The audit of going concern is often a challenge. Here we look at what a good audit file looks like in the context of going concern.

Related content

This case study is one of a series of three. It can be used independently or in conjunction with the full guidance and / or the full training materials.

1.1 Introduction to the case study

This case study has been prepared based upon a real scenario that is intended to demonstrate ‘what good looks like’ in these particular circumstances.

The case study is intended to be an illustrative example of how good auditors might respond to a particular set of circumstances. It is not a model or template that can be followed regardless of the specifics of the audit. This case study does not consider every action that needs to be taken by the auditor in relation to going concern. Instead, it focuses on specific aspects of the work in order to illustrate what good looks like in that respect.

This case study is particularly focused on:

- group support

- risk assessment

- audit team discussion

- challenging management’s going concern assessment

- material uncertainty, including disclosures and audit reporting

- small company implications

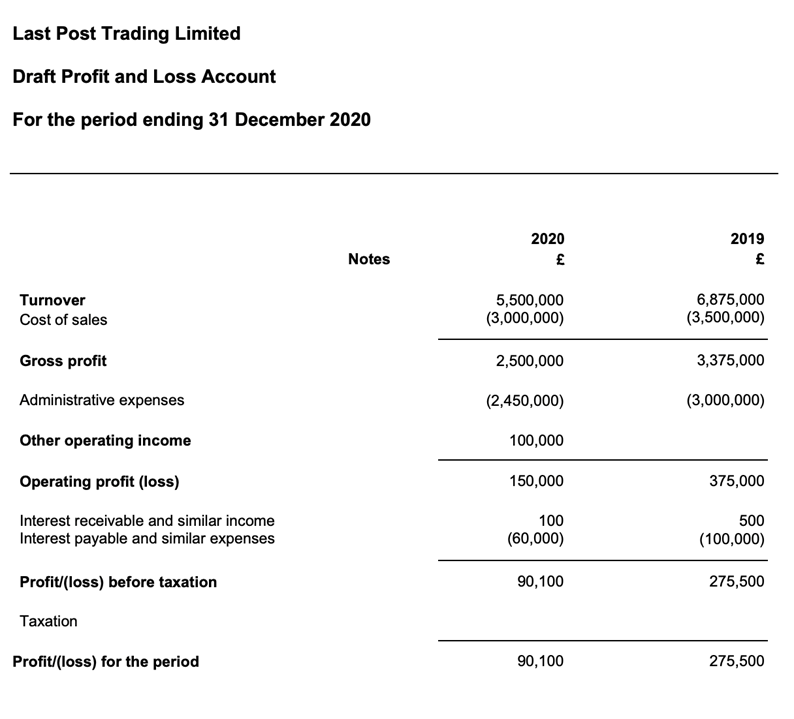

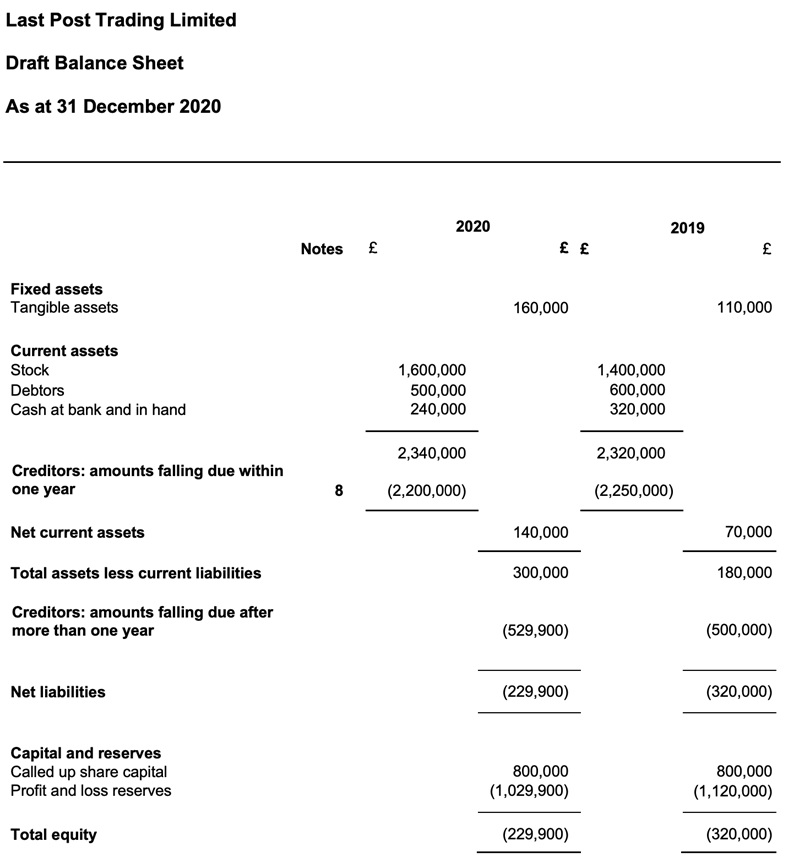

1.2 Relevant extracts from draft financial statements

1.3 Last Post Trading Ltd - period ending 31 December 2020

| Illustration – Extract from the planning memo |

|---|

We have been the auditor for eight years and have a good understanding of the company. There have been planning discussions with management that have confirmed the following, to support our knowledge of the company: About the company Last Post Trading Ltd (LPT Ltd) is the UK subsidiary of a US parent company. LPT Ltd is fashion retailer and has four high street outlets as well as having an established online presence. Impact of COVID19 The retail outlets have been closed for extended periods because of the COVID19 pandemic, but the performance of the online shop has been exceptionally strong. Turnover, profits and cashflow have been very positive in 2020. Reliance on group support LPT Ltd is funded by a large loan from the parent (Last Post Investments Inc), that is repayable on demand. The parent has undertaken not to request repayment of the loan in a letter of support. However, the parent company is experiencing significant financial difficulties and is in negotiations with its lenders to restructure its debt. |

1.4 Risk assessment

The auditor identified at an early stage of the audit, from discussions with management, that the parent company was experiencing financial problems. This was identified because during the extensive discussions with management explained that LPT Ltd had been asked by LPT Inc to make payments to the suppliers of other group companies and LPT Ltd had been forced by the group to move away from one major supplier who had refused to supply other group companies because of non-payment issues.

This led to the auditor’s risk assessment being specific about the nature of the inherent risk relating to going concern, in that the parent might be forced into receivership, removing the prospect of any further support and, perhaps more importantly, resulting a situation where the loan from the parent could be called in at any time. This audit risk was communicated to management in the pre-audit letter and identified as a significant risk. Therefore, at an early stage of the audit, the audit team determined that these circumstances would likely result in material uncertainties related to going concern.

| Illustration – Extract from going concern audit documentation |

|---|

