Q4 2025: The ICAEW Economic Update Middle East, is a quarterly economic forecast for the region prepared directly for the finance profession.

Economic Update: On track for another year of solid growth

- GCC: Domestic strength underpins outlook

- Saudi Arabia: GDP strength persists, while the fiscal deficit widens

- UAE: Non-oil growth sustains momentum

GCC: Domestic strength underpins outlook

- Middle East GDP will grow 3.7% in 2026, with GCC economy expanding by 4.4%.

- GCC consumers will continue to outperform other regions

- Beyond tourism, technology emerges as a driver of regional diversification efforts

The outlook for the global economy looks better than anticipated at the time of the September report, thanks to a more positive view on prospects for the US and China. We've raised our 2026 global GDP growth forecast by 0.2ppt to 2.7%, slightly below this year's estimated 2.8% gain. Stronger expected Chinese export growth may undermine exporter performance elsewhere, but the region will benefit from a stronger US economy, and we continue to expect Middle East growth to be stronger in 2026 than this year. We now expect Middle East GDP will grow 3.7% in 2026 (0.2pp more than previously), up from this year estimated outturn of 3% expansion.

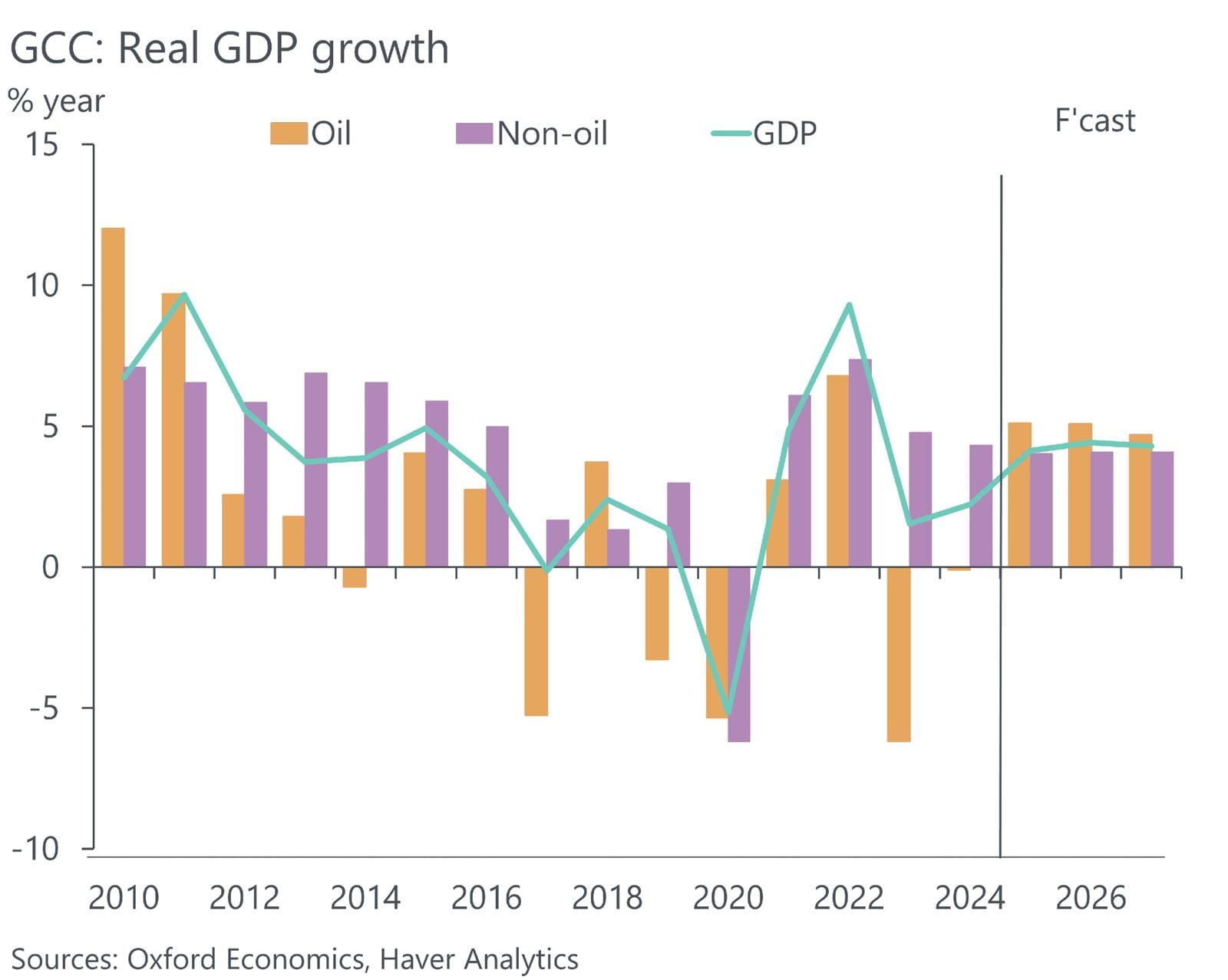

We expect GDP growth in the GCC of 4.4% next year, 0.2ppt lower than previously but 0.3ppt above our projection for this year. The downgrade reflects primarily the OPEC+ group’s pledge to halt oil output hikes in Q1 2026. We expect the pause to continue through H1, followed by a full unwinding of remaining curbs on production in H2 2026 and into 2027. We continue to expect a muted effect on regional trade of increased US tariff rates.

Our updated forecast for GCC now assumes oil production levels will be unchanged through H1 after one more small increase in December, before countries raise supply again in H2 2026 and beyond. The pause means GCC oil sectors will now expand by 5.1% in 2026, the same pace as this year. For Saudi Arabia specifically, we now project average oil production of 10.2mn bpd for the year, down from our previous estimate of 10.5mn bpd. This revision lowers our Saudi oil sector growth forecast to 4.5% in 2026, compared to our previous estimate of 6.7%.

