Financial reporting is the process of recognising, measuring and disclosing information that enable users to get an informed view of the financial position and performance of an entity that should allow them to make useful decisions and hold the entity to account. Measurement goes right to the heart of financial reporting and can involve complex models and judgement and can therefore be quite subjective.

Why measurement matters

The objective of financial reporting by public sector entities is to provide information about the entity that is useful to users of financial statements for accountability purposes and for decision-making purposes (IPSASB Conceptual Framework 2.1).

Each measurement basis has different attributes which help users assess the cost of services provided, the ability of an entity to support the provision of services in future periods and the capacity of the entity to fund its activities. Assets, for example, can either be held for their service potential which are operational assets used to deliver front line services or for their financial capacity which is the capacity of an entity to fund its activities e.g. investments.

Information provided in the financial statements must be useful to the users. This is achieved when the information meets the qualitative characteristics, set out in IPSASB’s Conceptual Framework:

| Relevant |

| Faithfully representative |

| Understandable |

| Timely |

| Comparable |

| Verifiable |

There are many different users of financial statements with differing demands. IFRS standards are written purely with the investor in mind which give the standards a clear purpose. By contrast, stakeholders of public sector financial statements tend to be broader. IPSASB's Conceptual Framework states that the users of government financial statements are all those who provide and consume goods and services to and from public entities. However, in the UK, the primary stakeholder for central government financial statements is deemed to be Parliament.

Measurement plays a key role in determining the value of an item in the financial statements. To recognise an item in the financial statements, it is necessary to attach a monetary value to that item, which is achieved by choosing an appropriate measurement basis and technique and determining whether the measurement of the item achieves the qualitative characteristics.

Measurement in IFRS and IPSAS is not suitable for natural assets

The requirement for all assets to have a monetary value attached to them is a key reason why current financial reporting frameworks are poorly suited for sustainability reporting; for example, what monetary value should be assigned to a forest.

The only value the forest has in accounting terms is for its timber which requires human intervention to turn trees into a commercial product and uses up the natural resource. Yet to leave the forest untouched has countless other benefits, from biodiversity, carbon storage and clean air to lifting the human spirit via woodland walks.

The IPSASB natural resources project confirmed that natural assets are unlikely to be recognised on the balance sheet since these will rarely meet the definition of an asset as currently defined. There are not only issues with measurement, but also existence uncertainty (subsoil resources) and control factors (water) to consider.

There are a number of alternative frameworks which look at these resources differently, for example the Natural Capital Coalition which looks at the dependencies and impacts of natural capital together with social, human and produced capital as well as UN's System of Environmental Economic Accounting, which takes a statistical approach to this topic.

Measuring our natural world will be incredibly important from a preservation point of view since allocating a value to an item automatically elevates its importance. Current accounting frameworks don't result in our natural assets being recognised but there are some alternatives emerging.

Measurement model, basis and technique – an overview

There are not many differences between the measurement bases and techniques applied under IPSAS and IFRS. The key difference is the applicability of fair value in the public sector vs the private sector. Whist fair value does also permit a cost approach in the absence of a market, it is really designed for arm's length transactions occurring in an orderly market; see below for further detail.

Fair value can be difficult to apply in the public sector for the following reasons:

- many assets are held for their continuous operational use and there is little purpose in obtaining the sales price;

- if an asset cannot be sold then the costs of revaluing an asset may outweigh the benefits of having up to date valuation; and

- many assets are either specialised or restricted meaning there is no market in which to obtain input data, making fair value difficult to apply.

IPSASB agree that fair value has a role in valuing assets held for their financial capacity and has developed a new measurement basis for assets held for their operational capacity, called current operational value, which is covered in more detail below.

