The audit of going concern is often a challenge. Here we look at what a good audit file looks like in the context of going concern.

Related content

This case study is one of a series of three. It can be used independently or in conjunction with the full guidance and / or the full training materials.

3.1 Introduction to the case study

This case study has been prepared based upon a realistic scenario that is intended to demonstrate ‘what good looks like’ in these particular circumstances.

The case study is intended to be an illustrative example of how good auditors might respond to a particular set of circumstances. It is not a model or template that can be followed regardless of the specifics of the audit. This case study does not consider every action that needs to be taken by the auditor in relation to going concern. Instead, it focuses on specific aspects of the work in order to illustrate what good looks like in that respect.

This case study is particularly focused on:

- understanding the entity and preliminary analytical procedures

- cash flow forecasts and challenge

- reporting to those charged with governance

- the need for going concern disclosure

- second partner review

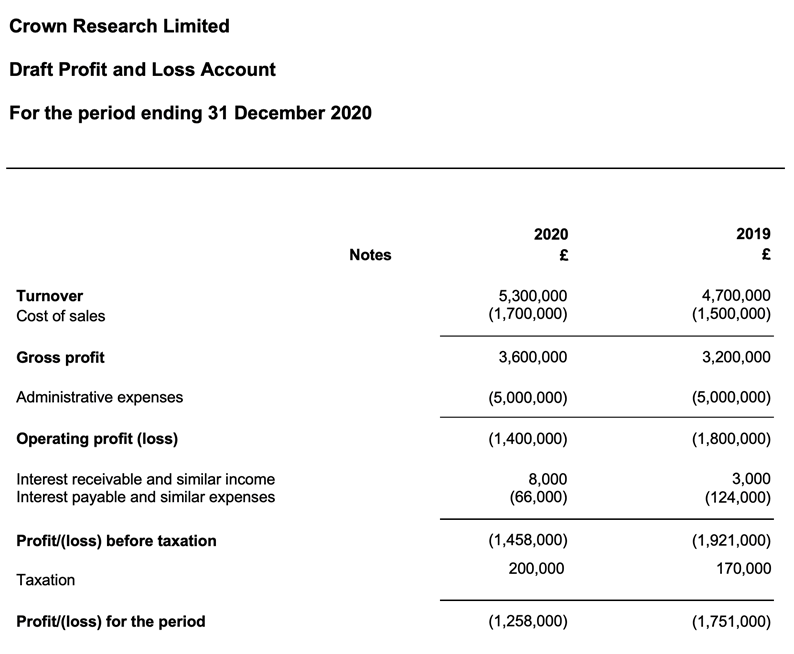

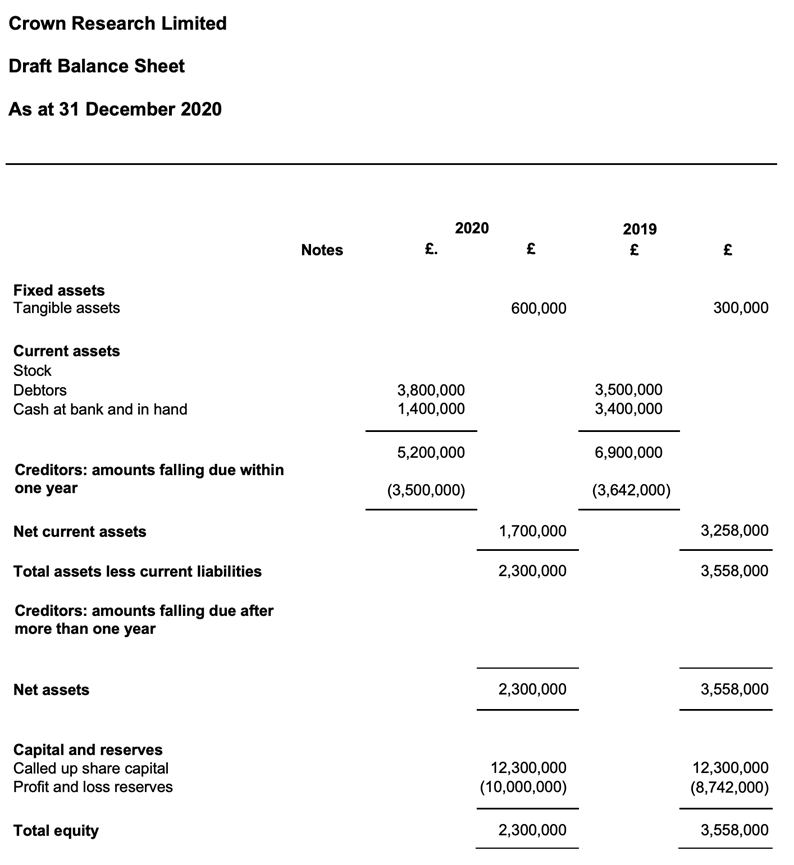

3.2 Relevant extracts from draft financial statements

3.3 Crown Research Ltd - period ending 31 December 2020

| Illustration – Extract from the planning memo |

|---|

We have audited the company since it started trading 5 years ago. There have been planning discussions with management that have confirmed the following, to confirm our knowledge of the company and any changes in the year: Background about the company Crown Research Ltd started business in 2016 offering bespoke customer surveys and brand awareness services to major brands, using sophisticated new software that it has developed in-house. Trading performance in the current year The company is growing fast but continues to be loss making. As a start-up it was initially funded by three rounds of equity investment but since then it has always had reasonable cash flow because it requires customers to pay in advance for their 12 month contracts. Impact of COVID19 Crown Research Ltd has not been significantly affected by the COVID19 pandemic, in terms of its trading activity. No staff have been furloughed. However, the company has not been able to obtain debt finance as the market considers its sector, and Crown Research Ltd in particular, to be a poor credit risk. The company applied for a Coronavirus Business Interruption Loan but was not successful, because of its history of making losses. Further rounds of equity funding would also be difficult, in the current environment. |