We see growth prospects for the GCC non-energy sectors remaining positive with the projected pace of expansion inching up slightly to 4.1% in 2026 from a likely 4% this year. October PMIs showed non-oil activity continued to expand across the Gulf, though the pace of growth softened in Qatar and the UAE. By contrast, the Saudi Arabia PMI index surpassed 60, marking the second strongest reading in more than a decade, indicating that the private sector is ending 2025 on a strong footing. We expect Saudi non-oil GDP growth to accelerate to 5% in 2026 from 4.6% this year, as authorities continue to fund diversification efforts across the economy.

GCC consumers will remain standout performers, supported by low inflation and unemployment rates, credit expansion, and falling interest rates. Our estimates suggest GCC consumer spending will expand by an average 3.5% per annum over the next two years, helping to attract more FDI investment to accommodate higher demand from regional markets.

Incoming data from across the GCC show travel and tourism sector has continued to grow despite lingering geopolitical concerns. We expect regional destinations will gain share of global activity thanks to large-scale projects, hosting of major events, new partnerships and carriers expanding capacity. Meanwhile, the long-planned GCC unified visa, recently confirmed to launch in 2026, will facilitate a further increase in arrivals in the region.

Beyond tourism, technology is emerging as another potential driver of regional diversification efforts, with GCC governments will continue to pursue large scale investments in AI infrastructure, particularly networks, data centres and education, recognising early adoption as an opportunity to become global leaders. We expect both Saudi Arabia and the UAE to prioritise technological advances, knowledge transfer and innovation in ongoing and future trade negotiations with the US.

