Details of the proposed changes regarding compulsory alternates.

There has been an increased focus on consumer protection by government and oversight bodies in recent years. Examples include:

- IAASA, the Irish audit oversight body, introduced a requirement in the 2022 Irish Audit Regulations for sole practitioner auditors to appoint alternates.

- ACCA also have a requirement in its regulations for sole practitioner auditors to appoint an alternate.

- A policy statement on consumer empowerment was published by the Legal Services Board1, and the Legal Services Consumer Panel exists to consider consumer protection in the legal services market.

- The publication by the Financial Conduct Authority of new consumer protection guidelines2 in July 2022 that took effect in July 2023. These potentially affect audit-regulated firms that are also licensed for financial services advice.

- The issue of ISQM1 (UK) by the FRC which heightens the need for practice continuity.

Given these developments, we consider that greater consumer protection is needed in the area of audit work. The introduction of compulsory alternates for sole practices would help reduce risk both to the consumer and the practice. As part of a firm’s overall succession planning, it would also help avoid the situation where employees, clients and other stakeholders are left in a state of uncertainty when the practitioner falls ill or sadly dies. The rising age profile of the sole practitioner auditor population means that there is an increased risk of issues arising due to incapacity of the practitioner.

At present, it is only compulsory for a sole practitioner to appoint an alternate if they handle client money, or are a licensed insolvency practitioner.

ICAEW provides guidance on the appointment of alternates:

- Arrangements for alternates - guidance for sole principals

- Arrangements for alternates - guidance for alternates

ICAEW members are also able to get in touch with each other informally through the district societies and seek support. However, district society participation is not available to sole practices we license for audit who are not members.

The proposed introduction of compulsory alternates for audit-registered sole practices has been discussed with the ICAEW Practice Committee. Their feedback has been taken into account in framing this consultation document.

Regulatory changes – compulsory alternates

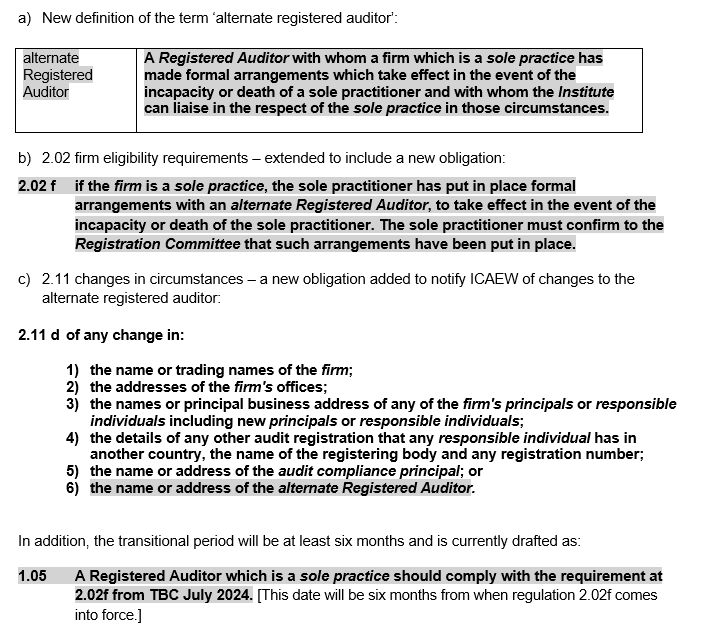

The following changes are proposed to the Audit Regulations (additions are highlighted in grey in the image provided):

This wording mirrors that already applied in the ICAI Irish Audit Regulations.

Extension to all areas of accountancy

In proposing the policy change to introduce compulsory alternates for audit-registered sole practices, the question has been raised as to whether compulsory alternates should be a requirement for all sole practices whatever type of accountancy services are provided. Should ICAEW decide to propose this wider policy change, there would be further consultation. However, we would welcome any initial views on this potential further extension of the compulsory alternates policy.

1. LSB statement of policy on empowering consumers (legalservicesboard.org.uk)

2. PS22/9: A new Consumer Duty (fca.org.uk)

Questions 1-7 (of 12, in total)

- Do you agree it is now a proportionate requirement for all audit-registered sole practices to appoint an alternate?

- Are there any additional factors that ICAEW should take into account when considering the policy?

- What additional steps should be taken to support sole practices?

- Are the draft regulations clear?

- Are there additional factors required in considering the transitional period for compulsory alternates?

- Should the compulsory alternates policy be extended to all areas of accountancy?

- If so, what are the principal hurdles that would need to be overcome?