Many businesses collect rafts of information while never really knowing which measures matter to performance. Bernard Marr reveals how it is possible to collect better and more relevant performance data.

Key Performance indicators (KPIs) should be the vital navigation instruments that help us understand whether a business is on track or veering off the prosperous path. However, organisations continue to struggle with identifying the KPIs that matter most and instead measure and report an often random set of metrics that rarely provide strategic insights.

For a moment let’s imagine you are part of the California gold rush of 1849, when people flocked to that US state with the hope of making their fortunes from unearthing more of the gold that had been found there. Thousands of prospectors used their gold pans to sift out gravel, sand and sediment, but retain the heavier and valuable gold nuggets. By panning endless tons of worthless silt, the prospector hoped to find those few precious nuggets of gold that would make them rich. Some did indeed become hugely wealthy. But most returned to their homes having either expended their investments without an adequate return (if any) or, worse, bankrupt.

Let’s now fast forward to today and replace the gold rush with the performance measures rush. What we see are business managers behaving in much the same way as the prospectors of old: they are panning masses of essentially worthless, or background, metrics, with the hope that somehow they will discover those golden nuggets that will give them some valuable new insights.

This problem was starkly highlighted to me when I was helping one of the leading retail banks with improving its performance management processes. Its top level KPI report – the pinnacle of its performance reporting and the aggregated set of strategic measures – was automatically generated and emailed to the 20 top executives on a monthly basis. An IT glitch caused a failure with the scheduling and for four months the report wasn’t emailed out. Surprise, surprise: nobody actually noticed. Furthermore, not one person requested this vital set of metrics regarded as the vital decision-support tool in the bank’s business!

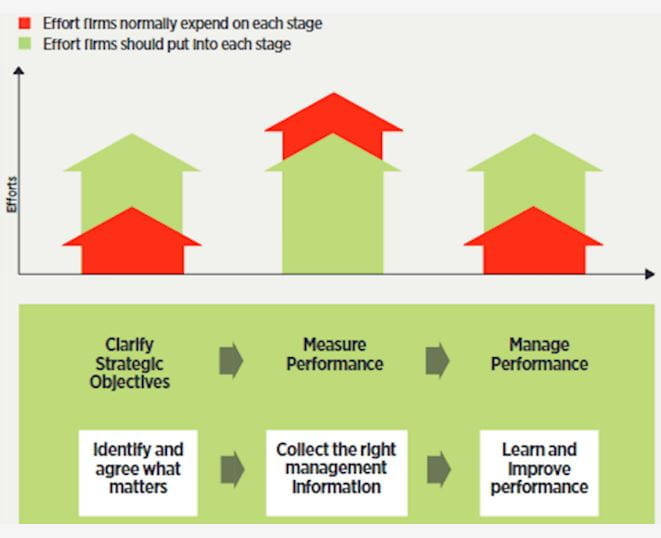

Accountants and financial managers are facing a number of challenges when it comes to measuring and reporting what matters. I would like to discuss three steps we have to take in order to make performance measures more relevant (see Figure 1). The basic steps are that we have first to be clear about our strategic objectives, then we have to measure performance in order to turn it into insights that we can use to manage and improve performance. This sounds simple and straightforward, but it is not what usually happens in companies.

Looking at these three steps and assessing the amount of effort that goes into each of them shows a much distorted picture. What we have seen in endless research studies and what I see most days working with clients is that we spend too little effort on clarifying the strategic objectives, we spend too much time on collecting ‘stuff ’ (measures that are not relevant), and then we don’t use most of the measures for any decision making. I have termed this the ICE approach:

- Identify everything that is easy to measure and count

- Collect and report the data on everything that is easy to measure and count

- End up scratching your head thinking, ‘What the heck are we going to do with all this performance data stuff?’

Instead, using even simpler language (though with no easy acronym), we have to:

- Identify and agree what matters

- Collect the right management information

- Use the insights to learn and improve performance.

The point I would like to stress here is that unless we use the insights from our KPIs to learn and improve then the entire exercise of measuring and reporting performance is a complete waste of time and money. And linking indicators to the strategic needs will help to make KPIs more relevant and useful. Let me expand on each of these steps and give you some practical tools and examples.

Unless we use the insights from KPIs to learn and improve then measuring and reporting performance is a complete waste of time and money

Step 1: Identify and agree what matters - use maps and questions

In order to be relevant KPIs have to link to your strategic objectives. A good starting point is to map the strategic objectives into a strategy map or balanced scorecard.

Tesco’s Corporate Steering Wheel

This is what Tesco has done. To guide their performance measurement and analytics activities, Tesco has adopted the balanced scorecard. The Tesco balanced scorecard, which they call the corporate steering wheel, outlines its strategic priorities in the following perspectives:

- finance;

- customer;

- community;

- people; and

- operations.

With the performance framework in place, any efforts to collect and analyse measures can be linked back to the strategic objectives of the organisation. That way, Tesco doesn’t waste valuable time analysing something that doesn’t really matter in the grander scheme of things. Tesco’s former CEO Sir Terry Leahy told me, “having objectives across five perspectives allows Tesco to be balanced in its approach to performance...the steering wheel creates a shared language, a shared way of thinking and a common blueprint for action.”

When your strategic objectives and priorities are clear then we can identify the questions to which we need answers. In order to be really effective KPIs have to answer the critical unanswered questions the executive team has about business performance and strategy execution. If measures only provide insights that confirm what everyone already knows then they are not true KPIs.