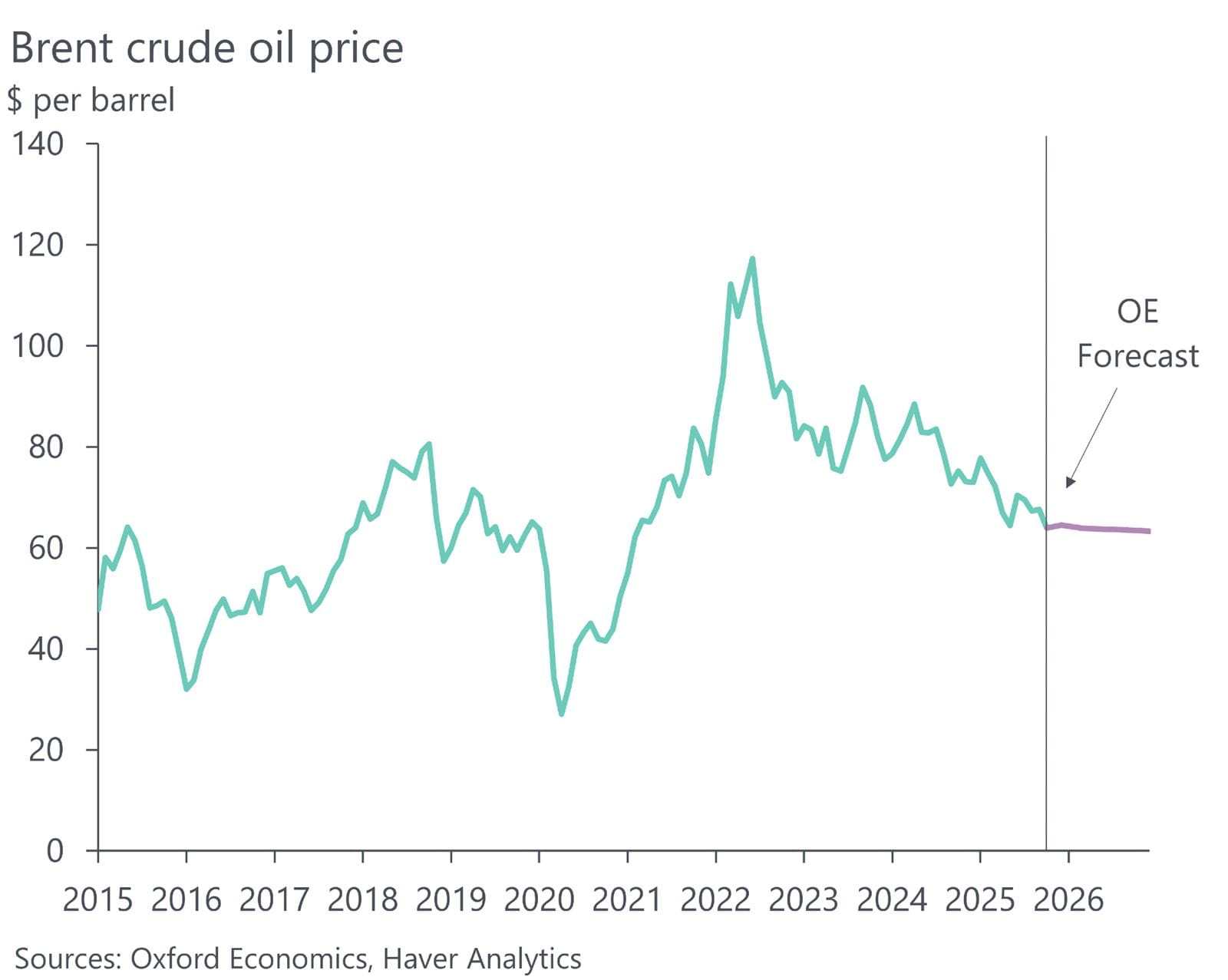

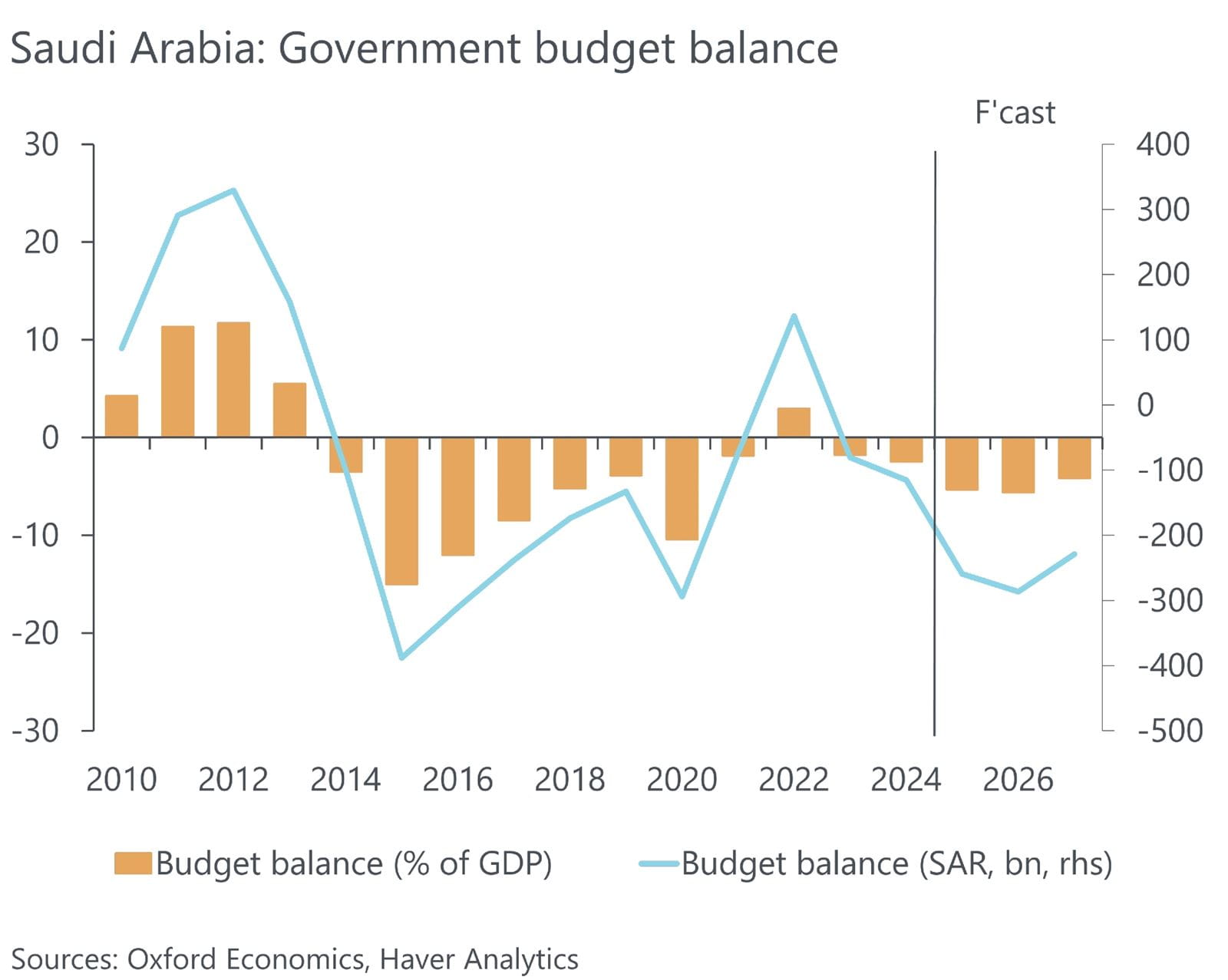

The muted outlook for oil revenues will challenge further expansion of fiscal policies, with some divergence likely within the region next year and beyond. Countries that have successfully diversified away from hydrocarbons, such as the UAE, will continue to push firmly ahead with development agendas via spending on major projects, as signalled in its 2026 federal budget. The Saudi 2026 pre-budget statement showed a cut in spending next year amid softer oil prices, but our baseline assumes the pullback in spending will not materialise. We anticipate a fiscal deficit of 5.3% of GDP this year in Saudi Arabia, widening to 5.6% in 2026.

We have cut our aggregate GCC inflation projections by 0.1ppt, to 1.9% for this year and 2.5% for 2026. Inflation is slowly picking up across several countries, including Oman and Qatar, while hovering just above 2% in Saudi Arabia. Within the region, our 2025 forecast is the highest for Kuwait, at 2.4%, with food costs rising at double the pace of the headline index, keeping inflation sticky.

The US Federal Reserve lowered its policy rate by 25bpts in October, earlier than we expected three months ago, prompting the majority of GCC central banks to follow with similar cuts, consistent with their US dollar currency pegs. The surprise exception was the Central Bank of Kuwait which decided to keep its policy unchanged, stating that its monetary policy was consistent with local economic conditions. Our forecast has three more quarter-point cuts by the end of next year, which we expect will support investment and consumer spending, providing a boost to regional domestic demand.