3.4 Risk assessment

Because of the history of trading losses and the funding problems the auditor identified a significant risk in relation to the use of the going concern basis and in particular the identification of material uncertainties.

As part of the preliminary analytical procedures, the audit documented the following.

| Illustration – Extract from risk assessment analytical procedures |

|---|

Risk factors It was identified that the company continues to be loss making but has some cash reserves from the previous round of fund raising and its customer billing model that generates positive cash flows. Administrative expenses contain very significant one-off costs incurred in further developing the company’s software. This was confirmed in discussions with management and separately with the head of development. Analytical review has not flagged any other areas of substantial change and margins have remained consistent. Going concern remains a risk – see summary of significant risks. |

The auditor also identified that, because of the company’s financial position, the going concern assessment might be more demanding than usual. The preparation of the going concern assessment is part of the company’s internal controls and this was considered as part of the auditors’ understanding of the entity and evaluated as part of the risk assessment.

This process is iterative and the initial assessment of internal controls and risk will have been amended when it was established that management’s going concern assessment needed to be more robust and use scenario planning.

| Illustration – Extract from internal controls documentation |

|---|

Going concern assessment The going concern assessment, including cash flow forecasts, are produced by the finance director and approved at board level. The FD is a qualified ICAEW member and has years of industry experience and the company produce good, detailed monthly cash flow forecasts for their own budgetary and control purposes. Added note: During the audit we thought it necessary for management to extend their going concern assessment to use scenario planning. The FD is sufficiently skilled and experienced to do this well. |

3.5 Management’s going concern assessment

The auditor challenged management's first going concern assessment because it only considered what management referred to as the most likely future scenario. The auditor thought that this was overly optimistic and, in any event, the method used by management to assess going concern was too simplistic and that management should prepare forecasts based on a number of possible future scenarios which would involve some contingency planning, should Crown Research Ltd not win as many new contracts as management planned.

