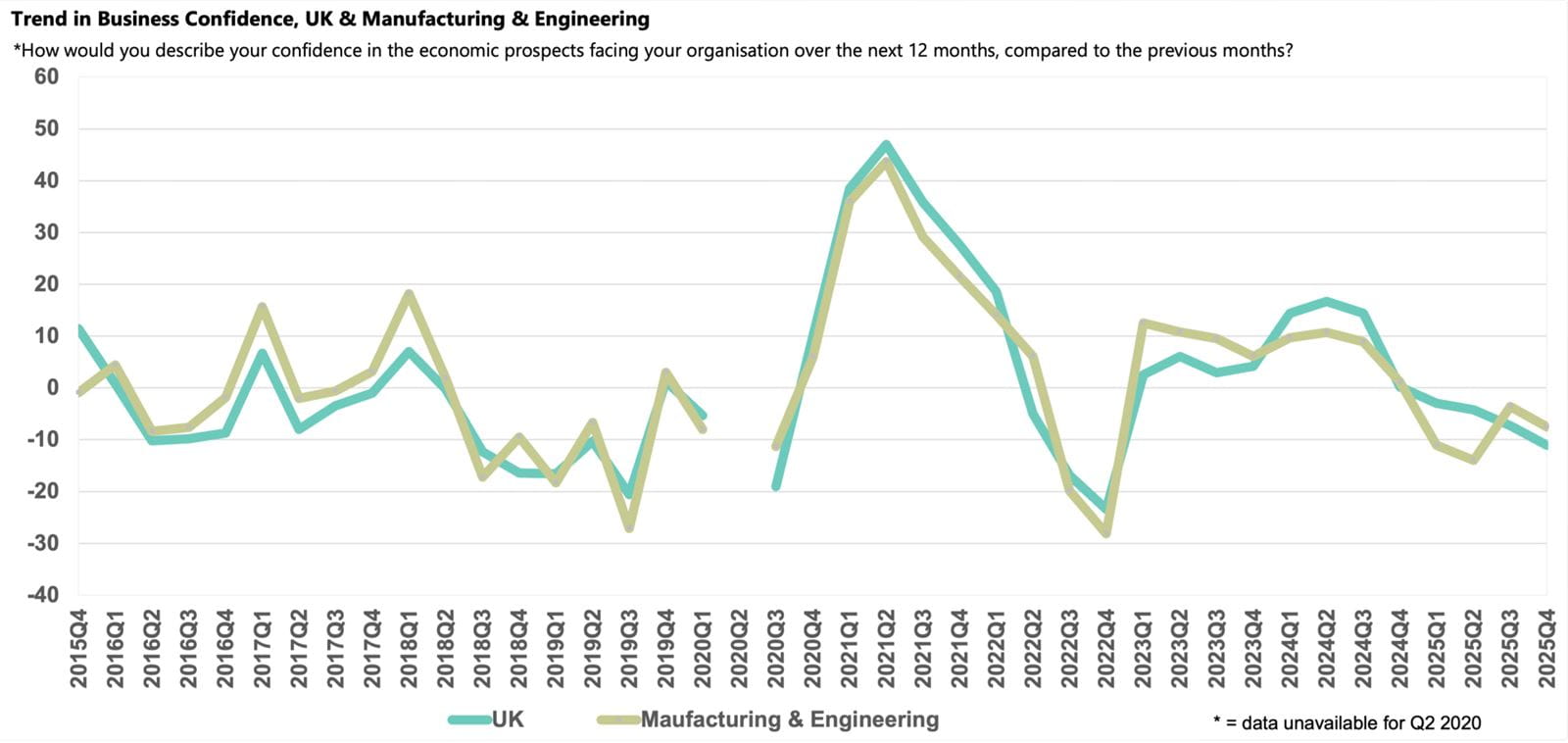

Q4 2025: Sentiment drops deeper into negative territory but remains above the UK average.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Business confidence in Manufacturing & Engineering fell further into negative territory in Q4 2025, but sentiment remains above the national average.

- Annual exports and domestic sales growth lagged the national average in Q4 2025 and while improvements are expected, growth is projected to underperform.

- The tax burden remained the primary challenge, but regulations also reached a new survey record high, while customer demand, competition and late payments were also prominent.

- Input price inflation rose back above the sector historical average, eroding profits growth as businesses limited the growth in their selling prices.

- Employment declined again in the year to Q4 2025, but businesses plan to increase recruitment over the next 12 months although skills shortages endure.

- Capital expenditure growth slowed from the previous quarter, but businesses plan to increase investment above the historical norm and R&D budget growth is set to outpace the national average over the coming 12 months.

Business confidence in the Manufacturing & Engineering sector

Following an uptick in the previous quarter, sentiment in the Manufacturing & Engineering sector slipped deeper into negative territory in Q4 2025, with the Business Confidence Index dropping to -7.5. While this score was above the national average (-11.1), confidence dropped below the sector’s historical norm (+4.8).

Businesses in the Manufacturing & Engineering sector have had a challenging year facing sustained international and domestic headwinds. Globally, US tariffs and geopolitical tensions increased uncertainty and curtailed demand from overseas. Domestically, increases in employment costs cooled recruitment plans and eroded profit margins, while the cyber-attack on Jaguar Land Rover halted production and pushed supply chains in certain areas into turmoil. The Bank of England’s Agents Summary of Business Conditions report for December states that Manufacturing output remains modestly down on the previous year, with the automotive and chemical sectors seeing the most significant contractions, however businesses in the sector are optimistic that challenges relating to the Budget and global tariffs will continue to dissipate. Encouragingly, the latest data from the ONS show that Manufacturing output recorded consecutive monthly increases in October and November, rising by 0.4% and 2.1% respectively and businesses in the sector will be hopeful that this momentum continues into 2026.