Elsewhere in the Middle East, business sentiment has benefitted from easing in security challenges amid the Gaza ceasefire deal, though violations continue to occur. In Lebanon, greater business optimism is evident in recent PMI readings, and we expect GDP growth to rise to 4.3% in 2026, from an estimated 1.8% this year. For Jordan, we forecast GDP growth of 2.7% this year and next, reflecting a more favourable credit environment supported by the return of global monetary easing and diminished concerns over US tariffs. And in Syria, nearly a year into its transition, the economic outlook is supported by further lifting of international sanctions and aid and investment pledges, though risk of political instability remains high. By contrast, the outlook for Iran has deteriorated in the last three months. The tightening of international sanctions since September threatens to further erode oil revenue in the coming quarters and deter much-needed private investment. Moreover, we expect the soaring prices and weak employment situation to drag down private consumption. We have lowered 2025 GDP growth forecast by 0.9ppts, to 0.7% and expect only slight recovery next year.

Saudi Arabia: GDP strength persists, while the fiscal deficit widens

- GDP growth will slow to 4.3% next year amid OPEC+ pause on oil output

- Recent reforms highlight focus on further opening of the economy

- The underlying trend remains for government spending to rise

We expect overall GDP growth in Saudi Arabia to slow to 4.3% in 2026, from a likely 4.5% this year. This reflects the OPEC+ decision to pause oil production hikes in Q1 2026, which will weigh on oil-sector activity. We expect growth momentum to strengthen to 4.5% in 2027, supported by increased oil production and non-oil sector expansion.

Preliminary Q3 GDP data showed expansion of 5.2% y/y, driven by an 8.3% rise in oil activities. Oil production will continue to rise from near 10mn bpd in September, before a pause in Q1 2026, which we expect to last until the end of Q2. This underpins our 4.5% projection for oil GDP growth next year, followed by a 4.1% expansion in 2027. We forecast the Kingdom's oil production to return to the previously reached peak of 11mn bpd by Q2 2028.

On the non-oil side, the October PMI soared to 60.2 from 57.8 in September, its second-highest level since 2014. The upturn reflected strong gains in output, new orders, and employment, supported by solid domestic demand and rising foreign investment. Overall, we expect non-oil activity to expand by 5% in 2026, from 4.6% this year, and accelerate to 5.3% y/y in 2027.

Non-oil exports have expanded by 17.1% y/y year-to-date through August, led by growth in exports of machinery and electrical equipment. Ongoing growth highlights the progress of the government's plan to expand the industrial sector as part of Vision 2030. We expect this trend to continue, with the non-oil share of exports rising throughout our forecast horizon.

Oil production increases will support government oil revenue in Q4 this year, but the pause in Q1 2026, alongside suppressed oil prices next year, will continue to weigh on the budget. Saudi Arabia’s fiscal deficit widened sharply to SAR88.5bn in Q3, marking the largest quarterly shortfall since 2020. We raised our 2025 full-year deficit forecast by 0.4ppts to 5.3% of GDP and expect it to widen to 5.6% in 2026. Despite rising fiscal pressures, we don't anticipate a significant pullback in government spending, as the authorities retain ample buffers to manage near-term financing needs.

Fitch Ratings' affirmation of Saudi Arabia's credit rating of A+ in Q1 this year will continue to support investor confidence, improving access to financing on favourable terms. Crucially, this will help keep borrowing costs low. We anticipate the near-term expenditure on interest rates will continue to grow, albeit at a slowing rate, as the effective rate on external debt continues to decline. This will benefit the Kingdom in its ongoing diversification efforts, which have recently come under pressure from a decline in oil revenue. We expect expanding non-oil activities to bolster public finances in the medium term.

Saudi Arabia is also easing restrictions on foreign investment in real estate and the local equity market aiming to spur global investor interest and boost inflows. The Saudi stock market has underperformed its GCC peers year-to-date, but should benefit from a higher foreign ownership limit, now planned for next year.

Saudi Arabia has recently introduced a five-year rent freeze on all residential and commercial properties in Riyadh. The measure aims to curb rental inflation, ease pressure on households and firms, and support the government’s broader Vision 2030 objective of improving housing affordability.

