Technical helpsheet with a flowchart to help ICAEW members to understand the process a non public interest company should follow upon resignation of its auditor.

Introduction

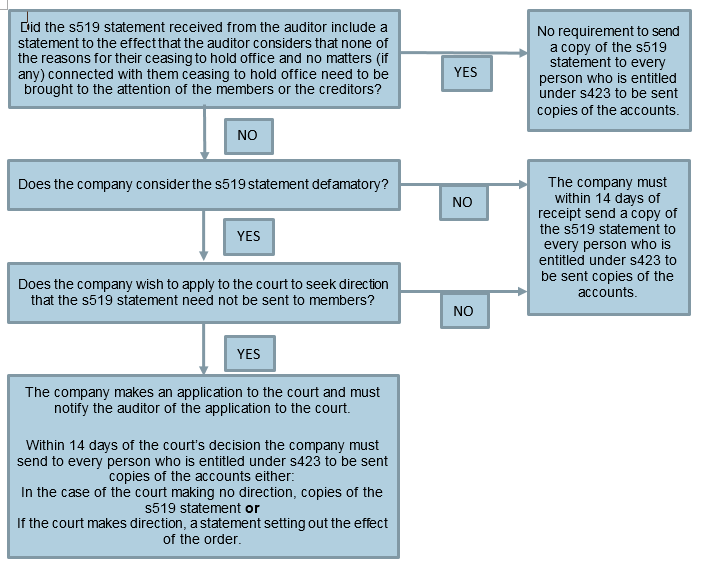

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members to understand the process a non public interest company should follow upon resignation of its auditor. A company must consider both whether it has to inform its members and creditors and whether it has to inform the appropriate audit authority.

Members may also wish to refer to the following related helpsheet:

Informing members and creditors

The Companies Act 2006 s520 addresses the company’s responsibilities when it receives a s519 statement from the auditor. The requirements of which are addressed in the below flowchart.

Informing the appropriate audit authority

The Companies act 2006 s523 requires that in certain circumstances a company sends the s519 statement received from the auditor to the appropriate audit authority.

If the auditor is ceasing to hold office at the end of a period for appointing auditors (in the case of a private company) or at the end of an accounts meeting (in the case of a public company) then there is no requirement on the company to inform the appropriate audit authority.

If the auditor is ceasing to hold office at any other time and the reasons for ceasing to hold office are not exempt reasons (see below), the company must send a copy of the s519 statement to auditorchange@icaew.com if the auditor is an ICAEW regulated firm (or otherwise to the Recognised Supervisory Body of the auditor).

Exempt reasons

The Companies Act 2006 s519A(3) specifies that ‘exempt reasons’ are:

(a) the auditor is no longer able to carry out statutory audit work with the meaning of Part 42 (s1210(1));

(b) the company is, or is to become, exempt from audit under s477, s479A or s480, or from the requirements of this part under s482, and intends to include in its balance sheet a statement of the type described in s475(2);

(c) the company is a subsidiary undertaking of a parent undertaking that is incorporated in the United Kingdom, the parent undertaking prepares group accounts and the auditor is being replaced by an auditor who is conducting, or is to conduct, an audit of the group accounts; or

(d) the company is being wound up under Part 4 of the Insolvency Act 1986 or Part 5 of the Insolvency (Northern Ireland) Order 1989 or a petition under Part 4 of that Act or Part 5 of that Order has been presented and not finally dealt with or withdrawn.

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

Download this helpsheet

PDF (168kb)

Access a PDF version of this helpsheet to print or save.

Download-

Update History

- 01 Nov 2016 (12: 00 AM GMT)

- First published

- 08 Aug 2022 (12: 00 AM BST)

- Changelog created, helpsheet converted to new template

- 08 Aug 2022 (12: 00 AM BST)

- Reviewed, no change to content.