HMRC has been consulting on a proposed reform to the current basis period method for taxation, which applies to unincorporated businesses and LLPs. They have drafted legislation and consulted on the proposed amendments. At the time of writing, it is expected that the reforms will be fully effective from the 2024/25 tax year, with 2023/24 being a transition year. These changes will affect all sole traders, unincorporated partnerships and LLPs who currently do not prepare their annual accounts to a reference date ending between 31 March and 5 April.

Current continuing businesses

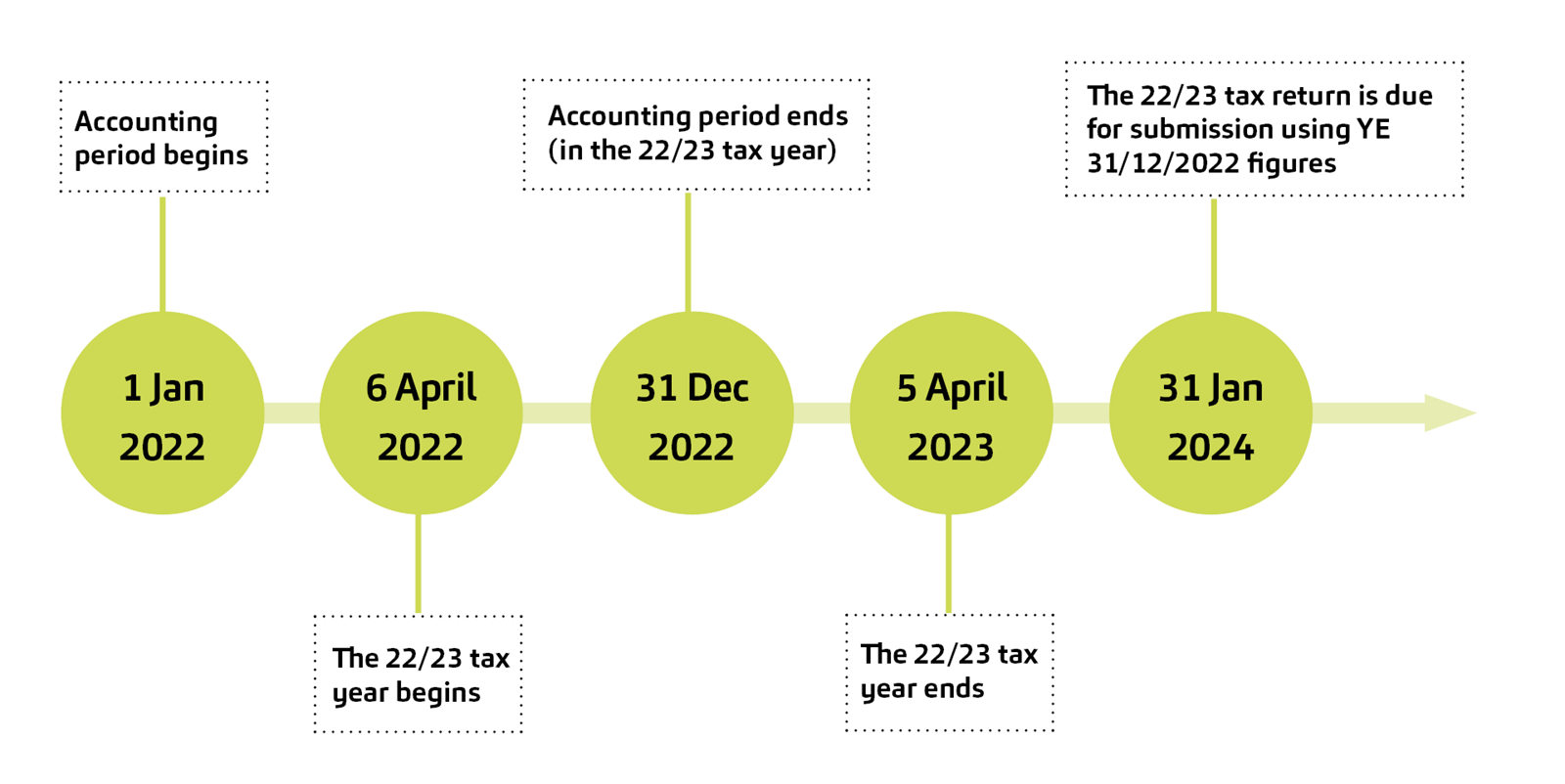

The current basis period rules mean that established sole traders and partners/members in ongoing businesses pay tax based on the financial performance of the business in the 12-month accounting period which ends in the tax year. For example, if a business prepares accounts for the 12 months ending 31 December 2022, and this is not the first period of account, then the profits from this period, after adjustments, would be taxed on the individual in their tax return for the 2022/23 tax year.

