Nick Wright summarises the key case law that is relevant to understand whether HMRC will provide statutory clearance for a transaction.

The tax charge attaching to a transaction can be a key issue. Provided that certain conditions are met, it may be possible to effectively defer a tax charge or to obtain assurance that the transaction will be taxed as a chargeable gain instead of as an income distribution.

There are several areas of the tax code that enable taxpayers to apply to HMRC for clearance before undertaking a transaction to reduce uncertainty as to HMRC’s view on the tax treatment. There are also non-statutory clearance procedures in certain cases, however, this article considers statutory clearances.

Some examples of the more common statutory clearances and the question that HMRC is required to provide an opinion on are outlined below:

From the above, it is clear that the majority of clearance applications deal with the commercial reasons for a transaction and whether one of the main purposes is the avoidance of one or more particular taxes.

Case law

To explain some of the key issues around clearances, the analysis of some historical cases is useful. Robustly explaining the commercial rationale in more marginal cases may be the difference between providing HMRC with a sufficient understanding of the reasons behind the transaction to grant clearance on those sound commercial grounds and a clearance refusal.

Brebner [1976] UKHL 43 TC 705

Brebner [1976] UKHL 43 TC 705 was the transactions in securities case of Aberdeen Coal & Shipping, which were the subject of a takeover bid. The directors believed the acquirer intended to break up the company, which would have resulted in the loss of favourable rates for coal that were being enjoyed by fishing companies, of which many of the directors had an interest, as well as a loss of jobs for the employees.

To defend the takeover and fund a takeover of their own, the directors made an offer of £108,000 for the company (financed by a bank loan), which was accepted by the shareholders.

Early repayment of the bank loan was satisfied by undertaking a scheme of reconstruction, which involved the capitalisation of reserves followed by a court-approved capital reduction to return the funds to the new shareholders to enable them to repay the loan.

The timeline was as follows:

In deciding in favour of the taxpayer, even though a tax advantage was clearly obtained, the court made the following key observations:

- “The Act draws a clear distinction between effect and object” (ie, one of the effects of the transaction was that an income tax advantage was obtained but that does not mean that was a main objective). The House of Lords also stated that the purpose cannot be narrowed down to an object of a company separate from the directors or shareholders themselves.

- They also noted that it was unreasonable to consider the director’s object in isolation at each step of the arrangements (ie, we must consider the purpose of the transaction as a whole).

- “No commercial man in his senses is going to carry out commercial transactions except upon the footing of paying the smallest amount of tax involved.” Meaning, if there are two ways to achieve the same result, the taxpayer is entitled to choose the method that enables them to pay the least amount of tax without necessarily making tax avoidance a main purpose.

The result was that, despite an income tax advantage being obtained, the House of Lords accepted that this was not the main purpose of the transaction.

Clark v CIR, Ch D 1978, 52 TC 482

Clark v CIR, Ch D 1978, 52 TC 482 was also a transactions in securities case. In this case the taxpayer, Robin, entered into a transaction to obtain cash for the purchase of an adjoining farm.

