Inflation: 75 years of ups and downs

Retail Prices Index (RPI) and Consumer Prices Index (CPI)

Latest

March rate cut improbable following disheartening inflation rebound

Suren Thiru, Economics Director at ICAEW, responded to the latest UK inflation figures for January 2025, released by the Office for National Statistics on Wednesday 19 February 2025.

ReadSurprise inflation fall in December

Suren Thiru, ICAEW's Economics Director, says surprise inflation fall In December makes February interest rate cut more likely.

ReadInflation target hit, but economy stalls

UK inflation finally returns to target, but the economy flatlines as UK GDP was dampened by severe weather throughout April.

ReadHow does high inflation impact savings and pensions?

Inflation is finally starting to come down in the UK, but not as fast as hoped. That isn’t great news for pensions – but neither is it a complete disaster.

ReadInflation turns corner and could force interest rate rethink

Official data reveals that UK inflation moved back into single digits in April, but food inflation remains near record high.

ReadEasing inflation may force interest rate voting split

Official data reveals that UK inflation remains in double digits, despite slowing in March. The slowdown in March was mainly driven by the continued fall in fuel prices. However, this was largely offset by rising food prices.

ReadSurprise inflation rise causes interest rate headache

Official data reveals that UK inflation rose for the first time in six months in February amid vegetable shortages, leaving the Bank of England with a tough decision on interest rates.

ReadSlowing inflation not easing the cost of living crisis

Official data reveals that UK inflation slowed for the second successive month in December as fuel prices continued to fall.

ReadPainful deceleration on the way as inflation slows

Official data from the Office for National Statistics reveals that UK inflation slowed slightly to 10.7% in November, but still the second highest rate since August 1980.

ReadHow high inflation impacts accounting

Guidance from ICAEW’s Corporate Reporting Faculty explores the impact of high inflation on accounting and considers the financial reporting implications and related uncertainties that entities will need to think about.

ReadScaling back of energy support risks renewed inflation surge

The latest official estimate from the Office for National Statistics reveals that UK inflation accelerated to 10.1% in September as food prices soar.

ReadHow can hospitality companies tough out inflation?

As research shows that two-thirds of the UK’s Top 100 restaurant businesses are losing money, we look at what hospitality companies can do to survive rising inflation.

ReadAn inflated sense of worth: what inflation means for savers

A fall in headline inflation to 9.9% in August down slightly from 10.1% in July is likely to be a transient moment of calm in a continuing storm. So what does rising inflation mean for pension savers and other investors?

ReadAugust’s dip in inflation a ‘temporary distortion’, says ICAEW

Latest official estimate revealed that UK inflation slowed to 9.9% in August, amid strong base effects and lower fuel prices.

ReadHigher food prices push UK inflation into double digits

Latest official estimates reveal that UK inflation rose to 10.1% in July, the highest rate since February 1982, and experts say it has yet to peak.

ReadUK businesses keen to invest are held back by inflation

About 66% of businesses plan to seek funding for business investment, according to research, while the same number have been negatively affected by rising inflation.

ReadICAEW: Middle East offsets inflation with rising oil prices

Middle East GDP growth in 2022 is projected at 5.2%, an increase of one percentage point on Oxford Economics’ forecast in the first quarter, following inflated oil prices

ReadAuditing with inflation on the rise

Inflation has only been above 3% twice in the last 30 years. Auditors will need to understand the impacts. We outline some of the key areas of the audit that may be affected by inflation.

ReadInflation adds fuel to the deficit as cost of borrowing soars

Economic pressures mount as the public sector deficit reaches £55bn in the first three months of the fiscal year.

ViewUK inflation reaches new 40-year high

Latest official GDP estimate revealed UK inflation UK inflation rose for ninth month in a row in June, amid higher petrol and food prices.

ReadRecession? What recession? Time for business to stop worrying and start investing

Iain Wright, ICAEW’s Managing Director, Reputation and Influence is joined by Kitty Ussher, Chief Economist at the Institute of Directors, and Suren Thiru, ICAEW’s Director, Economies.

