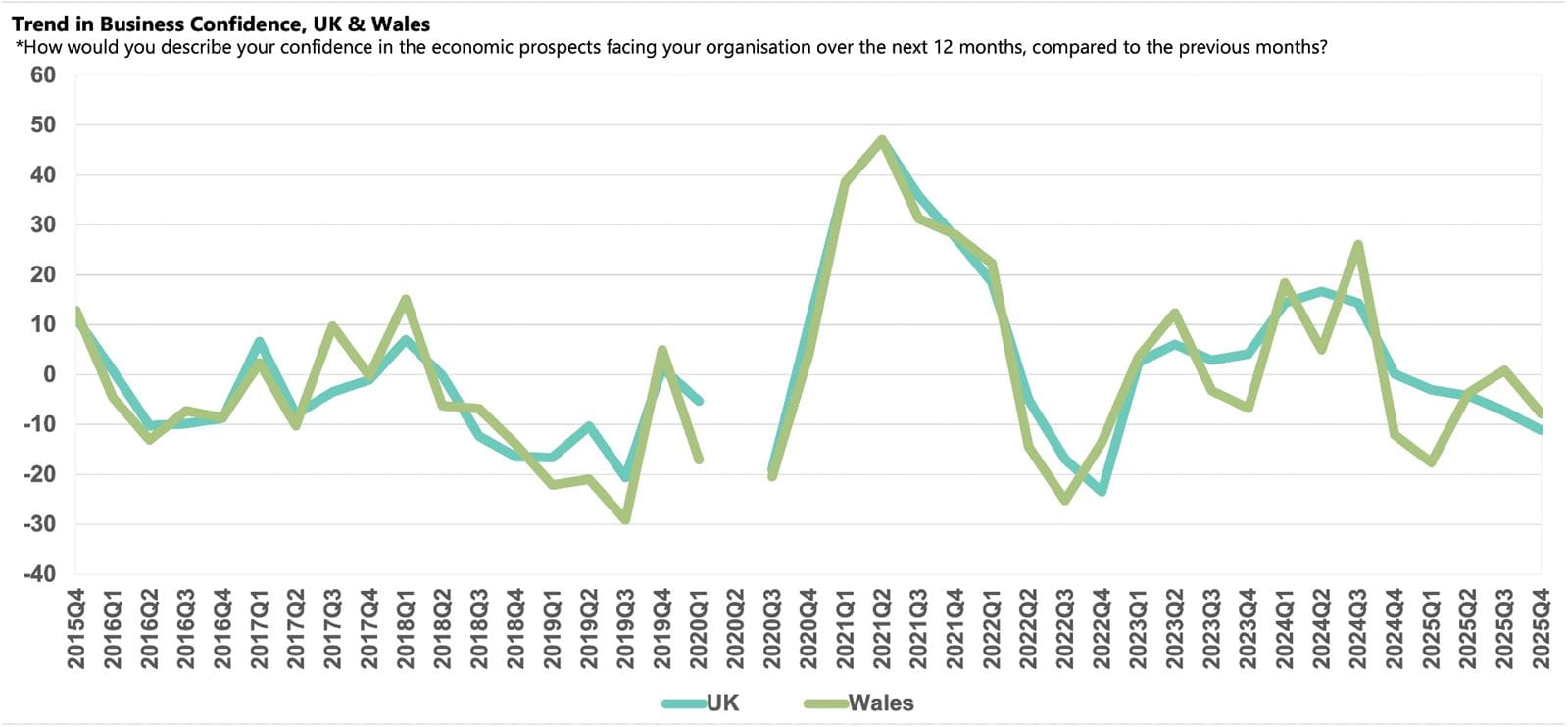

Q4: Confidence drops back into negative territory in Q4 2025.

The latest national Business Confidence Monitor (BCM) shows that business sentiment slipped deeper into negative territory amid uncertainty about the Budget and rising concern about both the tax burden and regulations. However, companies are optimistic that domestic sales and exports growth will improve over the next 12 months.

The survey results are based on 1,000 telephone interviews among ICAEW Chartered Accountants covering a range of UK sectors, regions and company sizes, ensuring a representative picture of the UK economy. The latest quarterly findings are based on the period 8 October to 11 December 2025.

- Business confidence in Wales slipped back into negative territory in Q4 2025, falling to -7.8, but remained above the UK average (-11.1).

- Both domestic sales and exports growth lagged their respective national averages in Q4 2025, but companies in Wales expect a sharp increase in exports growth over the coming year.

- The tax burden and regulatory requirements remain the most prevalent challenges for Welsh companies, with the proportion of companies citing these issues reaching new survey record highs.

- Annual input price inflation remains elevated, though significant moderation is expected over the year ahead.

- Salary inflation ticked up but is projected to ease as labour demand remains weak.

- Modest capital investment growth recorded in Q4 2025 is expected to improve but businesses do not plan to sustain the recent sharp rise in R&D budgets.

Business confidence in Wales

Sentiment in Wales slipped into negative territory in Q4 2025 with the Business Confidence Index score dropping to -7.8 in Q4 2025 from +0.9 in the previous quarter. Confidence was significantly below the region’s historical norm of +2.8 but remained above the UK average (-11.1).