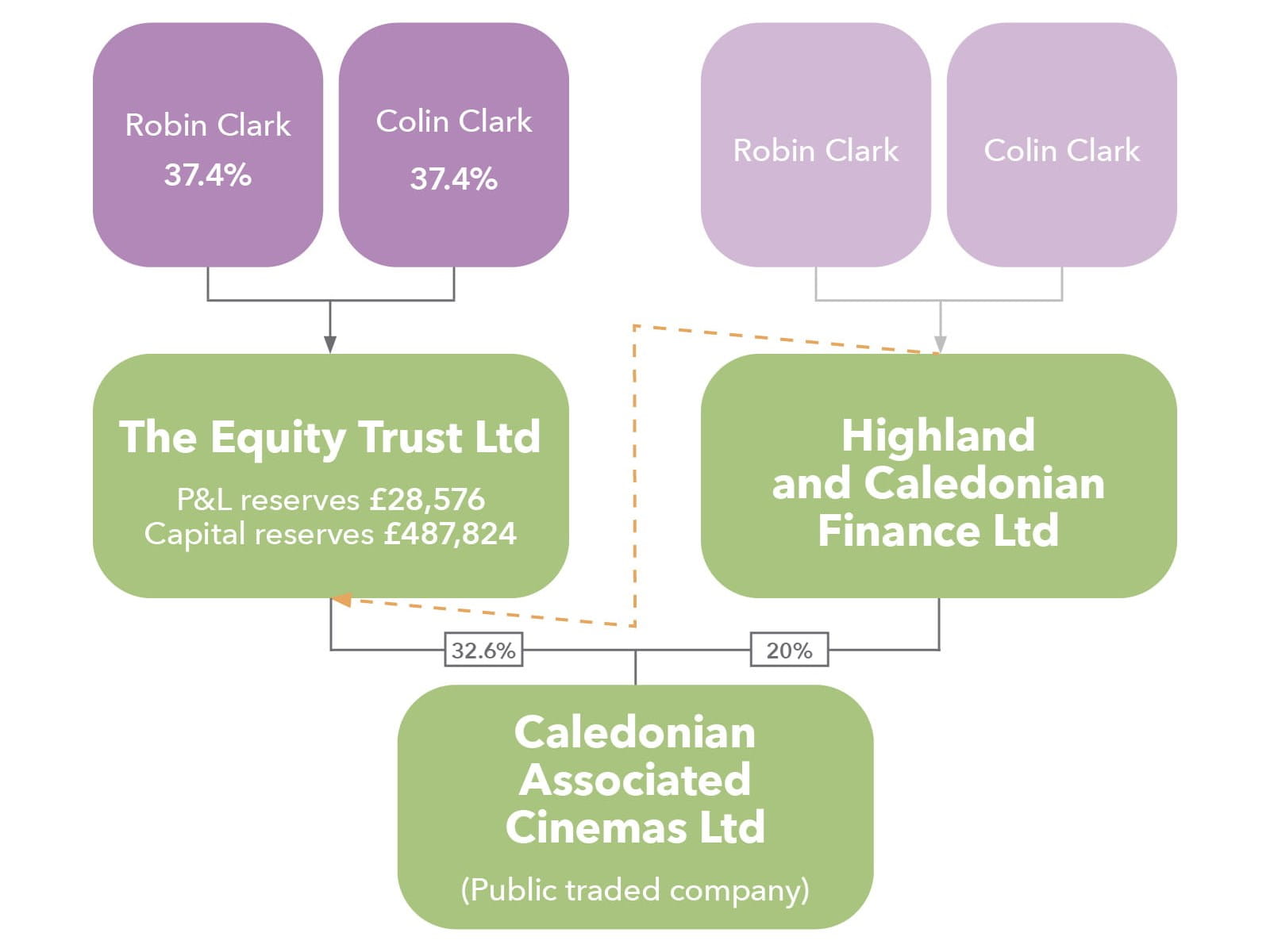

Robin and Colin were brothers, and the transaction involved the sale of a company (Highland and Caledonian Finance Ltd) that they held 50:50 to a family investment company (The Equity Trust Ltd) that they were also majority shareholders of for £102,000 in cash.

The rationale for this had nothing to do with either company’s business. Robin was a farmer, and he had an opportunity to acquire a neighbouring farm that was being sold at auction. He believed that the farm would be profitable if run alongside his existing farming business due to greater efficiencies and, as events transpired, he was correct.

Robin’s father was strongly opposed to the shares being sold outside the family as it would mean the loss of family control of Caledonian Associated Cinemas of which he was chairman and managing director.

His father persuaded him to sell the shares to The Equity Trust Ltd instead and, despite Colin having no need for the cash, he did not want to be left with a personal 50% ownership and thought a better price would be achieved by selling 100% of the company so he went along with the sale to The Equity Trust Ltd.

Clearly, the sale had nothing to do with the activities of any of the companies, but the High Court held that there is, “no requirement in the section of a nexus with particular parties affected by or in some way concerned in the transaction”.

So the key takeaway of the Clark case is that the commercial reasons do not have to relate to the companies in question. Of course, this analysis cannot apply in relation to company purchase of own shares or exempt distribution clearances given both require there to be a benefit to the trade rather than a bona fide commercial purpose.