ListenThe pain – and potential gains – of rising inflation

On this ICAEW Insights podcast episode, we speak to Martin Wheatcroft about rising inflation and what that means for businesses, plus capital allowances reforms.

ListenStronger-than-expected growth masks growing challenges

Latest official GDP estimate confirms that the UK economy rebounded in May after shrinking in April, as GP appointments boost the headline figure.

ReadFive strategies to weather the inflation storm

ICAEW Manufacturing Community member Katy Davies runs through her five-point plan to help bolster businesses against a backdrop of rising inflation.

ReadBoE: further rate increase is necessary to rein in inflation

The Bank of England’s chief economist warns inflation will be no quick fix and to expect further interest rate increases to achieve its objective of getting inflation back to 2%.

ReadInsight from firms

PwC examines accountants’ role as inflation soars

Using ICAEW inflation data, PwC UK Senior Economist Barret Kupelian assesses influential factors contributing to historically high inflation and explores what this means for businesses and the role of accountants.

Read

Mazars: deflation is dependent on multiple global economies

From ending war to kickstarting manufacturing, George Lagarias, Chief Economist at Mazars, examines how global markets have dealt with inflation during the 20th century, adding what we can learn from their experience.

Read

RSM: inflation spike harks back to post-war peak

ICAEW’s graphic highlights similarities between post-pandemic and post-Second World War inflation, say Thomas Pugh and Simon Hart from RSM, who explain what businesses should be doing to mitigate the effects.

Read

EY: inflation inevitable after the pandemic

Using ICAEW inflation data, EY UK Chief Economist Peter Arnold assesses key drivers behind rising inflation over the past seven decades and predicts how this current wave of high inflation looks set to pan out.

