What are the surveys, and what do they include?

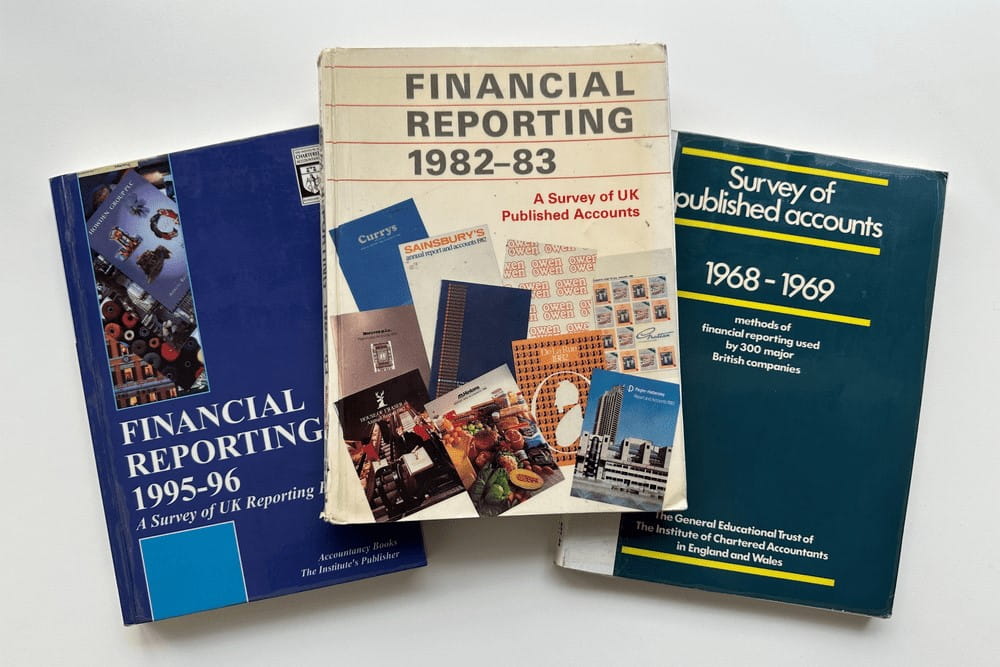

First issued under the title ‘Survey of Published Accounts’, and later renamed ‘Financial Reporting: a survey of UK reporting practice’, the surveys examine the published accounts of a sample of British companies.

Each edition is divided up into sections, most of which focus on a particular area of financial reporting. Generally, these topical sections include:

- Summaries of relevant current requirements and/or recommendations, as set forth in statutes and/or accounting standards, for instance.

- Statistical analyses of the methods and practices of disclosure found in the surveyed financial statements, often presented alongside comparative figures for previous years.

- Illustrative excerpts from published financial statements, which often serve to highlight variations in the treatment of a particular issue.

Topics covered in the 1982-83 edition, for example, include fixed assets, earnings per share, foreign currencies, and interim reports. Companies whose accounts were analysed for that edition included British Aerospace, Glaxo Holdings, and Unilever.

Some editions also include:

- Narrative sections, which provide an overview of the development of UK (and, later, international) accounting standards and statutory requirements up to the date of publication, and indicate any impending changes.

- Survey tables and examples.

How did the series come into existence?

The production of the first Survey of Published Accounts was initiated on the suggestion of Michael Renshall, who worked at ICAEW from 1960 to 1977 and became its first Technical Director in 1969 (see Principles Before Standards, pp.35-37).

As first conceived, the project had two primary aims:

- To investigate the methods of presentation which companies had selected in order to comply with new statutory financial reporting requirements – particularly those set out in the Companies Act 1967 (1st ed., p.5).

- To assess the extent to which companies’ accounts adhered to the Institute’s Recommendations on Accounting Principles – non-mandatory statements of best practice which had been issued from 1942 onwards (1st ed., p.9).

Initially, the project was met with significant resistance. In an interview conducted in 2008, Michael Renshall recalled that some members had opposed the research on the grounds that it would undermine efforts to standardise accounting practice. They argued that, since the project was likely to make public many deviations from the Recommendations, it would lead to a proliferation of non-standard reporting practices (see Principles Before Standards, p.37).

Despite these concerns, the first volume, for 1968-69, was published in April 1970.

Why is the series important?

One reviewer of the 1977 edition neatly encapsulated the significance of the survey when they praised it for presenting “not only an analysis of methods and examples of financial reporting used by major British companies, but also a guide to current accounting thought in the United Kingdom”, and “a brief history of the development of such thought” (Accounting Review, January 1979, p.254).

