in December (above).

Sales from food stores fell 3.1%, the steepest fall since May 2021 as early Christmas shopping led to slow December sales. On an annual basis, retail sales volumes fell by 2.8% in 2023 and were their lowest level since 2018.

Inflation outlook improving despite surprise December increase

UK CPI inflation stood at 4.0% in December 2023, up from 3.9% in November and the first rise in inflation since February 2023. Increases in tobacco and higher alcohol prices were the main drivers behind the surprise uptick. While inflation will have probably risen again in January following the increase in Ofgem’s energy price cap, it should fall at a strong pace thereafter, with the expected drop in energy bills from April and lower food inflation likely to bring inflation back to the Bank of England’s 2% target in the coming months.

Bank of England tentatively lays the groundwork for rate cuts

The Bank of England kept interest rates on hold at 5.25% for the fourth successive meeting. The Monetary Policy Committee (MPC) member voting split in favour of this outcome shifted to 6-2-1, from 6-3 at their last meeting, as one MPC member voted for a rate cut. This is the first three-way split on whether to cut, hold or raise since 2008.

While the Bank’s tone on rates remains disappointingly downbeat, this change in the vote split is an indication that it is tentatively laying the groundwork to loosen policy sooner rather than later. The Bank of England also released its Quarterly Monetary Policy Report, which revealed that it is now expecting inflation to fall back to its 2% target in the second quarter of this year.

Implications for accountants, business owners and the economy

These latest data releases suggest the economy struggled for momentum at the end of last year as weakened customer demand, an onerous tax burden and high interest rates drove a notable deterioration across key indicators of economic activity. The forward-looking measures from ICAEW’s latest BCM are more upbeat, with strengthening indicators of domestic and export activity suggesting that even if the UK did suffer a small technical recession at the end of last year, the return to growth would be pretty quick.

UK economy – what to watch for this month:

- The latest labour market data due out on 13 February will be closely watched by the Bank of England, which remains concerned that wage growth is too high, adding to the upside risks to inflation.

- The next inflation figures due out on 14 February could well show that inflation rose in January, following the increase in Ofgem’s energy price cap.

- The GDP data for December, to be released on 15 February, could place the UK economy in a small technical recession if GDP contracted or was even flat in December as this could lead to a second consecutive quarter of falling output.

Links to support

For more insights, analysis and resources for organisations facing rising costs of doing business, visit ICAEW’s Cost of doing business hub.

ICAEW also works with the charity caba to promote the mental health of chartered accountants and their families, producing articles, guides, webinars, videos and events that can provide support during these difficult times.

ICAEW launched a campaign titled ‘Resilience and Renewal’, which explores some of the most serious systemic challenges facing the UK economy and brings together government ministers, leading academics, economists and thought leaders to look at how to build a better, more resilient future economy and the vital role UK business and chartered accountants play.