ReadCharts and tables

22 Nov 2024

22 Nov 2024

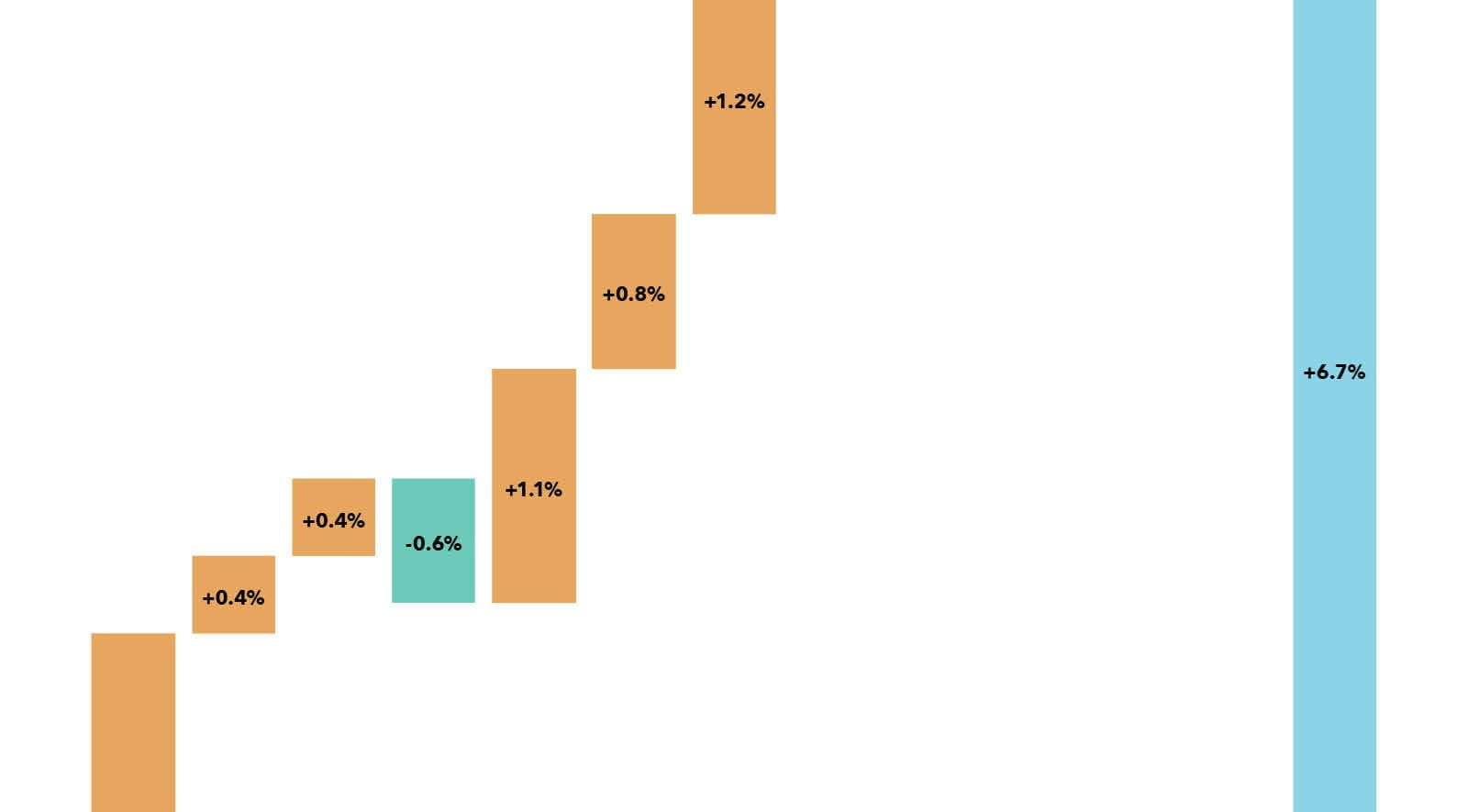

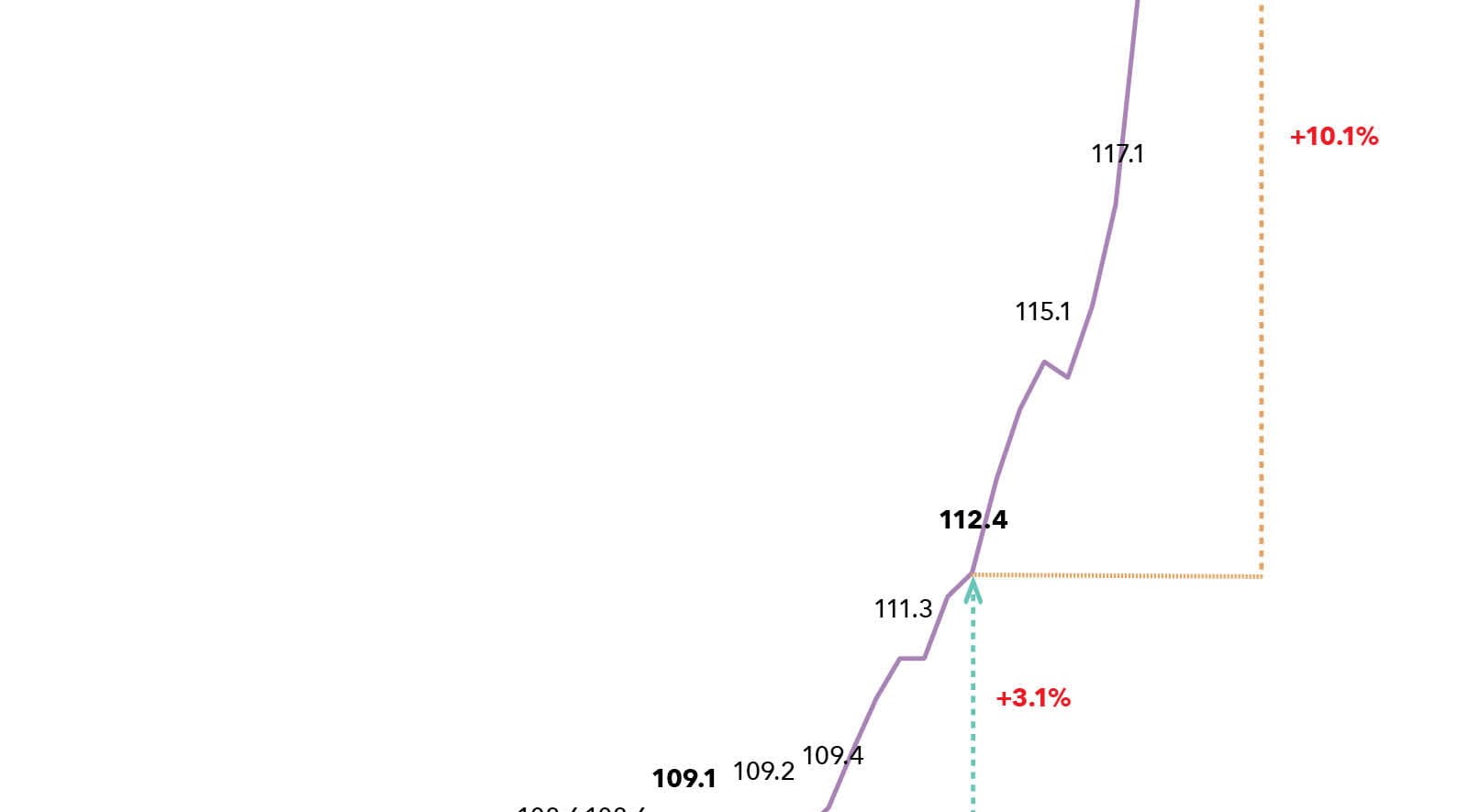

Chart of the week: Inflation jumps in October

Our chart this week looks at how the jump in annual inflation from 1.7% in September to 2.3% in October was driven by higher energy bills.

View 24 May 2024

24 May 2024

Chart of the week: Inflation fight far from over

Our chart this week shows that while headline inflation slowed to 2.3% in April, a core inflation figure of 3.9% means the fight against inflation is far from over.

View 21 Mar 2024

21 Mar 2024

Chart of the week: Core inflation

The Bank of England Monetary Policy Committee held interest rates constant at its latest meeting, despite CPI falling to 3.4% in February and core inflation dropping to 4.5%.

View 14 Mar 2024

14 Mar 2024

Chart of the week: wage inflation

Our chart this week takes a look at how average earnings have risen over the last decade and how they compare with the headline rate of inflation.

View 18 Jan 2024

18 Jan 2024

Chart of the week: Headline inflation v Core inflation

Our chart this week illustrates how core inflation has only dropped from 6.3% in December 2022 to 5.1% in December 2023, even as the headline rate has come down from 10.5% to 4.0%.

View 20 Oct 2023

20 Oct 2023

Chart of the week: Inflation by month

Our chart this week looks at how September’s inflation rate of 6.7% is made up by month, and why a big drop in the annual rate is predicted next month.

