Guidance on preparation and filing of accounts for the UK branch or place of business of an overseas company.

Introduction

This helpsheet has been issued by ICAEW’s Technical Advisory Service to help ICAEW members to establish the filing requirements for entities with branches or trading establishments in the UK.

Members may also wish to refer to the following legislation:

Regulation

Per regulation 4 within one month of opening an establishment in the UK the overseas company must deliver a return to the Registrar of Companies along with a certified copy of the constitutional documents (certified translations are required).

Filing of accounts

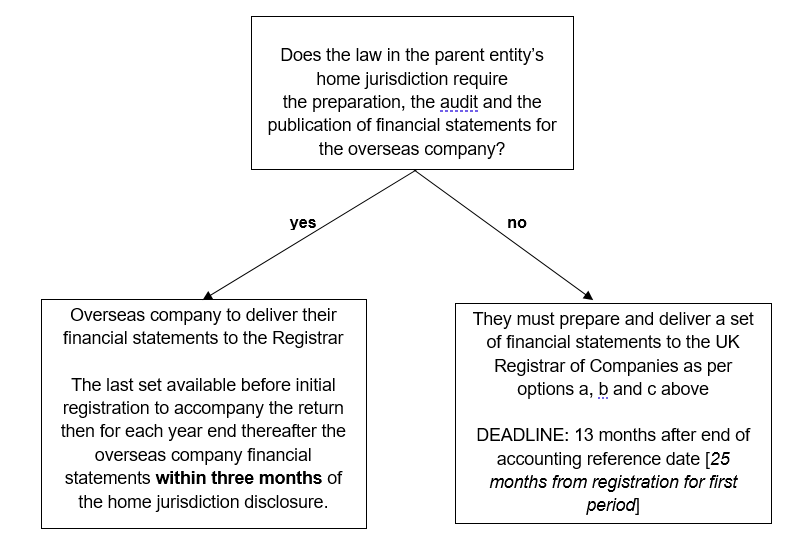

Note that the regulations DO NOT require UK branch or divisional accounts to be prepared or filed. It is the accounts of the overseas entity that are required to be filed in the UK, which may have already been prepared in accordance with the requirements of the overseas jurisdiction.

If the overseas entity does not prepare and publish audited accounts in its home jurisdiction then it will need to prepare accounts in accordance with the Regulations.

The entity has a choice between:

a) accounts prepared in accordance with its parent law (“parent law individual accounts”), but only if they would be compliant with section 396

b) accounts prepared in accordance with international accounting standards (“IAS individual accounts”), or

c) accounts prepared in accordance with section 396 (“overseas companies individual accounts”).

Section 396 requires that the accounts must comprise:

- a balance sheet as at the last day of the financial year, and

- a profit and loss account.

The content of the balance sheet and the profit and loss account must meet certain requirements and additional information must be provided by way of notes to the accounts (the requirements as to form and content can be found in Schedule 4 of the Overseas Companies Regulations 2009).

If the overseas entity is a parent itself, and is not exempted from preparing consolidated accounts, then similar requirements to the above apply, in addition to the requirements of Schedule 5 of the overseas Companies Regulations 2009.

Additional filings

The company must file a statement of the of legal, accounting and, if applicable, auditing framework applied.

Exemptions

Credit and financial institutions are outside the scope of this help-sheet as separate rules apply.

Unlimited companies also have no obligation to file accounts.

If in doubt seek advice

ICAEW members, affiliates, ICAEW students and staff in eligible firms with member firm access can discuss their specific situation with the Technical Advisory Service on +44 (0)1908 248 250 or via webchat.

© ICAEW 2026 All rights reserved.

ICAEW cannot accept responsibility for any person acting or refraining to act as a result of any material contained in this helpsheet. This helpsheet is designed to alert members to an important issue of general application. It is not intended to be a definitive statement covering all aspects but is a brief comment on a specific point.

ICAEW members have permission to use and reproduce this helpsheet on the following conditions:

- This permission is strictly limited to ICAEW members only who are using the helpsheet for guidance only.

- The helpsheet is to be reproduced for personal, non-commercial use only and is not for re-distribution.

For further details members are invited to telephone the Technical Advisory Service T +44 (0)1908 248250. The Technical Advisory Service comprises the technical enquiries, ethics advice, anti-money laundering and fraud helplines. For further details visit icaew.com/tas.

-

Update History

- 01 Sep 2012 (12: 00 AM BST)

- First published.

- 23 Nov 2022 (12: 00 AM GMT)

- Changelog created, helpsheet converted to new template

- 23 Nov 2022 (12: 00 AM GMT)

- No change to technical content, but helpsheet has been re-written to make more sense and be easier to follow.

Download this helpsheet

PDF (118kb)

Access a PDF version of this helpsheet to print or save.

Download