Current opening year rules

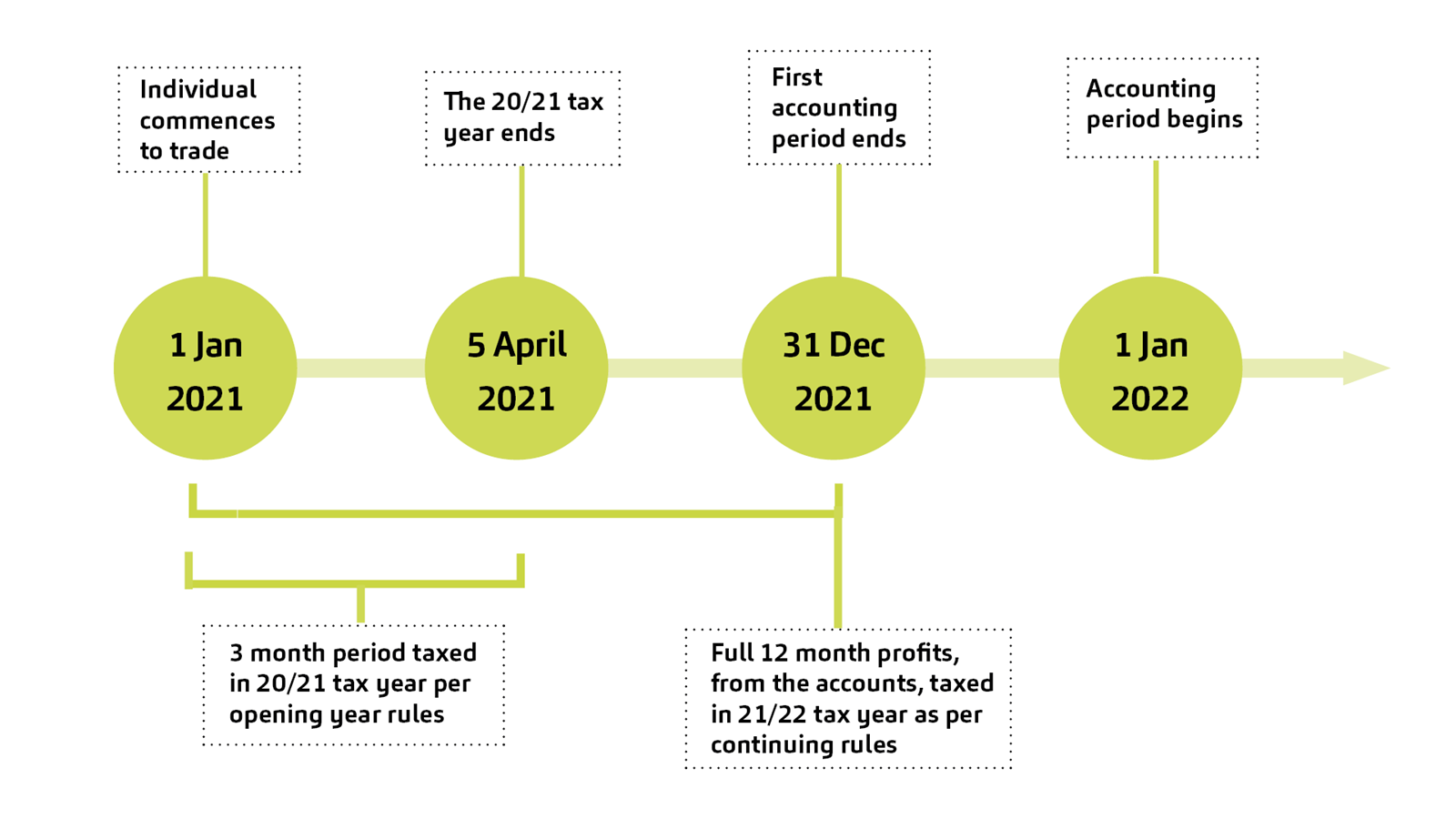

Different rules apply to individuals in the first tax year that they commence to trade. Partners or members are typically treated as commencing to trade on the date that they are admitted into the partnership/LLP. In their first tax year of trade, an individual is taxed on their profits from the date of starting to trade to the end of that tax year, being 5 April. For example, a new partner joins on 1 January 2021, where the accounting year end is 31 December. The first period that they are taxed is 2020/21, with income being their profits from 1 January 2021 to 5 April 2021. The next tax year, 2021/22, they are taxed on the first 12 months profits, being 1 January 2021 to 31 December 2021. There is a portion of profits taxed twice in these tax years, and this is known as “overlap profit”.

Proposed new rules

The new rules dictate that, from 2024/25, all unincorporated businesses will be taxed on the profits generated between the start and end of the tax year, from 6 April to 5 April. This will apply regardless of the year-end that the business prepares its accounts to. But HMRC do allow a year end that falls between 31 March and 5 April to be treated as if it falls at the end of the tax year. So, if a business has an accounting year end of 31 December, it will have to apportion profits from two accounting periods to fit into the 6 April to 5 April timeline. If the accounts have not been finalised before the tax return filing deadline, then estimated profits will have to be included.