Pre-Budget uncertainty undoubtedly contributed towards the decline in confidence in Wales. In the event, the UK Chancellor announced that the Welsh Government will receive an extra £505m over the next four years and increased borrowing flexibility, alongside funding for semiconductors, AI growth zones and the continued transformation of Port Talbot. However, the Budget also included further tax rises that are due at the end of this parliament. The fiscal details will likely be a matter for debate in the forthcoming Senedd election in May, with polls suggesting the election could bring a change in the political landscape in Wales - another factor which may have influenced business sentiment as the proportion of businesses that cited government support rose to its highest share since Q1 2024.

Domestic sales and exports growth

Companies in Wales reported sluggish domestic sales growth of just 1.4% in the year to Q4 2025, the slowest increase in over four years and less than half the national average (2.9%). Businesses expect an uplift in domestic sales growth over the coming year to 2.5%, however this rise is still below the region’s historical norm (3.0%) and the weakest of any region in the UK. The relatively weak performance and outlook of the locally important Manufacturing & Engineering sector contributes to the weaker expectation.

Welsh businesses recorded annual exports growth of 1.7% in the 12 months to Q4 2025, lagging both the region’s historical (2.7%) and the national (2.5%) averages. However, businesses in Wales expect a significant uplift in exports growth over the coming year, with a projected rise of 7.0%, nearly double the rise expected across the UK as a whole (4.1%).

Input and selling prices, and profits growth

Annual input price inflation remained at 4.1% for the third consecutive quarter in Q4 2025, matching the UK average. Businesses predict input cost inflation will close the gap to the historical average (2.8%), projecting growth of 2.9% next year and in line with the national average expectation (3.0%).

Welsh companies increased their selling prices by 2.3% in the year to Q4 2025, matching the UK average. Looking ahead, businesses plan to reduce the rate at which they increase their selling prices slightly over the next 12 months, to 2.1%. This projected rise is broadly in line with the 2.2% increase expected nationally, but still markedly above the region’s historical average of 1.5%.

Sluggish domestic and export sales growth and elevated annual input price inflation has eroded the profit margins of Welsh businesses, with companies reporting that annual profits growth slowed to 2.4% in Q4 2025, dropping below both the national (2.7%) and historical (2.5%) average. Despite a strong exports outlook, Welsh businesses expect profits growth will slow to just 1.0% over the next 12 months, lower than any other UK region and less than a quarter of the national average projection (4.3%).

Labour market

Like the rest of the UK, rising employment costs have dampened labour demand in Wales and businesses reported that annual employment growth slowed to just 0.1%, the lowest expansion of any UK region. This sluggish performance is expected to continue with businesses in the region planning to raise staff levels by just 0.6% next year, still only half the pace of the region’s historical average (1.2%) and the UK average projection (1.3%).

Cooling labour demand is also reflected in the share of businesses citing labour market concerns in Wales, with only 4% of businesses reporting the availability of management skills as a rising challenge in Q4 2025, a smaller share than in any other region. The availability of non-management skills (14%) was also cited by a much smaller proportion of companies compared to the national average (17%).

Despite weakening employment demand, companies in Wales reported annual salary growth of 3.3% in Q4 2025, outpacing the average UK rise of 2.9%. However, businesses expect annual wage inflation will slow sharply over the coming year to 2.4%, close to the region’s historical average (2.1%) and the slowest rise anticipated in any region.

Business challenges

April’s tax hikes, including increases in National Insurance Contributions, combined with pre-Budget speculation meant that the tax burden remains the most prevalent challenge for businesses in Wales in Q4 2025, cited by 69% of companies as a rising challenge. This share was the third historical high in four quarters and above the national average (64%). At the same time, regulatory concerns have spiked over the quarter, with 60% of businesses reporting regulations as a rising concern, another survey record high and significantly above the national average of 51%. At the same time, ahead of the forthcoming Senedd election in May, the share of companies reporting government support as a growing issue spiked to 23%, a larger proportion than in any other region and more than double the historical average (10%).

Welsh businesses are still facing a challenging trading environment, with 41% citing competition in the marketplace as a growing challenge in Q4 2025. This issue was more widespread in Wales than the UK average (38%) and above the historical average (34%). There was also evidence that businesses may be under additional financial stress across the UK, and in Wales 29% of companies flagged access to capital as a growing challenge, twice the historical average (14%), although concerns about late payments eased back.

Investment

Capital investment in Wales remains subdued despite a small pick-up in Q4 2025 to 0.8% year-on-year. This increase was less than half the 2.0% increase reported across the UK as a whole and the region’s historical average (1.9%). Over the next year, businesses plan to increase capital expenditure growth significantly to 1.6% and in line with the national average.

Businesses in Wales increased their R&D budgets by 3.4%, double the region’s historical average and the sharpest rate of any UK region in Q4 2025. However, companies plan to slow R&D budget significantly over the coming year, to just 1.1%,which is slightly lower than the national forecast (1.3%).