The management of Crown Research Ltd are very experienced at producing these types of forecast. The finance director produced cash flow forecasts based on four possible scenarios together with a board paper supporting this.

The scenarios used were referred to as 1. best case, 2. most likely, 3. downside and 4. extreme downside.

| Illustration – Extract from going concern audit documentation |

|---|

We asked management to revisit their going concern assessment as we thought that a single scenario forecast was too simplistic and possibly overly optimistic. We compared going concern forecasts to actuals for the past two years and found that the forecasts had a tendency to be a best case scenario rather than a reliable prediction. Management have now produced forecasts based on four different scenarios, with their original forecast as the best case. |

3.6 Cash flow forecasts

Only the most extreme downside scenario cash flow forecast resulted in the company possibly being unable to meet its obligations as they became due. Management also identified that in that situation certain mitigating actions could be taken, such as redundancies and salary reductions for management, which would ensure that the company survived.

The auditor ultimately concluded that management’s assertion that there were no material uncertainties related to going concern was supported by the audit evidence – see the illustration below.

| Illustration – Extract from going concern audit documentation |

|---|

Evaluation of management’s going concern assessment The finance director produced cash flow forecasts, for a 12 month going concern review period, based on four possible scenarios:

All four scenarios assumed that no existing clients (22 at the year end) would be lost and that all existing contracts would be renewed at the same fee levels. This is an appropriate method to use particularly as they have also done some mitigation planning on how the company could respond to the extreme downside scenario. The assumptions used by management in their cash flow forecasts have been consistently and properly applied across all four scenarios, the cash flows cast, the base data used by management has been reconciled back to the previous year’s accounts and the starting point of the forecasts have been agreed back to the latest management accounts (Sch T3.3) The opening bank balance has been checked to the online banking (copied on Sch T4.1). All key assumptions have been reviewed for reasonableness (Sch T3.4). The most critical assumptions made by management are:

Management were asked to support these assumptions and provided the following:

Year new contracts

Management were challenged as to how the new work could be taken on without increasing staff numbers. Management have said that the company’s core software is no longer being so intensively developed and adapted and that development programmers are being reassigned to deliver direct to clients. This was seen to be happening in the minutes of the management team meetings (Sch S3.1) and confirmed in discussions with the head of software development (Sch F10.2), and when auditing development costs (which included significant one-off costs in the year, charged to P&L). The 2% salary increase was discussed with HR and seems reasonable. The following considerations were applied when evaluating the going concern assessment:

|

3.7 Written representations

Management’s going concern assessment sets out various plans for future actions. In all scenarios, except the extreme downside scenario, management intends to obtain new contracts. In the extreme downside scenario there are plans for cost cutting. Good auditors obtain written representations ISA 570 (para 12-2(f)) regarding the feasibility of these plans.

| Illustration – Extract from the letter of representation |

|---|

Going concern We have prepared a going concern assessment using an appropriate method, and using appropriate assumptions and data. We have used scenario planning on the following basis:

We are confident that the most likely scenarios are one and two. In the event that the company wins no new contracts we have a cost saving strategy that can be implemented, which has been planned in detail and is feasible. The directors have agreed to accept a 50% reduction in remuneration in these circumstances. We are currently in talks with four potential new customers and we are confident that all four will sign on. On the basis of the going concern assessment, the use of the going concern basis is appropriate for the preparation of the financial statements and there are no material uncertainties related to going concern. The going concern disclosures included in note 2 of the financial statements are appropriate. |

3.8 Reporting to those charged with governance

As going concern was a significant audit risk and because the going concern conclusion was thought to be a ‘close call’, the auditors included a relevant section in the report to those charged with governance.| Audit risk/key judgement area | How we addressed this | Commentary |

|---|---|---|

Going concern The company’s going concern status and the existence or otherwise of material uncertainties is underpinned by positive cashflows from revenue from contracts servicing existing customers and winning new contracts. |