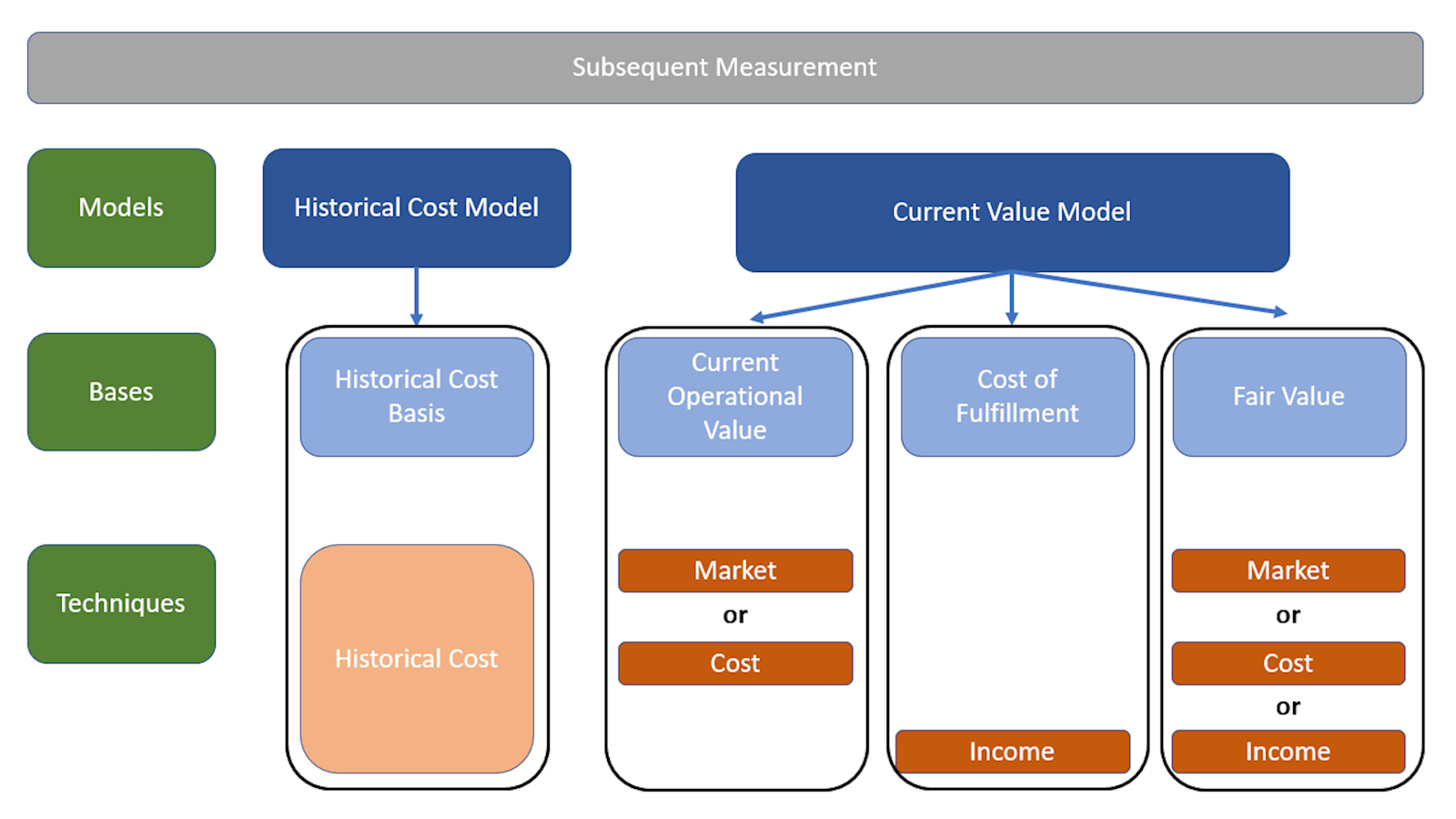

Overview of the measurement models, bases and techniques which are included in IPSASB's measurement consultation paper.

Source: IPSAS 46 Measurement (at a glance)

Measurement models are the broad approaches for measuring assets and liabilities and are divided into either a historic cost model or current value model. The choice of model will depend on what the users of the accounts will find most useful for decision making, taking into account any constraints on data availability.

Focusing on current value model, the two measurement bases for assets are current operational value (COV) and fair value (FV); cost of fulfilment is only for liabilities. Measurement bases provide information that best meets the qualitative characteristics whilst also taking into account the model and whether the asset is held for operational (COV) or financial capacity (FV).

Measurement techniques are methods to estimate the amount at which an asset or liability is shown in the financial statements under the relevant basis. The choice of measurement techniques depends upon factors such as the characteristics of an asset or liability and the availability of observable data.

Initial measurement reflects the actual or estimated price of the transaction or event that gave rise to the asset or liability. Subsequent measurement can then be either at historical cost or at current value. Hence the diagram above is for subsequent measurement only.

The historical cost basis does not have a separate technique. Both IFRS and IPSAS provide guidance on what can be included in the purchase price. Allowable costs include any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management are included, for example delivery costs, site preparation etc.

In relation to the current value model, the following tables show the key measurement bases and techniques and their definitions as currently proposed in IPSASB's exposure draft.

The IPSASB measurement standard defines the current value bases as follows:

| Bases | Definition |

|---|---|

Current Operational Value |

The amount the entity would pay for the remaining service potential of an asset at the measurement date. |

Cost of Fulfilment |

The cost that the entity will incur in fulfilling the obligations represented by the liability, assuming that it does so in the least costly manner. |

Fair Value |

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. |

The IPSASB measurement standard defines current value measurement techniques as follows:

| Techniques | Definition |

|---|---|

| Market | Prices and other relevant information generated by market transactions involving identical or comparable (i,e.similar) assets, liabilities or a group of assets and liabilities. |

| Cost | Amounts that would be required to replace the service capacity of an asset (often referred to as current replacement cost). |

| Income | Future cash flows converted to a single current discounted amount (often referred to as net present value or NPV). |

Models: historic cost versus current value

Choosing between the historic cost model or the current value model for valuations has a big impact on the look and feel of the financial statements. For example, historic cost involves depreciation and impairments, whereas the current value model additionally involves revaluations which can go up or down and effect the performance statement and/or reserves.

The two main factors in deciding which model to adopt are the:

- Informational needs of the users: the information provided must be useful for decision making and holding the entity to account.

- Availability of observable data: current values which are observable in the market (such as share prices) offer the best informational value, unobservable data the least.

To highlight some of the considerations that need to be made, think of the following example: A private person owns a house, with a mortgage. What information would you, as the house owner, find useful? The 'historic cost' will be of interest as that will determine the size of the mortgage; the 'repayments to date' so you know how much more you need to repay and finally the 'current market' value so that if you had to sell the house, you would be able to cover the loan repayment (ie, profit on the sale).

The informational needs would vary depending on the person; if the house was bought purely for a profit motive, more akin to an investment, then the market value would be of greater importance than the historic cost.

The time value of money always plays a role. If 50 years had elapsed since the house was purchased, the historic purchase price would have little connection with current prices (nominal versus real) and the mortgage would have been repaid long ago. Historic cost would not provide much informational value in these circumstances and is more or less irrelevant.

Property owners would want all the above information, that is to say the original cost of the house, any cost of improvements made to the house (capitalised expenditure), the net book value of the house (cost minus capital repayments) and the fair value.

However, accounting standards only require the calculation and disclosure of the value of the asset class based on the chosen model ie, historic cost or current value. Preparers can apply different measurement models to different asset classes meaning that a cost model could be adopted for buildings and a current value model for land, but the benefits of multiple valuations as described above in the house example is generally not achievable. (Please note, that in some circumstances you are required to disclose more.)

It is not possible to identify a single measurement model, or measurement basis, that best meets the measurement objective at a conceptual level. Below is a table listing out three key advantages and disadvantages for each model, please note this list in not exhaustive.

Historic cost vs current value – advantages and disadvantages

| Historic Cost | Current Value | ||

|---|---|---|---|

Advantages |

Disadvantages |

Advantages |

Disadvantages |

Ease of use, reliable |

Not very comparable, timing of when assets purchased |

Opportunity cost of capital |

Complex, can be manipulated in illiquid markets |

Cheap to obtain |

Older assets lose informational value and gains not recorded until realised |

More informative power - better measure of performance |

Cost, if no market exists, models to estimate can be very expensive |

Understood by most users due to simplicity |

Relies on good record keeping |

Timely reporting of gains and losses |

Volatility which is not easily understood |

Key IFRS vs IPSAS differences

There are a number of differences in the measurement bases and techniques when comparing IFRS and IPSAS. The IPSASB measurement standard provides a useful overview of the most commonly applied measurement bases and techniques. In contrast, IFRS only has a specific standard on fair value (IFRS 13) but does provide more guidance on measurement within other standards.

There are three differences that require greater scrutiny:

- Fair value and how that is applied in the public sector;

- Unique measurement basis in public sector – current operational value; and

- Assets held for their service potential and other specialist assets.

1) Fair value in the public sector

The objective of a fair value measurement is to estimate the price at which an orderly transaction to sell the asset or to transfer the liability would take place between market participants at the measurement date under current market conditions.

A FV measurement of a non-financial asset takes into account a market participant's ability to generate economic benefits using the asset in its highest and best use or by selling it to another market participant that would use the asset in its highest and best use.

A common concern with applying fair value in the public sector is that when an asset is held for its operational capacity1, fair value is difficult and inappropriate to apply because the following concepts are generally not applicable:

- Highest and best use; and

- Maximising the use of market participant data.

In the public sector, many assets are used to help in the delivery of services which can result in them not being put to their highest and best financial use. A good example would be a school in a city centre. Whilst operating the building as a school, the public sector entity may not be acting in its own best financial interests, but it would be meeting its objective of providing education. Whilst the standard says that highest and best use of non-financial assets takes into account the use of the asset that is physically possible, legally permissible and financially feasible, the highest and best use is nevertheless determined from the perspective of market participants, even if the entity intends a different use. In the city centre school example, market participants may use the building as office space as that might achieve maximum economic benefits.

This may make the application of FV difficult in a public sector context, not only to calculate the value but also to interpret the result. Many believe that such information is not helpful to users of the financial statements since if an asset will never change its use, then why value it as something it is not being used for?