We expect the rent freeze to contribute to near-term price stability by delivering short-term relief to tenants and certainty to firms. However, the policy may deter private investment in new rental developments by reducing the profitability of such projects, thereby constraining future housing supply relative to projected demand growth. This could impede progress toward the Vision 2030 housing supply targets and weaken the effectiveness of broader efforts to enhance affordability and market efficiency.

Annual inflation has hovered around 2%. Although housing inflation remains elevated, we expect recent disinflation and a rent freeze in Riyadh to keep overall inflation at 2.2% in 2025, with prices increasing only modestly to 2.7% in 2026. Saudi Arabia’s central bank followed the US Federal Reserve in cutting rates in October, which came earlier than we anticipated three months ago. Our forecast has three more quarter-point cuts by the end of next year.

UAE: Non-oil growth sustains momentum

- GDP growth seen rising to 5.6% in 2026

- Hefty budget spending increase will support GDP growth

- UAE is well positioned to advance its development goals

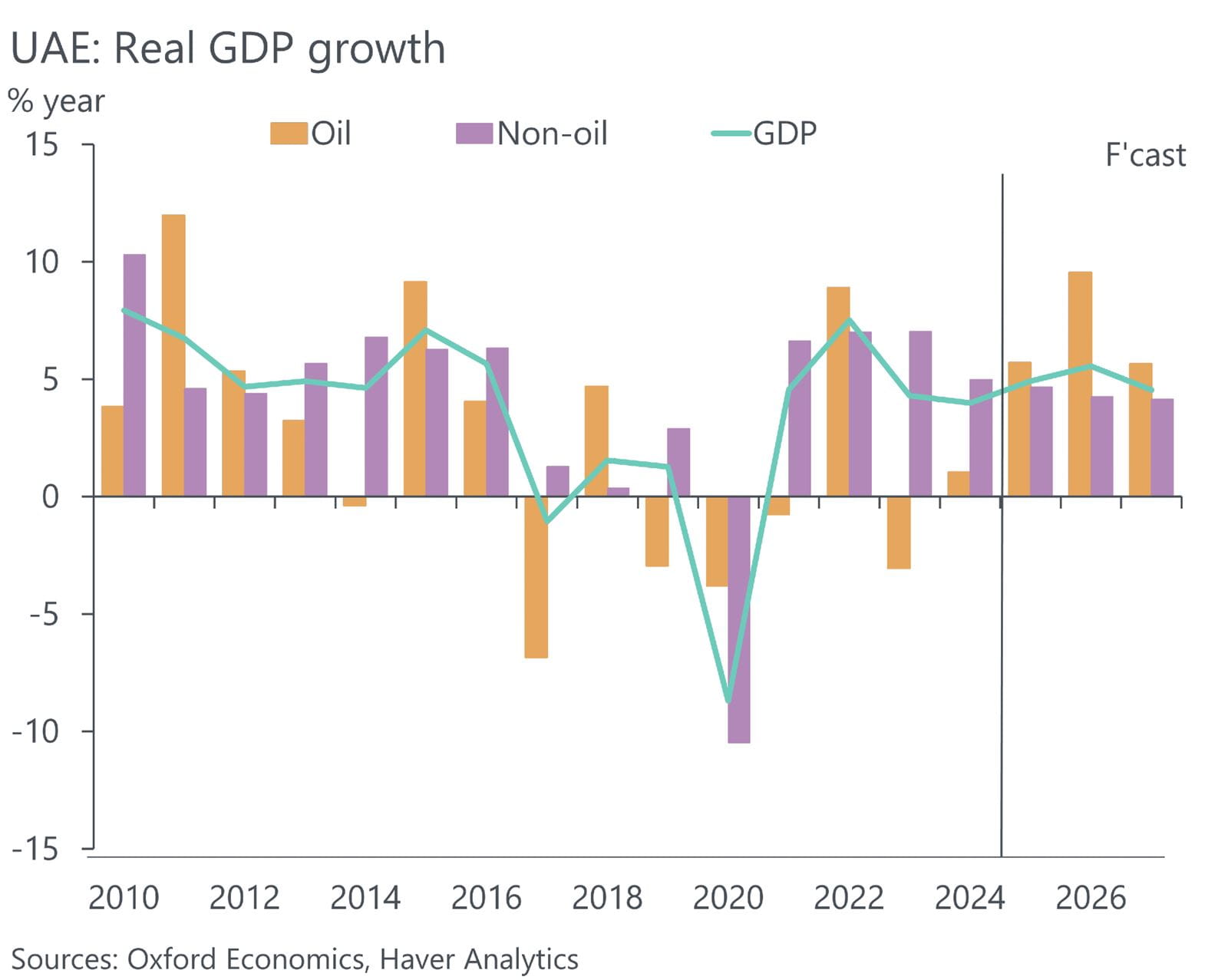

We expect UAE’s GDP growth to pick up to 5.6% in 2026, from an estimated 4.9% this year. We see the economy being driven by strong non-oil growth in key areas such as tourism, trade, and financial services, alongside a rebound in oil output as OPEC+ quotas ease again in H2 next year.

Non-oil activity has gathered pace in recent months. The PMIs have hovered around 54, reflecting strength in demand, driven primarily by domestic markets but with some support from external demand. Despite some moderation in H1, we expect non-oil GDP to expand by 4.7% this year and cool slightly to a 4.3% expansion in 2026, supported by sustained trade activity, robust consumption, rapid population growth and continued policy-driven diversification.

Strategic initiatives across trade, tourism, and technology continue to underpin growth, supported by accelerating digitalisation and sound fiscal management. Dubai’s economy grew by 4.4% y/y in H1 2025, driven by broad-based gains across non-oil sectors with wholesale and retail trade the largest single contributor, accounting for over 23% of growth. The sector has benefitted from a 6% increase in international visitors, as Dubai continues to channel investment into high-growth sectors such as tourism and technology to strengthen sustainable non-oil revenue streams under the D33 Economic Agenda. Dubai's 6.9% fiscal surplus in H1 2025 underscores the strength of its public finances and the effectiveness of its diversification strategy. The surplus highlights Dubai’s resilience even amid elevated global uncertainty, reinforcing its credibility with investors.