Exports and domestic sales growth

The Manufacturing & Engineering sector recorded a slight uptick in annual exports growth in Q4 2025, with a 0.9% rise. However, this expansion was among the weakest of any sector in the UK, lagging significantly behind the national average increase (2.5%). Businesses in the sector expect a significant improvement in exports growth over the coming year, anticipating that growth will exceed the sector’s historical norm (2.5%), at 3.6%. However, continued uncertainty in the macroeconomic and geopolitical environment represents significant downside risks to these projections and the sector’s predictions are less optimistic compared to most sectors and also weaker than the 4.1% rise forecast for the UK.

At the same time, Manufacturing & Engineering companies reported that annual domestic sales growth slowed in Q4 2025 compared to the previous quarter. The reported expansion of 0.9% was less than half the sector’s historical average (2.0%) and among the weakest rates reported by any sector. Businesses expect an uplift in growth to 3.2% over the coming year, though this outlook is still down on the national average projection of 4.2%.

Business challenges

April’s increase in employers’ National Insurance Contributions and the speculation that further tax hikes would be announced in the November Budget have clearly weighed on the outlook. Of the businesses surveyed in the Manufacturing & Engineering sector, 63% reported the tax burden as a growing challenge in Q4 2025, a new survey record high for the sector at over three-times the historical norm (17%) and comparable to the national average (64%).

Regulatory requirements also remain a prominent rising issue for Manufacturing & Engineering companies, cited by another survey record high of 52% in Q4 2025, significantly above the historical average (35%). The proportion of companies reporting customer demand (40%) and competition in the marketplace (39%) also ticked up compared to the previous quarter.

Market expansion is also slipping. The Bank of England’s Agents’ Summary report for December points to muted EU demand, tougher battles to hold market share, and looming rules-of-origin changes that could make things worse. BCM data for Q4 2025 shows that one in five Manufacturing & Engineering companies reported that expanding into new markets was getting harder, the highest of any sector.

Pressures are mounting elsewhere. Anecdotal evidence suggests insolvencies are beginning to trickle through after supply chain disruption from the Jaguar Land Rover cyber-attack, with some believing government action came too late. A survey-record 19% of Manufacturing & Engineering businesses reported access to government support as a growing challenge in Q4 2025, while late payments also spiked, with 27% of companies flagging the issue, the joint-highest rate alongside Business Services.

Labour market

The larger concentration of typically lower-paid roles left the Manufacturing & Engineering sector particularly exposed to April’s increases in employers’ National Insurance Contributions and the National Living Wage. As a result, companies in the sector reported they reduced their workforces by 0.2% in the year to Q4 2025, the weakest outturn of any sector (alongside Transport & Storage) and the second consecutive decline. Over the next 12 months, businesses plan to uplift their staff levels by 0.8% and while this increase is below the 1.3% growth projected nationally, it is double the sector’s historical norm of 0.4%. However, while employment demand has eased, there are ongoing labour market issues in the sector, with the availability of both management and non-management skills both above their historic norms and concern about staff turnover also ticked up in recent quarters.

Manufacturing & Engineering companies reported that annual wage inflation eased to 2.7% in Q3 2025, broadly in line with the 2.9% growth recorded across the UK, but still notably above the sector’s historical norm (2.2%). Looking ahead, businesses expect growth will continue at a similar pace, rising by 2.6% over the coming year, marginally below the 2.8% rise forecast nationally.

Input and selling prices, and profits growth

Manufacturing and Engineering businesses reported an uptick in inflationary pressures in Q4 2025, as annual input cost inflation climbed back above the sector’s historical average (3.1%) to 3.9%. Companies predict input price growth will slow to 2.4% over the coming year, below the national average forecast of 3.0%.

Despite the uptick in input cost inflation, companies in the Manufacturing & Engineering sector reduced the rate at which they raised their selling prices in the year to Q4 2025, to 2.0%. This was the softest rise since Q2 2021 and marginally below the UK average growth of 2.3%. Businesses in the sector plan to ease selling price growth slightly further over the next 12 months, to 1.9%, close to the historical norm (1.8%), but below the national average expectation of 2.2%.

The mounting challenges and increased inflationary pressures eroded profit growth for Manufacturing & Engineering companies in the year to Q4 2025, with businesses in the sector reporting annual profits expansion of just 0.1%. This small rise was the lowest increase since Q2 2021 and the softest of any sector, only outperforming Transport & Storage, which reported profits contracted over the year. Manufacturing & Engineering businesses anticipate a marked improvement in profits growth to 3.2% in the year ahead, a stronger forecast than the sector’s historical norm (2.4%) but still significantly down on the national average projection (4.3%).

Investment

Capital expenditure growth in the Manufacturing & Engineering sector softened from the previous quarter to 1.3% in Q4 2025, dropping further below the historical average (1.7%). This was the slowest expansion of all sectors and was only above Construction, which reported a reduction in capital investment over the year. Manufacturing & Engineering businesses intend to uplift investment growth slightly over the next 12 months to 1.8%, marginally ahead of the 1.6% forecast nationally.

Conversely, businesses reported that annual R&D budget growth accelerated from the previous quarter to 2.1% in Q4 2025. This rise equalled the sector’s historical norm and outperformed the national average increase of 1.6%. However, companies in the sector plan to moderate growth slightly to 1.8%, though this expected expansion is still higher than the 1.3% increase projected nationally.