Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members with practical tips on how to implement the revenue recognition amendments to FRS 102 introduced by the Periodic Review 2024.

Further guidance is currently being written. In the meantime, members may wish to refer to this related guidance:

Overview

In March 2024 the FRC published its Amendments to FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland and other FRSs Periodic Review 2024 (‘the amendments’) following its public consultation in FRED 82 issued in December 2022.

The majority of the amendments, including those relating to revenue recognition, are mandatorily effective for accounting periods beginning on or after 1 January 2026, with early application permitted provided all amendments are applied at the same time.

FRS 102 gives preparers a choice as to how they apply the revised Section 23 Revenue from Contracts with Customers:

- Retrospectively with the cumulative effect of initially applying that section recognised as an adjustment to the opening balance of retained earnings at the initial date of application (“cumulative catch-up”); or

- Retrospectively, by amending comparatives, including opening balance of retained earnings in the comparative period (“full retrospective”)

The key impacts of this choice are summarised as follows:

| Cumulative Catch-up (FRS 102 1.61(a)) |

Full Retrospective (FRS 102 1.61(b)) |

|---|---|

| Comparative information not restated. |

Restate comparative information. |

| Apply revised Section 23 retrospectively to contracts that are not completed at the date of initial application only. |

For completed contracts, no restatement needed for contracts that begin and end in the same annual reporting period or are completed before the beginning of the comparative period. |

| Can benefit from practical expedients in respect of completed and modified contracts. | |

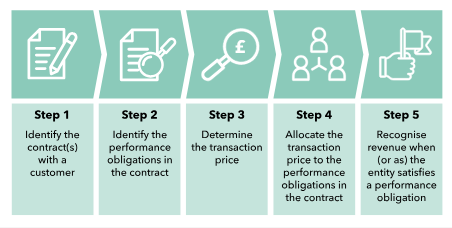

As a reminder, Section 23 Revenue from Contracts with Customers introduces a five-step model for revenue recognition. Further details can be found in the article Five-step revenue recognition model: what you need to know.

The following guidance gives practical tips to help preparers, advisors and companies implement the changes in revenue recognition. There is also specific guidance for auditors.

Practical approach

For the avoidance of confusion, any reference to ‘steps’ in the following guidance is in the context of the five-step revenue recognition model, rather than project management.

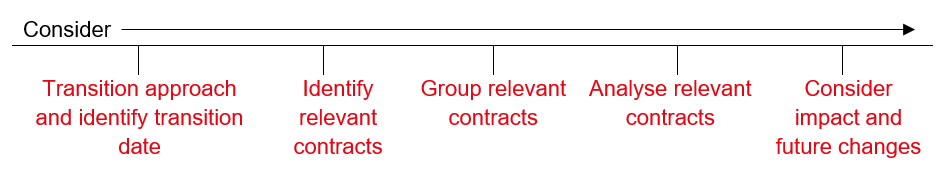

One approach to applying the five-step revenue recognition model may be to take the following project management stages:

- Transition approach and identify transition date

- Identify relevant contracts

- Group relevant contracts

- Analyse relevant contracts

- Consider impact and future changes

Throughout this guidance, reference will be made to a worked example. In this guidance the worked example is for a company reporting under FRS 102 with a 12 month period ending 31 December 2026, and a 12 month comparative period to 31 December 2025. The company is adopting the revisions to FRS 102 in respect of revenue recognition in the year ended 31 December 2026 (i.e. they are not early adopting).

Transition approach and identifying transition date

Before the details of the transition are considered, a practical first step would be to choose the transition approach and identify the key dates that need to be considered to apply that transition approach.

There is no prescribed criteria as to which transition approach should be used. Entities will need to consider their financial statement user’s needs and expectations, bearing in mind the qualitative characteristics of useful financial information set out in Section 2 Concepts and Pervasive Principles of FRS 102.

