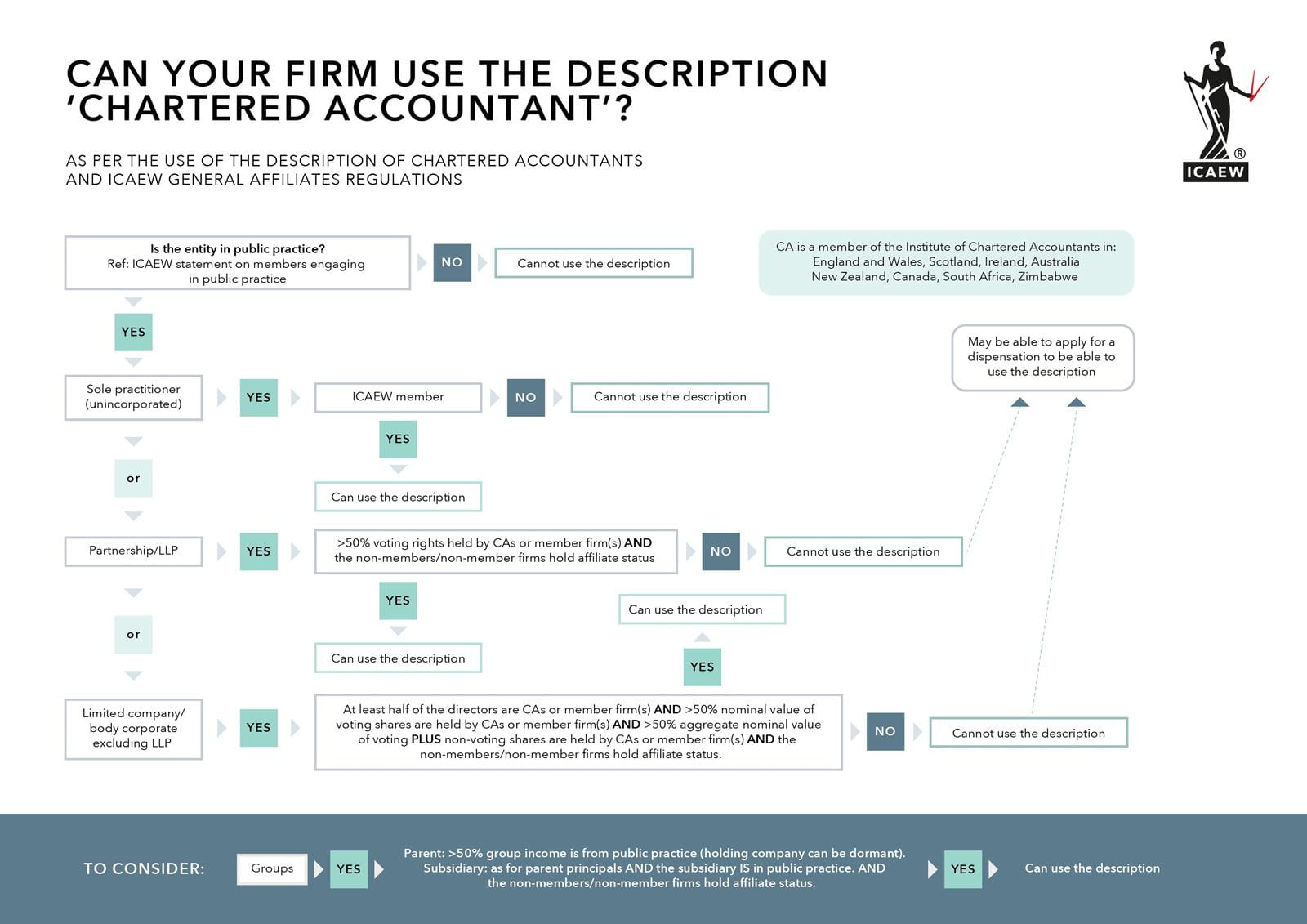

The Use of Description Chartered Accountants Regulations set out when a firm may describe itself as ‘Chartered Accountants’. They also set out the procedural rules for a principal who is not a chartered accountant who must become a general affiliate.

Please note the ‘use of description’ member firm definition is different to the definition in the Principal Bye-laws for an ICAEW member firm.

An accountancy practice (regulated or unregulated) may be part of a corporate group. A group entity (which may be a company or LLP) can only be described as ‘Chartered Accountants’ in the following circumstances.

- In the case of a parent entity, it is controlled by chartered accountants; and over 50% of the income of the group is derived from public practice (a holding company can be dormant).

- In the case of a subsidiary entity, it is engaged in public practice, majority owned by a parent company that is controlled by chartered accountants and part of a group where the parent company can use the description.

In the case of a company, 50% or more of the directors must be chartered accountants. Any directors in a parent or subsidiary company that uses the description, who are not chartered accountants, need to become affiliates.

If your firm is not eligible to use the description 'Chartered Accountants', it can apply for permission to use the description.

For structures with a parent and subsidiary, please also complete Appendix A in respect of the parent entity. If there are holding companies between the trading subsidiary and the ultimate parent, please complete an Appendix A for each entity. For LLPs with corporate principals, please complete a separate Appendix A for each principal.

You can find more information by viewing our helpsheet 'Use of the description 'Chartered Accountants'