There are huge challenges facing the accountancy profession as it comes to grips with the need to provide a holistic view of a business by incorporating traditional financial data and ESG metrics. Accountants must do so, however, if stakeholders are to make the right decisions in creating a sustainable world.

This is the message I shared at the World Forum of Accountants in New Delhi this weekend (31 January – 2 February 2025). The event was hosted by the Institute of Chartered Accountants of India (ICAI) to discuss the intersection of technology and environmental sustainability.

ICAEW was a sponsor and I was proud to be able to give the first keynote speech of the conference on the subject of incorporating ESG metrics into financial statements.

Paradigm shift in reporting

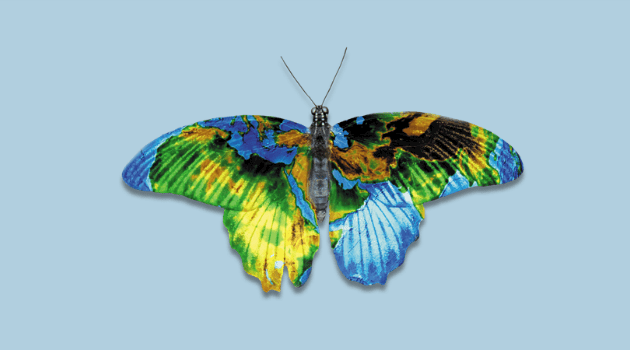

It is impossible to overstate the depth of our paradigm-shift towards sustainability reporting, and its effects on the profession.

In the past decade or so, statistics around global warming have brought the problem of planetary sustainability to popular attention. Now, we also recognise the wider biodiversity crisis. Those issues – along with social crises, such as modern slavery – were captured in the UN’s Sustainable Development Goals (SDGs), published in 2015.

As accountants well know, what cannot be measured cannot be controlled. Providing those measures to stakeholders in a trusted way means they have to be incorporated into published company reports.

We know how to do this for money. We have spent centuries building up reliable and trustworthy ways to collect and exchange financial data between companies. But with non-financial data – and, currently, unquantified financial data – we have no such mechanisms. We may be getting there with CO2 reporting, for example. But we struggle with most other SDG data points.

It is reasonable to see how we could get there for Scope 2 and 3 metrics on, say, child labour, or accidents at work, provided we have a reliable and trustworthy exchange of information between companies. But even evaluating metrics on how to support sustainable societies is extremely difficult.

This is one issue with providing this holistic picture, and accountants must at the heart of resolving it. Honed on financial information, we have the skills to install the correct systems to gather the data we need, verify its trustworthiness and summarise it in an unbiased way.

Holistic view

However, we struggle to incorporate ESG metrics into financial statements. In fact, in practice, we often don’t incorporate them at all. What we do is shuffle them hastily into ‘non-financial’ sections at the front of our annual reports, or into separate documents. That does not present a simple, holistic view of an organisation and its impact.

In parallel, there is another, important development to consider. When the traditional accounting framework was laid down, the majority of assets and liabilities were tangible. No one took notice of the consumption of planetary resources, nor the impact of, say, pollution.

Now, though, many of the assets and liabilities of public companies are no longer on their balance sheets. Just look at intangible assets, such as intellectual property, social capital and human resources. In 2020, US advisory firm Ocean Tomo estimated that intangibles now comprise 90% of the market value of the S&P 500. That’s up from 17% in 1975, when our current accounting framework was being devised. There are similar, if not greater, issues with liabilities where most of the impact we have on the planet simply goes unrecorded.

With the information currently provided, it is difficult to see how we can work out what ‘sustainable growth’ really is. And this matters. The danger is that if our figures are based on an out-of-date a methodology, we will make bad decisions.

New expertise

Aside from the difficulty of collecting relevant information, the scale of the ESG challenge is vast. The huge number of different standards and frameworks does not help. Materiality assessment is a nascent discipline. Measures used are often subjective in nature, presenting valuation hurdles. Risk and uncertainty is often poorly accounted for, if, indeed, in the area of ESG, we even know how to do it.

Then there’s presentation and maybe we need to rethink this too. Some areas of ESG, for example, do not neatly align with traditional financial accounts, and may, for example, best be assessed in terms of trends, rather than as balance sheet snapshots.

In this area of rapid innovation, another huge factor is market inertia. The current method of accounting has been around for two millennia or more. It is hard to change. People do not like rethinking old paradigms.

There have been many attempts to provide acceptable and workable frameworks – from the work of the Capitals Coalition, Accounting for Sustainability and many projects. None have yet had the traction to succeed. That does not mean we should be stuck in mid-20th century, capital market thinking. As accountants we can, and will need, to do better.

In addition to collecting the data and presenting it in a meaningful way, we have, as a profession, one other role. We need to ensure that ESG data is accurate, verifiable and fairly presented. Even meaningful data is worthless, if it is not trustworthy.

By providing assurance (and, one day, audit) on the full spectrum of ESG data points, our profession can – and must – lead the private sector away from greenwashing, rebuild trust in business and drive meaningful progress towards global sustainability goals.

We are part of a shared mission, not only to meet the evolving needs of businesses and economies, but to ensure we do so in a way that reinforces the integrity and trust that are so essential to our work.

The problems are huge and the time to solve them short. It is not something one professional body, or even one country can do on its own.

This requires us to intensify our collaboration – on a global, regional and national level – with fellow accountancy bodies and, indeed, governments and regulators. As we all face the future, with its many demands on our profession, that continued collaboration will be vital to drive the path towards a better and more sustainable future.

Get ahead on sustainability

You can now enrol on the Sustainability Accelerator Programme and take the next steps on your sustainability elearning journey.