Q4: London’s business confidence declines below national average amid growing concerns over tax and regulation.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

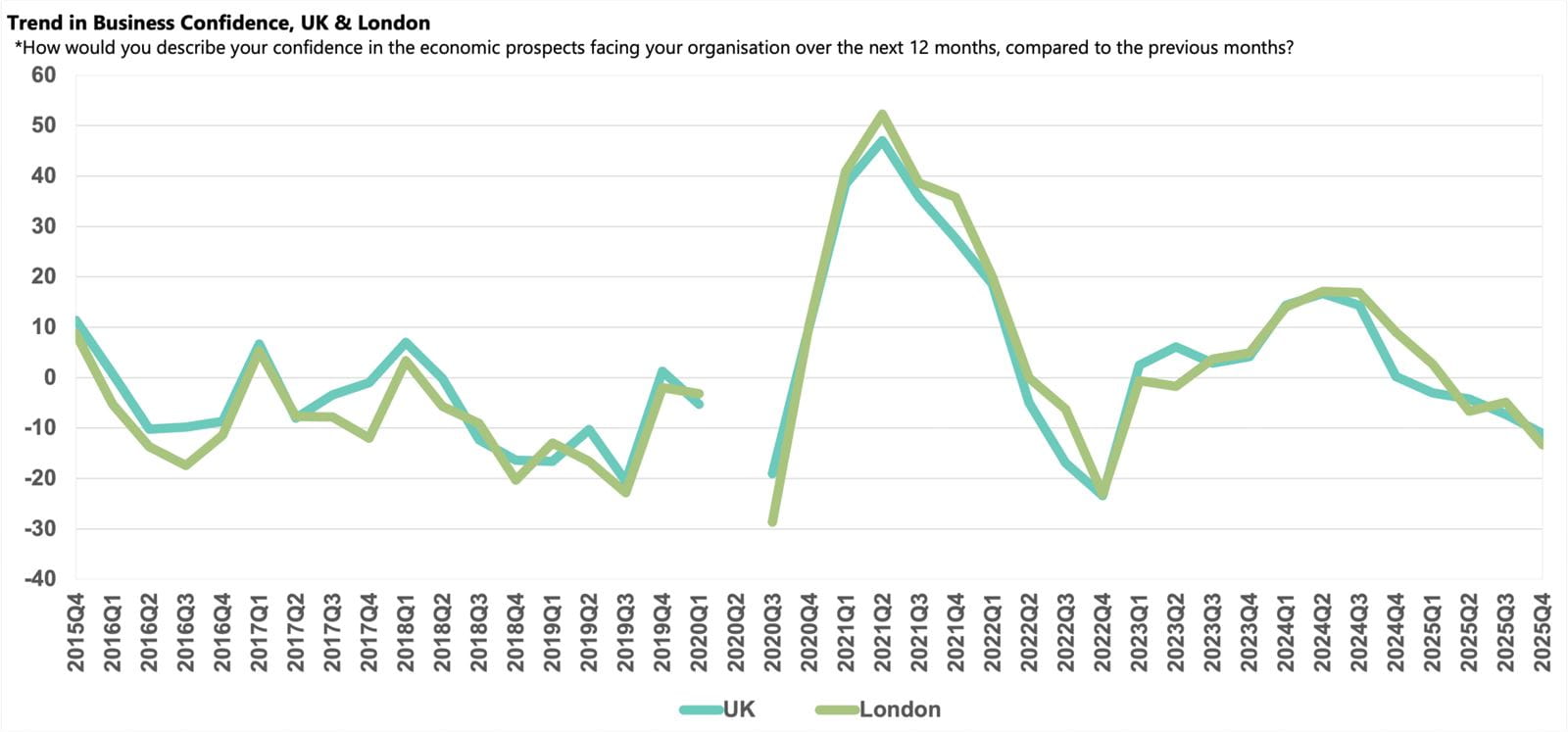

- Business confidence in London deteriorated to -13.3 in the latest quarter, dropping further below its historic norm (+5.4) and the UK average (-11.1).

- While robust domestic sales and exports sales growth is expected to accelerate in the year ahead, reports of tax pressures hit a survey record high.

- Concern about regulations climbed to a seven-year high, as competition and customer demand issues remain prevalent.

- Employment growth was subdued but is expected to pick up over the next 12 months. Wages growth also edged up but is projected to moderate.

- Input cost inflation ticked up in Q4 2025 but is predicted to ease in the year ahead, supporting expectations of stronger profits growth.

- Capital investment and R&D growth slowed and both are projected to cool further.

