What are CFOs focusing on?

According to Deloitte’s CFO Survey for Q4 2022, UK CFOs have the weakest focus on expansionary strategies in two-and-a-half years. However, they have the strongest focus on defensive strategies in two years, driven by a sharp rise in the priority given to increasing cash flow. Significant rises in operating costs and margin pressure have pushed cost reduction up the agenda.

Meanwhile, the goal of paying dividends or returning cash to shareholders is at the second-lowest point on record. The attractiveness of debt as a source of finance is now down to similar levels as equity.

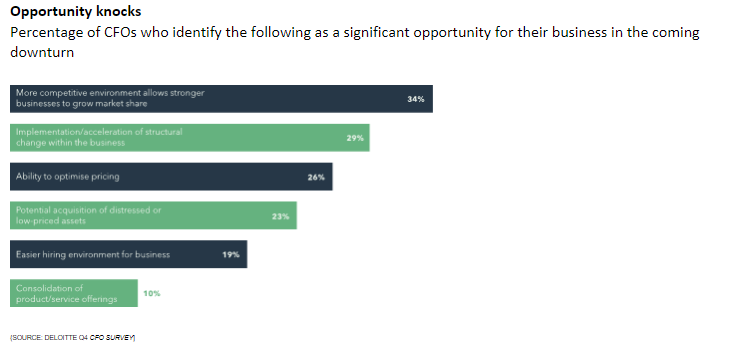

Opportunity knocks

Percentage of CFOs who identify the following as a significant opportunity for their business in the coming downturn.

$172.1bn

Total capital raised by 137 private debt funds closed during the first three quarters of 2022

$2.3trn

Projected global private debt assets under management by 2027

2.6%

Forecast decline in global private equity fundraising in 2023 following a 21.5% expected fall in 2022

$7.6trillion

Forecast for private equity assets under management (by December 2027)

[Source: Preqin]

Outlook for debt

Half of fund managers surveyed by Preqin at the end of 2022 said that they were concerned about rising interest rates, while 40% were concerned about inflation. Private debt provides an element of inflation protection through its floating rate exposure.

3,185

Global private equity funds in market as of September 2022, targeting $1.2trn in capital

Outlook for private equity

During the first nine months of 2022, private equity funds raised $404.6bn, 58.2% of the total raised in 2021 as a whole. And a survey of investors by Preqin showed the number expecting to allocate more to the asset class over the next 12 months fell from 43% in November 2021 to 31% in November 2022.

In its latest forecast for the 2021-2027 period, Preqin expects private equity to generate an annualised return of 13.5% globally, compared with 15.4% for 2015 to 2021.

Optimism on the rise

According to Grant Thornton’s latest Business Outlook Tracker, mid-market optimism rebounded across all indicators monitored at the end of last year.

Economic optimism increased 16% October-December 2022, leaving it 10% higher than the rolling two-year average

Revenue growth expectations grew 26% over the past quarter to the highest level recorded since January 2021

Profit growth expectations are at a two-year high – 22% up since October 2022

[Source: Grant Thornton]