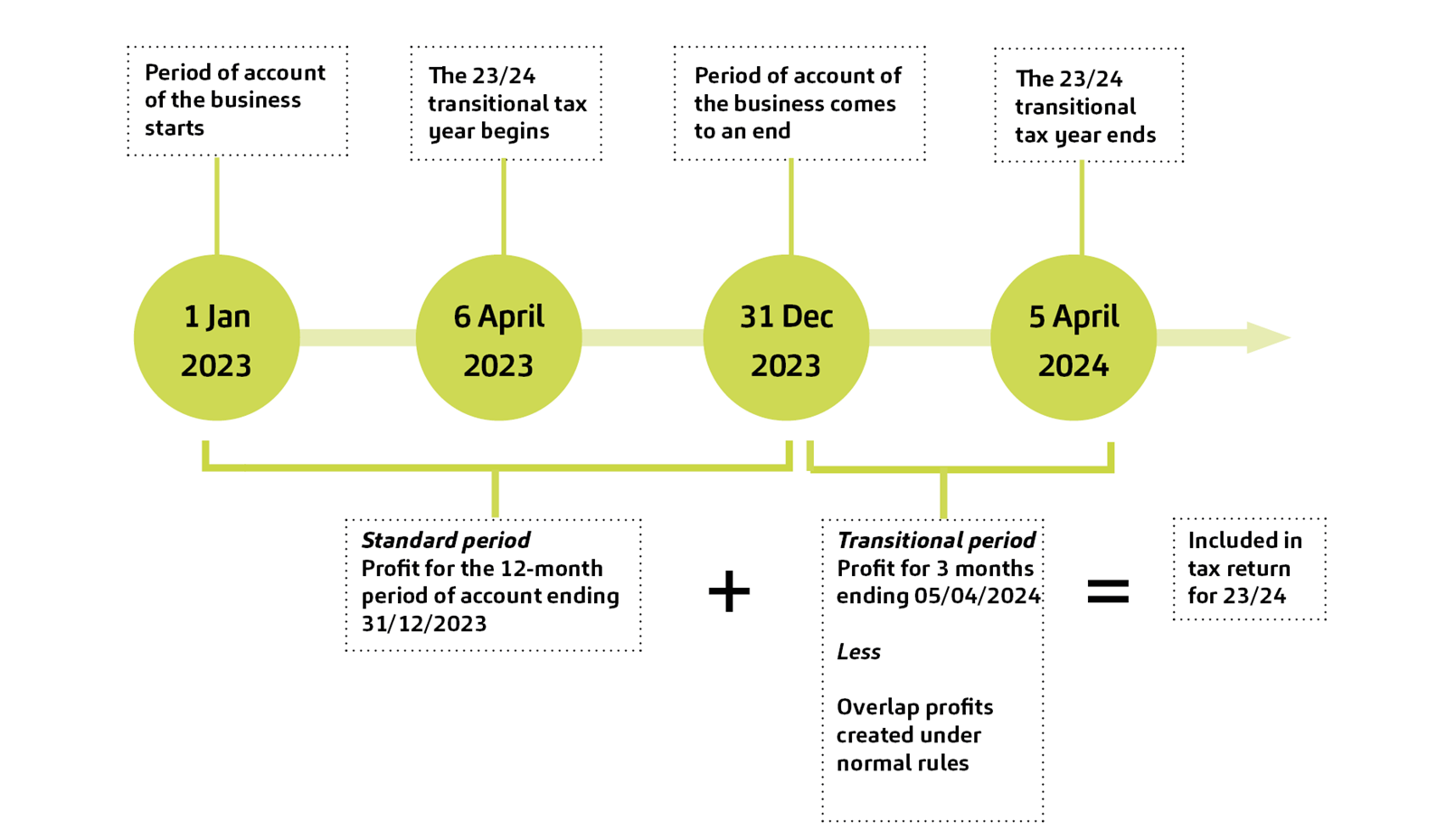

Tax year 23/24 – the transition year

2023/24 will be the key tax year when it comes to these proposed new rules, as this will be the year of transition. In this tax year, the individuals will be taxed on a long period of account ending 5 April 2024, such that this period picks up all untaxed accounting profits generated up to this date. Relief will be given for any overlap profits generated under the current basis period rules. In our example of an ongoing 31 December accounting year end, in 2023/24 the tax return will have to include profits for the 12 months ended 31 December 2023 plus profits for 3 months ended 5 April. This extra 3 months is known as the transitional period.

Transitional profit spreading

There are rules that allow the profits generated from the transitional period in excess of the available overlap relief to be spread over 5 tax years beginning with the year of transition. This should ease cashflow, by ensuring the extra tax due on these profits is not paid entirely in 2023/24.

| 2023/24 |

£20,000 x 1/5 = £4,000 |

| 2024/25 |

£20,000 x 1/5 = £4,000

|

| 2025/26 |

£20,000 x 1/5 = £4,000. Plus, election made to tax an additional £2,000 of transition profits, total £6,000.

So, to date, £14,000 of the transition profits have been taxed leaving £6,000 to tax over the remaining two years.

|

| 2026/27 |

Remainder £6,000 x ½ = £3,000

|

| 2027/28 |

Balance left = £3,000

|

Affects GP partnerships

There will be an impact on the pensionable earnings calculation for GP and non-GP partners because of the basis period changes affecting the 5 years from 2023/24. DHSC will have to decide how to deal with this change and then advise NHS Pensions how they will be expecting the pensions calculation to be dealt with.

Conclusion

Individuals should be taking advice to consider their future tax liabilities, and when and how they will become payable, including planning on how to best use the spreading options. Due to the interaction with pensions, planning is not going to be accurate until the guidance from NHS Pensions is available.

Businesses may also want to take this opportunity to consider a change to their accounting year end that may reduce the burden of estimating tax figures and re-submitting corrected figures that these new rules may create.

*The views expressed are the author’s and not ICAEW’s.