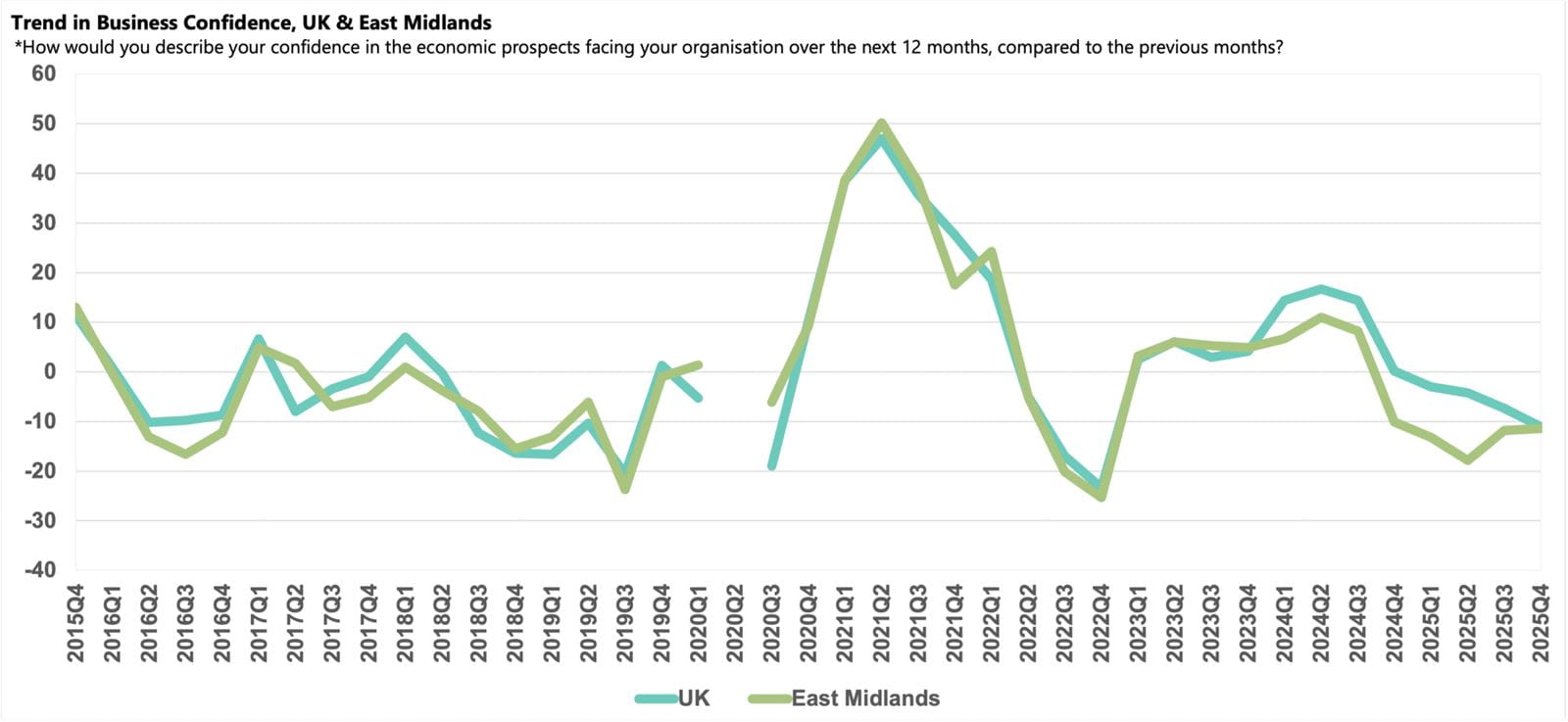

Q4: Confidence in negative territory for fifth successive quarter

The latest national Business Confidence Monitor (BCM) shows that business sentiment declined for the sixth consecutive quarter and slipped deeper into negative territory amid uncertainty about the Budget, lacklustre sales growth and rising concern about both the tax burden and regulations.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- The East Midlands business confidence score at -11.4 in Q4 2025 changed little from the previous quarter and is now in broadly line with the UK average (-11.1)

- Domestic sales growth edged ahead of the historical norm but improved exports sales growth remained relatively weak. Businesses expect both to accelerate in the coming year.

- The tax burden remains the primary business challenge, but concern about regulation and customer demand has increased.

- Annual employment growth returned to the region in Q4 2025 and companies expect above-average growth to be maintained next year.

- Profits growth rebounded over the year to Q4 2025 as input cost inflation eased.

- The trend of robust capital investment growth alongside slowing R&D budget growth is set to continue.

