Despite increasing funding for SMEs, small enterprises are still finding it necessary to seek out alternative finance. David Craik takes a look at some of the options.

In February the FT reported that bank lending to SMEs grew for the first time since the financial crisis. A survey by the British Business Bank found the availability of debt had increased for four consecutive quarters, with total stock of loans and overdrafts valued at £163bn in November 2015. While banks still accounted for more than 80% of business lending, the lion’s share of that money goes to companies offering lower risk, which tend to be larger enterprises – meaning other businesses need to find alternative means of finance. And that can mean taking a closer look at the balance sheet.

Phil Booth, owner of South Wales-based leisure and hospitality group Booth Group, managed to avoid too many thrills and spills when he acquired Brean Theme Park in Somerset back in 2014.

“I was looking for funding to finance the £6.7m purchase of the park with its rollercoasters, dodgems and adventure golf,” Booth explains. “I decided to choose asset-based finance to fund some of it as most of the value in the park was tied up in those amusement rides; all those big lumps of steel, which a lot of people feel are bound to depreciate.

“But when I looked into it the picture was better than expected. In fact, rides actually maintain their value very well from year to year and so I realised using them to raise finance was a safe bet.”

Booth gathered together a group of lenders to lend against the stock.

“We agreed a very flexible loan structure that took into account the seasonal nature of our business,” he explains. “Clearly, as a leisure park, we get the bulk of our visitors in the summer. We agreed a seasonal payments structure where we pay interest and capital in the summer months and then interest only in the winter. It is a five-year loan term and thanks to the flexibility we have, coupled with the continued success of the park in the summer, we have met all our commitments.”

Booth says he will have no hesitation in using asset finance again. “It is the nature of our business that we may need to introduce new attractions and rides into the park, such as a bigger rollercoaster. If and when we do, I will look at using asset finance again,” he states.

Booth’s experience highlights two key things that CFOs of SMEs should take into account. First, it reveals the potential value on a company’s balance sheet that can be unlocked to the greater benefit of the business and second, the rise in popularity of asset finance – also called asset-based lending (ABL).

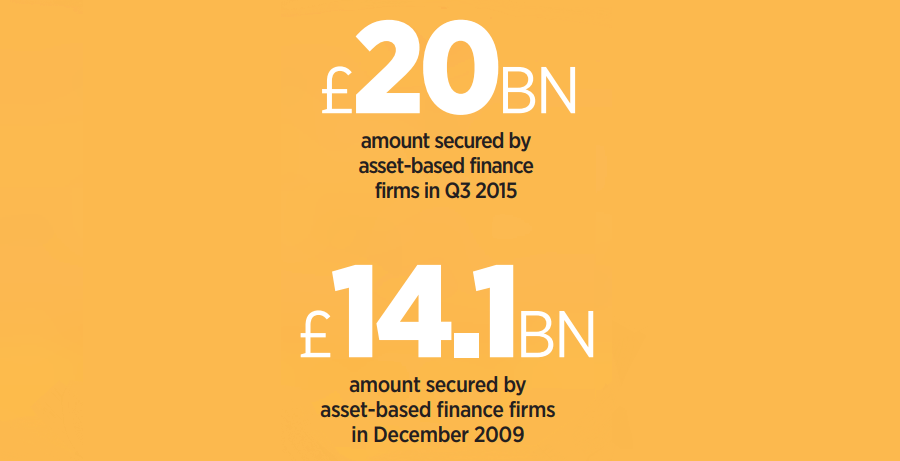

According to the Asset Based Finance Association (ABFA), which represents the asset-based finance industry in the UK and Ireland, firms secured an all-time high of £20bn in funding during the third quarter of 2015. This was a 4% increase from £19.4bn the previous year – and a huge jump from the £14.1bn provided at the height of the credit-crunch in December 2009. Indeed, ABFA says that asset-based finance now supports 15% of all UK company turnover – a third higher than the average 10% in Europe.

SMEs are finding value on their balance sheet from all manner of assets such as stock, property and unpaid invoices from suppliers and clients to improve cash flow and reduce liabilities

Steve Merchant of RSM Restructuring Advisory believes that a growing number of SMEs are using a combination of both invoice finance and stock finance to improve their funding options: “SMEs used to see ABL as risky lending for unstable companies,” Merchant explains. “But the market is fast expanding with banks seeing it as a less complex and cheaper way of providing funding to SMEs, as well as a whole army of smaller independent companies offering packages. We are seeing more SMEs unlock value from their existing assets especially around an event such as an acquisition, a turnaround, an MBO, a shareholder taking equity out or for working capital and cash flow.”

He says loans can range from as little as £5,000 to over £100m and be arranged within just three weeks on average. “A lender will see you face to face, they will look at your sales ledger and they will make sure that your invoices are collectable and non-disputable,” he states.

