What is the UK labour market?

The labour market, also known as the jobs market, refers to the supply of and demand for labour, and is reflected in several key indicators:

- Employment – number of people in paid work.

- Unemployment – number of people without a job who have been actively seeking work.

- Economic inactivity – number of people who are neither working nor looking for a job.

- Vacancies – number of positions for which employers are actively seeking recruits from outside their organisation.

- Pay growth – estimates of earnings and pay generally cover three areas: basic pay, overtime and bonuses.

How does the labour market affect people and businesses?

A business needs people to help the day-to-day running of the operation. A shortage of labour can cause difficulties through preventing the business from growing as fast as it would like and facing higher labour costs as they compete for a limited number of available workers.

On the other hand, businesses may look to invest further in staff training and new technology where feasible, instead of recruiting.

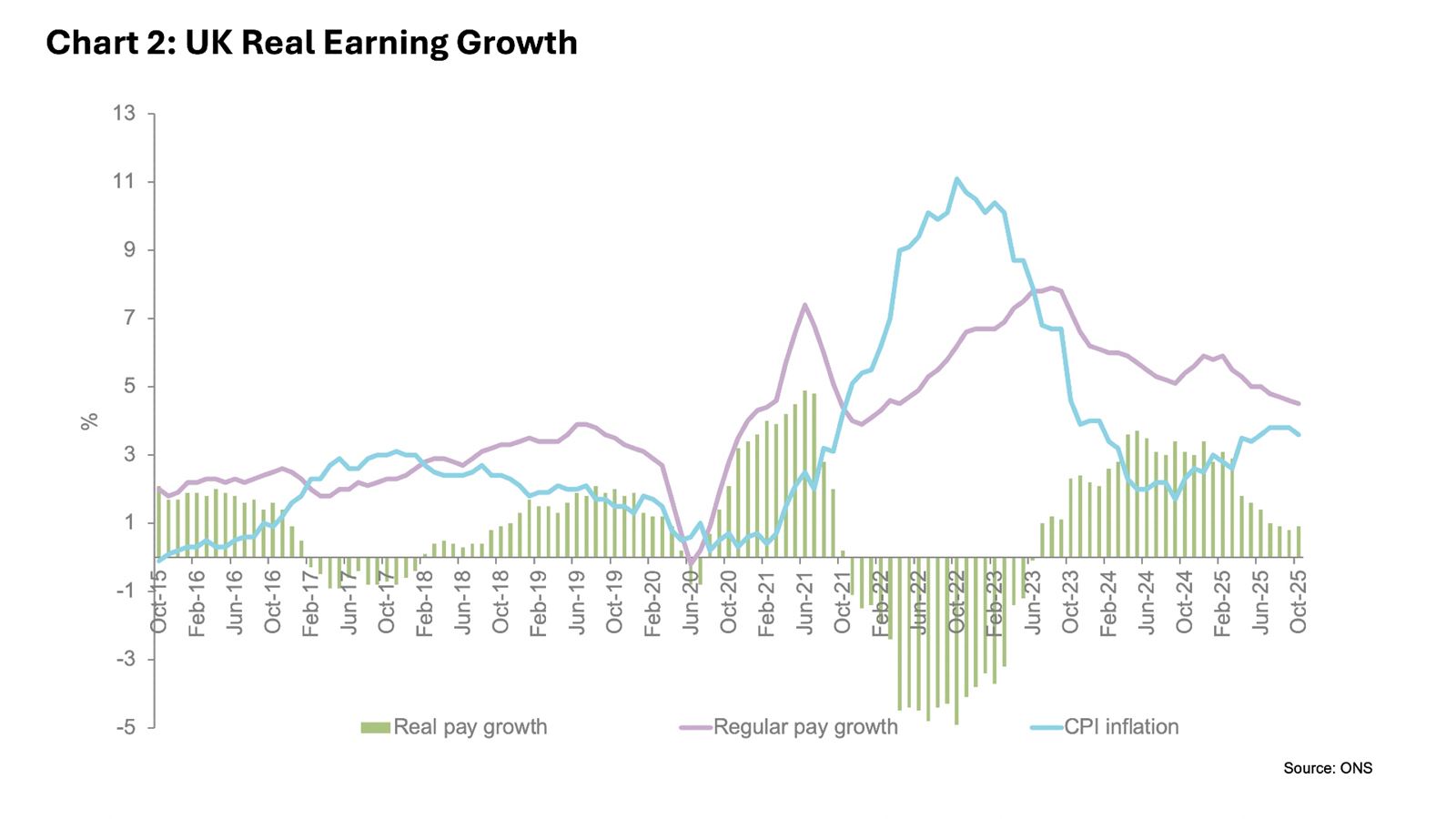

The hit to people’s incomes and wider consumer confidence during periods of high unemployment, also hinders the wider economy by weakening consumer spending, a key driver of UK GDP. The Bank of England when setting interest rates watches developments in the UK labour market closely because it’s a source of inflationary pressures, particularly pay growth.

What is the state of play?

