Technology now allows for continuous forecasting of financial outcomes, giving accountants a greater role in decision-making. It's time for change, says Craig Stirk.

From the first days of their careers, accountants are led to focus on period ends – monthly, quarterly, half-year and year. These may have once broadly aligned to all three of the key roles of a finance function:

- governance – delivery of statutory/regulatory filings, tax compliance, etc;

- stewardship – of shareholder funds, cash, investments; and

- information provision – to support business decision-makers.

The massive increase in the size and complexity of organisations and the data they generate, coupled with ever-rising customer expectations, has changed this. Many finance teams struggle to keep up.

The transforming world

Monthly management accounts may have provided useful decision-making information back in 1919 when the first flight from the UK to Australia took 28 days, or even when ‘please allow 28 days for delivery’ was the norm 50 years ago. But while business rhythms have accelerated massively, finance has not.

It is now possible to fly to Australia in 17 hours – an increase in speed of 3,733%. If finance information provision to the business had followed the same pattern, business decision-makers would be receiving accounts 448 times a year. In some sectors, such as the trading desks of investment banks, P&Ls are generated daily but, generally speaking, finance has been left standing by our colleagues in the rest of the organisation.

One important area of control for a finance team is procurement. If a supplier was still requesting that you allow 28 days for delivery, do you think that they would remain on your list? Sadly, that is where much of finance information provision is today, if we consider finance as a supplier to its organisation.

The result? Shadow finance all over the organisation as decision-makers try to track what is actually happening, capturing information locally in a plethora of methods and then ignoring formal finance reports as too slow and too out of date.

Perhaps we need to rethink the rhythms of finance teams so finance can become more relevant and a true partner for the business.

Finance business partnering

With hundreds of vacancies listed on reed.co.uk, the finance business partner role has grown significantly. A non-scientific sample of five ads showed that all required strong/advanced Excel skills, and four mentioned production of monthly management accounts. Is this what the business we are partnering with really wants? Someone who:

- can manipulate month-end data;

- spends most of their time reconciling one set of fictitious numbers (the budget) to an out-of-date set of backward-looking actuals (the management accounts);

- and is focused on finance rhythms rather than business rhythms.

Probably not. But this is, too frequently, the experience our colleagues actually have. Businesses invest in new technology to improve the customer experience and finance teams will often sit in judgement on these decisions. Only rarely, though, are the lessons learned and applied within finance.

Perhaps a better role title would be ‘Finance business governance lead’.

Whither finance? Or wither?

What, though, if finance were to shift its focus from governance to management, supporting decision-makers by promptly supplying the information they need?

The value of information decays over time; anyone driving a car who is happy only looking in the rear-view mirror is unlikely to reach their destination, taking far more risk than is necessary, and will probably waste much time on periodic provision of information – to their insurers.

Instead, imagine an organisation where transactions are recorded as they happen, the prediction of financial outcomes is continuously updated, Excel manipulation is reduced by more than 95%, and the business decision-makers actively seek out finance for guidance and support because information is available to support their business cycles, not just finance governance cycles.

Advances in technology – data collection and processing, process automation and machine learning – have changed the art of the possible and provided a foundation for rethinking time within finance.

Decision-making is a continuous activity in organisations. To be a true partner, finance should seek to monitor the organisation continuously in the same way that a smart knee implant does the patient, or a pandemic scientist does the waste flows (see ‘New ways with information gathering’).

Reimagining month end

In a search for a financial truth, month end is a time to apply accounting judgements such as accruals, bad debt provisions, overhead cost allocations and depreciation.

Traditionally, these activities were performed manually and could therefore only take place periodically. Finance systems, and the ubiquitous spreadsheet, enable much of this to be automated, but only at month end.

Time is money. How much money, or its equivalent for non-commercial organisations, is lost or wasted by not having information until several weeks after a month has finished and the transaction occurred? Finance departments around the globe echo the sound of stable doors being slammed shut with much effort and many late nights every period end.

With current technology, finance can turn month-end processes into valuable insight that matches organisation rhythms. Bad debt provisions and overhead cost allocations are just two examples.

Bad debt provisions

The calculations of bad debt provisions are often based on buckets of time outstanding multiplied by a percentage. As the time increases, so does the percentage, until the whole debt is provided for. For example, 0-30 days overdue attracts a 5% provision, while more than 365 days overdue attracts 100%. This simple two-factor model is applied to the debt book in its entirety and is useful only for completeness of the management accounts.

How much more value would finance add to the business if it could produce a more frequent prediction, at individual customer level, of which debts would go bad and use this across the organisation?

