What are interest rates?

When interest rates are mentioned in the news or by policymakers and economists, they are usually referring to the ‘Bank Rate’ (also called Bank of England base rate) which is the key interest rate in the UK because it influences many other interest rates in the economy. That includes mortgage lending, savings rates and the amount charged on credit cards and bank loans.

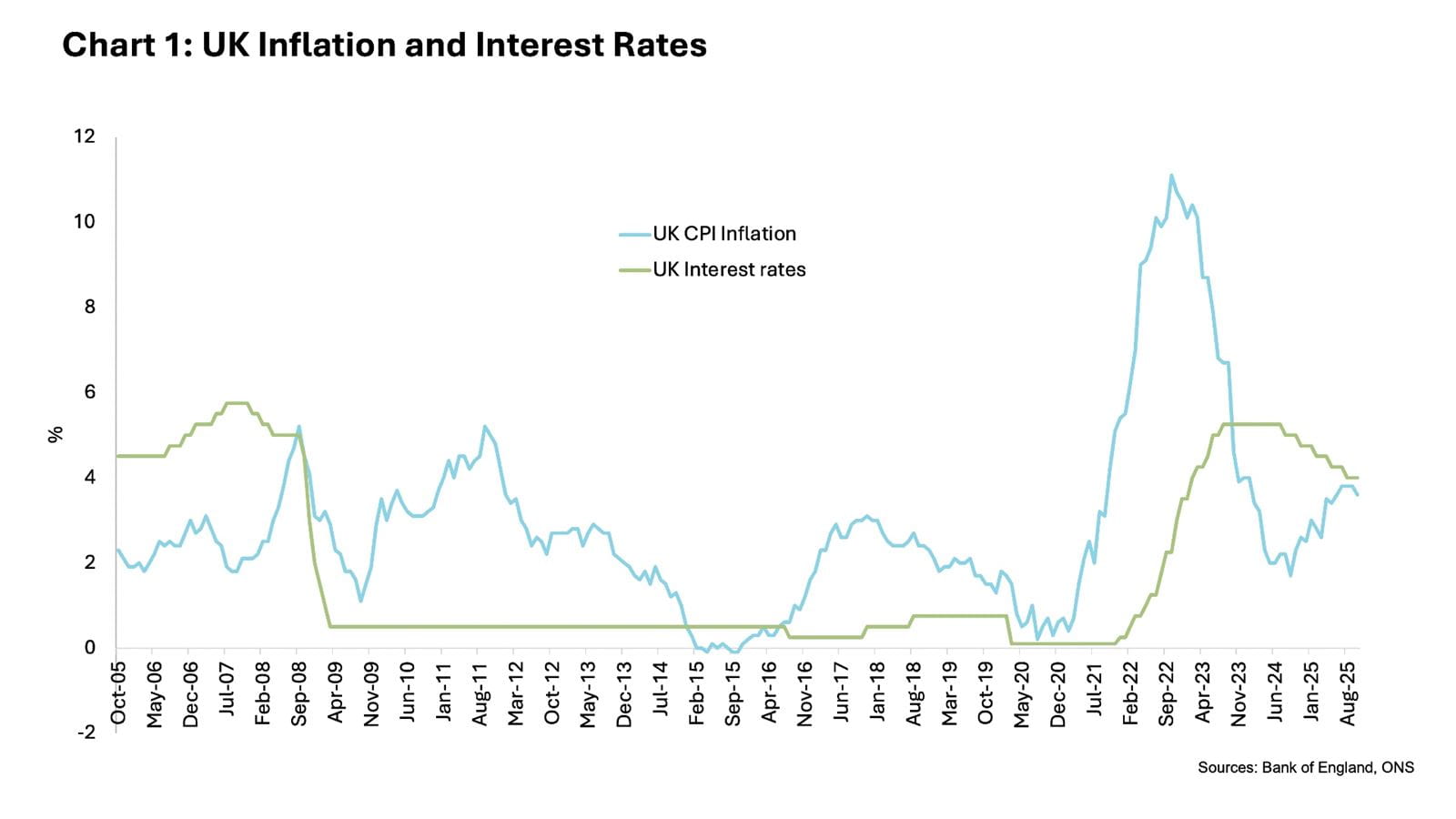

The Bank of England’s Monetary Policy Committee (MPC) sets Bank Rate as part of action to keep inflation at its 2% target over the medium term (see Chart 1). The theory is that if you make borrowing more costly, people will have less money to spend, which reduces consumer demand and eventually lowers inflation.

While the government sets the 2% inflation target, the Bank of England acts independently of the government in deciding how to achieve this goal, including how it sets interest rates. The MPC sets interest rates eight times a year.

How do interest rates affect people and businesses?

There are winners and losers from changes in interest rates. If rates rise, the losers are typically people with mortgages and debt who will face higher costs, particularly if they are on a variable rate. Businesses also borrow less, making them less likely to create jobs and invest.

The winners are people with savings who should get a bigger return on their deposits. In contrast, when interest rates fall, borrowers’ benefit, while savers lose out.

What is the state of play in November 2025?

From December 2021, interest rates rose sharply from 0.1% to reach a16-year high of 5.25% in August 2023 as the Bank of England tried to tackle the biggest inflation shock in more than 40 years. However, since then the MPC have been gradually reducing policy to its current rate of 4.00%.

What is the outlook for UK interest rates?

UK interest rates are likely to fall slightly further over the coming months as weakening GDP and labour market data is fuelling fears among rate setters over the health of the UK economy.

However, lingering concerns over underlying inflationary pressures mean that the pace of rate cuts will remain gradual.

Higher taxes is a mixed blessing for interest rates as while they can be deflationary by weakening customer demand, the upward pressure from any rise in business costs may mean that inflation is more stubborn than many expect.

Some of the main challenges facing UK interest rates

- A time-lag of around 18-24 months (estimated by the Bank of England) between raising interest rates and the full impact on the wider economy means they are a rather blunt instrument to tackle inflation.

- New inflation risks, include the upward pressure prices from higher taxes announced in the budget and possible new US trade tariffs, could mean that rates are kept higher for longer.

- Challenges of a weaker currency, including imported inflation, if the UK cuts interest rates ahead of the US.

ICAEW on the Budget