Business confidence in East midlands

Business confidence remains weak in the East Midlands and its score changed little from last quarter (-11.8) to -11.4 in Q4 2025 which is now comparable to the UK average (-11.1). This outcome marked the fifth consecutive quarter where the score was below both the historical norm (+3.0) and in negative territory.

While domestic sales have been stable, the manufacturing-intensive East Midlands region has suffered from sluggish exports growth. Concerns about customer demand are at their highest in almost five years and among the greatest in the UK. The tax burden prevails as the primary challenge for businesses with the issue remaining close to the historic regional high following April’s tax hikes and heightened pre-Budget uncertainty, however concern about government support has eased following a spike last quarter, believed to be linked to the Jaguar Land Rover cyber-attack.

Domestic sales and exports growth

Annual domestic sales edged up in the East Midlands to 3.0% in Q4 2025, moving ahead of the regional historical norm and the national average (both 2.9%). The improvement in the quarter is likely linked to the pick-up in sales growth in the Business Services and Retail & Wholesale sector reported nationally, alongside local improvements in Manufacturing & Engineering as the Jaguar Land Rover supply chain across the Midlands recovers after the cyber-attack last quarter. Businesses anticipate growth will continue to accelerate in the year ahead to 4.6%, slightly stronger than the UK projection (4.2%).

Exports growth also gathered pace in the year to Q4 2025 but, at 1.4%, it was markedly down on the UK average (2.5%) and historical norm (2.6%). The Jaguar Land Rover disruption and wider tariff-related uncertainty likely contributed to this underperformance. Companies in the region anticipate these headwinds will continue to dissipate and project exports growth will rise to 4.0% over the coming year, broadly in line with the forecast nationwide (4.1%).

Business challenges

Following April’s rise in taxes and during a period of pre-Budget uncertainty, the tax burden remained the main growing challenge for businesses in the East Midlands, reported by 63%, close to the historic survey high recorded last quarter and the national average (both 64%). With the Employment Rights Bill and Renters Rights Bill both receiving Royal Assent in late 2025, concern about regulation ticked up nationally and, in the East Midlands, 52% of businesses cited the issue, the highest proportion since Q1 2019 and comparable to the UK average (51%). Perhaps reflecting relatively weak exports performance, the proportion of businesses reporting customer demand as a growing challenge rose to 49%, the highest rate since Q1 2021.

Labour market

Annual employment growth returned to the East Midlands in Q4 2025, with headcount increasing by 2.0%, double the regional historical norm (1.0%). This was a strong outturn compared to both the weak performance reported across the three previous quarters and the national average recorded this quarter of 0.8%. Companies intend to maintain the above-average growth at 2% next year, considerably stronger than the UK forecast of 1.3%. Supporting this expectation, issues relating to the availability of management and non-management skills and staff turnover all eased in the region this quarter.

With labour market demand picking up, annual salary inflation in the East Midlands also edged higher to 3.3% in Q4 2025. This was stronger than the rise seen nationally (2.9%) and widened the gap to the regional norm (2.2%). Employers anticipate that salary inflation will rise further in the year ahead to 3.5%, above the UK expectation (2.8%) and second only to the West Midlands (3.6%).

Input and selling prices, and profits growth

Businesses in the East Midlands reported a fall in annual input price inflation in Q4 2025, to 4.0%, marginally below the UK average (4.1%). Companies have moderated their expectations for the year ahead and predict input prices will rise by 3.0% next year, consistent with the UK forecast.

Selling price inflation ticked up in the East Midlands in Q4 2025, perhaps reflecting previous input cost rises and the uptick in salary inflation this quarter. Businesses reported that they raised their prices by 2.4% year-on-year and intend to maintain that rate of growth over the coming 12 months, above the regional historical norm (1.5%) and the national expectation (2.2%).

Companies reported that profits growth rebounded to hit 2.7% in the year to Q4 2025, in line with the UK average and above the regional norm (2.6%). Businesses expect that a combination of weaker input price inflation and stronger sales will boost profits growth to 4.6% over the next 12 months, slightly faster than the national projection (4.3%).

Investment

The capital investment environment remains strong in the East Midlands with annual growth rising to 3.3% in Q4 2025, marking the fifth successive quarter above the historical norm and ahead of the UK-wide rate (both 2.0%). Businesses plan to maintain this trend, expecting investment to grow by 3.2%, the fastest rate of expansion of any UK region.

Meanwhile, the pace of growth in R&D budgets has slowed in recent quarters. While annual expansion of 0.8% in Q4 2025 was a notable improvement on the previous quarter, it was significantly below the historical norm (1.8%) and national average (1.6%). Companies in the region plan to moderate growth to 0.6% over the coming 12 months, weaker than most parts of the UK and the national forecast (1.3%).