This consultation is now closed

As an approved regulator and licensing authority for probate services, our activities are guided by and support the Legal Services Board (LSB) strategic themes; fairer outcomes, stronger confidence and better services, to strengthen trust and protect the public by enabling, evaluating and enforcing the highest standards in the profession.

To continue to deliver our ongoing programme of activity to fulfil these objectives and respond to the requirements of the Legal Services Act and new governance introduced by the LSB, we proposed to increase probate registration fees by 5% for 2022.

This consultation ran from Friday 25 June to Friday 6 August 2021.

Responding to the consultation

This consultation is now closed. It was open for six weeks from Friday 25 June to Friday 6 August 2021.

How we set the probate registration fees

The review of probate registration fees begins in June each year. The strategic and operational priorities are discussed with the ICAEW Regulatory Board (IRB) and a business plan and budget to deliver these are developed.

ICAEW operates a self-financing principle (also known as the ‘user pays approach’), which ensures all probate registration income is used for probate specific ‘permitted purposes’. Permitted purposes are prescribed regulatory activities as listed in Rule 6 of the Legal Services Board’s Practising Fee Rules. These permitted purposes are described in detail in the document What your fee pays for and include application and registration, policy and education, monitoring and conduct.

The detailed budget estimates and analyses costs to deliver the plan including for example, staff, insurance, legal, project, office and overhead costs, and contributions required to fund other activities such as the Legal Services Board (LSB) and Legal Choices website. The total cost of operations is then compared to our registered population of firms to ensure that income then matches expected expenditure.

The proposed new levels of registration fees are agreed by the IRB.

We consult with probate registered firm representatives for feedback on the proposed fee increase and level. The fees are adjusted as appropriate in response to feedback received. For 2021 there was no fee increase.

The fees must then be approved by the LSB under its Practising Fee Rules. This involves a detailed application process including sharing the business plan, priorities, budget and details of any fee changes. This application is published by the LSB.

In November the full probate registration fee scale is published on icaew.com/regulatoryfees and registration renewals are sent by email to firms.

We continue to carefully consider strategic, operational and oversight needs and associated funding and set the level of registration fees and levies as cost effectively as possible and on a year-to-year basis. Fees may need to continue to rise modestly in light of inflation and the requirements placed on our organisation by the LSB. This will ensure that costs of regulatory operations, ‘permitted purposes’, are funded by an appropriate level of registration fees. We will, of course, consult about any such changes each year.

Annual firm levy

The annual levy funds the operation and building of a reserved legal services compensation scheme fund. The levy for 2022 is unchanged from 2021.

Reserves

As part of its financial strategy, ICAEW holds reserves to provide financial strength, and as mitigation against unexpected events.

The level of probate reserves is specifically targeted as not to be too high or too low. The policy is therefore ‘reserves should be set at a level equivalent to between three and six months of expenditure through the income statement; and cash and investment balances should be at least sufficient to cover between three and six months of annual budgeted/forecast gross cash expenditure’.

Current reserves are in line with policy and therefore there is no requirement or element of 2022 fees which plans to draw on reserves or increase reserves.

2021/22 Business plan

Building on the firm foundation of our work in previous years, our probate work in 2021 and 2022 will focus on the following key areas:

- Ensure the Professional Standards Department (PSD) is best set up to deliver legal services regulation