Such information could help:

- marketing – which sectors and locations to target (and which to avoid!);

- sales – to reward agents for acquiring customers who are likely to add value rather than destroy it;

- operations – to support customers with predicted high risk of becoming a bad debtor with earlier interventions such as payment plans; and

- credit – to target collection of the riskiest debt first.

By doing this, the information would improve cash flow, reduce bad debt provisions, increase profit and improve staff morale. Even if it were only used in finance for period end, it would achieve a reduction in bad debt provision and hence profit increase, but at a lesser scale than if used across the business.

By using existing data sources (customer interactions, order patterns, payment history, location, sector and more), such a prediction can, and has been, created using modern predictive technologies such as machine learning.

This does not have to be a black box – some regulators, such as the Federal Financial Supervisory Authority of Germany, already require artificial intelligence to be ‘explainable’. There are examples in the UK today of the results of such models being used and audited in financial statements.

Overhead cost allocations

Allocations of central costs, such as IT, are often justified by the assertion that they help ensure those accountable for incurring the costs are charged for them. They arose in an era of on-premise systems, when data was captured in manual records and real-time visibility of performance was not possible.

One significant flaw in the traditional approach is that managers to whom the costs are allocated cannot be held accountable for them because they have no control over them.

In today’s world, where an ever-increasing proportion of systems and data is cloud-based, it is much more straightforward to allocate true direct costs, ensuring that managers can be held accountable for the costs they do control.

This would, of course, not address all IT costs.

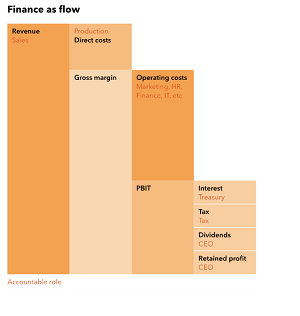

Perhaps a more appropriate approach for a ‘finance as flow’ world would be to require sales to achieve an adequate gross margin over direct costs that then covers indirect costs, tax, return on capital and changes in reserves, as shown in the diagram (below).

Brave new world of finance as flow

Finance can monitor transactions as they flow through the organisation, and the predicted outcomes associated with these. They can ensure each element of the diagram remains within tolerable limits and intervene as soon as an issue starts to arise, rather than waiting until it becomes material enough to notice at a period end, by which time the damage has been done.

How many other month-end activities could be changed to better support the organisation? By doing so, it would give finance the time and opportunity to truly engage with and understand the organisation, so that month end becomes a formal confirmation and recording of what is already known rather than a desperate wrestle with spreadsheets and, if time permits, some very limited variance analysis.

Achieving this would require the trend towards finance business partnering to accelerate and be deserving of the title. True finance business partners would have the ability to enable business improvement through better use of information, process improvement, as well as soft skills such as storytelling and change management, in order to support their stakeholders in the quest for continuous improvement in pursuit of the organisation’s goals.

This is a long way from traditional training, but something ICAEW recognised with the introduction of the ‘Case Study’ element of the ACA exams in the 1990s and has developed since.

Perhaps we will see the emergence of finance teams where the balance has tilted away from data manipulation and report generation towards multi-skilled, value-adding business advisers. It does not take artificial intelligence to predict that this would be a great outcome valued by our organisations.

New ways with information gathering

There are many examples of how information gathering for decision-makers can be accelerated and/or presented in more useful formats. Consider how technology offers scope for better outcomes and massive cost savings. For instance, smart knee implants powered by patient movement are becoming available, which alert patients when problems are being detected so they can be addressed much more quickly. This saves doctor/patient time on routine monitoring. Earlier identification and remediation of issues also means a major problem requiring surgery is less likely and improves the patient’s quality of life.

Existing flows can also be used for new purposes, enabling decision-makers to receive more timely data. A study conducted last year in Queensland, Australia, demonstrated how tracking chemicals in waste water can provide socio-economic predictions that are a good match for census information at a local level and could be updated daily or weekly – far more frequently than Australia’s five-yearly census cycle and without the inevitable impact of entropy. More recently, the same technique has been used to track the level of COVID-19 infections, enabling governments to move more swiftly to deal with rising cases.

With these examples in mind, why should finance not use its long-established ability skills in analysis and structure to help decision-makers drive the business?

About the author

Craig Stirk, owner, Sarcul Consulting, and member of the Business & Management board

More support on business

Read our articles, eBooks, reports and guides on finance transformation

Finance transformation hubFinancial management eBooksCan't find what you're looking for?

The ICAEW Library can give you the right information from trustworthy, professional sources that aren't freely available online. Contact us for expert help with your enquiries and research.