Snell v Revenue and Customs Commissioners [2006] EWHC 3350 (Ch)

The case of Mr Snell involved the sale and exchange of securities where Mr Snell disposed of a 91% holding of Sovereign Rubber plc to a newly formed company, Inhoco 564 Ltd, for £7,317,000 including £6,580,000 of loan stock. The following tax year, Mr Snell left the UK and became non-resident before redeeming the loan notes, meaning no UK CGT was payable on the loan notes.

The question before the court was whether the exchange of securities for loan stock was for a bona fide commercial reason given, had cash been paid instead, Mr Snell would have been subject to UK CGT as he was a UK resident at the time of the sale.

If Mr Snell did not intend to become non-resident as at 21 December 1996 (the date of sale) there would have been no link between this and the acceptance of loan notes as the form of consideration.

The timeline was:

Section 137, TCGA 1992, has two limbs:

- The exchange, reconstruction or amalgamation in question is effected for bona fide commercial reasons.

- The exchange in question… does not form part of a scheme or arrangement of which the main purpose, or one of the main purposes, is avoidance of liability to capital gains tax…

The special commissioners ruled that, “the far greater probability that he would become non-resident dictated that he wanted loan stock in the expectation that it would be redeemed when he was non-resident”.

Therefore, the main purpose of completing the transaction in this way was for the avoidance of CGT.

The High Court upheld this decision, making several additional statements:

- “The question is whether ‘the exchange in question … is effected for bona fide commercial reasons’. If the answer is in the affirmative, it is irrelevant to consider the reasons why the parties chose to structure their transaction in that way.” This is consistent with the decision in Brebner.

- “The ordinary meaning of the word ‘scheme’ is ‘a plan of action devised in order to attain some end.” Similarly, an arrangement is, “a structure or combination of things for a purpose”. So, there would only be a scheme or arrangement if the intention (in this case to become non-resident before redeeming the loan notes) exists at the time of the transaction.

- The word ‘liability’ in s137(1) cannot be limited to an actual liability, it must include a contingent or prospective liability (ie, we need to consider the future redemption of loan notes).

Although Mr Snell changed where he was going to emigrate to during the transaction, it seems clear given the amount of evidence in relation to his intentions that he structured the transaction with loan notes instead of cash purely to fall within the share exchange provisions and trigger the gain when non-resident.

Coll v RCC [2010] UKUT 114 (TCC)

The case of Mr Coll is an interesting one in considering HMRC’s current clearance decisions because it was concluded that there were arrangements by Mr Coll to avoid CGT. However, Mrs Coll argued that the rule should apply separately to each shareholder as she was not involved in the tax planning.

The conclusion of the Upper Tribunal was that the test applies to the transaction itself. This is consistent with the wording of s137(1), which disapplies the share exchange provisions from the entire issue.

That being said, there have been circumstances where HMRC’s responses to clearance refer to specific shareholders and sometimes imposing certain restrictions on specific shareholders, somewhat contradictory to the decision in Coll.

Snell & Snell v HMRC [2008] SPC 00699

The case of Mr and Mrs Snell involved the sale to a new holding company, Snell Group Ltd (Group), of their existing shares in PA Snell & Co Ltd, a property development company.

The sale concerned the issue by Group of new ordinary shares, £650,000 preference shares each and £50,000 cash each.

Initially, the amount of cash was intended to be higher (originally £180,000 each to qualify for retirement relief 2000/01 reduced to £137,000 in the knowledge the transaction would not take place until 2001/02 when the retirement relief limits were reduced).

As clearance was refused, the cash amount was reduced to £50,000 on the basis that this represented around 14% of the total consideration and it would not, therefore, be considered a main object.

The court concluded that there were bona fide commercial reasons for the transaction, being the retirement of Mr and Mrs Snell. However, as the court stated: “By the time the transaction occurred the cash payment had been decided upon and it does not cease to be one of the main objects of that transaction just because there is another more important object. Mr and Mrs Snell made a conscious decision to obtain cash and indeed they chose the highest figure that their advisers were then recommending. That is in my opinion significant when judging the importance of that object within the transaction.”

This case is consistent with Snell in that we need both bona fide commercial reasons and for one of the main purposes not being the avoidance of tax, but it also shows that there is not necessarily a de minimis limit.

Nick Wright ACA CTA, Associate Director, Jerroms Miller Specialist Tax