Google’s 30 questions

To avoid this trap, companies such as Google and Tesco have identified a small set of so-called key performance questions (KPQs) that articulate the real strategic information needs. They also make sure all KPIs they collect and report help to answer these critical questions.

In Google, the aim is to start with these questions and be clear about information needs at the outset. Executive chairman Eric Schmidt says, “We run the company by questions, not by answers. So in the strategy process we’ve so far formulated 30 questions that we have to answer and that stimulates conversation. Out of the conversation comes innovation. Innovation doesn’t come from me just waking up one day and saying, ‘I want to innovate’. I think you get a better innovative culture if you ask questions.”

Here are three illustrative examples of KPQs (from a range of companies):

- To what extent are we growing our profitability?

- How well are we penetrating the Chinese market?

- To what extent are we providing an engaging online customer experience?

Step 2: Collect the right management information - choose relevant KPIs

It is important that KPIs link back to the strategic priorities and the KPQs to ensure that you focus on measures that are linked to your strategic information needs.

Enterprise Rent-A-Car’s ESQi

A powerful example of how to collect the relevant information is provided by the leading US car rental company, Enterprise Rent-A-Car, which has the largest fleet of passenger vehicles in the world today (more than 700,000 cars and trucks). This organisation, which primarily serves customers arriving at airports requiring a rental car, has an unmovable conviction that only through the delivery of outstanding customer service will it secure sustainable competitive advantage in what is a very crowded and aggressive marketplace.

Enterprise Rent-A-Car does not want to be the biggest supplier of rental cars, but it does have an unrelenting drive to be the best in the eyes of the customer. A commitment to customer service excellence has been a hallmark of the business since it was founded in 1957. Every decision Enterprise Rent-A-Car makes anchors back to how it maintains that competitive advantage through customer satisfaction.

Maintaining the dominant position that it has achieved has been due to the organisation’s unique way of measuring customer satisfaction. It has created an enterprise service quality index (ESQi) that hinges on one simple term: ‘completely satisfied’.

Each month, the organisation measures customer satisfaction at each local branch through telephone surveys of recent customers. Using a five-point scale, customers are asked to answer one focused question: ‘How satisfied were you with your last experience?’ Each branch earns a ranking based on the percentage of its customers who say they were completely satisfied. The organisation calls the uppermost end of that ranking ‘top box’ and this becomes the standard of excellence it sets for itself when working with customers.

Note, however, that in its analysis Enterprise Rent-A-Car only counts the respondents who are completely satisfied. Internal research had shown that customers who are completely satisfied are three times more likely to return as a customer. The company now focuses on driving up the frequency of this response of this question. Having validated the results over time, the company now doesn’t need to store the responses to the other four scale items.

It is also important to point out that only those managers who have led branches or other operations where customer satisfaction scores are outstanding (ie ‘top box’) can be considered as promotion candidates. This sends an unequivocal and powerful message about the importance of customer service to Enterprise Rent-A-Car.

Everyone knows that today’s financial performance is a result of having done (or not done) the right things in the past; such as providing the right quality products or service to customers, building a strong brand image, engaging employees, or maintaining strong relationships with suppliers and partners.

Measuring intangible and non-financial performance indicators therefore provides vital leading indicators of future performance. While most financial metrics are well defined and understood, accountants often struggle to find KPIs for intangibles that are well defined, with solid formulas and analysis routines. However, leading-edge KPIs such as the net promoter score, brand equity, Six Sigma level, and staff advocacy score are all well-defined, non-financial KPIs.

Most employees in a company (even at the top) don’t fully understand most high-level finance KPIs

Step 3: use the insights to learn and improve performance - present KPIs clearly

To ensure the KPIs are providing insights that lead to learning and improved decision-making, we have to improve the way we report performance and we have to ensure performance is discussed appropriately.

The way we report KPIs (especially finance) often triggers anxiety and confusion in people. We have to realise hat the majority of employees in a company (even at the top) don’t fully understand most high-level finance KPIs. Instead of giving people long lists of finance data or even P&L statements we have to:

- balance the numbers with headlines that explain what the numbers actually mean;

- present data visually in more meaningful graphs; and

- supplement numbers with narratives that explain the context of the data.

Using good visuals together with narratives (and relegating data tables to an appendix) can make a massive difference to the way people engage with and understand performance information.

A number of my clients now produce dashboards and hard-copy reports in newspaper front-page format with a clear headline, a meaningful picture (graph or chart) and some high-level narrative commentary to provide context.

Conclusion

So in summary, we can make performance measures more relevant and meaningful by:

- being very clear about the strategic objectives and the questions we need answered;

- collecting KPIs that help us answer those questions: and, finally

- making sure we report performance in an engaging and informative manner to inform learning and decision making.

Download pdf article:

- Working out the best measures

Finance & Management Magazine, Issue 201,July/August 2012

About the author

Bernard Marr is a leading performance management expert and business author.

Related resources

You are permitted to access, download, copy, or print out content from eBooks for your own research or study only, subject to the terms of use set by our suppliers and any restrictions imposed by individual publishers. Please see individual supplier pages for full terms of use.

More support on business

Read our articles, eBooks, reports and guides on Business Performance Management

BPM hubTools, templates and case studiesCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.

-

Update History

- 18 Jul 2012 (12: 00 AM BST)

- First published

- 07 Oct 2022 (12: 00 AM BST)

- Page updated with Related resources section, adding further reading on collecting performance data. This provides fresh insights, case studies and perspectives on this topic. Please note that the original article from 2012 has not undergone any review or updates.