- Ensure regulated firms are delivering a good service

- Improve transparency and ensure effective communications

- Promote collaboration

- Contribute to a more inclusive culture

- Future development

Budget 2022

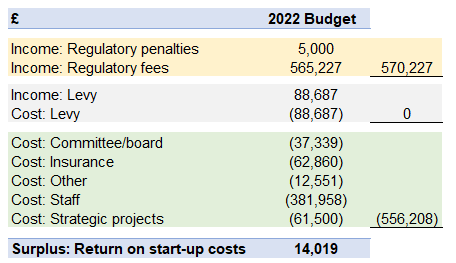

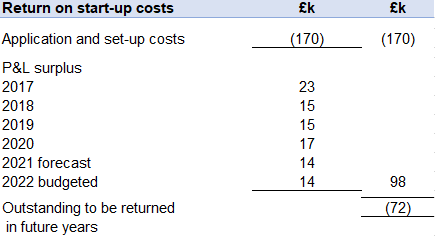

The budget for 2022 is targeted to self-finance and make a small surplus of £14,000 to return over time the start-up costs of becoming a regulator and licensing authority. In addition to inflation and salary increases, costs in relation to policy and governance have increased due to LSB requests for further administrative processes, consultations, and information returns.

Budgeted income is largely related to firm registration and licensing annual registration fees. All income is raised specifically for reserved legal services permitted purposes only. The levy income flows through the income statement to building the compensation scheme. Committee and board costs relate to the ICAEW Regulatory Board and the Probate Committee. Operational costs are in the main related to registration, regulatory, policy, quality assurance and conduct staff. Projects includes a contribution of £30k to fund the Legal Choices website.

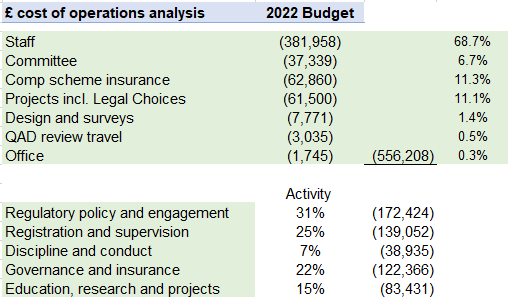

The analysis above provides further details on expenditure analysed by cost type and by function. Each of the legal services regulators is required to make contributions on behalf of those they regulate and supervise. In 2022, ICAEW is planning to contribute:

- 11k to the Legal Services Board (2.0% of total expenditure)

- £5k to the Legal Ombudsman (0.9% of total expenditure)

- £30k to Legal Choices (5.4% of total expenditure)

£14,000 is targeted as a surplus in 2022 as a contribution to return the start-up costs of becoming a regulator and licensing authority. It is estimated that the outstanding balance will be cleared in five years (December 2027).

Registration fees

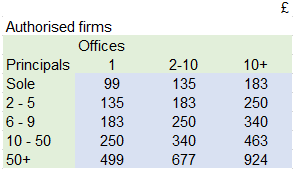

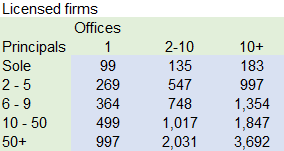

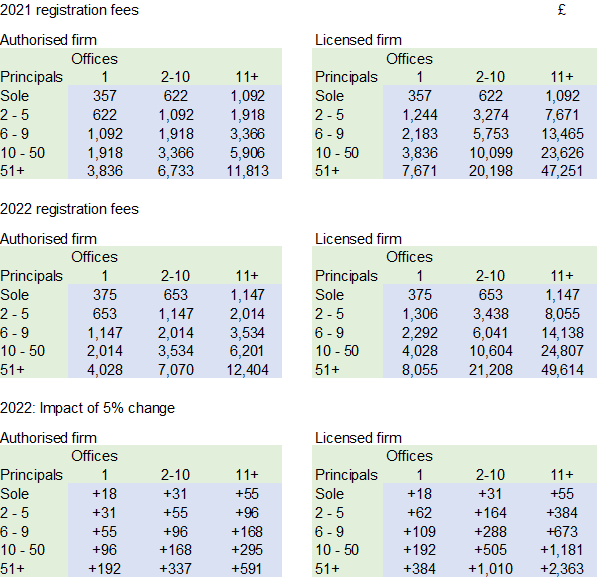

The tables below compare the 2021 registration fees to the proposed 2022 registrations fees and show the impact of a 5% increase in each category.

The levies for 2022 are unchanged from 2021: