Technical helpsheet to issued to help ICAEW members account for the issue of share options to employees in exchange for their service under FRS 102.

Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members to account for the issue of share options to employees in exchange for their service under FRS 102.

This helpsheet addresses equity-settled share-based payment transactions only and does not consider cash-settled share based payment transactions or share-based payment transactions with cash alternatives.

Background and terminology

Many companies incentivise and reward employees by issuing them with share options as part of equity-settled share-based payment arrangements.

What is a share option?

A share option gives the holder the right, but not the obligation, to subscribe for the company’s shares at a fixed or determinable price for a specific period of time. For example, an employee may hold a share option which entitles them to purchase a share of the company for £1 between 1 April and 31 December 2020, regardless of the company’s share price at that time.

What is a vesting period?

A vesting period is the period during which the specified vesting conditions must be satisfied. An employee will not become unconditionally entitled to the share options unless the vesting conditions are met within the vesting period. Vesting conditions may be:

- Service conditions (e.g. an employee may be required to remain in employment for a three year period); or

- Performance conditions which will either be:

- Non-market conditions (e.g. an exit event, completing a particular project or achieving a particular profit target); or

- Market conditions (e.g. an employee may only become entitled to the share options if the share price has increased to a particular value by a specified date).

The most common arrangements involve only service conditions – normally requiring an employee to remain in employment with the company for a specified period before the options vest (i.e. before the employee becomes unconditionally entitled to the options).

What is the grant date?

The grant date will be the date on which the company and the employee agree to the share-based payment arrangement (and approval at the appropriate level has been obtained).

Accounting for the issue of share options

On 1 January 2019, Company A granted an award of 100 share options to each of its 50 employees with the condition that they must remain in Company A’s employment for a period of three years. The fair value of each share option on the grant date is £30.

Company A’s year end is 31 December 2019.

Year ending 31 December 2019

At the end of the year, Company A expects that 20% of relevant employees will have left prior to completing the required three year service period.

The expense to recognise in the year will therefore be:

50 employees x 80% retention rate x 100 options each x £30 fair value x 1/3 years

= £40,000

The accounting entries will therefore be:

Dr P&L £40,000

Cr Share option reserve* £40,000

*There is no specific requirement to maintain a separate share option reserve, although this is often sensible.

Year ending 31 December 2020

At the end of the year, Company A now expects that 30% of relevant employees will have left prior to completing the required three year service period.

The expense to recognise in the year will therefore be:

50 employees x 70% retention rate x 100 options each x £30 fair value x 2/3 years

= £70,000 - £40,000 already recognised to date = £30,000

The accounting entries will therefore be:

Dr P&L £30,000

Cr Share option reserve* £30,000

*There is no specific requirement to maintain a separate share option reserve, although this is often sensible.

Year ending 31 December 2021

At the end of the year, Company A now knows that 25% of relevant employees have left prior to completing the required three year service period.

The expense to recognise in the year will therefore be:

50 employees x 75% retention rate x 100 options each x £30 fair value x 3/3 years

= £112,500 - £70,000 already recognised to date = £42,500

The accounting entries will therefore be:

Dr P&L £42,500

Cr Share option reserve* £42,500

*There is no specific requirement to maintain a separate share option reserve, although this is often sensible.

Variations

Whilst the above represents a typical situation, it is quite possible to end up with a credit to the P&L in any given period. For example, this may arise if the retention rate drops significantly from one period to the next.

Group situations

In some group situations, share-based payments are granted to the employees of one or more group entities but are settled in another. In these cases, paragraph 26.16 of FRS 102 permits group entities to measure the share-based payment expense on the basis of reasonable allocation of the expense for the group, calculated in accordance with Section 26 of FRS 102, IFRS 2 Share-based Payment or on an equivalent basis.

Classification of share-based payment arrangements

Paragraphs 26.1A and 26.2A of FRS 102 discuss group situations. The following table shows whether a share-based payment arrangement is to be treated as cash-settled or equity-settled.

| Cash-settled or Equity-settled | |||||

| Entity receiving employee services or goods |

Entity with the obligation to settle | Settled in |

Parent’s separate financial statements |

Subsidiary’s separate financial statements | Consolidated financial statements |

| Subsidiary |

Subsidiary |

Cash | N/A |

Cash |

Cash |

| Subsidiary |

Subsidiary |

Subsidiary's equity |

N/A |

Equity |

Equity |

| Subsidiary |

Subsidiary |

Parent's equity | N/A |

Cash |

Equity |

| Subsidiary |

Parent |

Cash |

Cash |

Equity |

Cash |

| Subsidiary |

Parent |

Subsidiary's equity |

Cash |

Equity |

Equity |

| Subsidiary |

Parent |

Parent's equity |

Equity |

Equity |

Equity |

The definition of an equity-settled share-based payment in FRS 102 is one in which the entity must settle in their own equity instruments, or one in which the entity has no obligation to settle with the supplier. Therefore, if the subsidiary is settling in its own equity, or the parent has the obligation settle, be it in cash or equity, then the subsidiary has an equity-settled share-based payment.

Disclosure

Companies reporting under full FRS 102 are required to adhere to the disclosure requirements of FRS 102 paragraphs 26.18 to 26.23.

Whilst there are no specific mandatory disclosure requirements under FRS 102 Section 1A, the accounts must nevertheless provide a true and fair view and disclosure may be required to achieve this (FRS 102 paragraphs 1A.5 and 1A.6).

Special case - exit events

Where the award only vests upon an exit event such as an IPO or a change in control and the employee still needs to be employed by the entity at the time of such an event, an estimate will usually need to be made for the vesting period. This will need to be revised each accounting period to reflect the most up to date information.

Where it is not considered probable that the exit event will occur, no expense will be recognised. This is unlikely to be the case, however, as the company would not usually make such awards if they were not expected to vest.

Cancellations or settlements

A company must account for a cancellation or settlement of an equity-settled share-based payment transaction as an acceleration of vesting, and therefore recognises immediately the amount that otherwise would have been recognised for services received over the remainder of the vesting period (FRS 102 paragraph 26.13).

Accounting for the exercise of a share option

The exercise of a share option is a completely separate accounting transaction from accounting for the issue of a share option in a share-based payment transaction discussed above.

Where a holder exercises their option, and the company issues shares as a result, the company will record the following accounting entries:

Dr Cash with the cash received

Cr Share capital with the nominal value of the shares issued

Cr Share premium with the balance

If the company has maintained a separate share option reserve (as shown in the above example), a reserves transfer between the share option reserve and the P&L reserve may be made for completeness:

Dr Share option reserve with the amount relating to the options actually exercised

Cr P&L reserve with the amount relating to the options actually exercised

The amount transferred will represent any balance in the share option reserve relating to the options which have been exercised at that point in time. This entry is often undertaken to tidy up the accounts.

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

Appendix 1: What is the fair value of a share option

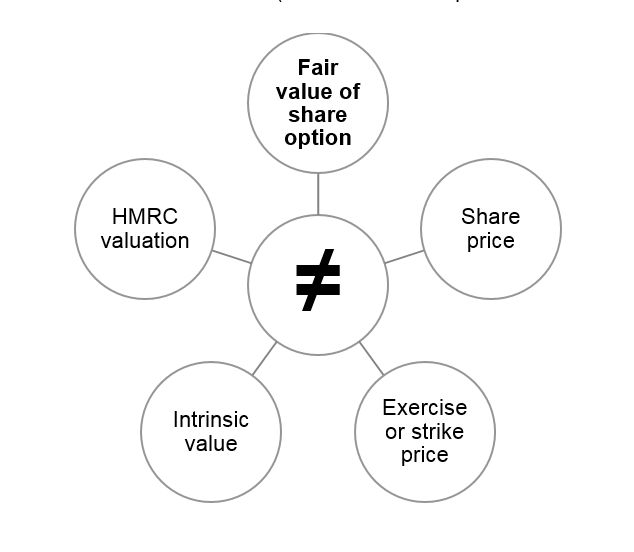

There are misconceptions around what the fair value of the share option actually is. The fair value of a share option is not the same thing as the share price, the exercise price, the intrinsic value or a HMRC valuation (each of which is explained further below).

Fair value of share option

FRS 102 paragraph 26.11 sets out how to measure the fair value of share options using a three-tier measurement hierarchy:

(a) If an observable market price is available for the equity instruments granted, use that price.

(b) If an observable market price is not available, measure the fair value of share options and share appreciation rights granted, using entity-specific observable market data such as for a recent transaction in the share options.

(c) If an observable market price is not available and obtaining a reliable measurement of fair value under (b) is impracticable, indirectly measure the fair value of share options or share appreciation rights using an alternative valuation methodology such as an option pricing model. The inputs for an option pricing model (such as the weighted average share price, exercise price, expected volatility, option life, expected dividends and risk-free interest rate) shall use market data to the greatest extent possible. Paragraph 26.10 provides guidance on determining the fair value of the shares used in determining the weighted average share price. The entity shall derive an estimate of expected volatility consistent with the valuation methodology used to determine the fair value of the shares.

Where market data is not readily available it is likely that a specialist will be required to assist in calculating the fair value using an option pricing model such as Black-Scholes, Binomial or Monte Carlo. The ICAEW Library and Information Service can provide members with access to a range of resources and guidance on such models.

Non-vesting conditions (e.g. a restriction on the transfer of the share options to third parties) and market conditions (e.g. the requirement to achieve a particular share price by a specified date) should be included in the grant date fair value of share options.

Share price

The share price is the price of one share of the entity - this will vary over time. A share is a different equity instrument from a share option. As such, the fair value of a share is not the same as the fair value of a share option.

Exercise or strike price

The exercise (or strike) price is the price that the holder of a share option would have to pay, on the exercise date, for a share. For example, the holder of a share option with an exercise price of £30 would, on exercising their option, be able to purchase a share for £30 on the exercise date, even if the share price on that date was £50. The exercise price is specified in the share option agreement and does not vary over time.

Intrinsic value

The intrinsic value of a share option is the amount by which it is ‘in the money’ at a particular point in time. In other words, at any point in time, it is the difference between the share price and the exercise price (where this is positive). For example where the current share price is £50 and the exercise price is £30, the intrinsic value is £20.

The intrinsic value will vary over time in response to changes in the share price.

HMRC valuation

When issuing share options to their employees, entities often consider the use of Enterprise Management Incentives (EMIs) in order to avoid the employees facing additional Income Tax or National Insurance.

Where such schemes are used, entities typically apply to have a valuation approved by HMRC. It is important to note that HMRC is approving the valuation of the share to which the employees could become entitled under the scheme not the fair value of the share option itself.

Summary

In summary, when accounting for share options issued as part of an equity-settled share-based payment arrangement, it is the fair value of the share option at the grant date that needs to be determined. As discussed above, this is most commonly calculated using a share option pricing model. Share option pricing models take into account a number of inputs, including the share price and exercise price, but these in themselves are not the fair value of the option.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

-

Update History

- 11 Feb 2020 (12: 00 AM GMT)

- First published

- 21 Oct 2021 (02: 30 PM BST)

- Changelog created, helpsheet converted to new template

- 21 Oct 2021 (02: 31 PM BST)

- Helpsheet reviewed - no changes.

- 15 Sep 2022 (01: 35 PM BST)

- New section headed 'Group situations' added. Name of helpsheet changed from 'Accounting for share options under FRS 102'.