The 2025 Q2 Economic Insight Report provides an analysis of the current trends and challenges facing the economies of China, Malaysia, and Singapore. China’s growth outlook is buffeted by the heightened trade tensions with the US, that could worsen existing domestic challenges and further push out the long-drawn property sector adjustment.

Mainland China

China: Tariff uncertainty weighs on outlook

- Resilient growth in H1 2025 is expected to give way to weakening momentum in H2

- Heightened external uncertainty is likely to spillover into slower investment, muted consumption and continued property weakness

- Further policy support could be announced, but spending may undershoot budget target

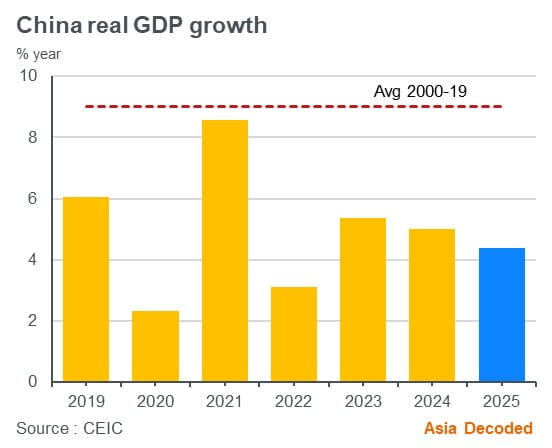

Despite the looming shadow of US tariffs, China started the year on a positive note. GDP growth was unchanged in Q1 2025 from Q4 2024 at 5.4% y/y. The better-than-expected growth outcome was supported by policy measures to revive consumption, boost infrastructure investment and aid the ailing housing market. This was reflected in stronger retail sales and a pickup in fixed asset investment.

GDP growth should hold around 5% in Q2, supported by front-loading of exports to the US to take advantage of the temporary trade truce. On 12 May, both sides agreed to a 90-day pause on tariffs announced since 2 April, lowering US tariffs on Chinese goods to 30% from 145% and Chinese tariffs on US goods to 10% from 125%. Beijing also unveiled additional measures to support the economy on 7 May, including a 10bp policy rate cut, a 25bp reduction in mortgage rates for first-time homebuyers, and expanded relending facilities.

However, considerable uncertainty remains around future tariffs. Even if the rates stay at current levels, China’s exports to the US will likely take a hit. A re-escalation would significantly worsen the outlook. Typically, a 1% increase in tariff lowers US import demand by 0.2% in the short-term, assuming full pass-through to prices.

In the past, China successfully re-directed exports to other markets when faced with rising US protectionism. But this is likely to be challenging, as economic outlooks weaken everywhere.

The timing is particularly unfortunate for Beijing, as a slowdown in exports would worsen the problems at home. Lower sales and heightened global uncertainty are likely to weigh on production, employment and wages in export-oriented firms. This would impede the ongoing consumption recovery and have a knock-on effect on private investment. The property market adjustment, underway since 2020-21, is also likely to be delayed amid weak spending intentions. Property sales fell 3% y/y in Q1, and new starts declined 27% y/y.

While Beijing could announce further policy measures, the stimulus is likely to be measured in line with the approach so far. Declining government revenues, due to the real estate slump, have made it difficult for pending to hit targets. It remains to be seen whether even the budgeted 1ppt stimulus for 2025 will materialise.

Overall, policy isn’t geared towards engineering a swift recovery in private consumption, which remains constrained by weak employment and income expectations. With demand staying subdued, deflationary pressures are expected to persist. We forecast GDP growth to slow to 4.4% in 2025 from 5% last year, and headline inflation to linger around zero similar to 2024.

Malaysia

Malaysia: Monetary policy support in pipeline

- Growth momentum cooled in Q1, even ahead of the US tariff announcements

- 2025 outlook is buffeted by external headwinds and sub-par domestic demand, despite electronics exports and tourism tailwinds

- Muted inflation and rising downside risks to growth pave the way for 50bp policy rate cut

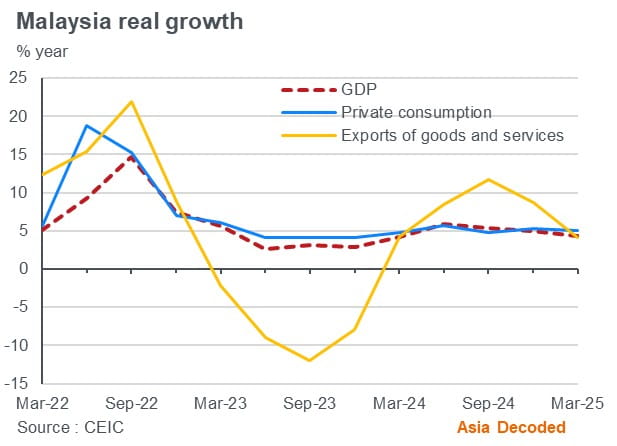

Malaysia’s GDP growth eased to 4.4% y/y in Q1 2025, continuing its slowdown from a peak of 5.9% y/y in Q2 2024. Private consumption and investment remained subdued versus historical averages, though momentum improved from Q4 2024. Domestic demand was once again the key driver of growth, while contribution from net exports (exports less imports) to GDP eased. Goods export growth slowed notably to 1.6% y/y from an average growth rate of 7.1% y/y over the last three quarters. Services exports also grew at a slower pace, but positive tourism trends still translated into a robust growth rate of 17% y/y.

