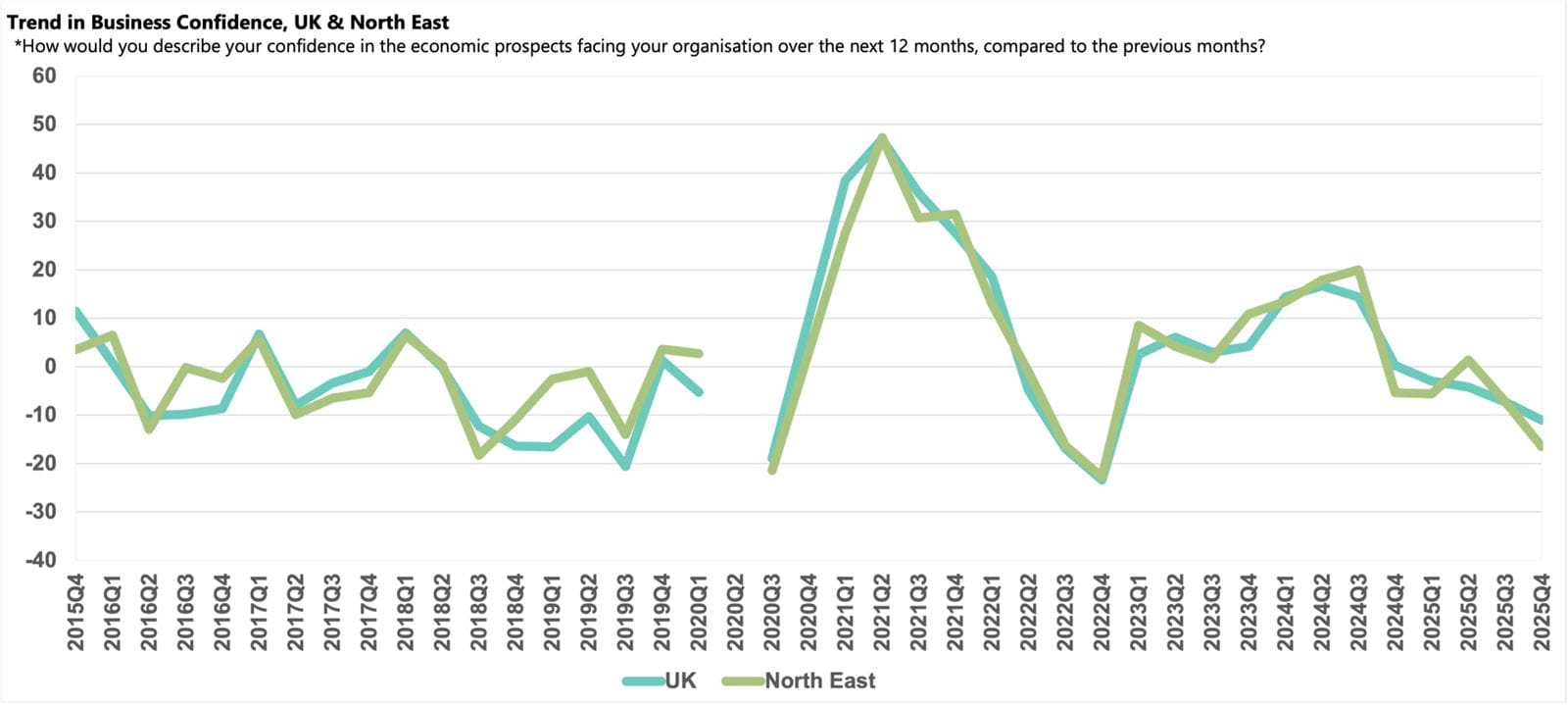

Q4: Business confidence in the North East falls further into deep negative territory.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- The Business Confidence Index in the North East dropped into negative territory in Q4 2025, falling to -16.5 which is significantly below the UK average (-11.1).

- Worries about the tax burden reached a new survey record high and were the most common growing challenge, while regulatory concerns also rose.

- Domestic sales growth slowed and there was a modest contraction in exports, however both are expected to improve over the coming year.

- Weak sales growth and an uptick in inflationary pressures dampened profits growth in the year to Q4 2025. Despite some moderation, businesses anticipate inflationary pressures will remain elevated.

- Despite subdued employment growth, salary inflation remains high and these trends are projected to continue over the next 12 months.

- The capital investment and R&D budget outlook deteriorated in Q4 2025 and businesses do not intend to grow their R&D budgets over the coming year.

Business confidence in North East

Business sentiment declined for the second consecutive quarter in Q4 2025, falling deeper into negative territory and hitting a three-year low. The Business Confidence Index dropped to -16.5 from -7.2 in the previous quarter, significantly below both the UK average score (-11.1) and the region’s historical average (+5.9).