If a cumulative catch-up approach is used:

| Key Point in Time |

Date (assuming no early adoption) |

Worked example for 31 December year end |

|---|---|---|

| First time adoption of revised Section 23 |

First financial reporting period for the period commencing on/after 1 January 2026 |

Year ended 31 December 2026 |

| First reporting date after adoption |

First financial reporting date for the period commencing on/after 1 January 2026 |

31 December 2026 |

| Date of initial application |

Start of the first reporting period commencing on/after 1 January 2026 |

1 January 2026 |

If a full retrospective approach is used:

| Key Point in Time |

Date (assuming no early adoption) |

Worked example for 31 December year end |

|---|---|---|

| First time adoption of revised Section 23 |

First financial reporting period for the period commencing on/after 1 January 2026 | Year ended 31 December 2026 |

| First reporting date after adoption |

First financial reporting date for the period commencing on/after 1 January 2026 | 31 December 2026 |

| Immediately preceding period |

The comparative period to the period commencing on/after 1 January 2026 |

Year ended 31 December 2025 |

Beginning of the earliest period presented Start of the comparative period for the first reporting period commencing on/after 1 January 2026 1 January 2025 (ie, closing balances as at 31 December 2024)

Identify relevant contracts

Whether the cumulative catch-up approach or the full retrospective approach is being adopted, relevant contracts will need to be identified.

In this context, ‘relevant contracts’ means contracts that are expected to be in scope of Section 23 Revenue from Contracts with Customers. As a reminder, Section 23 applies to all contracts with customers, except for lease contracts, contracts in scope of FRS 103 Insurance Contracts, financial instruments and other contractual rights or obligations in scope of Section 9, Section 11, Section 12, Section 14 or Section 15 and non-monetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers. Incoming resources from non-exchange transactions for public benefit entities are also scoped out of the section.

If a cumulative catch-up approach is used, relevant contracts will be:

- All contracts with customers in scope of Section 23 that are not complete at the date of initial application.

In our worked example, this will be all contracts that were not complete before 1 January 2026.

If a full retrospective approach is used, assuming that the practical expedient available under s1.65(a)(ii) that allows an entity not to restate contracts that have been completed before the earliest period presented is applied, relevant contracts will be:

- All contracts with customers in scope of Section 23 that were not complete at the beginning of the earliest period presented.

In our worked example, this will be all contracts that were not completed before 1 January 2025.

Tips:

- At this stage, it may not be necessary to collate the contracts themselves. However, it is important to know which contracts will need to be considered in due course.

- The entities records and financial system(s) will impact on how long it takes to gather this information. If this information is maintained and reported on as part of the entity’s management information, it may be a very quick process. If this isn’t data that management currently collects, then sufficient time should be left to obtain this information and check its integrity.

Group relevant contracts

Once relevant contracts have been identified it may be advantageous to group similar contracts together to ensure that the analysis process is as efficient as possible. It also allows contracts for which practical expedients are available to be identified.

If a cumulative catch-up approach is used, consider the following groupings for the relevant contracts identified:

| Grouping |

Details | Tips |

|---|---|---|

| Standard contracts |

These are contracts with identical commercial features – e.g. same product or service and same sales terms (such as transfer of ownership). | Different customers, sales dates or credit terms wouldn’t preclude such contracts from being grouped. |

| Bespoke contracts |

These are contracts with different commercial features that will require separate consideration for revenue recognition. | Consider whether tailoring of a standard contract has changed the commercial reality of the contract to the extent that it can no longer be grouped with standard contracts above. |

| Completed contracts which had variable consideration (relevant if seeking to take practical expedient under 1.65(b) – see tips) |

Contracts completed on or before the first reporting date after adoption which had variable consideration. | This would include contracts with variable amounts of consideration arising from terms such as some discounts, rebates, refunds, penalties or performance bonuses. |

| Contracts modified before the date of initial application (relevant if seeking to take practical expedient under 1.65(c) – see tips) |

Contracts whose terms had changed before the date of initial application – for example, changes to transaction prices or performance obligations. |

This could include contracts that increase or decrease the promised goods or services, or a change in price. The changes would be approved by both parties to the contract such that it creates new, or changes existing, rights and obligations. |

If a full retrospective approach is used, consider the following groupings for the relevant contracts identified:

| Grouping |

Details | Tips |

|---|---|---|

| Standard contracts |

These are contracts with identical commercial features – e.g. same product or service and same sales terms (such as transfer of ownership). |

Different customers, sales dates or credit terms wouldn’t preclude such contracts from being grouped. |

| Bespoke contracts |

These are contracts with different commercial features that will require separate consideration for revenue recognition. |

