Introduction

- For the purposes of this guidance, the term ‘error’ is intended to include all errors and mistakes whether they were made by the client, the member, HMRC or any other party involved in a client’s tax affairs, and whether made innocently or deliberately.

- During a member's relationship with the client, the member may become aware of possible errors in the client’s tax affairs. Unless the client is already aware of the possible error, they should be informed as soon as the member identifies them.

- Where the error has resulted in the client paying too much tax the member should advise the client to make a repayment claim. The member should advise the client of the time limits to make a claim and have regard to any relevant time limits. The rest of this Helpsheet deals with situations where tax may be due to HMRC.

- Sometimes an error made by HMRC may mean that the client has not paid tax actually due or they have been incorrectly repaid tax. There may be fee costs as a result of correcting such mistakes. A member should bear in mind that, in some circumstances, clients or agents may be able to claim for additional professional costs incurred and compensation from HMRC.

- A member should act correctly from the outset. A member should keep sufficient appropriate records of discussions and advice and when dealing with errors the member should:

- give the client appropriate advice’

- if necessary, so long as they continue to act for the client, seek to persuade the client to behave correctly;

- take care not to appear to be assisting a client to plan or commit any criminal offence or to conceal any offence which has been committed; and

- in appropriate situations, or where in doubt, discuss the client’s situation with a colleague or an independent third party (having due regard to client confidentiality).

- Once aware of a possible error, a member must bear in mind the legislation on money laundering and the obligations and duties which this places upon them. See:

- Where the member may have made the error, the member should consider whether they need to notify their professional indemnity insurers.

- In any situation where a member has concerns about their own position, they should consider taking specialist legal advice. For example, where a client appears to have used the member to assist in the commissioning of a criminal offence and people could question whether the member had acted honestly in in good faith. Note that The Criminal Finances Act 2017 has created new criminal offences of failure to prevent facilitation of tax evasion.

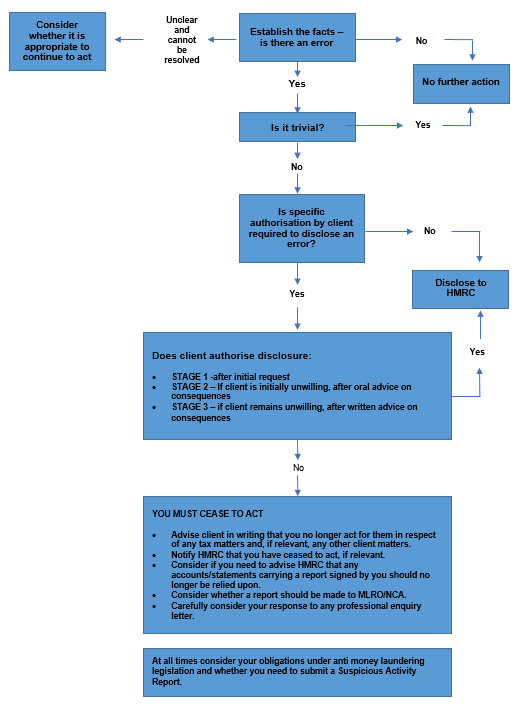

- The flowchart below summarises the recommended steps a member should take where a possible error arises. It must be read in conjunction with the guidance and commentary that follow it.

Establishing the facts

- A member is not required to make enquiries to identify errors which are unrelated to the work they have been engaged to perform. However, if they become aware of any error in a client’s tax affairs they should follow this guidance, whether or not the error related to a matter they have acted on.

- A member who suspects that an error may have occurred should discuss this with the client to remove or confirm the suspicion. They should take into account the fact that the client may not be aware of all the facts and circumstances and the member may not, therefore, be able to reach a conclusion.

- Where the client provides an explanation for the apparent error to the satisfaction of the member, the member is free to continue to act for that client.

- Where the client fails to explain the apparent error to the satisfaction of the member, the member should consider whether it is appropriate to continue to act. Where the member concludes that it is appropriate to continue to act they should monitor the position carefully. Should it later become apparent that there is an error despite the client’s previous assurances to the contrary, the member should follow the advice in the flowchart above. In cases where a member ceases to act, they should follow the guidance below (see sections: Ceasing to act; Informing HMRC; Withdrawing reports signed by the member; Reporting to MLRO/NCA and professional enquiry).

- If a member is unsure whether there is an error the member should consider seeking specialist advice. Likewise correcting more serious errors may also require specialist help. In some situations, the client may wish to seek, or advise the client, to seek a second opinion.

- Whether the member decides to continue to act for the client or not, the member should protect their position by documenting:

- The discussions they have had with their client, any colleague, specialist and/or HMRC;

- The client’s explanations; and

- Their conclusion and the reasons for reaching that conclusion.