Risk factors and inherent risk assessment A summary of the key indicators and events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern. Support of the parent LPT Ltd is dependent upon the support of its US parent company, LPI Inc, mostly in the form of the £1.8M loan from the parent which is repayable on demand. The directors of LPT Ltd have told us that LPI Inc has significant financial difficulties and is attempting to restructure its debt, but this is proving difficult. From our initial going concern assessment it seems likely LPT Ltd would be unable to repay the inter-company debt if called in, in the next few years and there will likely be a material uncertainty because of this. Trading The company’s trading performance appears to have been reasonably strong during the COVID19 lockdowns because online sales have grown. Cash flow also appears to be reasonable. Nevertheless, the future is uncertain for the retail sector and there could be significant uncertainties when preparing cash flow forecasts. Government support schemes During times when the shops have been closed because of COVID19 lockdowns, the company has made use of various government support schemes including CJRS. There is a risk that if the shops are forced to close again the schemes might not be available to sufficiently support the company. Alternative sources of funding Given the financial position of the company and group it is unlikely that the company could secure alternative sources of finance. Overall inherent risk assessment on going concern It is assessed that there is a significant risk in relation to there being material uncertainties related to gong concern because of the issues with parental support. There is also a risk that the going concern basis might not be appropriate because of the above circumstances. |

1.5 Audit team discussion

The auditor has been able to clearly identify a significant audit risk here, in relation to the material uncertainty or parental support. Nevertheless, at the audit team discussion the audit partner still made it clear that the audit team should continue to carefully evaluate management’s going concern assessment and remain vigilant for other circumstances that could result in material uncertainties, that might affect the disclosures in the financial statements. The need to challenge management's methods, assumptions and data, for the going concern assessment, was also emphasised.

| Illustration – Extract from audit team discussion |

|---|

Going concern The audit partner briefed the team on the financial difficulties being faced by the parent company and the impact that this is having on LPT Ltd. The team were reminded of the importance of challenging management’s going concern assessment as necessary. The going concern risk assessment was reviewed and discussed. Whilst the position of LPI Inc seems likely to result in a material uncertainty, the partner reminded the team to continue to consider whether the company is a going concern and to be vigilant for any other material uncertainties that might need to be addressed. The company’s trading position and the prospects for the retail sector were discussed. The current ONS data (see attached) was reviewed. At finalisation more up to date data needs to be obtained. |

1.6 Management’s assessment of going concern

Management identified the possibility that the parent’s support could be withdrawn, as part of their going concern assessment. Based on their budgeted profit and loss account for the period to 30 June 2022, management believe that the company will earn sufficient profits and that the going concern basis is still appropriate. Management have assumed that online sales will remain at the current high levels but that retail sales from their shops could be reduced by 20%.