View 01 Jun 2023

01 Jun 2023

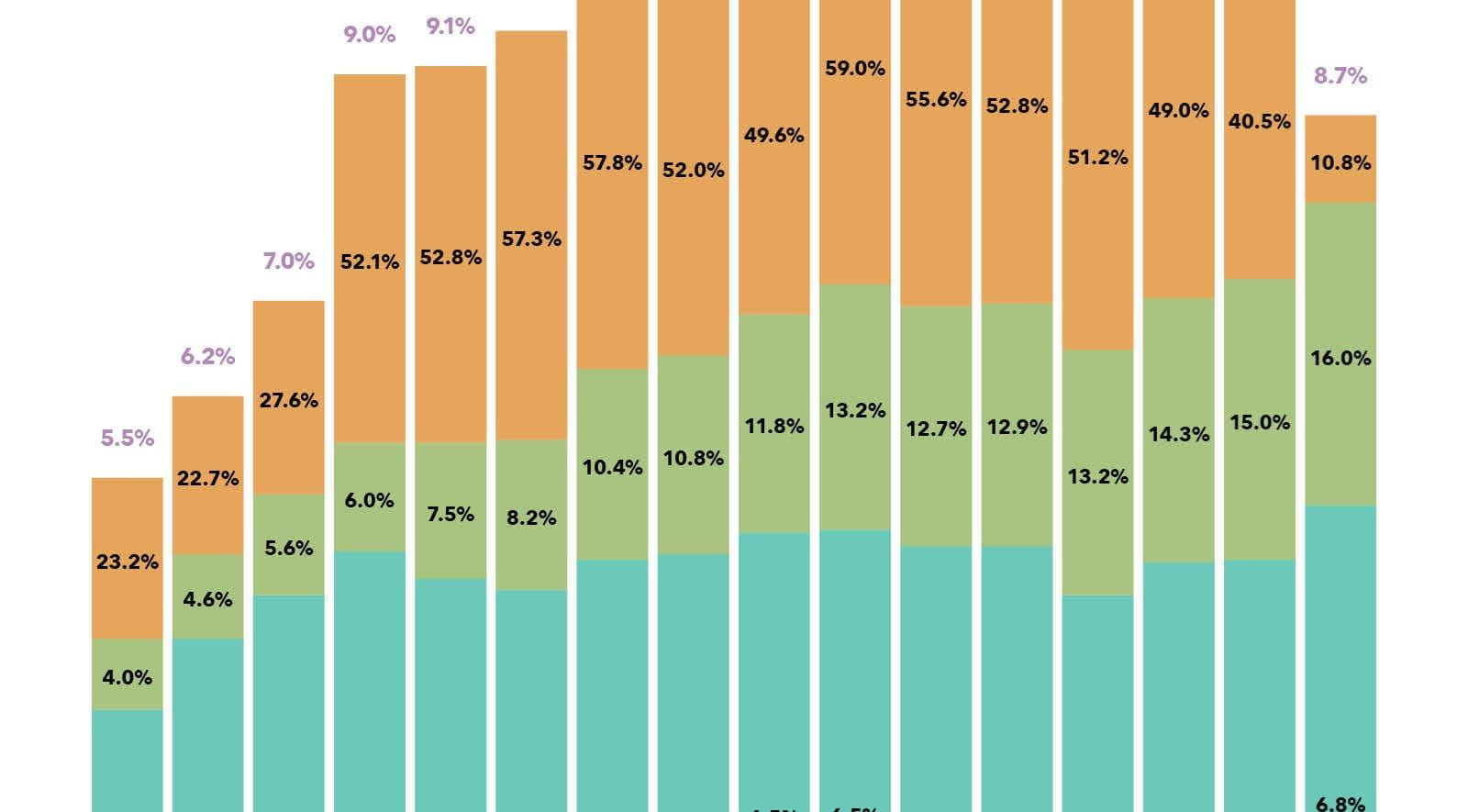

Chart of the week: Consumer price inflation

Our chart illustrates how ‘core inflation’, energy price rises, and food, alcohol and tobacco price inflation contributed to a lower than expected fall in the overall rate of inflation in April 2023.