It may be appropriate to confirm the facts in writing with the client.

Is the error trivial

- As a general principle all known errors should be corrected (save for non-material adjustments as described above). In the opinion of the professional bodies it is reasonable for a member to take no steps to advise HMRC of isolated errors where the tax effect is no more than minimal, say up to £200, as these will probably cost HMRC and the client more to process than they are worth to the Exchequer.

Does a member need specific authorisation from the client to disclose an error?

- A member must ensure that they have authority to disclose an error to HMRC.

- This could be specific authority agreed with the client or a general authority contained in a letter of engagement. If in any doubt, or if the amount of tax involved is material, the member should confirm the position with the client.

- If the client withdraws the member’s authority to correct the error, the member should follow the guidance below (see sections: Actions where the client refuses to disclose, Ceasing to act, Informing HMRC, Withdrawing reports signed by the member, Reporting to MLRO/NCA and professional enquiry).

- A member must have the client’s authority to agree a negotiated figure following disclosure of the facts and circumstances. A member cannot agree a figure that they know to contain an error.

- In all cases where HMRC has sent an over-repayment to the member they must return it to HMRC as soon as practicable. A member does not require their client’s authority to return an excessive repayment but, as a matter of course, they should notify their client that they have done so.

Stage 1: Asking the client for authority to disclose

- Subject to the circumstances set out above (see section: Does a member need specific authorisation from the client to disclose an error?), the member should ask the client’s permission to notify HMRC of the error. A member should encourage the client to make a timely disclosure. The member should advise the client of their obligations under the relevant tax legislation and refer, as relevant, to interest, surcharges and penalties for errors.

- Whether the client follows the member’s advice is, ultimately, the client’s decision. If, however, the client decides not to act in accordance with the member’s advice on their obligations, the member should take the further steps detailed below (see sections: Stage 2; Stage 3; Actions where the client refuses to disclose; Ceasing to act; Informing HMRC; Withdrawing reports signed by the member; Reporting to MLRO/NCA and professional enquiry).

Stage 2: Advising the client of the consequences of failure to disclose

- Where it appears that the client is reluctant to authorise disclosure of the error to HMRC, the member should explain to the client:

- The potential consequences of non-disclosure;

- The benefit of making a voluntary disclosure especially as regards reduced penalties; and

- The wide ranging powers to obtain information from taxpayers, their agents and third parties available to HMRC.

- This will also include the member explaining that they will:

- Be required to put their advice that disclosure is required in writing;

- Be obliged to cease to act and in some circumstances to disassociate themself from any work done, should disclosure not be made. The client should be left in no doubt that adverse inferences could be made and that this step could result in HMRC commencing enquiries which might lead to the discovery of the non-disclosure; and

- Comply with their professional obligations relating to the appointment of a new adviser, as it is the duty of professional advisers before accepting professional work to communicate with the person who previously acted in connection with that work.

- Where the client is an organisation and the client contact still remains reluctant to authorise disclosure of the error to HMRC, the member should raise the issue at a higher level within the client organisation. If, having followed this approach, the client continues to be reluctant to authorise disclosure to HMRC, the member should follow the guidance set out below (see sections: Stage 3; Actions where the client refuses to disclose; Ceasing to act; Informing HMRC; Withdrawing reports signed by the member; Reporting to MLRO/NCA and professional enquiry).

Stage 3: Advising the client in writing of the consequences of failure to disclose

- Where the client remains unwilling to make a full disclosure to HMRC the member should ensure that they can show they have acted properly. It is essential to advise the client in writing, setting out the facts as understood by the member, confirming to the client the member’s advice to disclose and the consequences of non-disclosure.

- If, after being advised in writing, the client delays making a full disclosure, the member should consider at which point the delay should be treated as a refusal to disclose.

Actions where the client refuses to disclose

- If, despite being fully advised of the consequences, the client still refuses to make an appropriate disclosure to HMRC, the member must:

- Cease to act;

- If relevant, inform HMRC of their withdrawal; and should:

- Consider withdrawing reports signed by the member;

- Consider whether a money laundering report should be made to the firm’s MLRO/NCA, and

- Consider carefully their response to any professional enquiry letter (also known as professional

- Clearance letter).

These obligations are set out in more detail below.

Ceasing to act

- Where the member should cease to act in relation to the client’s tax affairs they should inform the client of this in writing.

- If HMRC were to realise that the member had continued to act after becoming aware of such undisclosed errors, the member’s relationship with HMRC could be damaged. HMRC might, in some circumstances, consider the member to be knowingly or carelessly involved in the commission of an offence or be engaged in dishonest conduct.