We expect oil output to rise to 3.41mn bps in December before plateauing until H2 2026. We predict oil production will rise to an average 4mn bpd by 2027 amid ongoing capacity expansion, with discussions of a potential 6mn bpd target beyond 2027. ADNOC is continuing to scale its upstream footprint through new rig contracts and unconventional land wells, alongside securing long-term demand through a 15-year LNG agreement with the Indian Oil Corporation. This will provide a robust stream of revenue and enable the government to support overall GDP growth.

The UAE's 2026 federal budget shows a huge 29% increase in forecast government revenue and spending. We expect a similar picture for the general budget as the government aims to make strides in achieving the long-term targets in its 'We the UAE 2031' development plan. This involves doubling the country's GDP, pursuing various strategic goals to enhance its prosperity, and positioning the UAE as a global leader in technology, human capital, and international diplomacy. The new domestic minimum top-up tax (DMTT), which took effect at the beginning of this year, feeds into a higher tax revenue projection. The OECD’s recognition of the UAE’s DMTT under Transitional Qualified Status brings the UAE further in line with international standards. This recognition ensures that UAE-based profits are not subject to additional taxation abroad, providing greater certainty within the tax framework, safeguarding the domestic tax base, and strengthening the country’s competitiveness.

Meanwhile, international partnerships, including the newly effective UAE-Malaysia CEPA, are broadening the UAE's market access and reinforcing its position as a global trade and investment hub. These efforts have underpinned a rise in the current account balance from AED251.9bn in 2023 to AED293.7bn in 2024 (14.5% of GDP), highlighting strong non-oil export performance and external competitiveness.

We expect inflation to average 1.9% this year before rising to 2.5% in 2026. Price pressures are contained on a national level, albeit remaining elevated in Dubai, with transport prices now a key source of upward pressure on headline inflation. The expected decline in energy prices next year should limit the extent of the rise, while we expect housing pressures to linger pending increased supply within the next couple of years.