Consider whether tailoring of a standard contract has changed the commercial reality of the contract to the extent that it can no longer be grouped with standard contracts above. |

| Completed contracts that began and ended in the same annual reporting period (relevant if seeking to take practical expedient under 1.65(a)(i) – see tips) |

Short term (i.e. less than 12 month) contracts that do not span a financial reporting date. | Whilst all contracts may be short term, make sure any that do span a period end, even by a matter of days, are excluded from this group. |

| Completed contracts which had variable consideration (relevant if seeking to take practical expedient under 1.65(b) – see tips) |

Contracts completed on or before the first reporting date after adoption which had variable consideration. | This would include contracts with variable amounts of consideration arising from terms such as some discounts, rebates, refunds, penalties or performance bonuses. |

| Contracts modified before the date of initial application (relevant if seeking to take practical expedient under 1.65(c) – see tips) |

Contracts whose terms had changed before the date of initial application – for example, changes to transaction prices or performance obligations. |

This could include contracts that increase or decrease the promised goods or services, or a change in price. The changes would be approved by both parties to the contract such that it creates new, or changes existing, rights and obligations. |

Tips:

- Adequate time should be put aside for this task. The time needed will vary by entity. For example, a company that only trades on standard sales terms may very quickly be able to put all contracts into one ‘standard contract’ group. By comparison, an entity that writes bespoke contracts for one-off projects due to the nature of their business may quickly determine that all contracts are bespoke.

- Some groupings are only needed if the entity plans to take advantage of practical expedients on transition. Further details on the impact of the practical expedients can be found in the table within the Analyse relevant contracts section of this guidance.

- Sub-groups may be needed – for example, for standard contracts that has variable consideration that has been completed on or before the first reporting date, and standard contracts with variable consideration that have not been completed at the first reporting date.

Analyse relevant contracts

Once specific groups of contracts have been identified, the five-step model can be applied. As a reminder the five steps are summarised as follows:

Further details can be found in this article “Five-step revenue recognition model: what you need to know.

The above exercises that have been performed will hopefully mean contracts with customers have already been identified and the use of groupings mean that the following steps can be completed as efficiently as possible.

The following table sets out what needs to be considered for the groups of contracts that have been identified:

| Grouping |

Relevant to cumulative catch-up, full retrospective or both? | Application of Five-step revenue recognition model |

|---|---|---|

| Standard contracts |

Both |

Select an example contract from each group of standard contracts. Apply Step 2-4 to the example contract. |

| Bespoke contracts |

Both | Apply Step 2-4 to each contract. |

| Completed contracts that began and ended in the same annual reporting period |

Full retrospective only | If taking the practical expedient in accordance with FRS 102 1.65(a)(i) – no restatement needed, no further analysis of contracts needed. |

| Completed contracts which had variable consideration |

Both |

If taking the practical expedient in accordance with FRS 102 1.65(b) – if the contract has been completed by the first reporting date after adoption, use the transaction price at the date of completion for Step 3, rather than an estimate of the variable consideration. |

| Contracts modified before the date of initial application |

Both |

If taking the practical expedient in accordance with FRS 102 1.65(c) – reflect aggregate of all modifications that occurred before the beginning of the earliest period presented (full retrospective) or before the date of initial application (cumulative catch-up) when completing Step 2, 3 and 4. |

Tips:

- This stage may be very time consuming if there are lots of standard contract types, or multiple bespoke contracts. Ensure adequate time is available to apply the five-step model to all necessary contracts. Small details in contracts can potentially have a significant impact on revenue recognition, so care needs to be taken in the review. For a longer contract, it could take significant time and resource to analyse, interpret and apply the five-step model.

- Consider the timing of the review to ensure that the process is efficient as possible. For example:

- A bespoke contract with variable consideration that is expected to be completed by the first financial reporting date after adoption where the entity plans to take advantage of the practical expedient under s1.65(b) outlined above – preparer may complete Step 2, but refrain from completing Step 3 until contract is complete and price known. This prevents estimates being made that are rendered superfluous by the reporting date.

- Standard contract that is introduced during first financial reporting period of adoption of Section 23 – preparer may complete Steps 2-4 based on the draft contract, or at the date the first example contract is signed. This prevents the contract having to be located and reviewed at a later date.