View 11 May 2023

11 May 2023

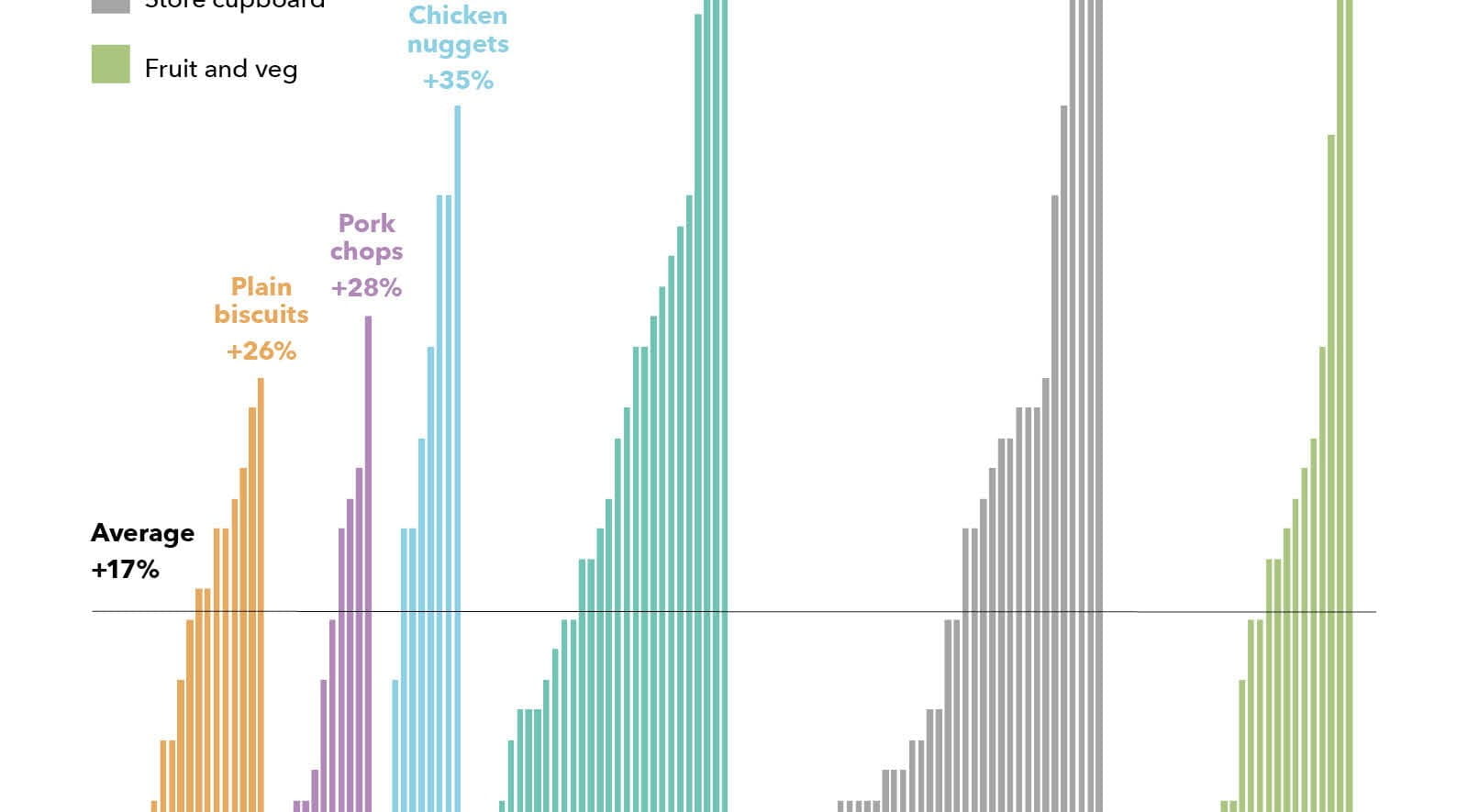

Chart of the week: Food prices

An inflation rate of 10.1% in the year to March 2023 conceals a huge variation in individual price rises, as illustrated by this week’s chart on food prices.

View 17 Feb 2023

17 Feb 2023

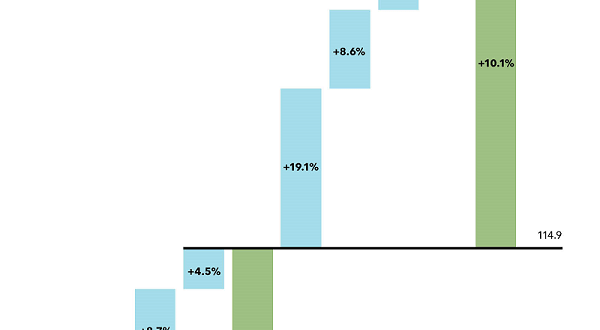

Chart of the week: Slowing inflation

This chart illustrates the slowing rate of inflation and how it should fall further once a big surge in prices between February and April 2022 falls out of the comparison.

View 21 Oct 2022

21 Oct 2022

Chart of the week: Consumer Price Inflation

This chart looks at how the benchmark percentage, used to determine the rise in the state pension and many welfare benefits from next April, reached 10.1% in September 2022.

View 21 Jul 2022

21 Jul 2022

Inflation adds fuel to the deficit as cost of borrowing soars

Economic pressures mount as the public sector deficit reaches £55bn in the first three months of the fiscal year.