2) Current Operational Value

IPSASB has created an alternative to FV known as current operational value (COV). This measurement basis is designed to help an entity estimate the value of a non-financial asset in achieving its service delivery objectives. This measurement basis is to be used for assets that are used for their operational capacity and provides a value of the existing asset in its current use, meaning that the issue of highest and best use is not applicable.

The following key aspects will affect the measurement of an asset's current operational value:

- Existing asset – COV assumes that the entity will continue to deliver goods or services by using the identical or a similar asset;

- Existing use of the asset – no alternative use is considered (rules out highest and best use as per FV);

- Existing location – value of the asset based on the current location, not an alternative site.

Surplus capacity, if required for operational purposes, such as additional classrooms in a school and which would be replaced if the asset were rebuilt is included in measuring the asset's COV. If the unused portion of an asset has no operational purpose, the entity determines if it has an alternative use. If it does, that portion of the asset is valued as a separate asset, if not, it is included in the COV but has no value.

COV permits the application of market approach and cost approach. The market approach requires the existence of an active market with transactions involving identical or similar assets. The cost approach is used when no active market exists and is the cost to develop or produce an identical or similar asset. The more specialised the asset, the less likely an active market exists.

If no cost information is available or if the existing asset would not be replaced with an identical asset, the entity may estimate the COV by calculating the cost of a modern equivalent asset and then making deductions for obsolescence and optimisation.

ICAEW is of the opinion that COV should also permit the income approach since some assets held for their operating capacity, such as right of use assets, are measured using present value of future cashflows, which is the income approach. However, COV does not permit this approach as only market and cost approaches are eligible. This is currently under review by IPSASB in phase II of the measurement standard which will review how COV is applied across the suite of IPSASB's literature.

3) Service potential and other specialist assets

The primary objective of most public sector entities is to deliver services to the public, rather than to make profits and generate a return on equity to investors. The type of assets that public sector entities hold is likely to reflect this objective – assets are held much more frequently for their service potential rather than their ability to generate cash flows. And because of the types of services provided, a significant proportion of assets used by public sector entities is specialised, examples include the road network, nuclear power stations, schools and hospitals. The specialised nature of these assets, in particular the lack of a market and lack of usability by other operators will have implications for the measurement of such assets.

The objective of IPSASB's measurement standard is to define measurement bases that assist in reflecting fairly the cost of services, operational capacity and financial capacity of assets and liabilities. However, where the service potential plays a more prominent role than the ability to generate cash flows, the measurement basis should provide information on the value of the asset's service potential.

The more specialised the asset, the less likely an active market will exist and the more likely the cost approach will be applied. In the UK, the central government financial reporting guidance (FReM) states that assets held for their service potential should be measured at their current value in existing use. They differentiate between specialised and non-specialised assets. A widely adopted measurement technique for specialised assets is depreciated replacement cost (DRC).

The UK's DRC does, however, allow for potential different locations and different configurations and is, in our view, slightly more flexible that COV. But with flexibility comes complexity and difficulty in comparisons. COV assumes existing asset, existing use and existing location (as explained above).

Finally, IPSASB noted that some jurisdictions considered the specialised vs. non-specialised distinction to be useful in considering whether fair value is an appropriate measurement basis. IPSASB concluded that while the specialisation of an asset is a useful distinction, it is not a clear determinant when assessing the appropriateness of fair value. Rather, IPSASB agreed that an entity's intent to hold the asset or liability for either financial or operational capacity is the clearest indicator of whether fair value is a suitable measurement basis.

Conclusion

One key difference between public and private sector entities is that the former are generally not profit maximising or even profit seeking. This can then impact the financial reporting when assets and liabilities are not used to their optimum capacity or when transactions are not at arm's length.

Applying the FV measurement basis for public sector assets that are used for their service potential (ie, operational assets to deliver services or that provide back office functions) may not always be appropriate. These assets are often of a specialised nature and hence lack an orderly market and may not be deployed at their highest and best use. There are techniques available to find a proxy for fair value, but these may lead to a valuation that users may not find useful or easy to understand. Therefore, IPSASB has created an alternative measurement basis, COV, that enables entities to value assets based on their service delivery objectives.

Current operational value is a broad, principles-based measurement basis and differs from fair value as it reflects the value of an asset in its current use, rather than its highest and best use. Current operational value measures the value of an asset held for its operational capacity in its current use. It reflects the amount an entity would incur at the measurement date to acquire its existing assets to be able to continue to achieve its present service delivery objectives. IPSASB is hoping it will provide a useful alternative to fair value.

1 IPSASB Conceptual Framework, 7.3 – the capacity of the entity to support the provision of services in future periods through physical and other resources.