Each edition provides a snapshot of the prevailing practices in UK financial reporting for the year in question, often with comparative reference to those observed in previous years. These practices are set in the context of past, present, and prospective requirements and recommendations.

Considered as a whole, the series represents a unique record of key trends and issues which emerged during a noteworthy period in the history of UK financial reporting – a period characterised by efforts towards increasing standardisation.

Significantly, the surveys shed light on the extent to which the actual reporting practices of UK companies aligned with or deviated from those advocated by standard-setting bodies, professional associations and others over time. In so doing, they helped to shape the development of UK financial reporting principles and practice, as well as documenting it.

Early entries in the series coincided with and influenced the nascent movement towards the creation of a new body of accounting standards. In January 1970, shortly before the publication of the first edition, ICAEW had established the Accounting Standards Steering Committee (ASSC), with the object of developing “definitive standards of financial accounting and reporting” (ASSC Constitution, as recorded in the Minutes of the Ordinary Meeting of the ICAEW Council, 4 February 1970).

Upon its publication, the first edition of the survey highlighted the considerable degree of variation in financial reporting practices at that time, which seems to have strengthened the resolve of certain influential figures to increase consistency via the codification of “definitive standards”. Speaking at the survey's launch event, the Institute’s President asserted that the number of variations in accounting practice illustrated by the survey ought to be reduced and narrowed, and re-stated ICAEW's commitment to advancing accounting standards (‘Institute's Approach to Accounting Standards’, The Accountant, 7 May 1970, pp.685-686).

Some months later, in January 1971, the first accounting standard – 'Accounting for the results of associated companies' – was issued as Statement of Standard Accounting Practice (SSAP) no. 1.

As the body of UK accounting standards (and, later, international accounting standards) grew and evolved in the subsequent 25 years, the annual surveys continued to chronicle, and influence, the course of that process.

Articles published in Accountancy magazine during the 1970s – such as 'Survey shows weak spots' (February 1972) and 'Survey provides food for thought' (February 1975) – indicate that the findings presented in the surveys were considered to be of interest not only as factual records, but also as spurs to critical reflection and action.

This impression is reinforced by an article published in the April 1987 issue of Accountancy (pp.25-26), in which Chris Swinson reviews the 1986-87 edition. He states that “[o]n the evidence of this survey, complacency about the state of financial reporting would be a dangerous folly”, pointing to a concerning rise in “off-balance sheet financing”, and calling on the profession (the Accounting Standards Committee in particular) to “[prove] it can cope with this threat”.

In the preface to the final edition of the survey, Len Skerratt notes that “[a]n important feature of much of the analysis […] is that the abuses of the 1980s have been substantially reduced or eliminated by the Financial Reporting Standards introduced by the Accounting Standards Board over the past few years” (p.ix). By having done much to highlight such “abuses”, earlier editions of the survey provided some of the impetus for this standard-setting activity.

Accessing the surveys

All editions of the survey are held in our off-site store. For full holdings information, please see the relevant catalogue entry.

If you wish to access any of our holdings of this title, contact us on +44 (0)20 7920 8620, or email library@icaew.com. Should you wish to consult the volumes in person, please let us know well in advance of your visit so that we can have these ready for you. Alternatively, the enquiry team can check the volumes for you to find the information you need.

Related resources

Between 1990 and 2010, the Library subscribed to the print journal Company Reporting, which provided information on the financial reporting practices of public companies. It served as a useful source of ‘real-life’ examples of disclosures, to help accountants in their application of best practice.

Today, Company Reporting is an online service, focused specifically on IFRS financial reporting. It includes selected extracts from recently published annual reports, arranged by issue/area, and presented alongside commentary highlighting areas of good practice and referring to relevant standards and requirements. It also contains Common Practice Reports, which review the treatment of a particular area or issue across a sample of annual reports.

The Company Reporting service is available through the Croner-i Tax and Accounting database. Members visiting the Library in person can access this database directly. Our enquiry team can also search the database on behalf of members and supply extracts by email within the terms of our licences — please contact us to discuss your requirements.

In addition, the FRC periodically publishes Annual Reviews of Corporate Reporting and Corporate Reporting Thematic Reviews, which include illustrative examples of how companies are applying/interpreting particular aspects of UK GAAP and IFRSs.

Can't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.

Contact the library

Expert help for your enquiries and research.