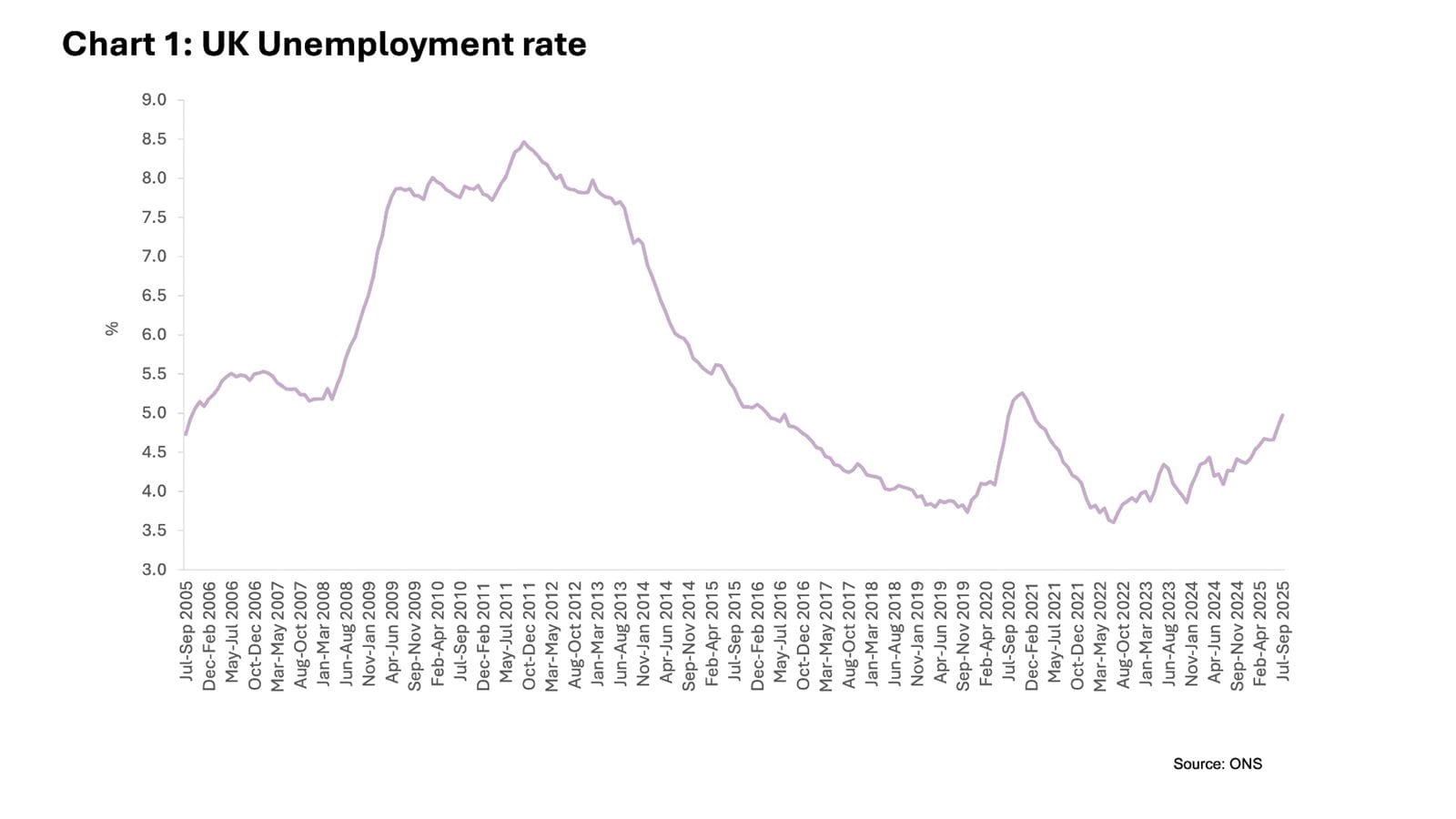

The UK labour market continues to show signs of cooling. The unemployment rate has risen (see chart 1), wage growth is slowing (see chart 2) and the number job vacancies – a good indicator of demand for labour – has fallen sharply over the past year.

The size of UK’s workforce has shrunk notably since the pandemic, there are 800,000 - or 40% - more people of working age who are off work due to long-term sickness than there were in 2019.

What is the outlook for the UK labour market?

The Bank of England forecast the unemployment rate would hit 5% in the final three months of the year and remain around that level until 2028. This reflects surging employment costs for businesses and weaker customer demand amid a slowing economy.

Some of the main challenges facing the UK labour market

- Low labour supply - adds to inflationary pressures and stunts GDP growth.

- High economic inactivity - holding back GDP growth, productivity and limiting improvements in living standards.

- Policy interventions - tax rises could mean unemployment by increasing employment costs on business and triggering weaker customer demand for products and services.

- Lack of a clear strategy to tackle skills shortages means it remains a big challenge for businesses and the public sector, limiting their ability to adapt to a changing economy.

- Gaps in the UK labour market data - driven by data collection problems, have made it more difficult to gauge the underlying state of the labour market.

ICAEW on the Budget