This deterioration in confidence is underpinned by heightened concern over the tax burden following April’s rise in National Insurance Contributions and the National Living Wage, together with elevated uncertainty that preceded November’s Budget. Alongside this, businesses in the region continue to report weak sales growth, with exports likely hampered by US tariffs and recent upticks in cost pressures, which is squeezing profits growth in the region.

Domestic sales and exports growth

Following an uptick in the previous quarter, companies in the region reported a slowdown in annual domestic sales growth in Q4 2025, to 1.9%. This was the lowest increase since Q3 2021, lagging both the region’s historical (3.1%) and national (2.9%) averages. This subdued rise is likely linked to the locally important Manufacturing & Engineering sector, where businesses reported a similar trend. Businesses in the region expect an uplift in domestic sales growth over the coming year. The anticipated increase of 4.7% is among the strongest outlooks in the UK, notably ahead of the UK average projection of 4.2%.

It was a difficult year for exporters in the North East, with businesses in the region reporting a modest decline of 0.1% in the 12 months to Q4 2025, underperforming all other regions. While a return to growth is anticipated for the year ahead, the projected 2.2% rise is lower than the region’s historical norm (2.4%) and the forecasts for most other regions.

Business challenges

In common with other UK regions, the tax burden was the primary rising business concern in Q4 2025. Pre-Budget speculation and recent tax hikes, including increases in National Insurance Contributions, continued to weigh heavily on businesses and the tax burden was cited by 64% of companies in the region, a new survey record high, at nearly four-times the historical norm (17%). At the same time, the Employment Right Bill achieved Royal Assent in October and represents a major change in standard employment practices. This appears to have influenced the proportion of businesses citing regulatory requirements, which rose for the fourth consecutive quarter in Q4 2025 to 53%, its highest level since Q1 2020. This proportion was significantly above the region’s historical norm (39%) and slightly more than the national average (51%).

The weak sales performance in the year to Q4 2025 is reflected in the proportion of businesses citing customer demand (38%) and competition in the marketplace (40%) as rising challenges. Both challenges were cited by a larger share of businesses than their respective historical averages in Q4 2025, with the latter concern reaching a seven-year high.

Labour market

Annual employment growth slowed significantly in Q4 2025, dropping to 0.5%, significantly down on the region’s historical norm (1.3%) and marginally below the 0.8% UK average. Companies in the region plan to increase the rate at which they raise their staff levels over the next 12 months, to 1.0%, however this rate is lower than the 1.3% growth anticipated nationally.

While labour market conditions are cooling in the region, concerns about the availability of both management and non-management skills in the region remain below historical norms. However, staff turnover was cited as a rising concern by 22% of companies surveyed in the North East, ahead of both the national average (20%) and historical norm (19%).

Despite the slowdown in annual employment growth, companies reported an uplift in salary inflation in the year to Q4 2025. The 3.4% rise was among the sharpest increases in the UK and considerably above the historical norm of 2.2%. Businesses expect wage growth will continue at a similar trajectory over the coming 12 months at 3.3%, still significantly above the national average projection of 2.8%.

Input and selling prices, and profits growth

Companies in the North East reported an increase in inflationary pressures for the third consecutive quarter in Q4 2025, as input costs rose by 4.1% year-on-year, matching the national average. While moderation is expected over the coming year, businesses anticipate the strongest rise in input prices of any UK region, at 3.6%, significantly above the historical norm (2.7%).

In response to the uptick in input price inflation, businesses in the North East increased the rate at which they raised their selling prices to 2.8% in the year to Q4 2025. This was among the largest rate increases of any region in the UK, significantly outpacing the national average of 2.3%. Companies plan to moderate their selling price growth over the coming year to 2.2%, in line with the UK-wide projection, but still markedly above the region’s historical average (1.7%).

The contraction in exports, coupled with strong salary and input price inflation, dampened profits growth in the North East, as companies reported an annual increase of just 1.5%, one of the softest rises of any UK region and just over half the region’s historical norm (2.9%). Businesses expect an uptick in profits growth over the coming year, but the 3.3% anticipated increase is among the weakest projected expansions in the UK, markedly below the 4.3% national average.

Investment

Capital investment growth in the North East has been relatively stable across recent quarters. In Q4 2025, companies lifted their annual capital investment expenditure by 2.5% which is ahead of the national average (2.0%). However, in the coming year businesses plan to moderate their capital investment to just 1.3%, below the 1.6% rise forecast nationally and the region’s historical norm (2.3%).

Businesses in the region reduced the rate at which they increased R&D budgets to just 0.3% in Q4 2025, significantly below both the historical (1.8%) and national (1.6%) averages. Over the coming year, companies expect a further deterioration, anticipating that budgets will not expand over the next 12 months. However, across the UK businesses intend to maintain R&D budget growth at 1.3% next year.