The auditor challenged management over the method that they adopted for their going concern assessment. The auditor encouraged management to produce cash flow forecasts rather than just P&L budgets. The auditor also asked management to look at a range of possible scenarios for the sector, based on a range of outcomes, including more pessimistic outcomes.

Management was initially reluctant to undertake the work but the auditor explained that without audit evidence to support the use of the going concern basis, the audit opinion would need to be a disclaimer.

Also, the auditor offered to supply a MS Excel cashflow template to management to assist with the cashflow scenario planning and the audit senior explained, to one of the directors, how to use it. This was considered to be a non-audit service but the self-review threats were thought to be minimal. In any event, the auditor was already assisting LPT Ltd with the production of the financial statements and tax computations and a second partner review was being used as a safeguard against self-review and management threats and the reviewer clearly documented the purpose of the review on file.

| Illustration – Extract from going concern audit documentation |

|---|

Managements’ going concern assessment Management of LPT Ltd produced a going concern assessment for the period to 30 June 2022 based on P&L budgets. We challenged their methods because there was not a focus on cash flow and as a retailer stock and trade creditors can fluctuate. We provided the FD with a copy of the firm’s cashflow template (see sch B21 for assessment of independence issues). They have used it to produce the forecasts filed on Sch T3.2 on a more appropriate basis. |

1.7 Evaluation of audit evidence

The auditor evaluated management’s new cash flow forecasts, considering the method, assumptions and data used. The method was thought to be appropriate and the data used was based on pre-COVID19 revenues and expenses for shop sales and suitably adjusted online sales during COVID19.

The assumptions about fashion sales and costs post-COVID19, both online and in shops, were thought to be a significant risk in relation to the going concern audit. The auditor is experienced in the fashion sector and has spent some time reviewing current performance in the sector and researching the industry’s trading expectations post-COVID19. The going concern basis of accounting for LPT Ltd is thought to be appropriate because the company had sufficient cash headroom, even with the more pessimistic scenarios used for the cash flow forecasts.

Note that, just because the auditor had identified a likely material uncertainty related to going concern at an early stage of the audit, this did not mean that they did not undertake the appropriate audit work on going concern to support the use of the going concern basis of accounting and to ensure that all material uncertainties had been identified and disclosed in the financial statements as necessary.

The starting point of LPT Ltd’s cash flow forecast showed a significant cash balance. The auditor corroborated this by looking at the company’s online banking. The auditor also reviewed other elements of the cash flow starting position, including stock and creditors. The basis for these figures was discussed with management, subject to analytical procedures and underlying accounting records were inspected.

Parent support

The letter of support has been inspected by the auditor.

The auditor has also carefully evaluated the ability of Last Post Investments Inc, to support LPT Ltd. Direct discussions have occurred between the auditor of LPT Ltd and the directors of the parent and their auditor. Last Post Investments Inc say that they are very confident that their debt restructuring will be successful and put the company on a much sounder financial footing.

These discussions were followed up with the inspection of documents, including the parent’s financial statements, management accounts, forecasts and correspondence with lenders. From this document review the auditor concluded that the audit evidence does not fully support the highly optimistic attitude taken by management of Last Post Investments Inc. Nevertheless, the auditor thinks that there is a realistic possibility that the negotiations will be successful, but there is no certainty in the matter.

Key documents inspected as part of this audit work were copied to be held on the current audit file as they were thought to be vitally important in understanding why it is appropriate for LPT Ltd to use the going concern basis of accounting.

The auditor also chose to delay the finalisation of the LPT Ltd audit until the audit was complete on the parent company. As expected, the auditor of Last Post Investments Inc, included a material uncertainty related to going concern paragraph in their audit report, in relation to the outstanding debt restructuring negotiations.

| Illustration – Extract from going concern audit documentation |

|---|

Evaluation of management’s going concern assessment The assumptions used by management have been consistently and properly applied in the cashflows, the cashflows cast, the base data used by management has been reconciled back to the audited accounts and the starting point of the forecasts have been agreed back to the latest management accounts (Sch T3.3) The opening bank balance has been checked to the online banking (copied on Sch T4.2). The opening stock figure in the forecasts was based upon the monthly stock take. This was discussed with the finance director and the stock level looks reasonable in these circumstances and margins look normal. Opening creditors were checked to the underlying accounting records and are as expected. All key assumptions have been reviewed for reasonableness (Sch T3.3). The most critical assumptions made by management are:

Management supported the first two assertions by:

Additionally, we have looked at a recent survey on consumer confidence (Sch T8.1) and an article in Trade Fashion magazine (Sch T8.2) that supports management’s views. The assumption that the shops would not have to close in the foreseeable future (assumption 3 above) was challenged. When pressed management accepted that there was a possibility of further lock downs and they modelled, what they called an ‘Armageddon scenario’ of shops closing from October 2021 to April 2022. This shows that with cost cutting and redundancies, they could survive (See Sch T10 for testing of assumptions and evidence that the cost saving methods are realistic). Industry comparisons Performance of the company was compared against ONS data. (see attached). Recent performance for online sales and in shop (when open) have exceeded the industry averages. This suggests that management’s forecasts might be supported. However, LPT Ltd is a small company, and as such, its performance might be more volatile, so this evidence should not be relied upon too much. LPI Inc Support A copy of the letter of support has been obtained (Sch T20). LPI Inc has undertaken not to seek repayment of the intercompany loan for the foreseeable future. LPT Ltd should not need any additional cash from LPI Inc but is reliant on the deferral of the inter-company loan. Management of LPT Ltd accept there is a material uncertainty regarding the ability of LPI Inc to defer the loan because of their financial difficulties. There is evidence that LPI Inc has a realistic possibility of restructuring its debt, but there is no certainty. The audit evidence to support this is:

|

1.8 Going concern disclosures in the financial statements

The auditor read LPT Ltd’s disclosure in the financial statements produced by one of the company’s directors. The auditor made a number of suggestions to improve the disclosure, particularly in order to clarify the position and the nature of the uncertainties as material uncertainties casting significant doubt on the use of the going concern basis.

The directors of LPT Ltd have had no previous experience of drafting this type of disclosure and did require a significant amount of guidance, from the auditor, to arrive at the wording. The auditor recognised the possible threats to independence arising because of this and were careful to only advise but not to take on the role of management and the nature of the assistance provided was documented on file.

Documentation

In the auditor’s documentation of their work, they include their review of management’s first draft of the disclosures, the challenges that they made to the wording and why the final draft of the disclosure is thought to be appropriate.

| Illustration – Extract from going concern audit documentation |

|---|

Review of going concern disclosures The disclosure was drafted by LPT’s FD. We made a number of suggestions to improve the disclosure (Sch A42). The FD’s second draft was discussed at the audit finalisation meeting resulting in the final wording below being agreed. This is an accurate representation of the position and accords with the audit evidence obtained (Sch T1). |

| Illustration - Last Post Trading Ltd – extract from the financial statements |

|---|

Note 2a: Going concern The Company has been significantly affected by the COVID19 pandemic. The shops have been closed for significant periods in 2020 and COVID19 is continuing to affect the business after the year end, as disclosed in note 21. Online sales have been strong and because of this, together with cost cutting and the benefit of government assistance the business has remained profitable. In their going concern review the directors have prepared cash flow forecasts for the period to 30 June 2022 for a number of possible post lockdown trading scenarios. Even in the downside trading scenarios the company can continue to trade using its current cash reserves. The company’s parent, Last Post Investments Inc, has confirmed its willingness to support the company and not to call in the intercompany loan for a period of 12 months from the date of these financial statements. On this basis the directors consider Last Post Trading Ltd to be a going concern for the purpose of preparing these financial statements. However, Last Post Investments Inc is currently in default of the terms of its borrowings and is in negotiation with its lenders to restructure its debt and at the time of finalising these financial statements, it is unclear whether these negotiations will be successful. Because of this, significant doubt exists about the ability of Last Post Investments Inc to continue as a going concern and to adequately support Last Post Trading Ltd. Due to these circumstances, it is unclear whether the company will be supported by its parent company and be able to defer the repayment of the inter-company debt. These are material uncertainties related to events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern for the foreseeable future and, therefore the company might be unable to realise its assets and discharge its liabilities in the normal course of business. |

1.9 The audit report

The audit report includes the material uncertainty paragraph shown below:

| Illustration - Last Post Trading Ltd – extract from audit report |

|---|

Material Uncertainty Related to Going Concern We draw your attention to Note 2a which indicates that it is uncertain whether the company will be supported by its parent company and be able to defer the repayment of the inter-company debt. As stated in note 2a, these events or conditions, along with other matters as set forth in note 2a, indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as a going concern. Our opinion is not modified in respect of this matter. In auditing the financial statements, we have concluded that the directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate. Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant sections of this report. |

Documentation

The auditor documents the audit evidence obtained and all necessary corroborating evidence. The documentation clearly sets out how the audit conclusion was reached.

| Illustration – Extract from going concern audit documentation |

|---|

Conclusion There is sufficient audit evidence to support the use of the going concern basis and the only material uncertainty relates to the ability of the parent company to continue to support this subsidiary. |

Filleted financial statements

LPT Ltd is a small company and the accounts filed at Companies House are filleted, so the audit report is not required to be included. Instead, the notes to the financial statements include the material uncertainty from the audit report, as part of the necessary audit disclosures, contained in Companies Act s444, including the fact that the audit opinion was unmodified.

Download case study 1

PDF (595kb)

Download a copy of the case study Last Post Trading Ltd, to print or save.

Download