- The member should consider carefully whether it is appropriate to continue to act in relation to any non-tax matters of the client.

Informing HMRC

- Where the member had been dealing with HMRC on the client’s behalf or had been formally appointed as a tax agent, the member should notify HMRC that they have ceased to act for that client. Because of the obligation to maintain client confidentiality a member should not provide HMRC with an explanation as to the reasons for ceasing to act.

Withdrawing reports signed by the member

- Where a member has undertaken work to verify or audit accounts or statements which carry a report signed by the member and these reports are subsequently found to be misleading, the same principles of client confidentiality apply. If the engagement letter provides the member with the authority to notify HMRC in such circumstances, they should inform HMRC that they have information indicating that the accounts or statements cannot be relied upon.

- If the member does not have their client’s consent to the disclosure, they should write to the client and explicitly ask for permission to withdraw the report. If the client does not give consent, the member should then obtain specialist legal advice as to what action they should take.

- A member should not explain to HMRC the reasons why the returns, accounts, etc. are defective. To do so without the client's consent is more likely than not to be considered by a court of law as a misuse of confidential information and an unjustified breach of client confidentiality.

- In deciding whether a report should be made to the NCA, the member (or the member's MLRO) should take into account the various requirements of the legislation and any reporting exemption which might apply.

Reporting to MLRO/NCA

Professional enquiry (also known as professional clearance)

- Having ceased to act, the member may be approached by a prospective adviser for information relevant to the decision of whether to accept the appointment or not.

- Before a member responds to a request for information from a prospective adviser, a member must ensure that they have authority from the former client. The information to be provided should include everything that has been reasonably requested by the prospective adviser to enable them to decide whether to accept the work. The member should only discuss these matters freely with the prospective adviser if the client has given authority for them to do so.

- If the client refuses permission for the member to discuss all or part of their affairs, the member should inform the prospective adviser of this fact. It is then up to the prospective adviser to make enquiries from the client as to the reasons for such a refusal.

Other related matters

Self-assessment

- Where the error relates to a self-assessment return the client should amend any self-assessment affected by the error if they are within the time limit to do so. Where the time limit for amending a self-assessment has passed the client should provide HMRC with sufficient and accurate information to explain the error.

- If HMRC fails, or is unable, to take any necessary action, for example to issue a discovery assessment, a member is under no legal obligation to draw HMRC’s failure to their attention, nor to take any further action. Where it is relevant a member should ensure that the client is aware of the potential for interest and/or penalties.

Decisions of Tribunals or Courts

- It is possible that after a client has made a self-assessment return a later (perhaps years later) unrelated decision of the Tribunal or Court may cast doubt on whether the self-assessment return was made on the correct basis.

- A member is not under a duty to monitor all returns and all tax cases for many years after the returns have been filed to identify this rare event. However, if the member is aware of such a situation, they should determine whether the interpretation in the court or tribunal case is applicable to the client’s return. The member may wish to consider seeking specialist advice if in doubt. The member should also ascertain whether the case is to be appealed and may await the outcome of any appeal. Where there is a final decision which is applicable to the client’s return(s), the member should refer to the guidance below to determine what action may be required.

What corrective action is required?

- If a later court or tribunal decision casts doubt on a past tax return, the action needed is a complex matter and one that presents practical difficulties.

- Where the client’s return is under enquiry, it remains open and can be amended in the normal manner.

- The following broad principles should be applied where the client’s return is not under enquiry:

- Subject to whether there is any further appeal, a decision of a Court is regarded as determining how the law should always be applied. A member will however need to have regard to whether the facts of the relevant case can be distinguished from the client’s circumstances.

- The client should notify HMRC of the possible deficiency in their return unless:

- the basis upon which the self-assessment was made was sufficiently clear in the original return, or

- there is continuity of treatment of the item from previous returns, or

- the item was treated in accordance with ‘prevailing practice.

- The member should consider HMRC’s powers to make a discovery assessment where the tax is out of normal time for assessment (generally four years).

- In cases involving marketed tax avoidance schemes HMRC may assert that longer time limits apply for example where there was no disclosure at all or a DOTAS SRN was not put on the return. Members should be careful not to accept an allegation by HMRC of negligent/ careless or fraudulent/ deliberate conduct by the client or the member without seeking specialist advice first.

- If a client refuses to authorise disclosure to HMRC the member should treat this situation in the same way as any other error. Unless the member has expert knowledge in this area, they should consult a specialist.

While every care has been taken in the preparation of this guidance the PCRT Bodies do not undertake a duty of care or otherwise for any loss or damage occasioned by reliance on this guidance. Practical guidance cannot and should not be taken to substitute appropriate legal advice.