What is the AAT-ACA fast track?

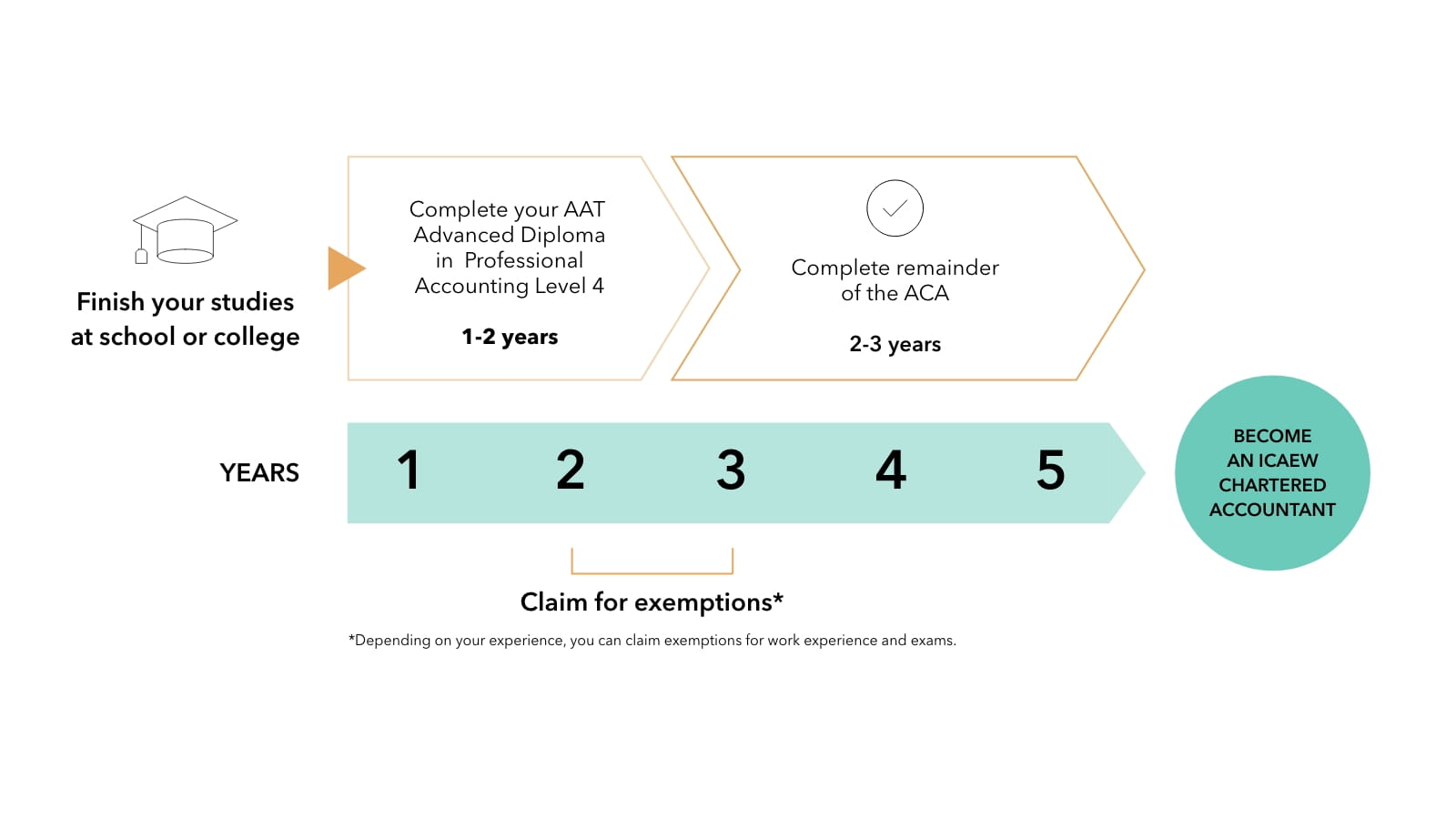

Whilst you can start the ACA straight after school or university, some people choose to first complete the AAT before moving onto their ACA. So, what does this look like?

You will start your AAT Level 2 – 3. This will cover in depth financial processes, such as final accounts for sole-traders, costs and revenues and professional ethics.

Once you have completed your level 3 training, it is a good time to start your work experience. To claim for credits for prior learning and work experience you must train with an ICAEW Authorised Training Employer.

Start your AAT Level 4 with an ICAEW Authorised Training Employer and continue on to your ACA.

Depending which AAT units you have completed at Level 3 and 4, you may receive credit for up to six ACA exams.

Then, start your ACA training and qualify within 4 years.

At a glance

-

Costs

Costs can vary, however these will often be covered by your employer.

-

Course duration

Depending on your experience level with AAT this route could take between 24-48 months.

-

Entry requirements

There are no formal entry requirements.

Have you already studied or partly studied your AAT qualification?

If you’ve already studied your AAT Level 3/4 then you can fast track some training steps towards qualifying as an ICAEW Chartered Accountant.

Depending on the units you have completed, you could gain credits for up to five of the exams at the first stage of the ACA, also known as the Certificate Level. If you have completed an AAT Level 4 apprenticeship, the ACA Professional Level Fundamental Case Study exam is equivalent to the AAT Level 4 End Point Assessment, meaning you would not be required to sit the Fundamental Case Study exam.

If you have done your training with an ICAEW Authorised Training Employer then you may also be able to claim up to 12 months' professional work experience. If you aren't sure whether your employer is authorised to train, please contact our student support team.

Find an AAT-ACA training vacancy

Find an AAT-ACA training vacancy

The best place to start your search to find a role offering the AAT-ACA Fast Track is on our ICAEW Training Vacancies platform.

AAT-ACA webinar

If you want to hear more about the AAT-ACA Fast Track route to becoming an ICAEW Chartered Accountant, you can attend one of our monthly webinars.

Looking for more detail?

Speak to a member of our team or sign up to our newsletter for the latest updates. Register your interest and choose your preferred option below.

I’m not afraid to be challenged. I’m reaching out, wanting to do more and apply my knowledge, and that’s because I feel like I’ve got a good core understanding. The more I learn, the more confident I become – and the more I want to put it into practice.