The reformed Prompt Payment Code should improve the financial position of many small businesses, but those at the end of a supply chain may still suffer says Martin Wheatcroft, and invoicing and purchase processes will need to keep up.

Despite technological assistance, the way businesses pay each other remains stubbornly slow. Delays in payment from customers is one of the most significant financial issues confronting small businesses as they try to manage cash flow. This in turn can make the difference in being able to pay staff or their own suppliers.

The good news is that, from 1 July 2021, the signatories to the reformed Prompt Payment Code (there are just under 3,000 of them) must pay 95% of small businesses within 30 days. This gives the Code much stronger teeth; previously it asked for 95% of invoices to be paid within 60 days (which is still the case for payments to large suppliers).

However, late payments will continue to be a big challenge for many small businesses, especially if they sit towards the end of an extended supply chain. Signatories to the Code might pay their direct suppliers promptly, but intermediate suppliers may not be signatories to the Code.

In practice, many procurement functions will be unhappy if they can’t achieve the target set out in the Code. Failing to do so would be a sign that their attempts to streamline purchasing processes are not working, given the substantial savings to be made by eliminating or reducing the burden of relatively low-value transactions. Greater use of corporate payment cards, self-billing and self-service portals are helping achieve this goal.

The 80/20 rule means that most of the value going through purchasing processes arises from a relatively small amount of transactions, while a substantial number of transactions represents a relatively small proportion of the value even when added together. For many large businesses, transactions in the tens of thousands of pounds – or more – are ‘low value’ in the context of the millions they spend annually.

There is a lot SMEs can do, too. What for a small business is a large amount of money might be relatively small to a large business customer. Perhaps customers could use a payment card to settle bills? There is a transaction cost, but the cash-flow benefit is likely to be worth a lot more, as well as being a lot less than the cost of factoring.

If this is not an option, SMEs should find out whether their largest customers provide self-billing or self-service options. In the former, the customer automatically generates invoices on behalf of the supplier and initiates payments directly based on the orders agreed. This avoids the need to create and submit invoices which, even if submitted by email, often require several elements of manual intervention to be pushed through the system and matched to the original purchase order.

Self-service options allow invoices to be submitted directly into customer systems, removing the opportunity for them to be ‘sat on’ at a series of virtual desks before reaching the right approver.

Large businesses will be less happy with the need to now segment their suppliers into large and small in order to check their compliance with the Code. This will add to the complexity of the statutory payment practice reports that all large businesses are required to file, not just the signatories to the Code.

However, Philip King, until recently the independent Small Business Commissioner, commented: “Prompt payment practice, to businesses of all sizes, should be the default ethical choice for companies doing business in the UK. As we continue to negotiate uncertainty due to public health and EU transition concerns, prompt payment has a major part to play in helping the country to build back better.”

The business culture of delaying payment to suppliers seems destined to change, with regulatory reforms and ethical business principles pushing this trend, along with the convenience of direct payment combined with better processes and technical solutions.

Just as the idea of cheques taking four days to clear is incomprehensible to those entering the workforce today, future generations are likely to be equally puzzled that there was once a time when businesses could take several weeks or months to pay for goods or services.

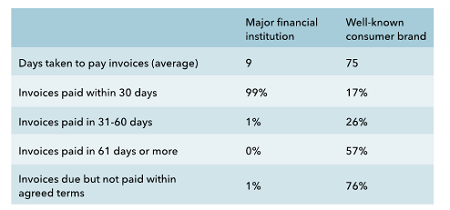

Contrasting payment statistics

Source: Taken from two payment reports filed in 2020-21

About the author

Martin Wheatcroft FCA, Managing Director, Pendan

More support on business

Read our articles, eBooks, reports and guides on Financial management

Financial management hubFinancial management eBooksCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.