Author: Hannah Keartland – Outsourced Chief Impact Officer (Keartland & Co)

The headline on the Task Force on Climate-related Financial Disclosures (TCFD) home page says it all:

Climate change presents financial risk to the global economy

We can choose to stick our heads in the sand, try to ignore the messaging about climate change and resist changing the way we live our lives and do business. But climate-related risks are coming, whether we like it or not. And this presents a great opportunity for accountants and business advisors to support their clients – to help them understand the risks to their business and ensure climate risk is embedded in their approach to risk management and strategic planning.

The risks

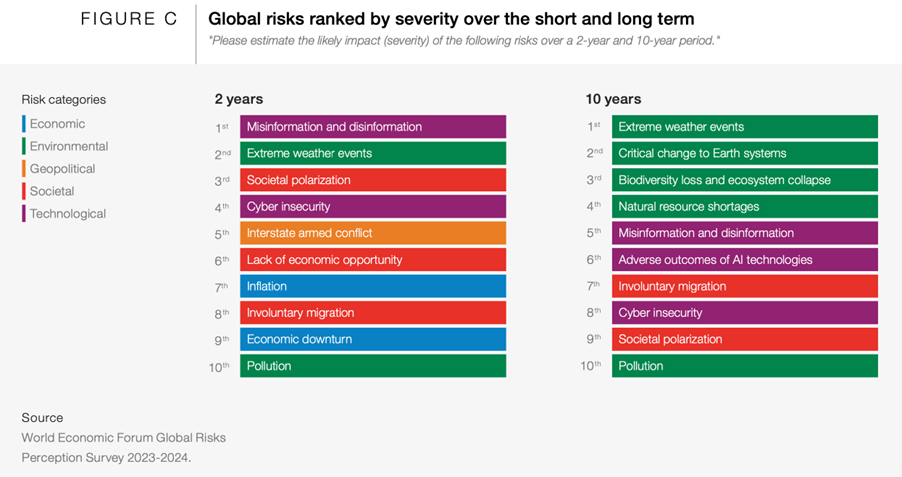

The World Economic Forum 2024 Global Risks Report shows that the biggest risks facing society, economies and businesses over the next ten years are environmental. There are some big changes from a few years ago so business advisors and business leaders need to be thinking about different things when planning and forecasting.

The TCFD risk framework lists six types of climate-related business risk.

Transition risks

- Policy & legal risks – policy changes to support and incentivise a shift to a low-carbon economy; climate-related litigation claims. For example, in September 2023, the People of the State of California sued the largest oil and gas companies doing business in California for misleading the public about climate change.

- Technology risk – new technologies emerging. For example, as we see a shift from internal combustion engines to electric vehicles, those businesses that don’t invest in these new technologies risk being left behind.

- Market risk – shifts in supply and demand for different types of product; changing demand from consumers and customers. For example, as we see increased demand for electric vehicles, so we see increased demand for the materials required to manufacture an electric vehicle (e.g. metals and minerals). This will push up the price of these raw materials and could affect other industries that use them. Those industries need to take these market changes into account in their financial forecasts.

- Reputation risk – how a company’s climate-change response is perceived by consumers and customers. For example, A number of UK universities have banned fossil fuel companies from recruiting students through their careers services.

Physical risks, which may damage assets or disrupt supply chains

- Acute risk – shocks to the system due to a specific event, e.g. extreme weather events or social unrest (increasingly likely due to climate-induced anxiety, inequalities, price rises and constrained resources). An internet search of ‘recent extreme weather events’ results in a catalogue of wildfires, flooding, hurricanes and heatwaves.

- Chronic risk – due to longer-term changes in climate – e.g. average temperature changes or sea level rise. For example, much of central London is forecast to become flooded annually by 2050 if we follow a trajectory aligned with current operational climate policies.

The timing, severity and likelihood of these risks are difficult to estimate – there’s a lot of uncertainty. This is where your skills as an accountant can come in, helping businesses make good enough estimates to inform decision making. And helping them understand which are relevant to decision-making right now.

Why does this matter?

Risks and uncertainty make decision making difficult. Business leaders, lenders, insurers and investors need to get a handle on the risks a business is exposed to. And they need a good enough understanding of potential impact and likelihood to help them make good decisions.

In the most extreme cases, there might be a going concern risk. For example, policy changes could put a car manufacturer out of business. What are they doing to transform themselves and remain relevant in a zero-carbon economy?

What you can do about it

As an accountant, you can help your clients:

- Identify and understand the different types of climate-related risk a business is exposed to, so the leadership team has visibility of these.

- Carry out scenario planning to understand the possible impacts and likelihoods of each risk – how resilient is the business to different future scenarios (e.g. those suggested by the Intergovernmental Panel on Climate Change).

- Put in place mitigation and adaptation plans. How much will it cost? How easy will it be to implement? What funding is available to support with mitigation and adaptation?

- Measure risks and consider how the balance sheet might be impacted, even if this involves large amounts of estimation and judgement. Investors and managers want this information.

- Put in place an ongoing risk management process that incorporates climate-related risk.