View 26 May 2022

26 May 2022

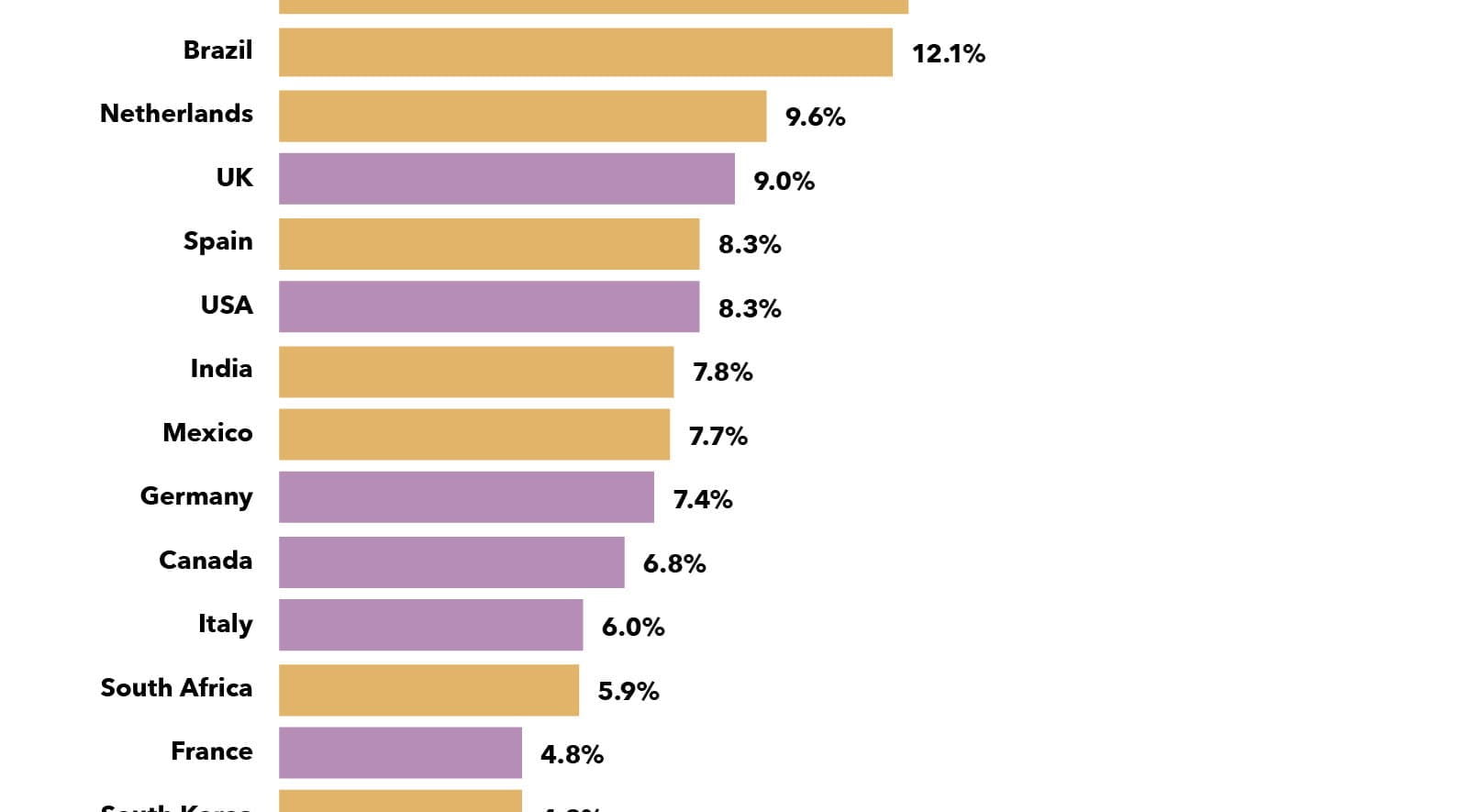

Chart of the week: Inflation around the world

This week we look at how inflation is racing upwards across the world, with the UK reporting in April one of the highest rates of increase among developed countries.

ViewMore support

ICAEW Community

Global Trade Community

Essential updates for those advising or working in companies seeking to export.

Find out more- Free and open to everyone

ICAEW Community

Manufacturing

Connect to finance professionals in manufacturing to network and share insight and technical expertise via ICAEW’s Manufacturing Community.

Find out more- Free and open to everyone

Resource

More economic insight

ICAEW works with Oxford Economics to provide useful insight and timely intelligence for finance professionals and their clients.

Read more