Q2 2025 began on a strong note with goods exports surging 26% y/y in April. This was mainly due to front-loading of electronics exports to the US to take advantage of the 90-day pause in the implementation of the reciprocal tariffs and should fade as duties become embedded in price structures.

A blanket tariff rate of 10% on all Malaysian imports, though lower than the initially proposed 24% on 2 April, would still take a toll on exports, with spillover impact on domestic demand and overall growth. We expect GDP growth to slow to 4.3% from 5.1% in 2024.

While Malaysia is less exposed to US demand than some of its ASEAN peers, the US still accounts for around 11% of Malaysia’s gross exports. In addition, several of Malaysia’s exports to China and other countries, are intermediate inputs into production of items eventually shipped to the US. In all, more than 4% of Malaysia’s GDP is linked to US demand, directly or as part of global supply chains. The downside risks are not limited to the US. Demand from other trading partners, especially its largest export destination, China, is also likely to weaken amid a broader global slowdown.

On the positive side, resilient demand for electrical and electronics exports, which are up 20% year to date, should provide some buffer. Tourism-led services exports could also be a source of support for the external accounts, although the pace of visitor arrivals may cool on rising employment and income uncertainties in source countries. Notably, 67% of Malaysia’s tourists came from within ASEAN in 2024.

Nonetheless, with the growth outlook faltering, the onus is on Bank Negara Malaysia (BNM) to limit economic damage. Elevated public debt limits the scope for fiscal measures. Despite keeping rates unchanged in the May policy meeting BNM acknowledged the rising downside risks to growth from both external and domestic channels. With headline inflation well-anchored around 1.5%, we expect the BNM to support growth more proactively with a 50bp rate cut this year.

Singapore

Singapore: Heightened external uncertainties weigh on growth.

- GDP contracted in Q1, driven by slowdown in the outward-oriented sectors

- The deteriorating external outlook is beginning to impinge on domestic demand

- Despite policy support, growth is expected to slump to 1.8% in 2025 from 4.4% in 2024

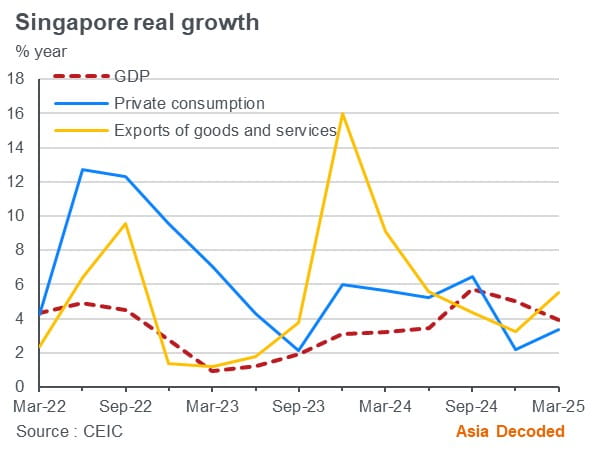

Singapore’s GDP contracted 0.6% q/q on a seasonally adjusted basis in Q1 2025 as external headwinds weighed on output in the outward-oriented sectors like manufacturing and wholesale trade. Domestically driven sectors like construction, retail trade, food and beverages and real estate performed better. This was reflected in the resilient performance of private consumption and investment on the expenditure side.

Technically, the Q1 GDP outcome has raised the possibility of a recession this year - defined as two consecutive quarters of negative growth. However, the 25% y/y jump in goods exports in April, following muted growth of 3% in Q1 2025, lowers probability of recession in our view. Front-loading and rerouting of shipments to the US should continue to support exports and overall GDP growth through the remainder of Q2.

That said, this momentum is likely to fade in H2 2025. While Singapore has the lowest US tariff amongst ASEAN economies at 10%, it is the most exposed to slowing US demand. A little more than 6% of its GDP depends on exports to the US directly or indirectly. Outside of domestic electronics exports, which continue to be supported by the resilient global tech cycle, the outlook for exports is weak.

This has substantial ramifications for growth as exports account for 124% of GDP and external demand plays an outsized role in driving the domestic economy. Early signs of a deteriorating external outlook spilling over into the domestic economy are evident in the Q1 labour data, with employment growth declining in outward-oriented sectors such as Professional Services, Manufacturing, and Information & Communications. Firms’ intentions to hire and increase wages over the next three months also hit their lowest levels in recent years.

On the positive side, Singapore has both fiscal and monetary space to support growth. The distribution of $1000 worth of vouchers to every household this year should buffer consumption and help businesses. More support could be in the pipeline. Favourable inflation trends are also likely to lift real incomes. Both headline and core inflation are expected to average below 1% in 2025, providing room for the Monetary Authority of

ICAEW South-East Asia:

Singapore (MAS) to continue easing the S$NEER slope, potentially lowering it to zero in July. We forecast GDP growth to slow to 1.8% in 2025, in the upper end of the official forecast range of 0-2%, from 4.4% in 2024.