- Keep in mind the earliest date that will be relevant under the chosen approach to transition. For example, in the worked example, if that entity used a full retrospective approach, then their first key date will be 1 Jan 2025, which would include the contracts still open after 31 December 2024. It may be easier to collate and analyse information as the key dates occur, than seeking to obtain all relevant information during the first year of adoption.

- The use of groupings, as well as the application of the five-step process, is highly judgmental. It is strongly encouraged to keep file notes outlining the judgments, conclusions and the proposed treatment as such events occur. These can then be referred to at the date of transition, and/or shared with an entity’s auditor to help justify the treatment applied.

Consider impact and future transactions

Once the extant contracts have been considered, entities are encouraged to understand whether there are any significant changes to the pattern of revenue recognition for the entity resulting from the adoption of Section 23 Revenue from Contracts with Customers. Some entities may see no or little impact on reported revenue as a result of the changes, others could find there is a significant impact on the timing of revenue recognition.

If the entity’s adoption of Section 23 Revenue from Contracts with Customers has a significant impact on the revenue presented in the financial statements, entities may want to consider:

- Communicating changes to interested stakeholders to manage their expectations in respect of the results presented in the financial statements for the first reporting date after adoption;

- Discuss the impact with lenders if any borrowings have covenants that will be impacted by revenue. It is encouraged to agree waivers or revisions to covenants before the first reporting date after adoption, to prevent liabilities being classified as current if covenants are breached;

- Manage the impact for any other payments linked to revenue – for example, contingent consideration for the acquisition of subsidiaries, employee incentives such as bonuses or share based payments or licences with variable considerations based on revenue generated; and

- Engage with auditors in advance of the first reporting date after adoption to see if audit procedures on key judgments can be performed pre year end to reduce the risk of material late adjustments in respect of revenue.

Going forward, the five-step model will apply to all contracts with customers for entities reporting under FRS 102 from the date of transition. Therefore, entities may wish to consider the impacts on revenue recognition when writing and negotiating contracts. Commercial realities may mean that it isn’t possible to obtain the desired outcome, but small changes can have potentially large impacts on revenue recognition. Entities may choose to apply the above considerations – particularly the analysis phase - to draft contracts to understand the impact they will have on revenue recognition.

Similarly, timely analysis and application of the five-step model at the draft or signing of a new contract means that considerations can be made on a timely basis and prevents a large volume of contracts requiring analysis around the year end reporting date.

Considerations for auditors

As noted in the detailed guidance above, the application of Section 23 Revenue from Contracts with Customers requires a number of judgments to be made. The transition process may well be time consuming for preparers to complete, and the audit work on transition may be just as time consuming as auditors seek to gain sufficient appropriate audit evidence over the transition itself and the ongoing revenue recognition.

In addition to the risk assessment in respect of revenue recognition (including the risk of fraud) and the planned risk response, auditors should be mindful of the ISA (UK) 500 requirements in respect of use of information prepared by the entity. The auditor is required to evaluate whether the information is sufficiently reliable for the auditor’s purposes and include procedures as necessary to obtaining audit evidence over the completeness and accuracy of the information and evaluating whether the information is sufficiently precise and detailed for the auditor’s purposes. Examples of where this may be relevant in the context of transition to Section 23 Revenue from Contracts with Customers include, but is not limited to:

- Accuracy and completeness of groupings – have contracts been included in the correct group; have groups been identified to a low enough level to ensure that one example contract is representative of the population?

- Accuracy and completeness of review of contracts – have all relevant terms and conditions been extracted?

- Accuracy and completeness of relevant contracts – have all relevant contracts been identified – is there a risk of inappropriate cut off – for example contracts that are not complete by the beginning of the earliest period presented, or were not completed within one financial reporting year?

As summarised above, a lot of the work by the client to support the transition could potentially be performed well in advance of the first reporting date following transition. Auditors are encouraged to engage with their clients to understand their transition timetable and consider whether it is appropriate to perform risk assessment and risk response procedures earlier in the audit cycle, potentially as interim work in advance of year end, or during audit work on the comparative period’s accounts.

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

Download this helpsheet

PDF (255kb)

Access a PDF version of this helpsheet to print or save.

Download-

Update History

- 04 Dec 2024 (12: 00 AM GMT)

- First published

- 04 Dec 2024 (12: 00 AM GMT)

- Changelog created