Guy Richardson and Mark Fielden, from the real estate and construction team at Moore Kingston Smith, recently presented an ICAEW webinar on “Emerging opportunities and current pitfalls in the tax regime for property investment and trading”. In this article we want to accentuate some of the practical tax complexities discussed in the webinar. Subsequently, in light of the Chancellor of the Exchequer’s recent Autumn Statement on 22 November 2023, we want to explore how current tax policy continues to create uncertainty in the real estate and construction sector.

The practical complexities

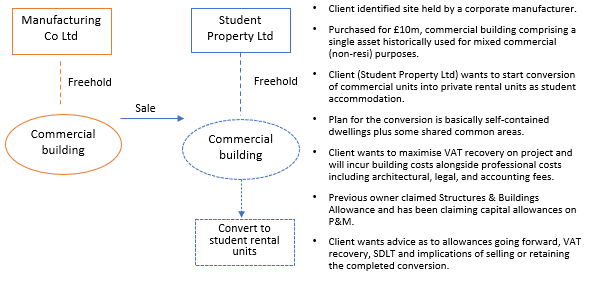

Scenario 1: Developing new student rental property

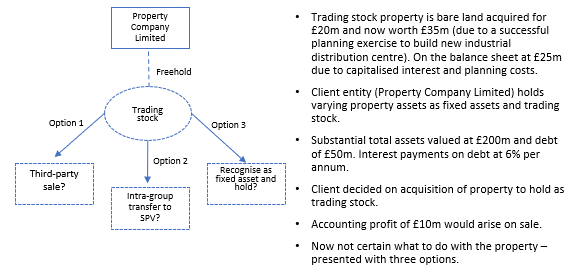

Scenario 2: Property held as trading stock

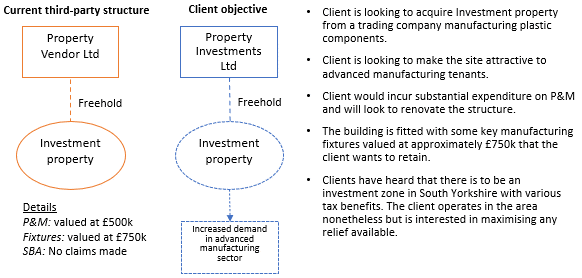

Scenario 3: Commercial property investment

Our final scenario discussed the opportunities available to “Property Investments Ltd” after acquiring an investment property in South Yorkshire. We noted that this region is currently designated as an investment zone and could, in the future, qualify for various tax and non-tax incentives. However, these investment zones are still in the early development stages. As the client here was looking to invest heavily, we explored the full expensing for main rate plant and machinery (P&M) investments and the 50% first year allowance for special rate P&M investments. In general, we note that companies need to ensure that expenditure is adequately reviewed and itemised. Additionally, it is of paramount importance to negotiate a s.198 election with the seller so that the client can benefit from capital allowances on the existing fixtures and fittings. The availability of SBA should always be considered as a useful cash-flow benefit, although relief would be clawed back through a sale proceeds adjustment.

Our recent presentation intended to illustrate how even the fairly straightforward transactions and developments discussed can give rise to complex tax issues. The facts and tax issues are only discussed, in our presentation and this article, at a high level to illustrate key points of principle. It is therefore important to take relevant expert advice at an early stage so that the tax risks and wider commercial consequences can be assessed fully before proceeding with any transactions given these layers of complexity. A question worth posing is whether current tax policy assists real estate and construction businesses or merely adds to this complexity.

Recent tax policy developments

A number of tax cuts were announced in the Autumn Statement 2023 based on improved economic forecasts. However, the Office for Budget Responsibility has downgraded growth forecasts from March 2023 and forecast that inflation will remain higher than expected. In reality, this means that the various freezes to tax thresholds continue to increase the tax burden to the highest level seen in the post-war period according to the Institute of Fiscal Studies. The most significant announcements were non-tax measures, including a government package termed “Getting Great Britain building again”, and planning law reforms which intend to incentivise construction, housing, and infrastructure developments. However, the headline tax measures were as follows:

- Full expensing is being presented as a the “biggest tax cut” to businesses and, whilst a welcomed and positive announcement, it primarily brings forward the deductibility of expenditure which would otherwise be claimed through the writing down allowance over a period of time. The extension of full expensing will primarily benefit very large companies expending over £1 million on P&M every year. It is important to note that the increase in the corporation tax rate from 19% to 25% may concurrently increase the overall tax burden for most companies in this sector.

- Investment zones will be extended from five to ten years with a proportionate increase in funding. There will also be a further £150 million fund established to help investment zones obtain further support. This extension should provide additional certainty for those looking to invest in these regions but the overall benefits and effects will need to be assessed over a longer period.

- Business rates are to remain subject to temporary extensions. The small business multiplier is frozen at 49.9p for a fourth fiscal year and the 75% relief for retail, hospitality, and leisure businesses will remain for a fifth fiscal year. Big questions remain as to more fundamental reforms to business rates and the temporary nature of these measures does create further long-term uncertainty for businesses.

In our view, the tax measures are underwhelming for those operating in the real estate and construction sector. Most measures offer temporary reliefs and do little to counteract the effect of fiscal drag, which may fail to generate long-term business confidence in UK real estate. The on-going tinkering, scaling back, and extension of various programmes and reliefs without clear long-term strategies generates further uncertainty. In our view, a more fundamental review of business rates seems warranted and more clarity around the non-tax measures will be eagerly awaited. Until then, long-term uncertainty remains for businesses as they continue to navigate the complexities of the UK tax system.

*The views expressed are the author's and not ICAEW's.