We discussed with management their going concern assessment and encouraged a scenario planning exercise which involved cash flow forecasting including severe but plausible down side scenarios. We reviewed the method, assumptions and data used in these forecasts. In particular we looked at the extent to which existing customers remain loyal to the company and the rate at which new contracts are likely to be won, based on past performance and discussions with management. We also considered the adequacy of the going concern disclosure in the financial statements. |

Our view is that the two downside scenarios were unlikely, but even in the event of the most severe downside scenario, cost saving measures (including a reduction in Directors’ salaries), would allow adequate headroom for the company to meet its obligations as they fell due. We concluded that the going concern basis of account is appropriate and that there are no material uncertainties. |

3.9 Disclosures in the financial statements

The financial statements were prepared using UK GAAP and there is no explicit requirement to make going concern disclosures. However, the directors of Crown Research Ltd have decided to make the following disclosures in the financial statements, in order to make it clear to the users of the financial statements why the going concern basis of accounting was thought to be appropriate despite the previous reported losses and the impact of COVID19 on the economy.

| Illustration - Crown Research Ltd – extract from financial statements |

|---|

Note 2 Going concern These financial statements have been prepared on a going concern basis. As part of the going concern assessment the directors reviewed cash flow forecasts for the period to 30 September 2022. To address the principal risks and uncertainties to which the company is exposed, the board considered four different scenarios based on differently levels of business activity driven by the company’s success in signing new contracts for its services. In the most extreme downside scenario, where no new work was obtained from new clients, the company would need to implement cost saving measures to avoid depleting its cash reserves within the review period. The directors are confident that in the unlikely event this extreme downside scenario did occur, that the necessary cost saving measures are achievable. Therefore, the company has continued to use the going concern basis for the preparation of these financial statements. |

Documentation

The auditor clearly documents that they have read the final version of the disclosure in the financial statements and their conclusion that the disclosure is appropriate.

Whilst there is no specific requirement in UK GAAP for this disclosure, there are thought to be some considerations around going concern, other that material uncertainties, which do need to be disclosed in order for the financial statements to show a true and fair view. If management had not chosen to include this disclosure, the auditors would have requested that something similar be included.

3.10 Audit report

Based on the auditor’s evaluation of the audit evidence, the auditor concludes that there are no material uncertainties related to going concern.

| Illustration - Crown Research Ltd – extract from the audit report |

|---|

Conclusions relating to going concern In auditing the financial statements, we have concluded that the directors’ use of the going concern basis of accounting in the preparation of the financial statements is appropriate. Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the company’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue. Our responsibilities and the responsibilities of the directors with respect to going concern are described in the relevant sections of this report. |

The auditor documented their overall conclusion on going concern as below:

| Illustration – Extract from going concern audit documentation |

|---|

Going concern – overall audit conclusion The going concern basis is appropriate and no material uncertainties related to going concern were identified. However, going concern was identified as a significant audit risk because the company is loss making and is, to a degree, dependent upon continued growth. Management’s going concern assessment is good. There is sufficient audit evidence to support that scenario 2, in the forecasts, is the most likely outcome, which should leave plenty of headroom on cashflow. There is also evidence that the downside scenarios are much less likely. In any event the company has a realistic strategy to ensure that it can meet its obligations as they become due, even in the unlikely event of the extreme downside scenario. This decision is thought to be a ‘close call’ and a second partner review has been done (Sch A41), which supports this conclusion. |

3.11 Second partner review

The audit firm has a policy that there should be a second partner review of all non-standard audit reports. Additionally, the firm’s policy requires a second partner review in circumstances where the auditor considered issuing a non-standard audit report but did not, referred to by the firm as a ‘close call’.

The audit partner submits this audit file for second partner review and the reviewer concentrates the review on the existence or otherwise of material uncertainties related to going concern. As well as reviewing relevant sections of the audit file, the second partner reviewer also discusses the conclusions reached with the audit partner and manager.

Download case study 3

PDF (550kb)

Download a copy of the case study Crown Research Ltd to print or save.

Download