Jonathan Hughes, regional sales director for the Thames Valley and South West at Leumi ABL says FDs are becoming much more aware of how ABL can help their businesses grow: “They are much more sophisticated about what is available,” he says.

Andy Gratton, finance director at West Midlands-based architectural, ironmongery and balustrades business Laidlaw Limited is one such FD.

He explains that he helped secure a turnaround ABL facility from Leumi, including debtors and a term loan, when parent firm Laidlaw Interiors Group entered administration last December. Gratton says the facility, which included invoice discounting, stock finance, plant and machinery finance and the amortising term loan helped facilitate headroom on the purchase of Laidlaw by Intrinsic Equity. “We delivered the deal and secured the jobs of 140 people,” Gratton says. “The support from the facility both pre- and post-deal was invaluable.”

Laidlaw’s experience highlights the particular importance of ensuring strong balance sheet management and flexibility in times of economic uncertainty.

It means balancing short-term liquidity risk with the long-term costs of running the company.

Liquidity risk can be caused by a wide range of factors such as the seasonal fluctuation of your business, unplanned reductions in revenue, business disruption, unplanned capital expenditure, increase in operational costs, differing stakeholders objectives in the running and direction of the business, and inadequate working capital and cash flow management.

As accountants HW Fisher point out, a lack of good access to funding also plays a part. That is particularly pertinent in a climate where major high street banks are still being criticised for squeezing SME lending and making terms more onerous.

“It is imperative that SMEs maintain a strong balance sheet which provides not only the capital necessary to invest for growth but also gives a degree of resilience in more difficult times,” it says. “This combination of strong balance sheets, cash flows and access to capital is crucial.”

David Birne, business recovery and insolvency partner at HW, says adopting a better management strategy is vital. He advises being realistic with cash flow forecasts on a week-by-week basis at the beginning of the process and then monthly thereafter. This will either put a CFO at ease that sufficient cash is coming in or let them know there is an issue and how much is needed to maintain the business. “Banks do want to lend but need a proper ‘pack’ of financial information and a forecast before they can evaluate a business properly,” Birne says. “If you can’t show them you have a solid understanding of how to manage cash flow in business, do not expect any new funds to be heading your way.”

CFOs should also be focused on leverage. The more gearing a company has – the ratio of debt to total funds – the more it is vulnerable to cash flow problems. Businesses will struggle to absorb losses or get rollover funds.

Finding the appropriate ratio for your business will depend on the type of business and how it operates, but an industry-wide rule of thumb would point to 30% debt to total funds being prudent and over 60% potentially leading to issues.

CFOs should also assess existing funding terms in the business and whether they are still adequate to its needs and status. What is the maturity profile of your facility? Are you relying on just the one lender? What are the terms and can you do better elsewhere?

Laura Shaw, partner for corporate finance at BDO, says SMEs should not be afraid to monitor and identify when loan relationships, including those with their banks, are not being advantageous: “Cash flow and liquidity are so important with the economy still being so challenging. Headroom on your balance sheet is vital to help you manage the bumps along the way,” she says. “You have to be open to change with your banking provider if you see your cash flow getting distressed. If you have not changed your facility for some time, then have a conversation with your provider about terms. You have to avoid liquidity problems. Cash is king.”

Software saviours

There are many options for those looking for a business intelligence software package, with offerings from SunAccounts, Triforce Global Solutions and Sapphire Systems as well as others. Saphire systems is proud of its Infor d/EPM business intelligence software package. It incorporates financial reporting and analysis, dashboards, budgeting, planning, forecasting, data-mining and financial consolidation capabilities. “It allows you to take data from different sources within a company such as sales, invoices and general ledger and put it into a central repository area,” explains Bryn Emans, business development manager. “You can then format it and disseminate it throughout the business. We’re seeing a lot of interest in this system because you can aggregate the data in an automated way, which frees up time for the more added value business of financial analysis. Balance sheets are always going to be used but CFOs want them to be more graphical and visually appealing. They don’t want a static balance sheet anymore.”

Ian Preston, VP sales, UK and Ireland at cloud software provider Adaptive Insights, says using such products can also help SMEs better access funding: “When you make lending applications you can’t rely on a wet finger in the air and a spreadsheet,” he says. “There is a need for robust forecasting when going to a financial institution. They want to know that there is no danger of breaking debt covenants.”

He says software can help a CFO structure their financial forecasts against a business plan and targets, and keep covenants in focus: “Tools like dashboards can keep your KPIs in the headlights, ” he adds. “A lot of CFOs do still rely on spreadsheets but there is a lot of scope there for errors and misunderstandings. Everyone involved in finance has been scarred when spreadsheets have let them down. Software can take the risk out of it.”

Download PDF version:

More support on business

Read our articles, eBooks, reports and guides on Financial management

Financial management hubFinancial management eBooksCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.