Business confidence in London

Sentiment in London slipped further into negative territory in Q4 2025, with the Business Confidence Index falling from -4.9 to -13.3. Business confidence in the capital was significantly below both the region’s historical (+5.4) and national (-11.1) averages.

The decline in confidence is likely linked to the spike in concerns over the regulatory and tax burdens. April’s increase in National Insurance Contributions has been a challenge for all regions, with businesses across the country still grappling with the rise in labour costs and concerns were likely exacerbated by pre-Budget speculation. Alongside these issues, companies in the capital are increasingly worried about regulations, including the implications of the Renters Reform Bill and Employment Rights Bill which both achieved Royal Assent in the second half of 2025 and will be phased in starting this year.

Domestic sales and exports growth

Annual domestic sales growth eased in Q4 2025, dropping to 3.4% year-on-year, though the capital still outperformed both the historical norm (3.0%) and the national average (2.9%). Companies in London expect sales growth to improve in the year ahead to 4.1%, however, even with this uplift, the forecast for the capital is marginally lower than the 4.2% growth projected nationally.

Annual exports growth remained unchanged from the previous quarter in Q4 2025, at 3.5%, matching the capital’s historical norm and outpacing all other UK regions. This comparative strength is likely a result of London’s greater dependence on service-based sectors, which were relatively less exposed to the heightened uncertainty in the global trading environment over the past year. This strong performance is expected to continue over the year ahead, with London businesses anticipating export sales growth of 5.2%, a significantly stronger uplift than the 4.1% rise projected across the UK.

Business challenges

Concerns about the tax burden rose to another survey record high among London businesses in Q4 2025. Following April’s rise in National Insurance Contributions and heightened pre-Budget speculation, the issue was reported by 60% of businesses, nearly three times the region’s historical norm (21%).

At the same time, both the Renters Reform Bill and Employment Rights Bill achieved Royal Assent late in 2025, signalling a major upheaval in standard operating practices as they start to be introduced this year. As a result, the proportion of businesses reporting regulatory requirements as a rising challenge reached a seven-year high in Q4 2025, at 52%.

Meanwhile, competition in the marketplace (40%) and customer demand (39%) remain prominent issues for London companies, each exceeding their respective historical norms.

Labour market

Businesses in the capital increased their staffing levels at a softer pace compared with the previous quarter, reporting employment growth of just 0.7%, less than half the regional historical average (1.6%) and marginally below the national average (0.8%). Companies plan to raise the rate of expansion to 1.3% over the next 12 months, matching the rise projected nationally. The survey results suggest that skills supply issues remain less prevalent in London compared to most other regions, however, the proportion of companies reporting the availability of non-management skills (16%) as a growing challenge exceeded the region’s historical norm (15%) in Q4 2025.

Despite sluggish employment growth, companies in the capital reported an uptick in annual wage inflation to 3.3% in Q4 2025. This increase was among the sharpest rises in the UK, surpassing the 2.9% rate recorded nationwide. Salary inflation is expected to moderate in the capital over the next 12 months, with London businesses anticipating one of the softest rises in the UK at 2.6%, but above the region’s historical norm (2.1%).

Input prices, selling prices and profits growth

London companies reported a marginal uptick in input inflation in Q4 2025. The 3.8% rise in input costs was among the lowest in the UK, below the 4.1% recorded nationally. Businesses anticipate that input price growth will slow significantly over the next 12 months to 2.7%, moving closer to the regional historical average (2.4%).

Businesses in London recorded the softest uplift in selling prices of any UK region, at just 1.9% in the year to Q4 2025 but remaining above the region’s historical average (1.2%). Companies anticipate that growth will continue at a similar pace over the coming year, with the projected rise of 1.8% which is lower than the 2.2% anticipated across the UK.

Strong exports and domestic sales growth offset still-high inflationary pressures and resulted in London businesses recording the strongest annual profits growth of any UK region, at 3.5% in Q4 2025. Companies in the region expect a further uplift in profits growth over the next 12 months, with an anticipated rise of 4.7%, above the national projection (4.3%), and further widening the gap to the historical average (3.4%).

Investment

After an extended period of above-average growth, capital investment expanded by 1.9% in Q4 2025, dropping below the region’s historical average for the first time since Q2 2024. Businesses in the capital plan to cut growth further over the coming year to 1.0%, one of the weakest rises forecast in the UK and significantly lower than the national average projection (1.6%).

R&D budgets growth also dipped to 1.8% in Q4 2025, only marginally above the historical average (1.7%). Businesses plan to scale back R&D growth further to 1.5% in the year ahead, although this expansion is slightly stronger than the UK projection (1.3%).